Automation And Instrumentation In Power Market Research, 2032

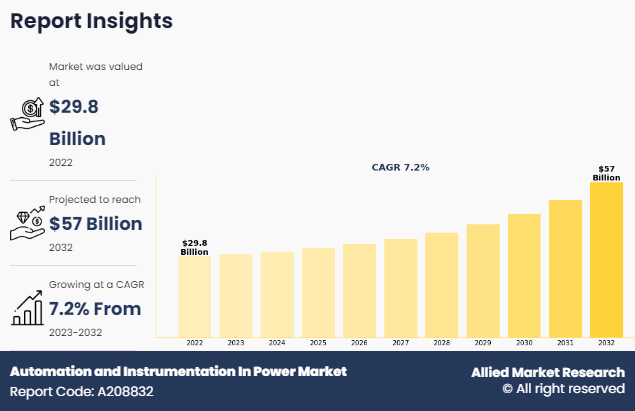

The global automation and instrumentation in power market size was valued at $29.8 billion in 2022, and is projected to reach $57 billion by 2032, growing at a CAGR of 7.2% from 2023 to 2032. Automation and instrumentation in power systems refer to the application of modern technologies to improve the efficiency, dependability, and safety of electrical power production, transmission, and distribution operations. Automation is the use of control systems, sensors, and software algorithms to automatically monitor and manage different elements of electricity generation and distribution, therefore eliminating human intervention and potential mistakes. Instrumentation, on the other hand, refers to the instruments used to measure, monitor, and regulate the parameters & variables in power systems to ensure optimal performance & safety criteria are fulfilled.

Automation and instrumentation play an important role in the transmission and distribution of electrical power as they maintain grid stability, manage voltage levels, and ensure the consistent supply of electricity to customers. Advanced control systems and smart grid technologies allow utilities to remotely monitor and manage substations, switchgear, and other essential infrastructure components, optimizing power flow and reducing losses.

Automation and instrumentation are essential for integrating renewable energy sources into the power grid and realizing the full potential of distributed energy resources (DERs). As the amount of renewable production grows, utilities must manage the inherent fluctuation and intermittency of solar and wind power. Automated control systems allow operators to estimate renewable generation, dynamically change output, and coordinate energy storage resources to balance supply and demand in real time. Furthermore, advanced grid monitoring and communication technologies make it easier to integrate DERs such as rooftop solar, battery storage, and demand response programs, allowing utilities to improve grid operations, reduce reliance on traditional generation, and decarbonize the energy mix.

Automation and instrumentation help to improve safety standards, reduce operational risks, and ensure regulatory compliance throughout the power sector. By automating regular processes and applying predictive maintenance procedures, utilities may reduce human error, occupational risks, and improve workplace safety for individuals working in dangerous areas like substations and power plants. Further, automated compliance management systems assist utilities in meeting demanding regulatory standards, monitoring emissions, and properly reporting operational performance data, preventing costly penalties and reputational harm. All these factors are anticipated to drive the automation and instrumentation in power market growth.

The use of automation and instrumentation provides a level of technical dependency that may be both beneficial and detrimental. While these technologies improve operational efficiency & accuracy, they also raise the risk of cyber-attacks and system breakdowns. A single software failure or cyber-attack may cause huge disruptions in power generation and delivery, potentially leading to widespread blackouts and economic losses. This danger is exacerbated by the quick rate of technological improvement, which frequently outpaces the development of strong security measures, exposing vital infrastructure to new cyber-attacks.

Moreover, the complexity of automated systems might lead to a skills deficit in the workforce. Traditional power plant operators may not have the appropriate skills to operate & maintain sophisticated automation and instrumentation technology efficiently. Bridging this gap necessitates significant investment in staff training and education, and the hiring of specialized professionals with automation and data analytic skills. Failure to address this skills deficit could compromise the stability & performance of automated power systems, undermining the benefits of their installation.

With an increasing emphasis on sustainability and environmental stewardship, optimizing resource utilization is critical for the power generation business. Automation and instrumentation provide for precise control over energy production processes, easing the integration of renewable energy sources like solar and wind into the grid. Furthermore, improved monitoring systems help to eliminate energy waste, optimize fuel use, and reduce greenhouse gas emissions, aligning power production practices with changing regulatory frameworks and global sustainability goals. Safety is a top priority in power generating, and automation and instrumentation play critical roles in reducing risks and maintaining compliance with strict safety regulations.

Integrated sensors, smart monitoring devices, and automatic shutdown mechanisms improve early defect detection and reaction, lowering the risk of accidents or equipment failure. In addition, remote operating capabilities decrease personnel's exposure to dangerous settings, thereby improving safety measures. The power generating sector is undergoing a major digital transition, marked by the confluence of IT (Information Technology) and OT. Automation and instrumentation act as catalysts for this transition, enabling the seamless integration of digital technology across the value chain.

Moreover, the key players profiled in this report include Siemens, ABB, Emerson Process Management, Rockwell automation, Schneider Electric, Honeywell process solutions, Mitsubishi electric, Yokogawa electric, Omron automation, and Danaher Industrial Ltd. Strategic partnerships and collaborations are common strategies followed by major market players. For instance, 27 Sept 2023, ABB launched a new value provider program for process automation solutions at its channel partner conference of the year.

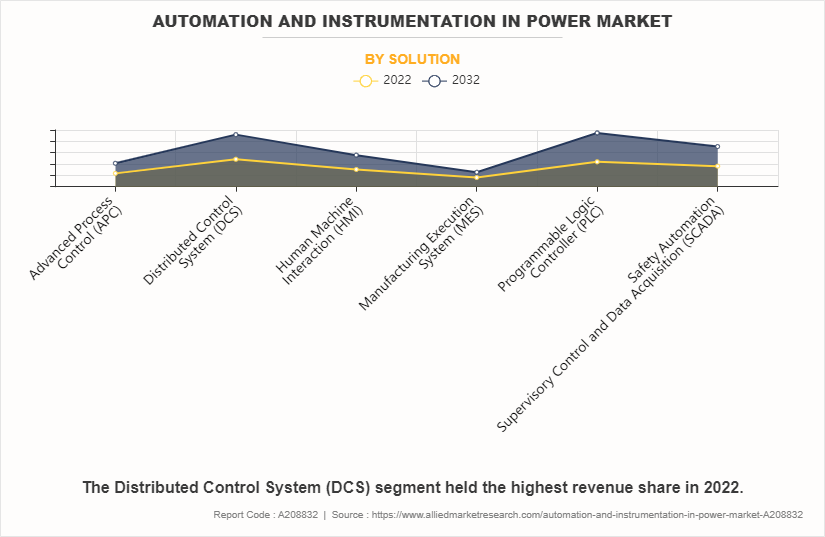

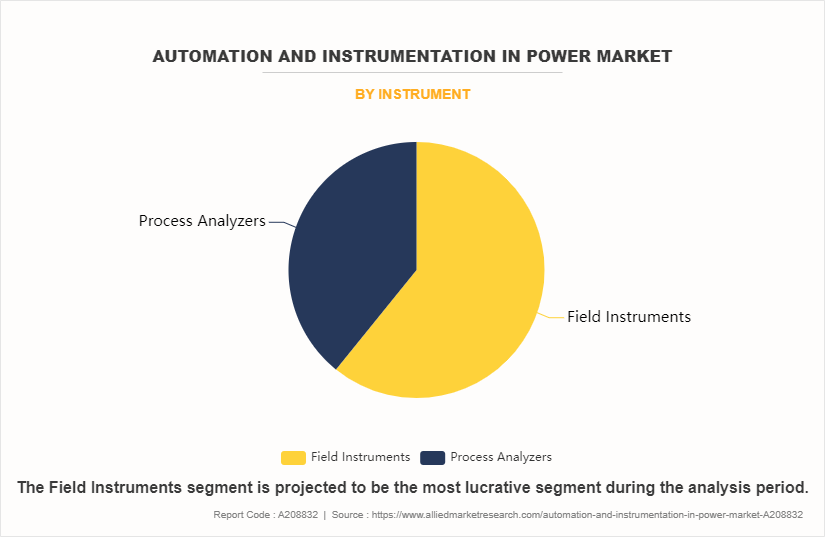

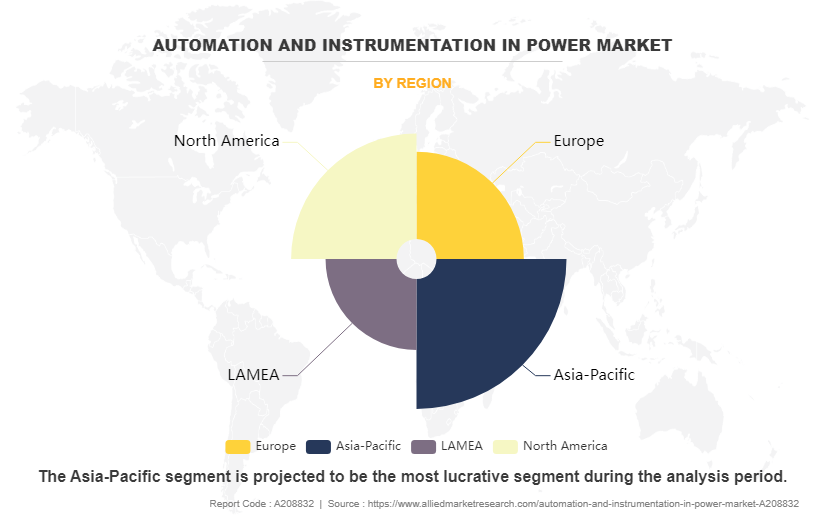

The automation and instrumentation in power market overview is segmented into solution, instruments, end user, and region. By solution, the market is segregated into advanced process control (APC), distributed control system (DCS), human machine interaction (HMI), manufacturing execution system (MES), programmable logic controller (PLC), and safety automation supervisory control and data acquisition (SCADA). Based on the instruments, the market is bifurcated into field instruments and process analyzers. Depending on region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The automation and instrumentation in power market is segmented into Solution and Instrument.

By solution,

By solution, the distributed & advanced control system segment dominated the global automation and instrumentation in power market in 2022. The drive for increased efficiency is one of the key reasons for the deployment of distributed and advanced control systems in the power sector. These systems use complex algorithms and real-time data analysis to optimize power generating, transmission, and distribution networks. By continually monitoring system conditions and modifying control settings, these systems may minimize energy losses, enhance load balancing, and maximize overall power system performance. Improving dependability is another significant driving factor for the use of distributed and advanced control systems in power.

These systems are intended to offer real-time monitoring and control over essential power system components such generators, transformers, and switchgear. By immediately identifying & responding to irregularities or defects, these systems can reduce downtime and the danger of extensive outages, providing customers with a more stable power supply. Flexibility is also an important driving force for the usage of distributed and advanced control systems in power. These systems are intended to be extremely flexible & adaptable, allowing power system operators to respond swiftly to changing system conditions and operating requirements.

By Instruments,

By instruments, the field instruments sub-segment dominated the global automation and instrumentation in power market share in 2022. Continuous technical improvements promote innovation in field instruments, bringing new features & capabilities that improve their performance & dependability. Wireless communication, Internet of Things (IoT) connection, and enhanced diagnostics enable field equipment to provide more extensive data and insights, opening the path for more intelligent and efficient power systems. Field instruments play an important role in power plant automation systems, allowing for smooth integration with distributed control systems (DCS), programmable logic controllers (PLC), and supervisory control and data acquisition (SCADA) systems.

This integration allows for extensive monitoring, control, and data collecting across several plant processes, simplifying operations, and increasing overall efficiency. Field instruments contribute to asset management programs by providing useful data for predictive maintenance plans. These tools aid in the early detection of possible problems before they become costly failures by continuously monitoring equipment health & performance. Predictive maintenance not only lowers downtime and maintenance costs, but it also increases the lifespan of important assets, maximizing asset utilization and overall reliability.

By Region

By region, Asia-pacific dominated the global automation and instrumentation in power market in 2022. One of the key drivers is rise in power demand, which is being driven by population expansion, industrial development, and increase in the usage of electric cars and heating systems. This upsurge need has led power utilities to improve their infrastructure and operations, resulting in greater expenditures in automation and instrumentation technology. Another notable factor is increase in need to upgrade the ageing electricity infrastructure. Many power plants and gearbox systems in Asia-pacific are nearing the end of their useful lifespan, necessitating modifications and replacement.

Automation and instrumentation technologies are critical in modernizing these systems, rise in efficiency, dependability, and safety while lowering maintenance costs. Regulatory regulations also influence the use of automation and instrumentation in the power industry. Asia-pacific governments and regulatory organizations are rapidly putting rigorous requirements on power companies to cut emissions, increase energy efficiency, and improve grid stability.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the automation and instrumentation in power market analysis from 2022 to 2032 to identify the prevailing automation and instrumentation in power market opportunities

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the automation and instrumentation in power market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global automation and instrumentation in power market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global automation and instrumentation in power market trends, key players, market segments, application areas, and market growth strategies.

Automation and Instrumentation In Power Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 57 billion |

| Growth Rate | CAGR of 7.2% |

| Forecast period | 2022 - 2032 |

| Report Pages | 320 |

| By Solution |

|

| By Instrument |

|

| By Region |

|

| Key Market Players | Omron automation, Honeywell process solutions, Mitsubishi Electric, Emerson Process Management, Siemens, Yokogawa Electric, Rockwell Automation, Inc., Danaher Industrial Ltd, Schneider Electric, ABB |

The automation and instrumentation in power market size is expected to grow due to integration of renewable energy sources globally. In addition, the market is driven by growth focus on energy efficiency.

The major growth strategies adopted by automation and instrumentation in power market players are strategic partnerships and collaborations.

Asia-Pacific will provide more business opportunities for the global automation and instrumentation in power market in the future.

Siemens, ABB, Emerson Process Management, Rockwell automation, Schneider Electric, Honeywell process solutions, Mitsubishi electric, Yokogawa electric, Omron automation, and Danaher Industrial Ltd., are the major players in the automation and instrumentation in power market.

The distributed & advanced control system automation and instrumentation in power sub-segment of the type segment acquired the maximum share of the global automation and instrumentation in power market in 2022.

Power Generation Companies are the major customers in the global automation and instrumentation in power market.

The report provides an extensive qualitative and quantitative analysis of the current trends and future estimations of the global automation and instrumentation in power market from 2022 to 2032 to determine the prevailing opportunities.

Energy management and optimization is expected to experience a growth in adoption, as automation and instrumentation technologies enable utilities and industrial facilities to optimize energy usage and reduce costs.

Increase in use of cybersecurity and resilience, rise in awareness among people about the benefits of energy storage solutions, and surge in demand for renewable energy integration drive the global automation and instrumentation in power market.

Loading Table Of Content...

Loading Research Methodology...