Automotive Camera Market Outlook - 2025

The global automotive camera market was valued at $11,401.6 million in 2017, and is projected to reach $24,092.1 million by 2025, registering a CAGR of 9.70% from 2018 to 2025. The automotive camera is an onboard camera, which is designed to capture the highest quality video to extend visibility for enhancing the safety of the driver. These cameras are majorly used to assist the driver for parking, to assess vehicle performance, for night vision, and to gather critical evidence. Furthermore, they are embedded with advanced computer vision algorithms, which extract meaningful data from the captured images to assist the driver for various purposes, and play a crucial role in advanced driver assistance systems (ADAS).

The automotive camera market is expected to grow at a significant rate, due to an increase in sales of automobiles and advancement of sensors used in cameras. Furthermore, rise in number of road fatalities is expected to stimulate the growth of the market. In addition, social factors such as a surge in awareness of road safety by the people and implementation of stringent road safety regulations by the government are anticipated to fuel the market growth

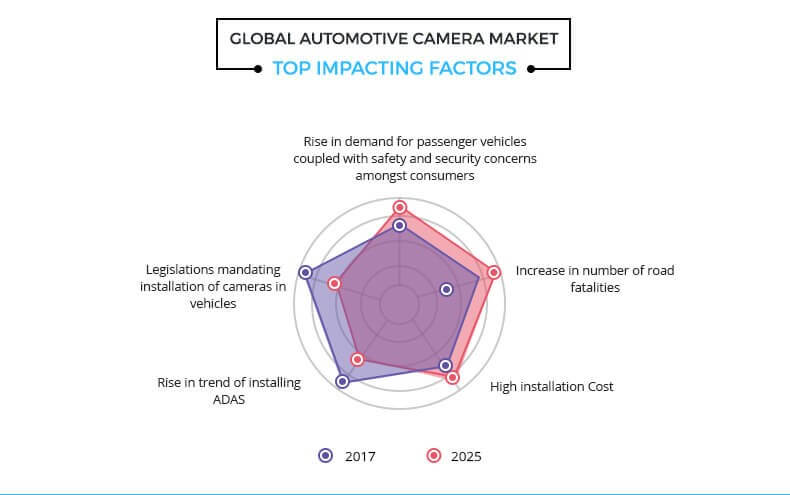

Furthermore, the safety and security concerns among consumers have increased tremendously, thereby having a positive impact on the growth of global automotive camera market. However, high installation cost of the cameras restricts the market growth. On the contrary, expected increase in trend of installing advanced driver assistance systems (ADAS) and legislations mandating installation of cameras in vehicles are expected to provide lucrative opportunities for emerging as well as existing players in the global automotive camera market.

The key market players profiled in the report are Automation Engineering Inc., Robert Bosch GmbH, Continental AG, Aptiv PLC, Stonkam Co., Ltd., Mobileye N.V., Autoliv Inc., Magna International Inc., OmniVision Technologies, and Valeo.

The automotive cameras market is segmented on the basis of application, technology, vehicle type, and region. By application, the market is categorized into park assist system, lane departure warning system, adaptive cruise control system, driver monitoring system, autonomous emergency braking system, blind spot detection, and others. Based on technology, it is classified into infrared camera, thermal camera, and digital camera. Depending on vehicle type, it is segregated into passenger cars, light commercial vehicles, and heavy commercial vehicles.

Region Wise, it is Analyzed Across North America, Europe, Asia-Pacific, and LAMEA.

Top Impacting Factors

The significant factors that impact the growth of the global automotive camera industry include a rise in demand for passenger vehicles coupled with safety & security concerns among consumers, increase in number of road fatalities, high installation cost, growth in trend of installing advanced driver assistance system (ADAS), and legislations mandating installation of cameras in vehicles. Each of these factors is anticipated to have a definite impact on the automotive camera market during the forecast period.

Increase in Number of Road Fatalities

According to the fact sheet of the World Health Organization, road traffic injuries are the leading cause of death among people aged between 15 and 29 years. Around 1.25 billion people die every year as a result of road accidents. In addition, 90% of the world's fatalities on the roads occur in low & middle economical countries, though such countries have approximately 54% of the world's vehicles. Moreover, for most of the countries road accidents cost 3% of their GDP.

Such factors result in increased demand for vehicles which are equipped with cameras for safety & security of the vehicle, driver, and passengers. As the cameras incorporated in the vehicle can provide blind spot detection, drowsiness detection is expected to significantly minimize road accidents. Furthermore, road accidents cause considerable economic losses to individuals, their families, and to nations as a whole. Such losses arise from the cost of treatment as well as lost productivity for people killed or disabled by their injuries, and for the rest of family members, which in turn fuel the demand for automotive cameras, thereby supplementing the market growth.

High Installation Cost

The installation cost of automotive cameras is considerably high. In addition, latest technologies such as advanced driver assistance systems (ADAS) require cameras for numerous applications such as lane detection systems, blind spot detection, lane departure systems, and others, which are expensive. Hence, high cost of the cameras is anticipated to significantly hamper the growth of the automotive camera market.

Legislation Mandating Installation of Cameras in Vehicles

Numerous legislations have taken the initiative of mandating the installation of cameras in the vehicles for safety purposes. According to the New Car Assessment Programs (NCAPs) policy, vehicles need to have safety ratings to encourage significant safety improvements in new car designs. Similarly, the national highway traffic safety administration (NHTSA) has announced that all the new light vehicles, including SUVs, trucks, and vans must be incorporated with a backup rearview visibility camera starting from May 1, 2018. Increased focus of the government on road safety is expected to fuel the growth of the market in the near future.

The global automotive camera market has witnessed significant growth in recent years, driven by technological advancements and increase in emphasis on safety & driver assistance systems in vehicles. Automotive cameras play a crucial role in enhancing driver visibility, improving road safety, and enabling advanced driver-assistance features. This report provides an overview of the automotive camera market, including key trends, growth factors, and market forecasts.

The market for automotive cameras is experiencing a shift toward higher-resolution cameras with advanced features such as night vision, object detection, and lane departure warning. The integration of cameras with other sensor technologies, such as LiDAR and radar, is further gaining traction. To capitalize on the market opportunities, manufacturers and industry stakeholders should focus on developing high-resolution cameras with advanced functionalities. In addition, there is growth in demand for surround-view and 360-degree cameras, offering a comprehensive view of the vehicle's surroundings. Moreover, increase in adoption of electric vehicles and autonomous driving technologies fuels the demand for automotive cameras.

Other factors driving the growth of the automotive camera market include stringent road safety regulations imposed by regulatory authorities, rise in consumer awareness regarding vehicle safety, and increase in demand for advanced driver assistance systems (ADAS). Furthermore, integration of cameras with vehicle infotainment systems and rise in the number of luxury & premium vehicles equipped with advanced camera-based features contribute to the market expansion.

Key Benefits of Automotive Camera Market:

- This study comprises an analytical depiction of the global automotive camera market size with current trends and future estimations to depict the imminent investment pockets.

- The overall market potential is determined to understand the profitable trends to gain a stronger foothold.

- The report presents information related to key drivers, restraints, and opportunities with detailed impact analysis.

- The current market is quantitatively analyzed from 2018 to 2025 to benchmark the financial competency.

- Porters five forces analysis illustrates the potency of the buyers and suppliers in the industry.

- The report includes the market share of key vendors and automotive camera market trends.

Automotive Camera Market Report Highlights

| Aspects | Details |

| By Application |

|

| By Technology |

|

| By Vehicle Type |

|

| By Region |

|

| Key Market Players | AUTOLIV, INC., AUTOMATION ENGINEERING INC. (MYCRONIC AB), MAGNA INTERNATIONAL INC., VALEO, ROBERT BOSCH GMBH, OMNIVISION TECHNOLOGIES INC., STONKAM CO., LTD., APTIV PLC (DELPHI AUTOMOTIVE PLC), CONTINENTAL AG, MOBILEYE N.V. |

Analyst Review

Automotive cameras are expected to curb down the number of traffic accidents significantly. Thus, the future cars might be mirrorless, and completely be based on cameras and AI technology for navigation. For instance, Mitsubishi, announced in January 2018, that it developed the automotive industry’s highest performing automotive camera technology. The cameras incorporated in the vehicle can detect objects up to 100 meters away. In addition, the technology boosted the object detection accuracy from 14% to 81%.

The automotive camera market holds high potential for the automotive industry. The current business scenario is witnessing an increase in the demand for automotive camera, particularly in the developing regions such as China, India, and others. Companies in this industry are adopting various innovative techniques to provide customers with advanced and innovative product offerings.

Among the geographical regions, North America exhibits the highest adoption of automotive cameras. On the other hand, Asia-Pacific is expected to grow at a faster pace, predicting lucrative growth.

Automation Engineering Inc., Robert Bosch GmbH, Continental AG, Aptiv PLC, Stonkam Co., Ltd., Mobileye N.V., Autoliv Inc., Magna International Inc., OmniVision Technologies, and Valeo are the key players that occupy a significant revenue share in the global automotive camera market.

Autoliv Inc., acquired certain assets of Fotonic i Norden AB, a Swedish-based company specializing in LiDAR and time of flight camera. The aim of this acquisition was to strengthen the LiDAR and vision algorithms

The global automotive camera market generated revenue worth $11,401.6 million in 2017, and is projected to reach $24,092.1 million by 2025, to register a CAGR of 9.7% during the forecast period (2018-2025).

The report sample/ company profile section for automotive camera market report can be obtained on demand from the website.

The current business scenario is witnessing an increase in the demand for automotive camera, particularly in the developing regions, such as China, India, and others. Such countries are potential customers for market expansion.

The automotive camera market include market players, such as Automation Engineering Inc., Robert Bosch GmbH, Continental AG, Aptiv PLC, Stonkam Co., Ltd., Mobileye N.V., Autoliv Inc., Magna International Inc., OmniVision Technologies and Valeo

The company profile section for automotive camera market report can be obtained on demand from the website.

Based on the global automotive camera market analysis, North America is the major revenue contributor in 2017. However, Asia-Pacific region is expected to provide more business opportunities coupled with lucrative growth during the forecast period.

The service providers of the automotive camera industry are the key players manufacturing camera system for vehicles. This also includes the aftermarket players who sells the automotive camera for replacement purpose based on customers demand

The key growth strategies adopted by the automotive camera industry players includes innovations and developments of better and efficient products coupled with the increased RnD expenditure which have a wider application in vehicles.

Park assist system, lane departure warning system, adaptive cruise control system, driver monitoring system, autonomous emergency braking system, blind spot detection, and others are the market applications of the automotive camera market.

Loading Table Of Content...