Atrial Fibrillation Market Statistics - 2030

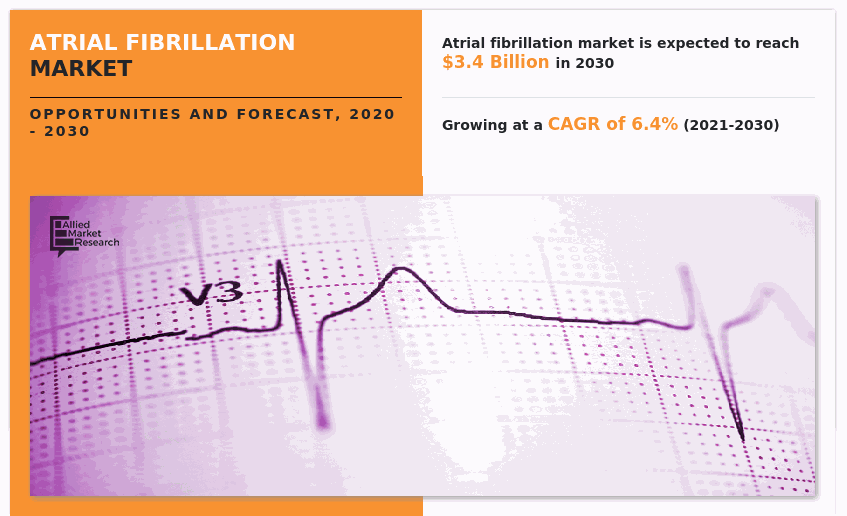

The global atrial fibrillation market size was valued at $1,825.85 million in 2020, and is projected to reach $3,370.70 million by 2030, growing at a CAGR of 6.4% from 2021 to 2030. Atrial fibrillation is the most common arrhythmia and occurs when the heart's upper chambers (atria) receive erratic electrical impulses. As a result, the beat becomes fast and uneven. Atrial fibrillation can cause heart rate of 100 to 175 beats per minute. Confusion, dizziness, exhaustion, and fainting are the symptoms of atrial fibrillation.

The expansion of the atrial fibrillation market is fueled by increase in the frequency of atrial fibrillation in the elderly population, technical developments, and a preference for catheter ablation for cardiac arrhythmia therapy. The atrial fibrillation market is projected to be hampered by scarcity of experienced specialists and adverse preference for pharmacological treatments (drugs) over AF therapy devices. Furthermore, novel medicine therapy based on biotechnology and genetics is projected to boost drug demand while reducing need for AF devices. Moreover, combining medications with devices produces better outcomes in the treatment of cardiac arrhythmia. As a result, this may contribute to atrial fibrillation market expansion during the forecast period.

Catheter ablation is a procedure used to treat irregular cardiac rhythms when medicines are ineffective. It is a low-risk, minimally invasive method for the treatment of cardiac arrhythmias. The catheter ablation device includes removing of defective cardiac tissues that cause irregular heartbeats. Catheter ablation has a 95.0% success rate in the treatment of cardiac arrhythmias. Furthermore, key players are manufacturing advanced catheter ablation for the treatment of atrial fibrillation and reducing the risk of stroke in patients. For instance, in August 2020, Abbott Laboratories, a manufacturer of healthcare products and medical devices introduced TactiFlex PAF IDE ablation catheter, which is used to treat patient suffering from irregular heartbeat, paroxysmal atrial fibrillation. It has sensors enabled for patient with atrial fibrillation (AFib) symptoms that cannot be treated with medicine.

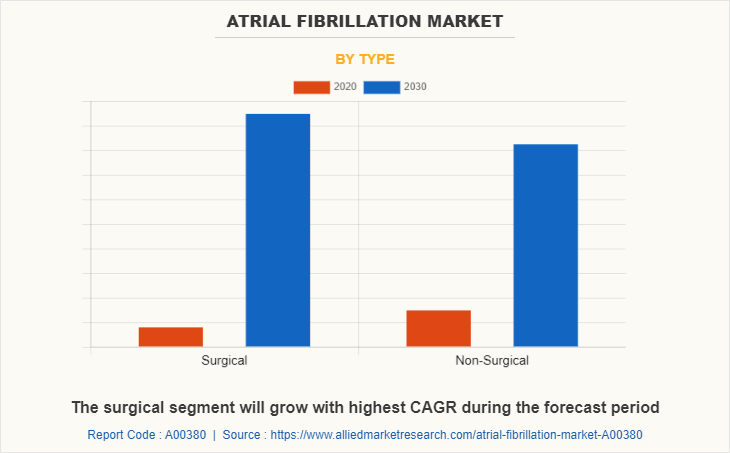

The most often used surgical device for the treatment of cardiac arrhythmias is catheter ablation. When anticoagulant medicines and other medications fail to function, atrial fibrillation treatment is prescribed. As a result, this category accounted for the largest share of the overall atrial fibrillation market size in 2020, and it is predicted to increase at the fastest rate throughout the forecast period.

By type, surgical segment registered the highest revenue in 2020 owning to increase in adoption of heart monitoring system during the treatment of atrial fibrillation. Increase in number patient with arrhythmia or an irregular heartbeat problem has resulted in growth in demand for cardiac monitors.

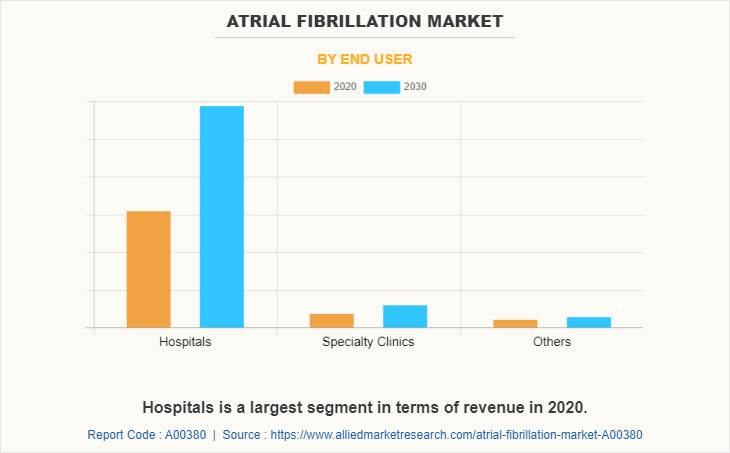

By end user, hospitals segment has registered highest revenue in 2020, owning to increase in adoption of laser and radiofrequency method for catheter ablation. The novel coronavirus (COVID-19) rapidly spread across various countries and regions in 2019, causing an enormous impact on lives of people and atrial fibrillation market growth. It began as a human health condition and has now become a significant threat to global trade, economy, and finance. The COVID-19 pandemic halted production of many products in the atrial fibrillation market, owing to lockdowns. Furthermore, the number of COVID-19 cases are expected to reduce in the future with the introduction of the vaccine for COVID-19 in the market. This has led to the reopening of atrial fibrillation companies at their full-scale capacities. This is expected to help to increase and recover the atrial fibrillation market share by the start of 2022. After COVID-19 infection cases begin to decline, equipment & machinery producers must focus on protecting their staff, operations, and supply networks to respond to urgent emergencies and establish new methods of working.

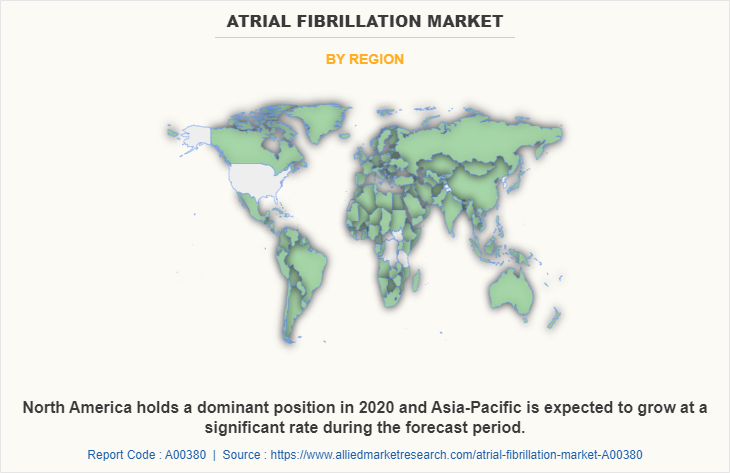

By geographic region, North America generated highest revenue in the atrial fibrillation market in 2020. High adoption of technologically advanced devices for atrial fibrillation in the North American countries is the prime factor that drives the growth of the atrial fibrillation market. Moreover, rapid increase in cardiac diseases in aging population is one of the major challenges faced by healthcare systems. Hence, to overcome this challenge, many new products are approved and launched in North American countries, which further drives the growth of the atrial fibrillation industry.

The market is segmented on the basis of type, technology, end user, and geography. On the basis of type, it is divided into surgical and non-surgical. On the basis of technology, it is divided into radiofrequency, laser, cryotherapy and others. By end user, the market is segmented into hospitals, specialty clinics, and others. Region wise, the market analysis is conducted across North America (the U.S., Canada, and Mexico), Europe (the UK, France, Germany, Italy, and Rest of Europe), Asia-Pacific (China, Japan, India, South Korea, and Rest of Asia-Pacific), and LAMEA (Latin America, the Middle East, and Africa).

Key Benefits For Stakeholders

- The report provides an extensive analysis of the current and emerging atrial fibrillation market trends and dynamics.

- In-depth atrial fibrillation market analysis is conducted by constructing market estimations for key market segments between 2021 and 2030.

- Extensive analysis of the atrial fibrillation market share is conducted by following key product positioning and monitoring of top competitors within the market framework.

- A comprehensive analysis of all the regions is provided to determine the prevailing opportunities.

- The global atrial fibrillation market forecast analysis from 2021 to 2030 is included in the report.

- The key players within atrial fibrillation market are profiled in this report and their strategies are analyzed thoroughly, which help understand the competitive outlook of the atrial fibrillation industry.

- The atrial fibrillation market share analysis from 2020 to 2030 is included in the report.

- In-depth analysis of atrial fibrillation market size is conducted by constructing market estimations for regions and countries between 2020 and 2030.

- The report includes atrial fibrillation market opportunity and comprehensive analysis of all the regions is provided to determine the prevailing opportunities.

Atrial Fibrillation Market Report Highlights

| Aspects | Details |

| By Type |

|

| By TECHNOLOGY |

|

| By END USER |

|

| By Region |

|

| Key Market Players | Medtronic plc, Johnson & Johnson, Boston Scientific Corporation, Biotronik SE & Co. KG, Abbott Laboratories, MicroPort Scientific Corporation, st. jude medical, Siemens AG, Koninklijke Philips N.V., AtriCure Inc |

Analyst Review

Some of the primary factors that drive the atrial fibrillation market include, the increase in rate of arrhythmias, technological developments, and a rise in emphasis on early prevention. Further, the market is growing owning to rise in the number of patients with cardiac arrhythmia as the global population's median age changes toward older age groups, and increase in technology advancements in the medical sector. Moreover, utilization of different devices and drugs for the treatment of atrial fibrillation is expected to witness a significant rise with increase in incidence rate of cardiac arrhythmia, such as atrial fibrillation. The atrial fibrillation market gains high interest from healthcare providers due to high incidence of atrial fibrillation.

Various market players introduce technical advanced atrial fibrillation treatment devices for healthcare and hospitals. For instance, in May 2021, MicroPort Scientific Corporation, a manufacturer of medical devices introduced EP Columbus 3D EP Navigation System in Brazil. EP Columbus is a 3D procedure to treat patients with atrial fibrillation. Such advanced medical devices are expected to provide significant growth in the atrial fibrillation market during the forecast period.

The atrial fibrillation market size was valued at $1,825.8 million in 2020.

The non surgical segment holds the maximum market share of the Atrial Fibrillation Market

The atrial fibrillation market size is projected to reach $3,370.7 million by 2030, registering a CAGR of 6.4% from 2021 to 2030.

Increase in healthcare spending in developing countries is key trend in the Atrial Fibrillation Market .

Ans: The product launch is key growth strategy of Atrial Fibrillation industry players.

The company profile has been selected on factors such as geographical presence, market dominance (in terms of revenue and volume sales), various strategies and recent developments.

Loading Table Of Content...