Automated Teller Machine (ATM) Market Overview

The global automated teller machine market was valued at $22.6 billion in 2022, and is projected to reach $50 billion by 2032, growing at a CAGR of 8.6% from 2023 to 2032. Growing demand for cash, rural banking expansion, technological advancements, financial inclusion initiatives, security upgrades, and rising adoption of managed services by banks are contributing to the growth of the market.

Market Dynamics & Insights

- The ATM industry in Asia-Pacific held the largest market share in 2019.

- By deployment solution, the mobile ATMs segment held the largest market share in 2019.

- By type, the smart ATM segment held the largest market share in 2019.

Market Size & Future Outlook

- 2019 Market Size: $20.58 Billion

- 2027 Projected Market Size: $30.50 Billion

- CAGR (2020-2027): 5.2%

- Asia-Pacific: dominated the market in 2019

- LAMEA: Fastest growing market

What is Meant by Automated Teller Machine (ATM)

An automated teller machine (ATM) is an electronic telecommunication device, which offers services to customers in terms of financial transactions such as deposits and withdrawals and account information and transfer of funds, without the physical involvement of bank staff. Continuous innovations in ATMs have made current ATMs more advanced as compared to the first-generation ATMs. With rise in customer demand for mobility and do-it-yourself banking, the industry is anticipated to continue to grow in the coming years. Presently, market have become the most powerful asset for the financial institutions to serve their customers 24X7.

Furthermore, an industry is a self-service banking terminal that enables people to carry out different financial activities without the help of a person. Automated teller machine industry allow users to withdraw cash, check their account balances, deposit money, transfer money between accounts, and obtain mini-statements of recent activities. They are most frequently located in banks, retail establishments, and public spaces. Customers insert a plastic debit or credit card connected to their bank account into an ATM and, for further security, enter a personal identification number (PIN). These devices, which are a common component of contemporary banking systems, have significantly improved the accessibility and convenience of banking services by enabling consumers to manage their accounts at any time of the day or night.

The increase in demand for cash is a significant driver of the growth of the automated teller machine market size. As cash remains a crucial payment method in many regions, and ATMs serve as convenient access points for users to withdraw money, ensuring continued relevance in the financial ecosystem. Furthermore, facility of wireless communication in smart ATMs is driving the demand of the market. However, emergence of online banking services is hampering the growth of the automated teller machine market share. Because the usage of ATMs has been further restricted as a result of the spread of digital payment alternatives, such as mobile wallets and contactless payments, which have reduced the need for cash for everyday purchases. As a cost-effective alternative to maintaining massive ATM networks, financial institutions have supported online and mobile banking to streamline operations and lower expenses.

Moreover, lack of security standard are major factors that hamper the growth of automated teller machine market growth. On the contrary, integration of new technologies such as contactless payments, QR codes, and touch screens is an market opportunity. ATMs are now more versatile and user-friendly owing to these advancements, which also improve their functioning and user experience. The time spent at the ATM is decreased by contactless payments and QR codes, which allow for fast and secure transactions. Users can more easily navigate across different banking services because to touch displays' intuitive user interface. These developments allow market to serve as a central location for a variety of financial services, such as mobile top-ups, bill payments, and even digital wallet transactions, in addition to catering to the changing tastes of tech-savvy clients. The fmarket can maintain its relevance and fulfill the evolving needs of consumers by adjusting to various technologies, resulting in sustained development.

Automated Teller Machine (ATM) Market Segment Review

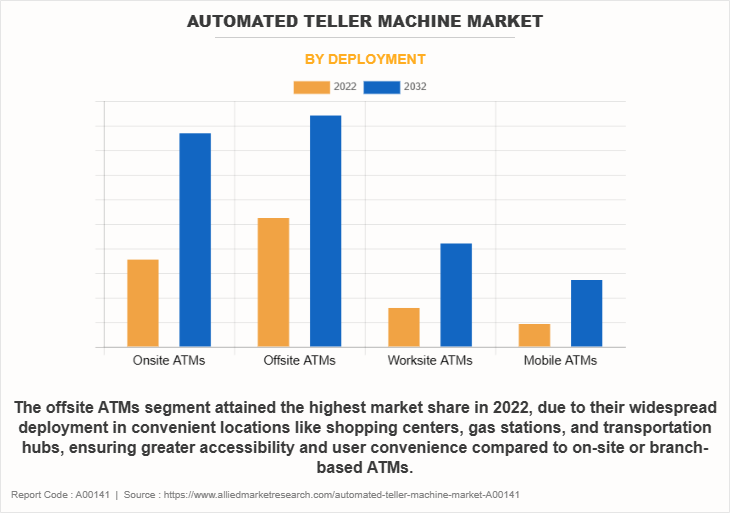

The automated teller machine (atm) market is segmented on the basis of type, deployment and region. By type, it is segmented into conventional/ banks ATMs, brown ATMs, white ATMs, cash dispenses ATM, and smart ATMs. On the basis of deployment, it is segmented into onsite ATMs, offsite ATMs, worksite ATMs, and mobile ATMs. By region, it is analysed across North America, Europe, Asia-Pacific, and LAMEA.

On the basis of deployment, the offsite ATMs segment attained the highest market share in 2022 in the automated teller machine market. This can be attributed to the fact that offsite ATMs significantly expand ATM accessibility by being deployed in a wide range of locations, including convenience stores, retail outlets, and other high-traffic areas. This extended accessibility appeals to a broader user base. Meanwhile, the mobile ATMs segment is projected to be the fastest-growing segment during the forecast period. This is attributed to the fact that Mobile ATMs can be installed in a variety of places, such as isolated and underserved communities, to offer easy access to financial services. Their quick increase in market share can be attributed in large part to this accessibility.

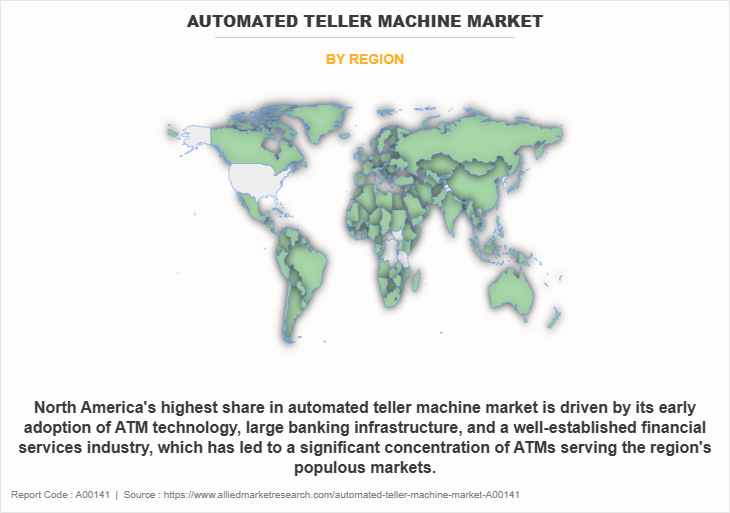

On the basis of region, North America attained the highest market share in 2022 and emerged as the leading region in the market. This is attributed to the fact that The North America region's emphasis on innovation has prompted the adoption of advanced ATM technology, including contactless payments and improved security features, which has increased market development as governmental assistance and a strong focus on banking convenience have encouraged a competitive ATM sector in North America, making it the world leader in terms of market share. On the other hand, the Asia-Pacific region is projected to be the fastest-growing region for the automated teller machine market during the forecast period. This growth is attributed to the fact that the Asia-Pacific region has a diversified and widely distributed population, which has increased demand for cash-based transactions. ATMs are essential in facilitating money transactions. The continuous need for ATMs in the area is a result of the region's growing urbanization, expansion of the retail and hospitality industries, and continued reliance on cash for everyday transactions in the culture.

The report analyses the profiles of key players operating in the market such as Diebold Nixdorf, Incorporated., Euronet Worldwide, Inc, FUJITSU, GRGBanking, HESS Cash Systems, Hitachi Channel Solutions, Corp, Hyosung TNS Inc., NCR Corporation, Source Technologies, and Triton Systems of Delaware, LLC. These players have adopted various strategies to increase their market penetration and strengthen their position in the automated teller machine market.

Competition Analysis

What are the Recent Product Launched in the Automated Teller Machine (ATM) Market

- In September 2023, Hitachi payment services launched India's first UPI-ATM in collaboration with the National Payments Corporation of India (NPCI) at the Global Fintech Fest. The launched of the UPI-ATM, which smoothly integrated UPI's convenience and security into conventional ATMs, represented a significant turning point in financial services. Without a physical card, this novel idea aims to make instant access to cash possible even in distant parts of India.

What are the Recent Partnership in the Automated Teller Machine (ATM) Market

- In July 2023, Red Link extended its partnership with Diebold Nixdorf to migrate 90% of its network to DN Series. The remaining 10% are planned to be replaced with the DN Series later this year. This partnership offers the flexible ATM has a minimal footprint while providing the latest cash processing technology and multi-layered security features. The transition to the DN Series has allowed Red Link and its more than 40 partner banks to improve the consumer experience with additional functionalities, such as fingerprint and facial recognition, and increase efficiencies.

What are the Top Impacting Factors in Automated Teller Machine (ATM) Market

Facility of Wireless Communication in Smart ATMs

To reduce the risk of automated teller machine market frauds such as card skimming and card trapping, smart ATMs have been introduced, which can communicate with the smartphones of customers easily through near field communication (NFC) technology. NFC technology is a way of transferring data wirelessly between ATM and mobile app by generating code that consumers use to unlock their bank accounts, then withdraw money from an ATM with the tap of a mobile device. With advancements in technology, smart ATMs have reduced the burden of carrying ATM cards. Thus, smartphone apps help to secure financial transactions, which is supporting the ATM market growth. Furthermore, integration of advanced security features such as voice recognition, EMV adoption, and biometrics provide additional advantage in securing customers financial transactions.

Moreover, wireless connectivity allows banks and ATM operators to remotely monitor and manage smart ATMs. With the help of this function, downtime and operating expenses can be decreased by real-time upgrades, software maintenance, and troubleshooting. In addition, stronger security measures are made possible by wireless technology, including monitoring ATM activities and real-time fraud detection. It makes it possible to apply biometric authentication techniques, substantially boosting transaction security as well. Therefore, facility of wireless communication in smart ATMs are driving the demand of automated teller machine market outlook.

Increasing Demand for Cash

Despite the growth of digital payment methods, the demand for physical cash remains significant, particularly in emerging markets and regions with limited banking infrastructure. ATMs continue to be the primary source for accessing cash. Furthermore, many individuals still prefer using cash for daily expenses, such as small purchases, tips, and personal transactions. ATMs provide convenient access to cash, allowing people to manage their finances based on their preferences. In addition, cash is essential in emergency situations when electronic payment methods may not be available due to power outages or network disruptions. ATMs serve as a critical resource for obtaining cash in such scenarios. Furthermore, in regions with limited banking infrastructure, ATMs play a vital role in providing access to financial services. They help bridge the gap between unbanked or underbanked populations and essential banking services. Furthermore, certain services, such as public transportation, parking, and vending machines, continue to accept cash payments. ATMs ensure individuals have access to the necessary funds for these services. Therefore, demand for cash are driving the growth of automated teller machine market.

Lack of Security Standards

Earlier, the risk of fraud was considerably low, as ATMs were considered secure due to PINs integrated with online authorization to authenticate transactions. With the increase in innovation in the FinTech industry, fraudsters have been coming up with new frauds such as magnetic strip skimming and pinhole cameras, which hamper market growth. Furthermore, attacks on ATMs can take many different forms, including malware-driven attacks, cash trapping, card skimming, and card trapping. It is more difficult for ATM makers and operators to successfully protect against these risks because there are no strict security standards in place. In addition, consumer confidence in using ATMs may be damaged by security issues. The demand for ATM services is impacted when users believe that ATMs are not secure and are therefore less inclined to utilize them for transactions.

Furthermore, security breaches and fraud incidents result in substantial financial losses for banks and ATM operators. These costs can be a deterrent to investing in new ATM installations and can impact profitability. Therefore, lack of security standards are hampering the growth of automated teller machine market.

Integration of new Technologies such as Contactless Payments, QR Codes, and Touch Screens

Contactless transaction is considered as a key factor that significantly contributes toward the growth of the automated teller machine market. For instance, Apple Pay and Android Pay enable new technologies such as NFC and contactless payments with QR codes and pre-staged mobile transactions, which are gaining increased traction in the ATM market. Owing to the integration of these new technologies, a range of end users are adopting advanced ATMs to improve personalization, modernize customer ID & authentication, and maximize the performance of ATMs & self-service channels.

Moreover, the introduction of new services such as mobile cash withdrawals with a QR code on smartphones has enabled bank customers to experience superior usability, which is expected to create ample opportunities for the ATM market during the forecast period. In addition, interactions with ATMs are more simple and user-friendly because to touch screens and intuitive user interfaces. More people may use ATMs as a result of the enhanced experience. Furthermore, integration with contactless payment methods allows users to quickly and securely complete transactions without the need to insert a physical card into an ATM machine. This aligns with the growing preference for contactless payments and card less ATMs. Therefore, integration of new technologies such as contactless payments, QR codes, and touch screens are opportunity for automated teller machine market.

What are the Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the automated teller machine market analysis from 2022 to 2032 to identify the prevailing market forecast.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the automated teller machine market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global automated teller machine market trends, key players, market segments, application areas, and market growth strategies.

Automated Teller Machine Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 50 billion |

| Growth Rate | CAGR of 8.6% |

| Forecast period | 2022 - 2032 |

| Report Pages | 333 |

| By Type |

|

| By Deployment |

|

| By Region |

|

| Key Market Players | Fujitsu, Euronet Worldwide, Inc., GRGBanking, HESS Cash Systems GmbH, Triton Systems of Delaware, LLC, Diebold Nixdorf, Incorporated., Hitachi Channel Solutions, Corp., Source Technologies, NCR Corporation, Hyosung TNS Inc. |

Analyst Review

Automated teller machines (ATM) are convenient, reliable, secured, and allow consumers to perform quick, self-service transactions for everyday banking needs such as deposits and withdrawals to more complex transactions, including bill payments and transfers. Cash recycling is the major driving factor of the ATM market, as it ensures customers such as small businesses to withdraw or deposit large volume of cash, thereby saving bank’s times and reducing cost associated with cash in transit. Integration of mobile devices to ATM machines via smartphone apps help to secure financial transactions, which supports the ATM market to grow. Advanced security features such as voice recognition, EMV adoption, and biometrics further aid in securing customer financial transactions, which boost the growth of the market. In addition, nowadays, a lot of ATMs allow for mobile integration, enabling users to start transactions on their mobile devices, finish them at the ATM, and avoid using a real card. This improves user ease and security. Furthermore, the number of traditional brick-and-mortar branches is frequently reduced when banks and other financial organizations reevaluate their branch networks. The usage of ATMs to provide a wider range of services, such as check deposits and bill payments, has helped the ATM market expand. In addition, manufacturers and operators of ATMs have made investments in enhancing security protocols in response to the rise in online threats and card fraud. This includes enhanced physical security measures, real-time monitoring systems, and encryption.

Furthermore, market players have adopted various strategies for enhancing their services in the market and improving customer satisfaction. For instance, in July 2023, Triton Systems of Delaware expanded its ATM service by signing a sale agreement with Dovers Corporation, a global provider of ATMs, to Nautilus Hyosung Inc., a subsidiary of Hyosung Corporation. Based in Seoul, Korea, it is a $7 billion revenue organization with a diversified business model. Global producer of comprehensive ATM solutions, Nautilus Hyosung offers services, software, and hardware to the ATM industry as a whole. Moreover, in October 2022, Euronet worldwide expanded its ATM network into Southeast Asia by establishing independent ATMs in the Philippines and also acquiring 500 ATMs from the bank of the Philippine Islands. With the recent acquisition of ATM assets (Bank of Ireland), the company has expanded its footprint in existing markets and is now offering ATM network participation services to multiple banks in Spain, Italy, Romania, and Poland. The agreement in Southeast Asia is the latest in a string of global ATM expansion initiatives for Euronet, which also include deploying its IAD in new markets in Europe (Iceland, Lithuania, and Montenegro), Northern Africa (Egypt), and forming strategic partnerships in Latin America. These strategies by the market players operating at a global and regional level is expected to help the market to grow significantly during the forecast period.

Some of the key players profiled in the report include Diebold Nixdorf, Incorporated., Euronet Worldwide, Inc, FUJITSU, GRGBanking, HESS Cash Systems, Hitachi Channel Solutions, Corp, Hyosung TNS Inc., NCR Corporation, Source Technologies, and Triton Systems of Delaware, LLC. These players have adopted various strategies to increase their market penetration and strengthen their position in the cyber insurance.

The upcoming trends in the ATM market include the integration of advanced technologies such as biometrics and artificial intelligence, the rise of cash recycling ATMs for improved efficiency, and the continued emphasis on contactless and secure transactions to enhance the user experience and address evolving consumer preferences.

Offsite ATMs is the leading application of Automated Teller Machine Market

North America is the largest regional market for Automated Teller Machine

50020.12 million is the estimated industry size of Automated Teller Machine

Diebold Nixdorf, Incorporated., Euronet Worldwide, Inc, FUJITSU, GRGBanking, HESS Cash Systems, Hitachi Channel Solutions, Corp, Hyosung TNS Inc., NCR Corporation, Source Technologies, and Triton Systems of Delaware, LLC. are the top companies to hold the market share in Automated Teller Machine

Loading Table Of Content...

Loading Research Methodology...