Automotive Electric Coolant Valve Market Insights, 2032

The global automotive electric coolant valve market size was esteemed at USD 3,914.5 million in 2020 and is estimated to reach USD 10,061.1 million by 2032, exhibiting a CAGR of 8.53% from 2023 to 2032.

Report Key Highlighters:

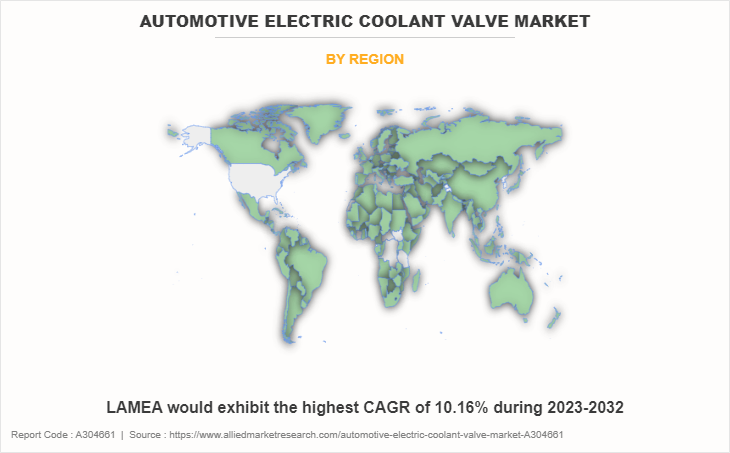

- The automotive electric coolant valve market study covers 14 countries. The research includes regional and segment analysis of each country in terms of value ($million) for the projected period 2020-2032.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

- Over 3,700 product literature, annual reports, industry statements, and other comparable materials from major industry participants were reviewed to gain a better understanding of the market.

- The automotive electric coolant valve market share is highly fragmented, into several players including Thermal Management Solution Group, Zhejiang Sanhua Auto Motive Co., Ltd, Robert Shaw, Voss Fluid GmbH, Emerson Electric Co. (Asco Valve Inc), PV Clean Mobility Technologies, Vitesco Technologies GmbH, Schrader Pacific Advanced Valves, Hanon Systems, Modine Manufacturing Company, Honeywell International Inc., Siemens AG, Parker Hannifin Corporation, Rheinmetall AG, Robert Bosch GmbH, Continental AG, And Rotex Automation Limited.

Automotive electric cooling valves are hardware utilized in various components of a vehicle. Electric cooling valves are specifically used to optimize the flow of coolant through cooling systems, engine and powertrain of a vehicle. These help in regulating the temperature of a vehicle and improve its performance. In electric and hybrid vehicles, these values are also used for coolant flow distribution for batteries and power electronics.

The global automotive electric cooling valves market growth due to rise in emission norms and fuel efficiency standards, increase in demand for hybrid and electric vehicles, and increase in demand for hybrid and electric vehicles. However, rise in the cost of raw materials and decrease in ICE Vehicle sales are hampering the market growth. Furthermore, advancements in smart cooling technology and growth in aftermarket demand are anticipated to create lucrative growth opportunities for companies operating in the global market.

As the automotive and the industrial sectors progress towards electrification, demand for reliable thermal management solutions has grown very much. Electric coolant valves serve a very essential function in ensuring that the right operating temperatures are maintained for electric vehicles, leading to better energy efficiency and also prolonged battery life. Moreover, the cleaner and greener practices have fueled the use of electric coolant valves for many various applications. The sector is also taking advantage of the improvement in electric car technology and growing sales for Electric cars.

Also, the need for electric coolant valves is very essential in regulating the optimum temperatures of automotive vehicle components also continues to rise steadily. The increased popularity of EVs is further enhanced by government initiatives and policies aimed at advantaging clean energy solutions thus ensuring a very favorable climate for the automotive electric coolant valves market. Also, the inclusion of new technologies in the coolant valve systems creates lucrative growth opportunities for market players. Innovations including smart and connected coolant pumps that allow for real-time monitoring as well as control are taking off. Thermal management systems, driven by these new technologies, are becoming much better capable of reacting to the changes in the operating environment. Consequently, market players in the Electric Coolant Valves industry are offered many chances to provide solutions for their customers who want leading-edge products that will be used on electric and hybrid automobiles.

The increasing focus on energy efficiency and sustainability serves as a considerable opportunity for the automotive electric coolant valves market trends. Major players are, more and more, paying attention to developing energy-efficient pumps that lead not only towards the reduction of consumption but also fit into global sustainability objectives. Moreover, the market growth is characterized by strict green environmental regulations that promote the adoption of greener technologies; increased consumer awareness regarding the advantages of using electric vehicles, and constant research & development initiatives leading to improvement in coolant pump systems' performance.

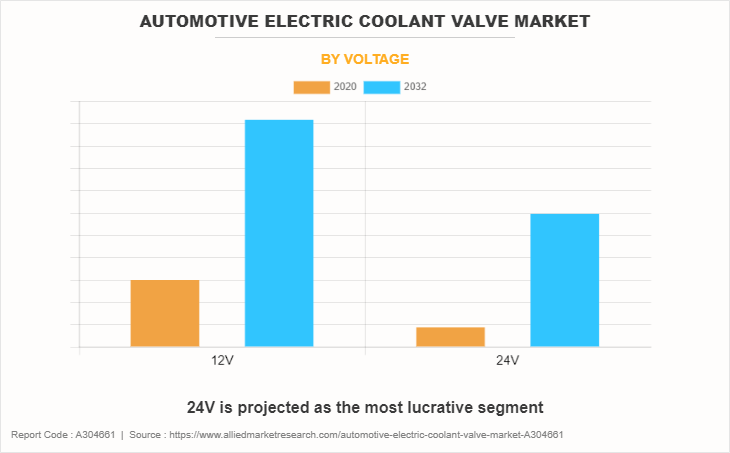

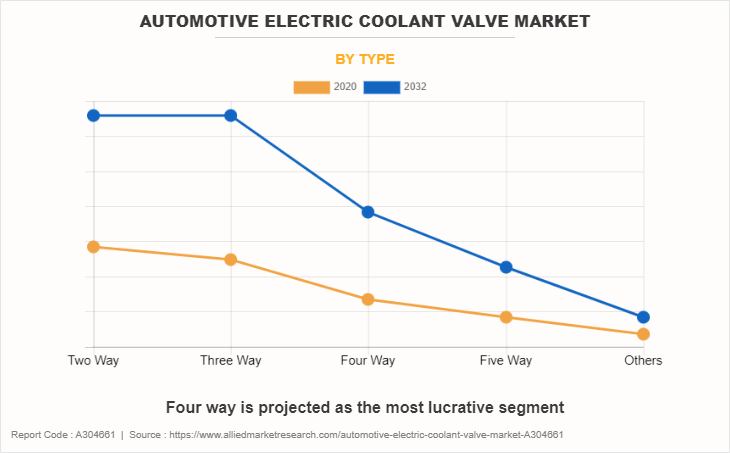

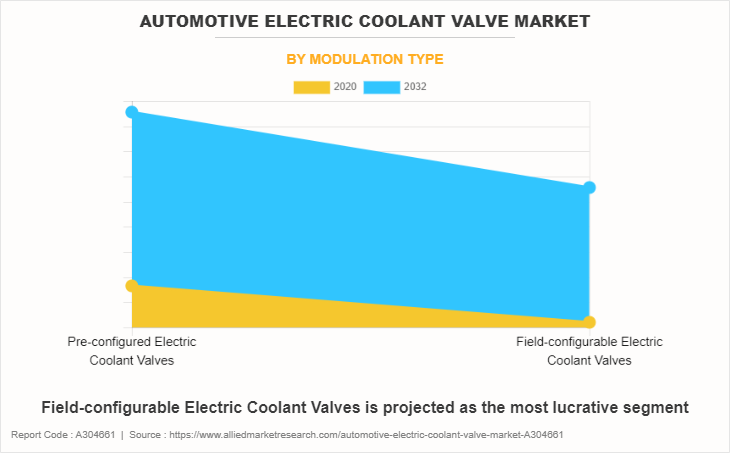

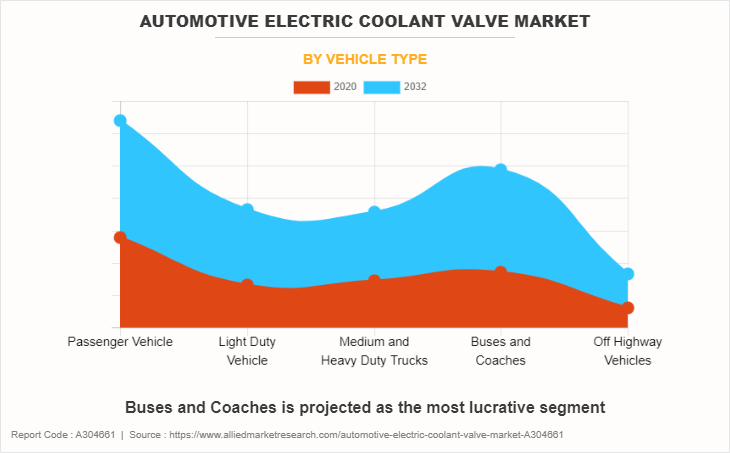

The global automotive electric coolant valve market is segmented into type, modulation type, communication protocol, vehicle type, voltage, and region. By type, the global market has been fragmented into two-way, three-way, four-way, five ways, and others. By modulation type, the market has been analyzed across pre-configured electric coolant valves and field-configurable electric coolant valves. By communication protocol it is analyzed across direct analog, analog w/ voltage feedback, CAN, LIN and others. On the basis of vehicle type, the market is fragmented into passenger vehicles, light duty vehicles, medium and heavy-duty trucks, buses and coaches, and off-highway vehicles. The off-highway vehicle segment is further fragmented into construction & mining equipment, agriculture vehicles, and industrial vehicles. By voltage type, the market is segmented into 12V and 24V. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Moreover, the well-developed road network and infrastructure in Europe play a significant role in driving market growth. Technological advancements and the adherence to stringent vehicle standards further contribute to the expansion of the automotive electric coolant valve market in Europe. Furthermore, the rapid surge in sales of premium cars fosters the growth of advanced vehicles in Europe, thereby propelling the automotive electric coolant valve demand in the region. European governments and environmental agencies are enacting stringent emission norms and laws that increase demand for electric vehicles in Europe with growth in environmental concerns.

By 2050, the EU aims to achieve the target of 0% greenhouse gas emission. The regulation EU 253/2014 sets the target of 147 gm of carbon dioxide emission per kilometer for 2020 and 2021, for commercial vehicles, based on the New European Driving Cycle (NEDC) test procedure. In addition, the European Union set a target of 31% reduction of carbon dioxide emission for Light Commercial Vehicles (LCVs) by 2030. In addition, the region is a home to electric truck manufacturers such as Volvo, Daimler and others and the diesel bans, and other emission regulations are forcing the vehicle manufacturers to include electric vehicles in their product offerings in Europe. These factors are leading to the growth of electric coolant valves as they regulate the engine temperature along with battery pack and electric motor.

Key Developments in the Automotive Electric Coolant Valve Industry

The leading companies are adopting strategies such as acquisition, agreement, expansion, partnership, contracts, and product launches to strengthen their market position.

In December 2023, Hanon Systems invested USD $129 million to develop three of its sites in Hungary in Székesfehérvár, Pécs, and Rétság. Hanon Systems Hungary Kft. plans to set up manufacturing capacities of EV thermo parts and transform its operation in Székesfehérvár by integrating digital technologies into its manufacturing and industrial processes. The Pécs plant witnesses a capacity extension that is to support the company’s business in the EV segment.

In October 2023, Modine Manufacturing Company expanded production of its EVantage thermal management systems product family to Europe. Its production facility in Pontevico, Italy, manufactures battery thermal management and electronics cooling systems for heavy-duty, commercial, and specialty vehicle manufacturers across the continent.

In November 2021, Hanon Systems started its latest manufacturing site located in Naengcheon-ri, Oedong-eup, Gyeongju-si, Korea. It is the first plant that is fully dedicated to producing components for eco-friendly vehicles in Korea. This new facility is producing a range of solutions for electric vehicles including heat pump systems and coolant valve assemblies to be supplied to the Ulsan plant of Hyundai Motor Group for the E-GMP (electric global modular platform) based IONIQ 5, 6, 7, and Genesis vehicles.

In September 2020, Voss Fluid GmbH acquired Hessian company HENZEL Automotive GmbH. This strategy helps Voss Group's development and production competencies in the automotive business unit for continued growth in thermal management. Furthermore, it also leads to an enhanced product portfolio that includes thermostats with integrated sensors, passive and actively controlled switching and proportional mixing valves, and highly integrated function modules.

Increase in Emission Norms and Fuel Efficiency Standards

The growth in global automobile production and rise in ownership of personal vehicles, resulted in increasing pollution level. Likewise, there has been an increase in demand for high powered engine vehicles, resulting in increased demand for efficient thermal management to improve vehicle efficiency and reduce engine power loss. Automotive electric coolant valves help maintain the optimal temperature in a vehicle by regulating the flow of coolant in the engine, resulting in increased fuel economy and lowering emission. For instance, the European Emission Standards or Euro Norms govern and restrict vehicle emissions. The law also encourages the use of automobile technologies that are cleaner and more efficient.

Similarly, in April 2022, India passed a law that outlines a permissible amount of pollutant from a vehicle, especially from automobiles that run on petrol and diesel. Additionally, other countries around the world such as the U.S., China, Japan, South Korea, Canada, and others, have also implemented or updated their fuel efficiency standard and emission norms. The market demand for automotive electric coolant is expected to witness stable growth rate during the forecast period due to increase in regulatory pressure by government resulting in automakers shifting their focus toward the development of more fuel efficient and cleaner engine vehicles.

Increase in Demand for Hybrid and Electric Vehicles

Increase in global concerns regarding the negative effect of climate change and alarming pollution levels recorded in the major cities have created a significant demand for electric and hybrid vehicles. The demand for fuel-efficient vehicles has increased recently, owing to the rise in prices of petrol and diesel. To make electric and hybrid cars more efficient, manufacturers are lowering the size of batteries. The more power created in smaller space produces intense heat. To perform efficiently, the batteries in EVs and hybrids need to be at optimal temperature; thus, creating need for efficient thermal management system and driving the demand for automotive electric coolant valves. Efficient thermal management system facilitates increased performance, higher efficiency, and lowered overall maintenance cost in an electric and hybrid vehicle.

According to the International Energy Agency, as of 2022, the electric vehicle segment sales were around 10 million; according to the data, the sales of EVs have more than tripled in the last three years, accounting for 4% in 2020 and reaching approx. 14% in 2022. As per the data, around 14% of all cars sold in 2022 were electric, which was 9% in 2020. The growing demand for electric and hybrid vehicles is expected to witness strong growth in coming years, thereby driving the market for automotive coolant valves.

Rise in Cost of Raw Materials

The prices of these materials used in the manufacture of automotive electric coolants have increased a lot significantly over a short period. Secondly, the Russia-Ukraine conflict has also led to an increase in steel and iron prices as these countries are major suppliers. For instance, the prices of raw materials like steel and iron shot up astronomically in the year 2021 by Ukraine sold pig iron worth $1.3 million in its exports which was reduced considerably at a staggering rate. This was caused by destruction of manufacturing plants and their associated infrastructure in the nation. Also, increases in the inflation rate and the distruption of supply chain continue to lead to many variations in commodity costs. The increasing cost of raw materials is augmenting its production value and inspiring the manufactures to enhance their selling price, thus limiting its market growth.

Advancements in Smart Cooling Technology

The integration of autonomous electric cooling valves with the latest technologies, such as Advanced Thermal Management, Self diagnosis and Predictive Maintenance is expected to give rise to profitable opportunities for undertakings active in the automotive electric coolant valve industry. The demand for advanced and effective thermal management systems is growing, which further fuels the market with increased consumption of electric vehicles and developments in connected cars and autonomous driving technologies. As electric coolant valve allows efficient control of the cooling process in vehicles, this further improves the comfort and performance of a vehicle; thus, improving the overall range of electric vehicles. Furthermore, advancements in the automotive sector, and the growth in demand for electric, hybrids, and alternative fuel cars are expected to create multiple opportunities for key players in the global automotive electric coolant valve market.

Key Benefits For Stakeholders

- This automotive electric coolant valve market report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the market analysis from 2020 to 2032 to identify the prevailing market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global automotive market trends, key players, market segments, application areas, and market growth strategies.

Automotive Electric Coolant Valve Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 10.1 billion |

| Growth Rate | CAGR of 8.5% |

| Forecast period | 2020 - 2032 |

| Report Pages | 389 |

| By Voltage |

|

| By Type |

|

| By Modulation Type |

|

| By Communication Protocol |

|

| By Vehicle type |

|

| By Region |

|

| Key Market Players | Vitesco Technologies GmbH, Hanon Systems, MODINE MANUFACTURING COMPANY, Emerson Electric Co. (Asco Valve Inc), Zhejiang Sanhua Auto Motive Co., Ltd, Rheinmetall AG, Siemens AG, Honeywell International Inc., Parker-Hannifin Corporation, Continental AG, PV Clean Mobility Technologies, ROBERTSHAW, Schrader-Bridgeport International, Inc., VOSS Fluid GmbH, Rotex Automation Limited, Thermal Management Solutions Group Ltd., Robert Bosch GmbH |

The global automotive electric coolant valve market size was esteemed at $3,914.5 million in 2020 and is estimated to reach $10,061.1 million by 2032, exhibiting a CAGR of 8.53% from 2023 to 2032.

Passenger Vehicle is is the leading application of Automotive Electric Coolant Valve Market

North America is the largest regional market for Automotive Electric Coolant Valve

Increase in emission norms and fuel efficiency standards, growing demand for hybrid and electric vehicles and rise in need for advanced thermal management

Thermal Management Solution Group, Zhejiang Sanhua Auto Motive Co., Ltd, Robert Shaw, Voss Fluid GmbH, Emerson Electric Co. (Asco Valve Inc), PV Clean Mobility Technologies, Vitesco Technologies GmbH, Schrader Pacific Advanced Valves, Hanon Systems, Modine Manufacturing Company, Honeywell International Inc., Siemens AG, Parker Hannifin Corporation, Rheinmetall AG, Robert Bosch GmbH, Continental AG, And Rotex Automation Limited.

Loading Table Of Content...

Loading Research Methodology...