Surgical Equipment Market Research, 2032

The global surgical equipment market size was valued at $35.6 billion in 2022, and is projected to reach $59 billion by 2032, growing at a CAGR of 5.2% from 2023 to 2032. Surgical equipment refers to the various tools, instruments, and devices used by healthcare professionals such as surgeons, nurses, and other medical personnel during surgical procedures. These tools are designed to aid in performing surgical tasks with precision, safety, and efficiency. Surgical equipment encompasses a wide range of items, each serving a specific purpose in the operating room. Surgical equipment are tools that aid the physical modification of biological tissue or help to provide access to the internal body. The inception of modern electronic technologies such as minimally invasive surgery equipment primarily drive the growth of the surgical equipment market.

Market Dynamics

The rise in incidence of chronic diseases such as cardiovascular diseases, cancer, and diabetes necessitates a greater number of surgical interventions for diagnosis, treatment, and management which is expected to drive the market growth. The surgical equipment market benefits from this trend, as these conditions often require specialized surgical instruments, diagnostic tools, and monitoring devices. Surge in demand for minimally invasive surgery and surge in geriatric population, which is highly susceptible to ocular disorders, gastric disorders, intestinal disorders, and other health conditions.

One of the primary drivers of growth in the surgical equipment market is continuous technological innovation. Advancements in materials, design, and manufacturing processes have led to the development of more precise, efficient, and minimally invasive surgical instruments. These innovations have not only improved surgical outcomes but have also expanded the scope of procedures that can be performed.

Furthermore, the rise in the adoption of minimally invasive surgical techniques has been due to their numerous benefits such as smaller incisions, reduced pain, shorter hospital stays, and quicker recovery times for patients. As a result, there is a growing demand for specialized surgical equipment such as laparoscopic instruments and endoscopes which fuels the market growth.

According to surgical equipment market analysis the market is expected to be driven by availability of improved healthcare infrastructure, increase in unmet healthcare needs, rise in prevalence of chronic diseases, and surge in demand for advanced surgical equipment products. Furthermore, with the rise in geriatric population, there is a higher prevalence of age-related health conditions and chronic diseases that often require surgical interventions. In addition, there is an increase in demand for elective cosmetic and reconstructive surgeries. This demographic shift has led to a higher volume of surgical procedures, which, in turn, boosts the demand for surgical equipment.

Moreover, emerging markets and developing countries are witnessing significant investments in healthcare infrastructure, including the establishment of new hospitals, clinics, and healthcare centers. This expansion creates a substantial demand for surgical equipment to equip these facilities with the necessary tools and instruments. The global expansion of healthcare infrastructure offers surgical equipment market opportunity.

However, infections acquired during surgery (nosocomial infections or healthcare-associated infections) remain a significant concern. Surgical instruments and equipment must be meticulously cleaned, sterilized, and maintained to prevent infections. Any lapses in infection control may result in severe consequences for patients, legal liabilities for healthcare facilities, and damage to the reputation of surgical equipment manufacturers which may hinder the market growth. In addition, the surgical equipment market is subject to stringent regulatory standards and quality assurance requirements, which may create barriers to entry for new manufacturers and slow down product innovation and restrain the surgical equipment market growth.

Recessions may slow down the growth of the surgical equipment market due to financial constraints, cautious adoption, and shifting priorities. However, the extent of the impact depends on various factors, including the severity and duration of the recession, the overall healthcare spending environment in improving patient care.

Segmental Overview

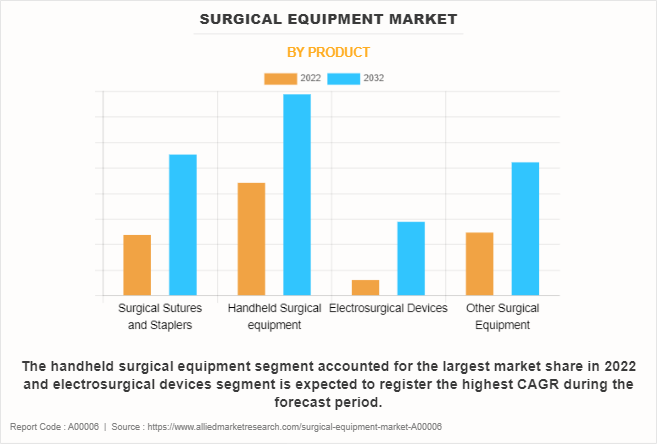

The surgical equipment market size is segmented into product, category, application, and region. By product, the market is categorized into surgical sutures & staplers, handheld surgical devices, electrosurgical devices, and other surgical equipment. The handheld surgical devices segment is further sub-divided into forceps & spatulas, retractors, dilators, graspers, auxiliary instruments, cutter instruments, ligating clips, and others (suction tubes, rasps, dissectors, needle holders, and other surgical clips). The other surgical equipment segment includes surgical hernia mesh, surgical glue, and powered surgical instruments.

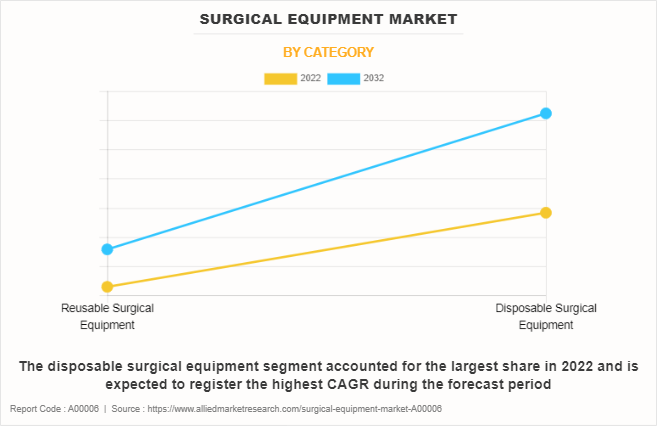

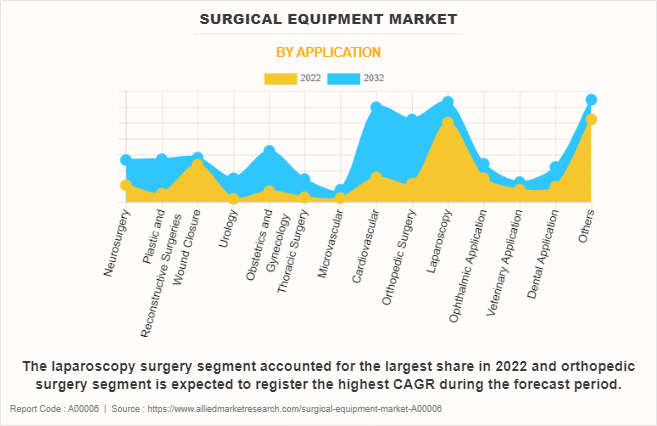

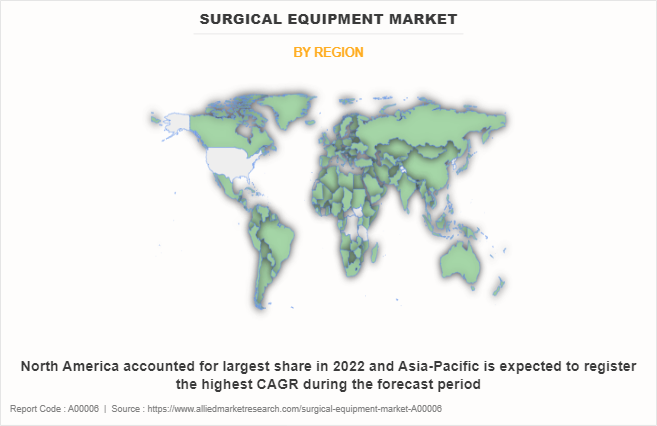

By category, the surgical equipment industry is classified into reusable surgical equipment and disposable surgical equipment. By application, the market is categorized into neurosurgery, plastic & regenerative surgery, wound closure, urology, obstetrics & gynecology, thoracic surgery, microvascular, cardiovascular, orthopedic surgery, laparoscopy, ophthalmic application, veterinary application, dental application, and others. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By Product

The handheld surgical equipment segment dominated the global surgical equipment market share in 2022 and is expected to remain dominant throughout the forecast period, owing to surge in number of surgeries performed globally and its frequent use in all types of surgeries. However, the electrosurgical device segment is expected to register the highest CAGR during the forecast period owing to a rise in demand for minimally invasive surgeries and advancement in technology.

By Category

The disposable surgical equipment segment dominated the global surgical equipment market share in 2022 and is anticipated to continue this trend during the forecast period. This is attributed to its convenience, infection control benefits, and increasing demand for single-use, sterile instruments.

By Application

The laparoscopy surgery segment held the largest market share in 2022 and is expected to remain dominant throughout the forecast period, owing to its minimally invasive nature, shorter recovery times, and a wide range of applications across various medical specialties. However, the orthopedic surgery segment is anticipated to witness highest growth, owing to the rise in prevalence of orthopedic conditions, rise in aging population, and advancements in orthopedic surgical techniques and technologies.

By Region

The surgical equipment industry is analyzed across North America, Europe, Asia-Pacific, and LAMEA. North America accounted for a major share of the surgical equipment market in 2022 and is expected to maintain its dominance during the surgical equipment market forecast period. The presence of several major players, such as B. Braun SE, Boston Scientific Corporation, Integra Life Sciences Holdings Corporation, and Medtronic plc and advancement in manufacturing technology of surgical equipment in the region drive the growth of the market.

In addition, the presence of well-established healthcare infrastructure, high purchasing power, and rise in adoption rate of advanced surgical equipment products are expected to drive the market growth. Furthermore, product launch, and agreement adopted by the key players in this region boost the growth of the market.

Asia-Pacific is expected to grow at the highest rate during the forecast period. The market growth in this region is attributable to the growing infrastructure of industries, rise in prevalence of chronic diseases, such as cancer and cardiovascular conditions, has driven the need for sophisticated surgical interventions, which surgical equipment provide.

Moreover, the increase in awareness and acceptance of minimally invasive procedures among patients in the Asia-Pacific region along with the benefits offered by surgical equipment propels the market growth in this region.

Competition Analysis

Competitive analysis and profiles of the major players in surgical equipment, such as B. Braun SE, Boston Scientific Corporation, ConMed Corporation, Johnson & Johnson, Medtronic plc, Cousin Surgery, LLC, KLS Martin Group, Fuhrmann GmbH, Entrhal Medical GmbH, and Integra LifeSciences Holdings Corporation are provided in the report. Major players have adopted product launch and agreement as key developmental strategies to improve the product portfolio of the surgical equipment market.

Recent Developments in Surgical Equipment Market

- In June 2022, Ethicon, part of Johnson & Johnson MedTech, announced the U.S. launch of the ECHELON 3000 Stapler, a digitally enabled device that provides surgeons with simple, one-handed powered articulation to help address the unique needs of their patients.

- In April 2022, Ethicon, part of Johnson & Johnson MedTech, announced the launch of the ENSEAL X1 Straight Jaw Tissue Sealer, a new advanced bipolar energy device that cuts and transects, enables stronger sealing, and captures more tissue per bite.

- In June 2021, Ethicon, part of the Johnson & Johnson Medical Devices Companies announced the launch of the ENSEAL X1 Curved Jaw Tissue Sealer, a new advanced bipolar energy device that increases procedural efficiency.

- In March 2021, Ethicon, part of the Johnson & Johnson Medical Devices Companies announced the global launch of the ECHELON+ Stapler with GST Reloads, a new powered surgical stapler designed to increase staple line security and reduce complications through more uniform tissue compression and better staple formation, even in challenging situations.

- In June 2020, Aesculap, Inc., an industry leader in sterile processing and operating room solutions, is pleased to announce the availability of the next generation of surgical instrumentation with the launch of SQ. line Surgical Instruments.

- In March 2021, Boston Scientific announced that it has entered into a definitive agreement with an affiliate of Baring Private Equity Asia (BPEA) to acquire the global surgical business of Lumenis LTD., a privately held company that develops and commercializes energy-based medical solutions, for an upfront cash payment of $1.07 billion, subject to closing adjustments.

- In November 2020, Boston Scientific Corporation announced it has entered into a definitive agreement to acquire Apollo Endosurgery, Inc. for a cash price of $10 per share. The Apollo Endosurgery product portfolio includes devices used during endoluminal surgery (ELS) procedures to close gastrointestinal defects, manage gastrointestinal complications and aid in weight loss for patients suffering from obesity.

- In October 2021, Medtronic plc, the global leader in medical technology, announced that it has received CE Mark for the Hugo robotic-assisted surgery (RAS) system, authorizing the sale of the system in Europe. CE Mark approval is for urologic and gynecologic procedures, which make up about half of all robotic procedures performed.

- In November 2020, Medtronic Completes Acquisition of Medicrea. This acquisition expands Medtronic's Artificial Intelligence and Data Capabilities and becomes the first company to offer an Integrated Spine Solution Including AI-Driven Surgical Planning, personalized spinal implants and robotic assisted surgery.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the surgical equipment market from 2022 to 2032 to identify the prevailing surgical equipment market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the surgical equipment market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global surgical equipment market trends, key players, market segments, application areas, and market growth strategies.

Surgical Equipment Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 59 billion |

| Growth Rate | CAGR of 5.2% |

| Forecast period | 2022 - 2032 |

| Report Pages | 390 |

| By Product |

|

| By Category |

|

| By Application |

|

| By Region |

|

| Key Market Players | Johnson & Johnson, Boston Scientific Corporation, Medtronic plc, Integra LifeSciences Holdings Corporation, KLS Martin Group, B. Braun SE, Entrhal Medical GmbH, Fuhrmann GmbH, ConMed Corporation, Cousin Surgery, LLC |

Analyst Review

This section provides various opinions of thr surgical equipment market. Increase in demand for surgical equipment and rise in awareness about the importance of early diagnosis and treatment are expected to offer profitable opportunities for the expansion of the market. However, increased risk of infections through surgical equipment hinders the market growth.?

In addition, the surge in the prevalence of chronic diseases and a rise in awareness regarding the potential benefits of advanced surgical equipment have led to an increase in demand for surgical equipment across the globe, which is expected to fuel market growth during the forecast period. In addition, the surge in geriatric population and rise in healthcare expenditure drives the growth of the market.

Furthermore, North America is expected to witness the largest growth, in terms of revenue, owing to a rise in adoption of minimally invasive surgical procedures along with rise in geriatric population and presence of major key players in the region. However, Asia-Pacific is anticipated to witness notable growth, owing to surge in number of surgeries, technological advancements, and rise in prevalence of chronic diseases amongst the geriatric population.

The total market value of surgical equipment market is $35.6 billion in 2022.

The market value of surgical equipment market in 2032 is $58.9 billion.

The forecast period for surgical equipment market is 2023 to 2032.

The base year is 2022 in surgical equipment market.

The North America dominated the market share in 2022.

Johnson & Johnson, Medtronic plc, B. Braun SE, Boston Scientific Corporation, and Integra LifeSciences Holdings Corporation held a high market position in 2022.

Several factors contribute to the growth of this market, including the aging population, increasing surgical procedures, technological advancements, rising healthcare infrastructure, and rise in the demand for minimally invasive surgeries.

The handheld surgical instruments segment accounted for the largest market share in 2022. This is attributed to high adoption of the handheld surgical instrument as they provide versatility, precision, ease of use in various surgical procedures, and continuous advancements in design and materials.

Loading Table Of Content...

Loading Research Methodology...