Augmented and Virtual Reality Market Share & Insights:

The global augmented and virtual reality market size was valued at USD 27.6 billion in 2021, and is projected to reach USD 856.2 billion by 2031, growing at a CAGR of 41.1% from 2022 to 2031.

The global augmented and virtual reality market is influenced by several factors such as proliferation of smartphones, increase in popularity of gaming, cost-efficient benefits of augmented and virtual reality-based solutions and surge in adoption of AR and VR technologies by the enterprises are anticipated to drive the growth of augmented and virtual reality. However, lack of good user experience design is expected to hamper the market growth during the forecast period. These factors collectively provide opportunities for the market growth. However, each factor has its definite impact on the market.

Virtual reality is an extensive term for a multi-sensory computer-generated experience that enables users to experience and interact with a simulated environment. Whereas, augmented reality enhances the real world using digitally produced perceptual overlays. A growing number of industries are depending on AR and VR technology to augment their productivity, customer service, and communication.

The augmented and virtual reality market is segmented into Organization Size, Application and Industry Vertical. The global augmented and virtual reality market is segmented based on organization size, application, industry vertical, and region. On the basis of organization size, the market is fragmented into large enterprises and small & medium sized enterprises. In terms of application, the market is bifurcated into consumer and enterprise. Depending on industry vertical, it is segregated into gaming, entertainment & media, aerospace & defense, healthcare, education, manufacturing, retail, and others. Region wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The Augmented and virtual reality industry is dominated by key players such as Google Inc., Sony, Magic Leap, Inc., HTC, Microsoft Corporation, Osterhout Design Group, Facebook, DAQRI, Samsung Electronics Co., Ltd., and Wikitude.

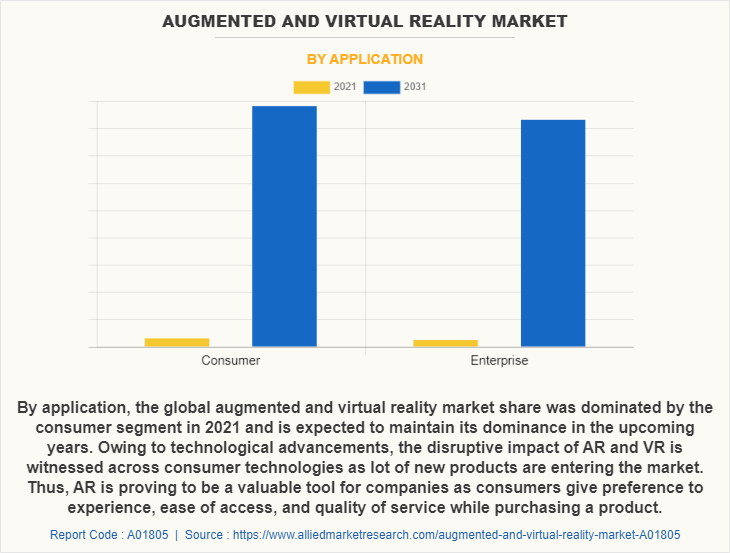

By application, the global augmented and virtual reality market share was dominated by the consumer segment in 2021 and is expected to maintain its dominance in the upcoming years. Owing to technological advancements, the disruptive impact of AR and VR is witnessed across consumer technologies as lot of new products are entering the market. Thus, AR is proving to be a valuable tool for companies as consumers give preference to experience, ease of access, and quality of service while purchasing a product. However, enterprise segment is expected to witness the highest growth, as the increasing number of enterprises apart from gaming and other consumer entertainment subsectors are adopting and testing AR and VR technologies in an extensive range of work-related applications.

Depending on region, North America dominates the augmented and virtual reality industry. This is due to the demand from gaming, entertainment and media, aerospace and defense, retail, and manufacturing industries. In addition, North America is a home to major players such as Google, Facebook, DAQRI, and others, which offer advanced solutions. Moreover, enterprises in this region have invested on AR & VR along with the simulation. However, Asia-Pacific is expected to observe highest growth rate during the forecast period. The introduction of 4G technology and high-speed communication along with growing number of smartphone users has driven the adoption of AR and VR market in this region.

The report focuses on the growth prospects, restraints, and augmented and virtual reality market analysis. The study uses Porter’s five forces analysis to understand the impact of various factors, such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants & substitutes, and bargaining power of buyers on the augmented and virtual reality market growth.

Top Impacting Factors:

Surge in Demand for Market Globally Due to COVID-19 Outbreak

With increase in demand for Augmented and virtual reality globally due to COVID-19 outbreak, many companies started manufacturing Augmented and virtual reality’s with latest technologies and different functionalities. and features. Some Tablets come with different processors and operating system (OS) such as Android ICS which is now gradually being replaced by Android Jelly Bean, some support dual 3G SIM for calling and browsing needs in a single tab. Augmented and virtual reality with different features will be hitting the market. Latest technology and innovation are expected to help to bring out a revolution in the features and specifications of the upcoming augmented and virtual reality. Moreover, 5G technology is expected to provide lucrative opportunities for the market growth. It is getting tremendous response from the people and thus the enhancement in the tablet technology will definitely create a buzz in the Augmented and virtual reality market around the world.

Increase in smartphone penetration

Rising adoption of smartphones and technological advancements have allowed its users to view virtual images immersed in real contexts. In addition, they are also able to connect with these images and objects to interact with them by simply using the camera on their smartphone devices, which are the major factors boosting the growth of the AR and VR market. Moreover, augmented reality (AR) and virtual reality (VR) are becoming vital components of modern smartphones, and mobile devices are expected to drive the demand for these technologies. Also, smartphone makers are now planning to develop the next wave of revolutionary computing devices, which is expected to bring new opportunities for the growth of the market.

Furthermore, AR can be delivered through smartphone alone owing to the location-based AR apps. Although, the adoption of AR is still in its nascent stage, there are huge opportunities for the large-scale adoption of AR as, the penetration of smartphones is booming at a rapid rate in emerging economies such as India, which is expected to be opportunistic for the growth of the AR and VR market in upcoming years.

Key Benefits for Stakeholders:

- This report provides a quantitative analysis of the Augmented and Virtual Reality Market Forecast, current trends, estimations, and dynamics of the augmented and virtual reality market analysis from 2021 to 2031 to identify the prevailing augmented and virtual reality market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the augmented and virtual reality market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global augmented and virtual reality market trends, key players, market segments, application areas, and market growth strategies.

Augmented and Virtual Reality Market Report Highlights

| Aspects | Details |

| By Organization Size |

|

| By Application |

|

| By Industry Vertical |

|

| By Region |

|

| Key Market Players | Samsung Electronics Co., Ltd, OSTERHOUT DESIGN GROUP, Wikitude GmbH, Microsoft Corporation, DAQRI, SONY CORPORATION, HTC, Magic Leap, Inc., Alphabet, Facebook |

Analyst Review

In accordance with the insights by the CXOs of leading companies, the global augmented and virtual reality market is projected to witness prominent growth, especially in Asia-Pacific and Europe region. This growth is attributed to the high adoption of smartphone devices; growth in number of gamers; and increased awareness among the end-user industries regarding the benefits of augmented and virtual reality technology-based solutions. Prominent players operating in the augmented and virtual reality industry are inclined toward developing augmented and virtual content that can support various platforms such as mobile devices, gaming console, tablets, and personal computers.

According to CXOs of key players operating in the augmented and virtual reality market, initial investments and development cost of training & simulation solutions among various end-user industries is higher as compared to other solutions. However, augmented and virtual technology-based solutions provide better options for training as compared to conventional tools and methods.

The solution manufacturers focus on very minute details of real incidents while developing the solutions, so that a user can get a real-world training with minimum wastage of resources such as money, human life, and physical entities. For instance, in November 2021, the Samsung Electronics invested in DigiLens XR glasses firm at valuation over $500M. It raised for the development of its extended reality glasses (XR), which will offer AR features, such as overlaying digital images. This funding round puts the necessary pieces in place to finally bring enterprise and consumer smart glasses to market at a realistic price point.

Prominent players in augmented and virtual reality market are projected to concentrate on social experience enhancement; and introduction of industry-specific solutions to expand their presence across various industries such as mining, oil & gas, travel & tourism, and transportation.

Key players are projected to focus on the acquisition or strategic alliance with startups and well-established local players to expand their market presence and outperform competitors. For instance, in May 2022, Google acquired the startup firm, Raxium, which works on microLED display technologies for wearables and augmented and virtual reality (AR and VR) headsets. With the help of this acquisition Google continue to strengthen its AR/VR based product that will compete with other enterprises products.

The global augmented and virtual reality market was valued at $27,569.23 million in 2021, and is projected to reach at $856,166.61 million by 2031

The augmented and virtual reality market is projected to grow at a compound annual growth rate of 41.1% from 2022 to 2031.

The global augmented and virtual reality market is dominated by key players such as Google Inc., Sony, Magic Leap, Inc., HTC Corporation, Microsoft Corporation, Osterhout Design Group, Facebook, DAQRI, Samsung Electronics Co., Ltd., and Wikitude.

Depending on region, North America dominates the augmented and virtual reality market

Rising adoption of smartphones and technological advancements have allowed its users to view virtual images immersed in real contexts. In addition, they are also able to connect with these images and objects to interact with them by simply using the camera on their smartphone devices, which are the major factors boosting the growth of the AR and VR market.

Loading Table Of Content...