Autoimmune Disease Therapeutics Market Share and Trends

The global autoimmune disease therapeutics market size was valued at $109,833 million in 2017, and is projected to reach $153,320 million by 2025, registering a CAGR of 4.2% from 2018 to 2025. An autoimmune disease causes the immune system to destroy its own body tissue. There are more than 80 different types of autoimmune disorders; however, lupus, multiple sclerosis, IBS, type 1 diabetes, rheumatoid arthritis, psoriasis, and others are the most common form of autoimmune disease. Different types of drugs such as anti-inflammatory, NSAIDs, interferons, immune suppressants, corticosteroids, and others, are approved for the treatment of autoimmune disease.

Increase in incidence of autoimmune disease, surge in adoption of autoimmune disease therapeutics, and growth in R&D activities to develop ideal therapeutics are the key drivers of the global autoimmune disease therapeutics market. Furthermore, technological advancements in screening procedures, wide availability of therapeutics, and strong presence of pipeline drugs such as tocilizumab, baricitinib, certolizumab, secukinumab, etanercept, olokizumab, abatacept, apremilast, PF-06438179, golimumab, ustekinumab, etrolizumab, tofacitinib and others, are expected to further influence the market growth. On the other side, higher cost of advanced therapeutics can hamper the autoimmune disease therapeutics market growth.

Autoimmune Disease Therapeutics Market Segmentation

The global autoimmune disease therapeutics market is segmented based on drug class, indication, sales channel, and region. Based on drug class, the market is classified as anti-inflammatory, antihyperglycemics, NSAIDs, interferons, and others. On the basis of indication rheumatic disease, type 1 diabetes, multiple sclerosis, inflammatory bowel disease, and other indications. According to the sales channel, the market is categorized as hospital pharmacy, drug stores & retail pharmacy, and online store. Based on region, the autoimmune disease therapeutics market size is studied across North America (U.S., Canada, and Mexico), Europe (Germany, France, the UK, Italy, Spain, and rest of Europe), Asia-Pacific (China, Japan, Australia, India, South Korea, and rest of Asia-Pacific), and LAMEA (Brazil, Saudi Arabia, and rest of LAMEA).

Segment review

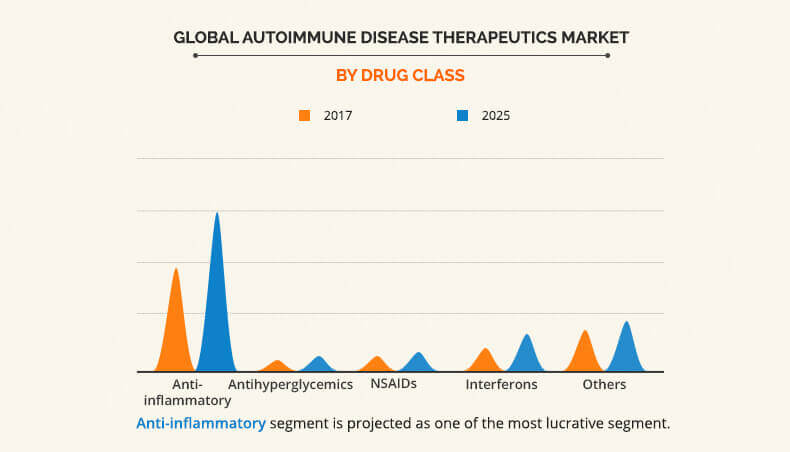

Based on drug class, the market is classified as anti-inflammatory, antihyperglycemics, NSAIDs, interferons, and others. Anti-inflammatory was the major revenue contributing segment in 2017 and is expected to exhibit dominance during the forecast period owing to increase in demand for anti- inflammatory drugs, launch of newer anti- inflammatory drugs with the supportive reimbursement policies for use of advanced anti- inflammatory drugs in some countries. Moreover, expected launch of pipeline anti-inflammatories such as tocilizumab, certolizumab, secukinumab, etanercept, golimumab and others, is estimated to further influence the market growth.

Anti-inflammatory drugs are preferably used in the treatment of inflammatory bowel disease, osteoarthritis, rheumatoid arthritis, fibromyalgia, systemic lupus erythematosus, gout, juvenile idiopathic arthritis, infectious arthritis, psoriatic arthritis, ankylosing spondylitis, reactive arthritis, scleroderma, polymyalgia rheumatica etc. Rise in incidence of these disease further fuels the market growth.

Presently, Adalimumab, Etanercept, Infliximab, Abatacept, Certolizumab, Golimumab, Ustekinumab, Tocilizumab, Secukinumab and others are widely used in the treatment of different form of autoimmune disease. Wide availability of anti-inflammatory drugs, preferable use of these drugs with favorable reimbursement in some countries contribute to the market growth.

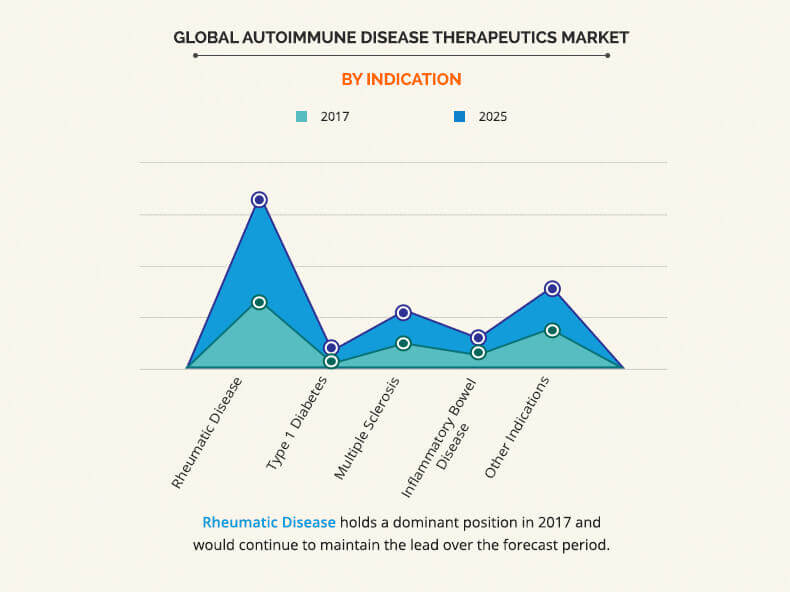

Based on indication, the autoimmune disease therapeutics market is classified as rheumatic disease, type 1 diabetes, multiple sclerosis, inflammatory bowel disease, and other indications. The rheumatic disease segment held nearly half of the autoimmune disease therapeutics market share in 2017 and is expected to remain dominant during the forecast period due to strong presence of pipeline drugs, surge in prevalence of arthritis, fibromyalgia, systemic lupus erythematosus, gout, scleroderma, polymyalgia rheumatica and others, wide availability of advanced therapeutics for treatment of rheumatic disease, and availability of advanced therapeutics for the treatment of these diseases.

Snapshot of Asia-Pacific autoimmune disease therapeutics market

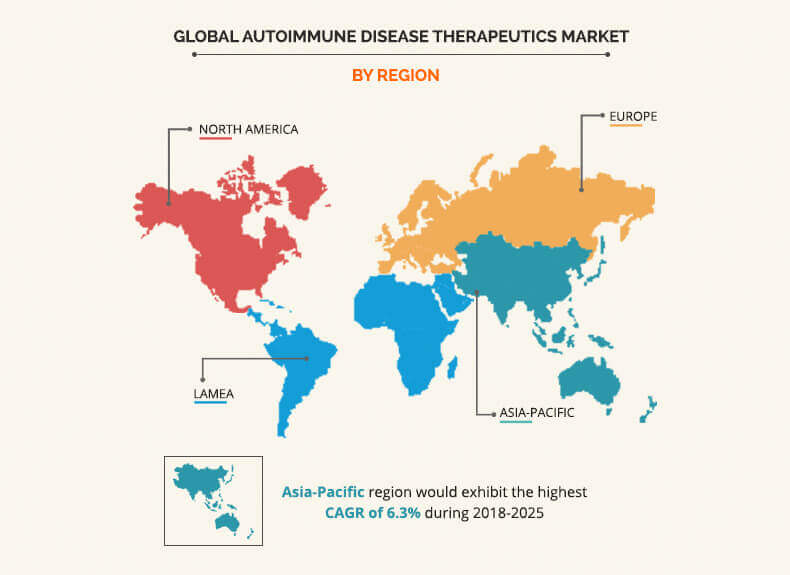

Asia-Pacific presents lucrative growth opportunities for the key players operating in the autoimmune disease therapeutics market owing to large population base, rise in purchasing power, surge in prevalence of autoimmune disease, and increase in demand for advanced autoimmune disease therapeutics. Growth in number of aging population, and increase in early detection of the disease with rise in healthcare expenditure fuel the growth of the autoimmune disease therapeutics market in this region.

Competition Analysis

The key players profiled in this report include Abbott Laboratories, AbbVie Inc., Amgen Inc., AstraZeneca plc., Bristol-Myers Squibb Company, F. Hoffmann-La Roche AG, Johnson & Johnson, Novartis AG, Pfizer Inc., UCB S.A.

Key Benefits for Autoimmune Disease Therapeutics Market:

- The study provides an in-depth analysis of the market along with the current autoimmune disease therapeutics market trends and future estimations to elucidate the imminent investment pockets.

- It offers a quantitative analysis from 2018 to 2025, which is expected to enable the stakeholders to capitalize on the prevailing market opportunities.

- Autoimmune disease therapeutics market forecast is studied from 2018 to 2025.

- A comprehensive analysis of all the regions is provided to determine the prevailing opportunities.

- Autoimmune disease therapeutics market size and estimations are based on a comprehensive analysis of the key developments in the autoimmune disease therapeutics industry.

- The profiles and growth strategies of the key players are thoroughly analyzed to understand the competitive outlook of the global market.

Autoimmune Disease Therapeutics Market Report Highlights

| Aspects | Details |

| By Drug Class Type |

|

| By Indication |

|

| By Sales Channel |

|

| By Region |

|

| Key Market Players | Pfizer Inc., Novartis AG, Johnson & Johnson, AbbVie Inc., F. Hoffmann-La Roche Ltd. (Genentech, Inc.,), Abbott Laboratories, AstraZeneca Plc., UCB S.A., Bristol-Myers Squibb Company, Amgen Inc. |

Analyst Review

Autoimmune disease is a condition in which the immune system mistakenly attacks own body cells. Drugs such as anti-inflammatory, NSAIDs, interferons, immune suppressants, corticosteroids, beta-blockers, are widely used for treatment & management of autoimmune disease. The adoption of autoimmune disease therapeutics is expected to increase owing to increase in prevalence of autoimmune diseases across the globe, rise in adoption of advanced therapeutics along with wide availability of drugs.

Increase in R&D studies for the development of ideal therapeutics, expected launch of pipeline drugs, technological advancement in screening procedures are projected to supplement the market growth during the forecast period. Moreover, rise in number of risk factors such as sedentary lifestyle pattern, & obesity is further expected to fuel the market growth. However, higher cost of advanced therapeutics can hinder the market growth.

North America is a major revenue contributing region and is expected to remain dominant during the forecast period due to surge in use as well as easy availability of therapeutics, early screening of the disease, favorable reimbursement policies, strong presence of key players, and higher number of target population.

In addition, Asia-Pacific and LAMEA are expected to offer lucrative growth opportunities to the key players during the forecast period due to increase in prevalence of autoimmune disease, rise in healthcare awareness, improvement in healthcare infrastructure with developing economies, and growth in the demand for advanced therapeutics.

Loading Table Of Content...