Automotive Air Filters Market Insights, 2030

The global automotive air filters market was valued at USD 4.7 billion in 2020, and is projected to reach USD 7.8 billion by 2030, growing at a CAGR of 5.4% from 2021 to 2030.

Automotive air filter restricts dirt particles and other impurities from entering the engine or the cabin of a vehicle. Most modern cars are equipped with two air filters, which include air intake air filters and cabin air filters. Air intake filters prevent bugs, dirt, debris, and contaminants from entering the engine’s delicate systems, and ensure a good mixture of air and fuel to support performance, thereby reducing emissions and improving performance of the vehicle. It aids in maintaining appropriate engine power, torque, and low fuel consumption, while increasing longevity of vehicles. The cabin air filters capture pollutants such as dust and allergens to maintain the air quality inside a vehicle. Automotive air filters are manufactured using materials such as paper, cotton, and foam among others.

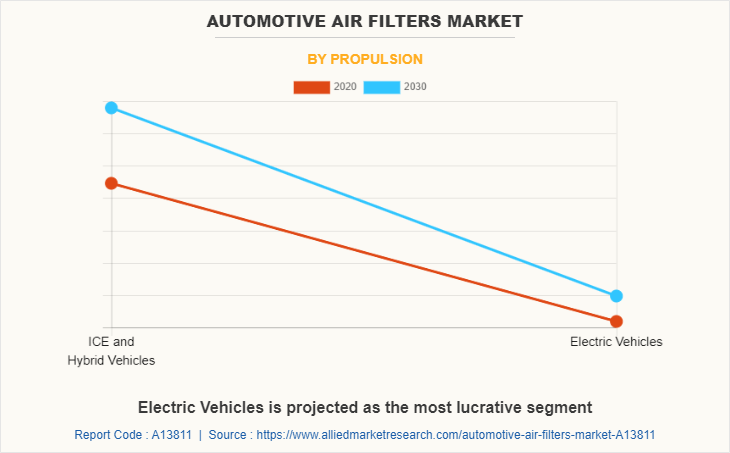

The growth of the global automotive air filters market is propelling, due to introduction of regulations regarding emission of greenhouse gases, increase in demand for luxury vehicles with greater cabin comfort, and rise in production & sale of automotive. However, rise in demand for electric vehicles is the factor restraining the growth of the market. Furthermore, increasing demand for multi-filtration system, and technological advancements are the factors expected to offer growth opportunities during the forecast period.

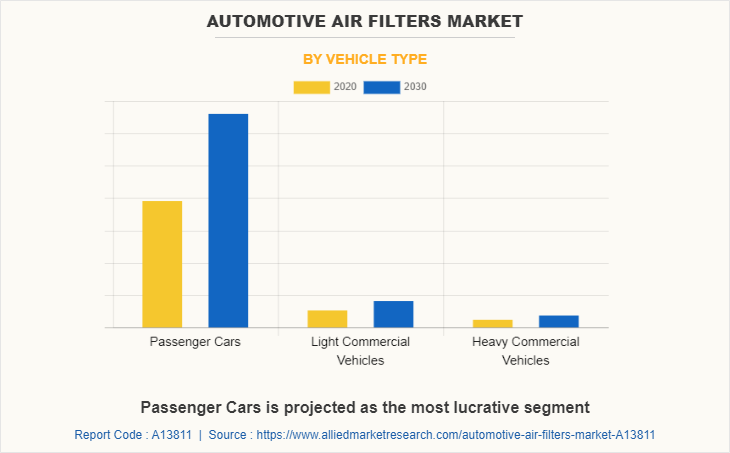

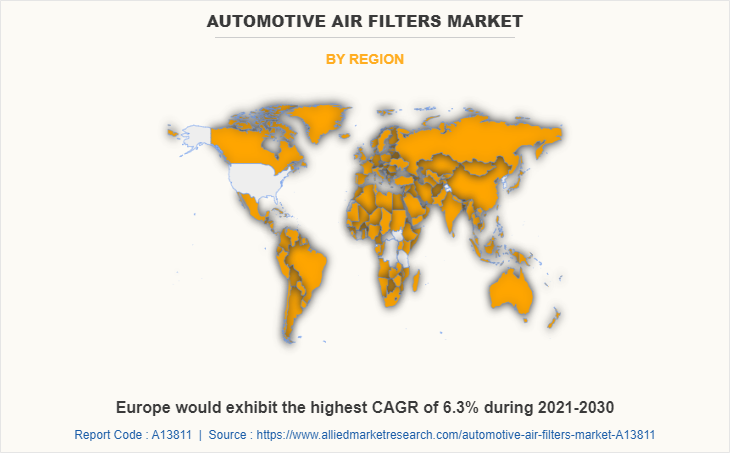

The global automotive air filters market is segmented on the basis of type, vehicle type, propulsion, sales channel, and region. Based on type, it is segmented into air intake filters, and cabin air filters. Based on vehicle type, it is classified into passenger cars, light commercial vehicles, and heavy commercial vehicles. Based on propulsion, it is bifurcated into ICE & hybrid vehicles and electric vehicles. Based on distribution channel, it is fragmented into original equipment manufacturer (OEM), and aftermarket. By region, the report is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Some leading companies profiled in the automotive air filter market report comprises Ahlstrom-Munksjo Oyj, Cummins Inc., Denso Corporation, Donaldson Company, Inc., General Motors Company (AcDelco), Hengst SE, Mahle GmbH, MANN+HUMMEL International GmbH & Co. KG, Robert Bosch GmbH, Sogefi S.P.A, Alco Filters Ltd, CabinAir Sweden AB, Freudenberg Filtration Technologies SE & Co. KG, Hanon Systems, Hollingsworth & Vose GmbH, K&N Engineering, Inc., Parker Hannifin Corporation, Toyota Boshoku Corporation, UFI FILTERS S.p.A., and Valeo SA.

Introduction of regulations regarding emission of greenhouse gases

Over the past couple of decades, mounting environmental concerns and efforts to minimize greenhouse emissions led to introduction of regulations regarding emission of greenhouse gases. Government bodies across the globe have formulated vehicular emission norms for checking the particulate emissions. For instance, Corporate Average Fuel Economy (CAFÉ) standard formulated by the U.S., Euro emission standards formulated by European Union, and Japanese long-term emission standards are some existing emission standards being implemented.

In addition, air filters are also utilized to control emissions produced by automotive. Air filters employ a specific type of filtration media such as fabric, sintered metal or ceramic to collect and remove dry particulates and contaminants such as microbes, dust, and pollen from the air passing through them.

Moreover, with the introduction of regulations regarding emission of greenhouse gases, several companies are introducing improved air filter in order to comply with these new regulations. For instance, Freudenberg’s “micronAir” cabin air filter is one instance of air filter that is developed in accordance with Bharat Stage VI emission standard and Euro-6 standard. Thus, introduction of regulations regarding emission of greenhouse gases is driving the growth of the automotive air filters market.

Increase in demand for luxury vehicles with greater cabin comfort

Luxury vehicles are equipped with high safety and advanced features. Luxury vehicles provide comfort features such as heated and cooled comfortable seats, airbags, blind-spot intervention system, and cabin air filtration system. Due to these features, demand for luxury vehicles has been observed in recent years. Automobile manufacturers are also introducing luxury vehicles with improved air filtration system to provide greater cabin comfort to the passengers inside the vehicle.

For instance, in 2021, Volvo launched S90, XC60 facelifts in India. The updated Volvo car models comprise “Advanced Air Cleaner” system that filters cabin air and displays air quality on the infotainment screen, which is Google-powered with a built-in assistant to offer a smartphone-like experience.

In September 2020, New Range Rover Velar was launched with option of mild or plug-in hybrid electric engine. It is equipped with a new cabin air filtration system that reduces levels of harmful particulates, pollen and even odors inside the cabin of vehicle. The new system is also capable of filtering out ultrafine particulates up to and even below PM2.5.

Rise in production & sale of automotive

COVID-19 impacted the automotive industry in a negative manner, resulting in decrease in vehicle production & decline in sales of automobiles. In addition, shortage of automotive components resulted in delays in production of vehicles across the globe.

However, post-pandemic, the automotive industry witnessed growth in production & sale of automobiles across the globe. Several automobile manufacturers have recorded growth in sales of vehicle over the years. Global car market grew by 4% in 2021 and global electric vehicle sales recorded a growth of 109% in 2021. In addition, in 2021, 79.1 million motor vehicles were produced across the globe, an increase of 1.3% compared to 2020.

This growth in production & sale of vehicles is expected to increase the demand for automotive air filters, which in turn is anticipated to be driving the growth of the automotive air filters market during the forecast period.

The automotive air filters market is segmented into Type, Vehicle Type, Propulsion and Sales Channel.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the automotive air filters industry analysis from 2020 to 2030 to identify the prevailing automotive air filters market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the automotive air filters industry segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global automotive air filters market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global automotive air filters market trends, key players, market segments, application areas, and market growth strategies.

Automotive Air Filters Market Report Highlights

| Aspects | Details |

| By Type |

|

| By Vehicle Type |

|

| By Propulsion |

|

| By Sales Channel |

|

| By Region |

|

| Key Market Players | General Motors Company, Parker Hannifin Corporation, Ahlstrom-Munksjo Oyj, Valeo SA, Donaldson Company, Inc., Sogefi S.p.A, CabinAir Sweden AB, MAHLE GmbH, Robert Bosch GmbH, Hengst SE, ALCO Filters Ltd., Hollingsworth & Vose GmbH, Denso Corporation, K&N Engineering, Inc., Hanon Systems, MANN+HUMMEL International GmbH & Co. KG, Cummins Inc., Freudenberg Filtration Technologies SE & Co. KG, UFI FILTERS spa, Toyota Boshoku Corporation |

Analyst Review

Growth of the automotive air filter market is propelled by factors such as rise in production & sale of automotive, and technological advancements. There has been increasing focus on development of advanced air filter. Several companies are focusing on producing improved cabin air filter in order to provide clean air inside the cabin of the vehicle. For instance, in 2021, BMW announced the introduction of a new nanoparticle filter to BMW 5 series, 6 series GT and M5 models. The new nanoparticle filter ensures enhanced interior air quality using nano-fleece and active carbon layers.

Several developments have been carried out by key players operating in the automotive air filter industry. In September 2021, Sogefi SPA launched a new cabin air filter “CabinHepa+”, which is 50 times more protective than a conventional cabin air filter by stopping up to 99.97% of 0.3 micron particles. It also traps pollens, dust and other pollutants which may enter the vehicle. Moreover, in March 2019, Robert Bosch GmbH launched its latest cabin FILTER+ which filters almost 100% of all fine dust particles, harmful & foul-smelling gases, and eliminates bacteria in a special anti-allergy layer. It also protects the air conditioning systems and improves driver & passenger vision by reducing deposits.

Rise in demand for automotive air filter from emerging economies such as Asia-Pacific coupled with rise in production & sales of vehicles in the region is expected to supplement the market growth. Collaborations and acquisitions are expected to enable the leading players to enhance their product portfolios and expand into different regions.

The global automotive air filter market was valued at $4,659.0 million in 2020 and is projected to reach $7,767.7 million in 2030, registering a CAGR of 5.4%.

The largest regional market for automotive air filters is Asia-Pacific.

increase in demand for luxury vehicles with greater cabin comfort, and rise in production & sale of automotive. However, rise in demand for electric vehicles is the factor restraining the growth of the market. Furthermore, increasing demand for multi-filtration system, and technological advancements are the factors expected to offer growth opportunities during the forecast period.

Some leading companies operating in the automotive air filters market include Ahlstrom-Munksjo Oyj, Cummins Inc., Denso Corporation, Donaldson Company, Inc., General Motors Company (AcDelco), Hengst SE, Mahle GmbH, MANN+HUMMEL International GmbH & Co. KG, Robert Bosch GmbH, and Sogefi S.P.A.

The leading application of automotive air filters is passenger cars.

Loading Table Of Content...