Automotive Ecalls Market Insights, 2032

The global automotive ecalls market was valued at USD 3.4 billion in 2022, and is projected to reach USD 9.3 billion by 2032, growing at a CAGR of 10.8% from 2023 to 2032.

Report Key Highlighters:

- The automotive eCalls market study covers 14 countries. The research includes regional and segment analysis of each country in terms of value ($million) for the projected period 2023-2032.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

- Over 3,700 product literature, annual reports, industry statements, and other comparable materials from major industry participants were reviewed to gain a better understanding of the market.

The automotive eCalls market share is moderately fragmented, into several players including LG Electronics Inc., Continental AG, Thales, u-blox, Samsung, Panasonic Holdings Corporation, Aptiv, Valeo SA, Denso Corporation, and Telit. The companies have adopted strategies such as product launch, contract, expansion, agreement, and others to improve their market positioning.

An automotive eCall (emergency call) is a system designed to automatically contact emergency services in the event of a serious road accident. When a severe crash occurs, sensors within the vehicle, such as accelerometers and airbag sensors, detect the impact and trigger the eCall system. This system then initiates a call to a designated emergency response center, providing essential information about the accident, such as the location of the vehicle, the time of the incident, and the vehicle's identification number.

The primary function of automotive eCalls market is to reduce the response time of emergency services, potentially saving lives by ensuring that help arrives as quickly as possible. The system can also be activated manually by vehicle occupants in case they witness an accident or require immediate assistance. In addition to voice communication, eCall systems often transmit data related to the crash severity and vehicle status to aid emergency responders in assessing the situation.

The global adoption of automotive eCalls industry has been driven due to the heightened focus on the safety of passengers and road users. This is underscored by the widespread integration of cutting-edge technologies aimed at mitigating accident severity, amplifying safety measures, and furnishing prompt aid in crucial circumstances, all of which are contributing to the positive trajectory of market growth. Additionally, the increasing occurrence of road accidents is driving the need for systems that can deliver rapid emergency responses, thereby fostering further advancement within the market. Furthermore, the integration of 4G/5G networks and global positioning systems (GPS) that enable accurate location tracking and seamless communication with emergency services is creating a positive outlook for the automotive eCalls market.

Furthermore, safety and security are other aspects that lead the growth of the automotive eCalls market. This aspect has always been crucial from the perspective of the consumers as well as the auto manufacturers. In case of accidents, these cars can send an SOS message along with the coordinates of the driver’s location. Also, in case of theft by any external force, the owners can track their vehicle instantly using a smartphone app developed for this purpose. Therefore, an increase in the need of safety and security is expected to boost the growth of the automotive eCalls market.

Alla result of safety mandates imposed by the European Union, starting from April 2018, all newly manufactured passenger cars and light commercial vehicles within the European Union must be outfitted with an eCall system capable of automatically initiating communication with emergency services following an accident. This regulatory development has triggered a notable increase in worldwide interest and demand for eCall technology. Nevertheless, while this has generated heightened interest, certain geographical areas still do not have regulations in place that require the incorporation of eCall systems. This lack of regulatory enforcement could potentially impede the initial adoption of eCall technology in the early stages of the projected timeline. However, it is anticipated that the stringent safety standards established in Europe will pave the way for similar vehicular safety regulations in other regions, thus catalyzing growth on a global scale within the automotive eCalls industry.

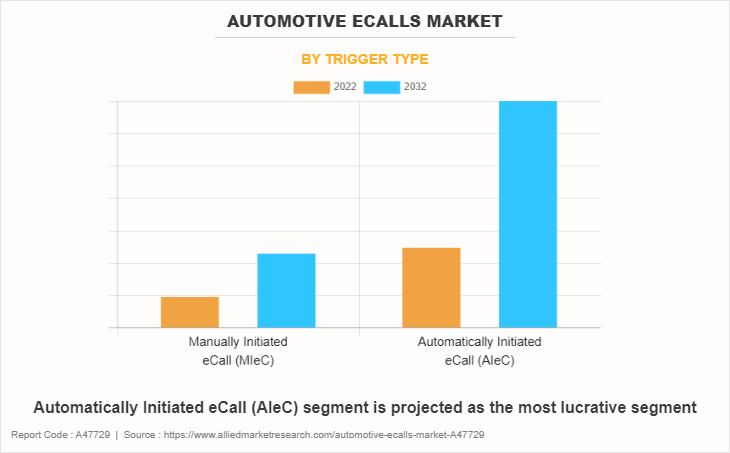

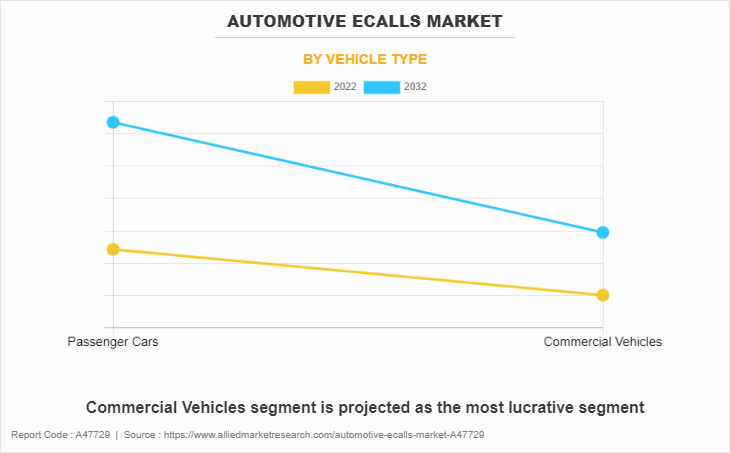

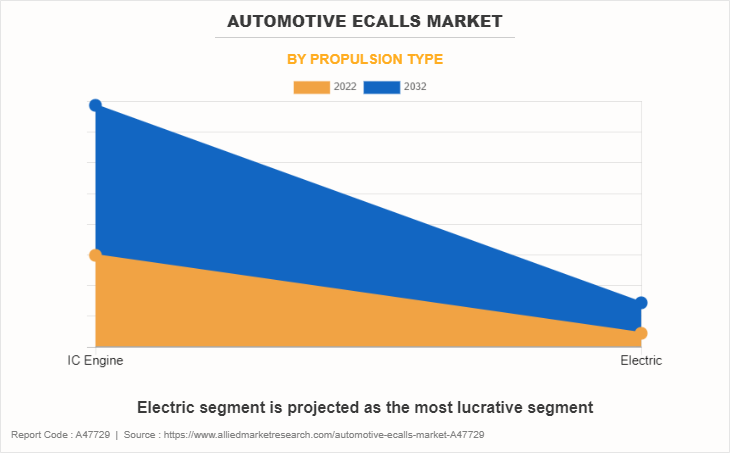

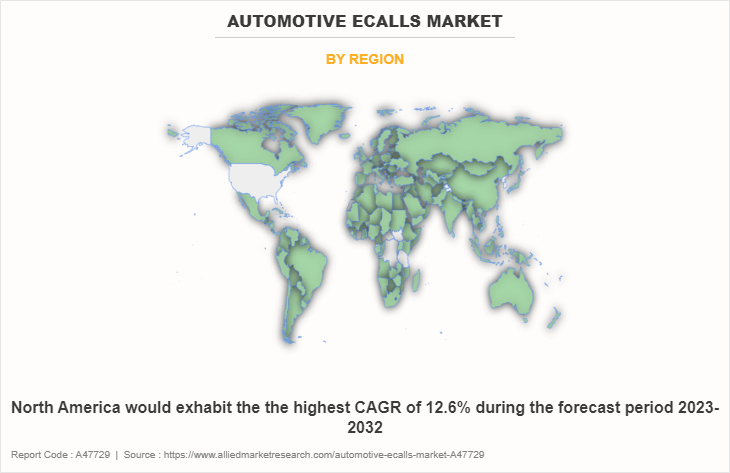

The global automotive eCalls market is segmented on the basis of trigger type, vehicle type, propulsion type and region. By trigger type, the market is segmented into Manually Initiated eCall (MIeC) and Automatically Initiated eCall (AIeC). Further, based on vehicle type, the market is segmented into passenger cars and commercial vehicles. Based on propulsion type, the market is segmented into IC Engine and Electric. Region-wise, the market is segmented into North America, Europe, Asia-Pacific, and Latin America, Middle East & Africa (LAMEA) including country-level analysis for each region.

The automotive eCalls market in Asian countries has witnessed significant growth and is poised to offer compelling opportunities in the coming years. The increasing adoption of eCall systems as a result of expanding urbanization and rising concerns about road safety. In densely populated cities like Tokyo, Japan, and Seoul, South Korea, where traffic congestion and accident rates are significant, there is a growing emphasis on deploying eCall technology to enable rapid emergency response and mitigate the potential impact of accidents.

Countries like China, and India are leading in the implementation of smart city infrastructure, and the integration of eCall technology into these frameworks allows for real-time communication between vehicles, traffic management centers, and emergency services. For example, in Shanghai, eCall systems are being incorporated as part of the city's broader efforts to enhance urban mobility and safety by enabling seamless communication between vehicles and city infrastructure.

In addition, automakers in the region are collaborating with telecommunications providers to develop eCall systems that leverage 5G connectivity for faster and more reliable emergency communication. For instance, in October 2022, Anritsu Corporation was pleased to announce that Signalling Tester MD8475B has achieved Japan-standard eCall (Emergency Call) in-vehicle AECS (Accident Emergency Call System) type approval test for compliance with UN-R144, collaborating with Honda Motor Co., Ltd (Honda). These collaborations highlight the region's commitment to leveraging cutting-edge technologies to enhance road safety and emergency response.

Key Developments

The leading companies are adopting strategies such as acquisition, agreement, expansion, partnership, contracts, and product launches to strengthen their market position.

- In May 2023, LG Electronics Inc. launched a connected vehicle alarm system, LG MyCar Alarm Service. It integrates with Infoconn, the connected car service as mobile application of KG Mobility & developed in response to increasing demand from automotive companies and consumers for vehicle-integrated mobility services.

- In October 2022, Continental AG developed connected infotainment box that enables the use of digital services such as ecalls, turn-by-turn navigation and stolen vehicle tracking. Along with that it provides optional features such as stolen vehicle tracking.

- In July 2022, Thales developed & offers a secure connectivity solution to bring drivers, passengers and maintenance teams’ greater access to useful information. This seamless connectivity management solution enables drivers and passengers to access eCall (automatic EU emergency call in case of an accident), remote software updates and smoother recall actions.

- In November 2020, Panasonic Holdings Corporation developed in-vehicle emergency call system (eCall). The number of cars equipped with this system & it provides emergency response in case of an accident.

Rise in number of road accident deaths due to delays in medical assistance

Globally, the growth in vehicle sales and production is primarily driven by factors such as rise in urbanization, shifts in demographics, improvements in living standards, and a surge in disposable income. This trend is further accentuated by mounting traffic congestion and a notable uptick in road accidents, leading to heightened safety concerns among consumers. As a result, there is a surge in inclination toward advanced safety and security features within vehicles, sparking a substantial demand for automotive eCalls market on a global scale.

Furthermore, automotive manufacturers actively integrate these systems into their vehicles, driven by the escalating safety apprehensions of both drivers and passengers. The aim is to curtail road fatalities and swiftly help injured individuals. This rise in concern has witnessed a significant growth in the automotive eCall system market industry. The Road Safety Authority (RSA), Ireland has reported a gradual reduction in global fatalities in recent years; however, this number could potentially be further diminished through the enhancement of emergency service efficiency and timeliness. The widespread adoption of automotive eCall market systems is a contributing factor to this positive trend.

Stringent government regulations

The rapid expansion of the vehicle population has resulted in an escalation of traffic congestion, concurrently leading to an increase in the fatality rate as numerous individuals lose their lives in road accidents worldwide. This pressing scenario has prompted governments across diverse nations to enforce rigorous standards and regulations aimed at mitigating accident rates and bolstering the safety of both vehicles and their occupants.

These governments are additionally establishing benchmarks for vehicular safety, compelling automotive manufacturers to incorporate emergency call systems not only in high-performance vehicles but also in entry-level and mid-sized vehicles, which collectively constitute the majority share of the automotive industry. Furthermore, substantial governmental investments are being directed toward advocating the adoption of technologically advanced systems, with the aim of fostering the integration of safety features into vehicles and providing crucial support to the automotive sector, thereby facilitating the efficient and prompt functioning of emergency service providers.

Increase in jamming and interface issues

The emergency call systems integrated into automobiles are linked to the Public Safety Answering Point (PSAP). In the event of any fatal road incident, essential information, referred to as the Minimum Set of Data (MSD), is transmitted to the PSAP. This comprehensive dataset includes details about the accident, as well as the vehicle's past and current status. Consequently, crucial data is promptly relayed to the nearest emergency service provider. Nevertheless, this system is not without limitations, such as susceptibility to disruptions such as satellite signal interference and related issues. At times, the GPS receiver encounters difficulties in determining the precise position of the vehicle, presenting a significant challenge for the proper functioning of the eCall system.

Implementation of Next Generation eCall

The automotive industry has undergone a profound evolution, marked by a concerted effort to pioneer advanced technologies that revolutionize various aspects of vehicle design and functionality. With a primary focus on augmenting connectivity solutions, elevating safety features, and enhancing the overall in-vehicle user experience, manufacturers are shaping a new paradigm for modern vehicles. One notable strategy employed by automakers is the strategic integration of emergency calling systems within the broader framework of telematics devices. By combining these functionalities, manufacturers not only optimize costs but also provide consumers with a more comprehensive and seamless suite of services that cater to both safety and convenience.

As the automotive landscape continues to evolve, manufacturers are taking a holistic approach to in-vehicle technology. The concept of infotainment systems has taken center stage, with automakers striving to equip vehicles with sophisticated multimedia capabilities that transcend mere entertainment. These infotainment systems are being enriched with an array of features designed to not only enhance travel safety but also elevate the overall driving experience. By seamlessly integrating navigation, communication, and entertainment functions, automakers are creating an ecosystem that ensures travel is not only efficient but also enjoyable and effortless.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the automotive ecalls market analysis from 2022 to 2032 to identify the prevailing automotive ecalls market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the automotive ecalls market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global automotive eCalls market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global automotive ecalls market trends, key players, market segments, application areas, and market growth strategies.

Automotive Ecalls Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 9.3 billion |

| Growth Rate | CAGR of 10.8% |

| Forecast period | 2022 - 2032 |

| Report Pages | 355 |

| By Trigger Type |

|

| By Vehicle Type |

|

| By Propulsion Type |

|

| By Region |

|

| Key Market Players | Aptiv, Continental AG, Thales, LG Electronics Inc., VALEO SA, Denso Corporation, SAMSUNG, Telit, Panasonic Holdings Corporation, u-blox |

Globally, the growth in vehicle sales and production is primarily driven by factors such as rise in urbanization, shifts in demographics, improvements in living standards, and a surge in disposable income. This trend is further accentuated by mounting traffic congestion and a notable uptick in road accidents, leading to heightened safety concerns among consumers. As a result, there is a surge in inclination toward advanced safety and security features within vehicles, sparking a substantial demand for automotive eCalls market on a global scale.

The companies to hold the market share in Automotive Ecalls include LG Electronics Inc., Continental AG, Thales, u-blox, Samsung, Panasonic Holdings Corporation, Aptiv, Valeo SA, Denso Corporation, and Telit.

The largest region for Automotive Ecalls is Europe

The global automotive ecalls market is projected to grow at a compound annual growth rate of 10.8% from 2023 to 2032.

The global automotive ecalls market was valued at USD 3.4 billion in 2022, and is projected to reach USD 9.3 billion by 2032,

Loading Table Of Content...

Loading Research Methodology...