Automotive Electric Power Steering Market Insights, 2032

The global automotive electric power steering market size was valued at USD 24 billion in 2022, and is projected to reach USD 42 billion by 2032, growing at a CAGR of 5.8% from 2023 to 2032.

Report Key Highlighters:

- The automotive electric power steering market studies more than 15 countries. The research includes a segment analysis of each country in terms of value ($ million) for the projected period 2022-2032.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions to achieve their most ambitious growth objectives.

- Over 3,700 product literature, annual reports, industry statements, and other comparable materials from major industry participants were reviewed to gain a better understanding of the market.

- The automotive electric power steering market is moderately fragmented, with several players including JTEKT Corporation., HL Mando Corp., Nexteer Automotive, Robert Bosch GmbH, NSK Ltd., ZF Friedrichshafen AG, Hitachi Astemo, Ltd., ThyssenKrupp AG, Zhejiang Shibao Co., Ltd., and BBB Industries. Key strategies such as collaboration, expansion, agreement, product launch, investment, and other strategies of the players operating in the market are tracked and monitored.

Automotive electric power steering is an advanced steering system in vehicles that reduces the overall effort required by the driver to turn the wheels. This is achieved by increasing the force applied to the steering wheel with the assistance of electric power. By utilizing an electric motor, the EPS system effectively manages and supports vehicle steering, delivering an optimal and pleasurable steering experience. Moreover, the EPS (Electric Power Steering) technology plays a vital role in facilitating highly automated driving systems. Within an electric power steering system, when the driver initiates a steering input by turning the steering wheel, sensors positioned on the steering column capture the input and transmit it to the Electronic Control Unit (ECU) of the vehicle. The ECU analyzes these inputs and subsequently dispatches an electronic signal to an electronic motor located at the end of the steering column. The electric motor's gears, in response to the signals received from the ECU, generate torque, which is then transmitted to the pinion. The pinion, in turn, transfers this torque to the rack, effectively facilitating the rotation of the wheels of the vehicles.

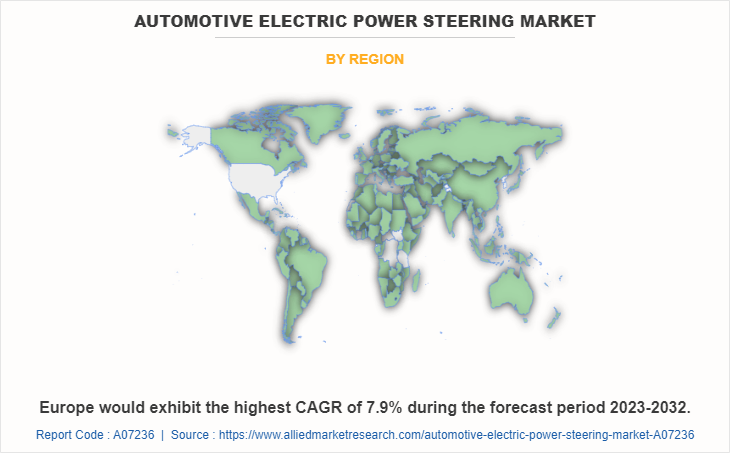

Asia-Pacific is analyzed across China, India, Japan, South Korea, and the rest of Asia-Pacific. Asia-Pacific has observed a substantial rise in disposable income and the expansion of the middle class, resulting in an increased demand for advanced vehicles that provide enhanced comfort and safety features. As individuals' purchasing power improves, there is a surge in preference for vehicles equipped with electric power steering (EPS) systems, which offer improved steering control and a more seamless driving experience. This surge in demand from the emerging middle-class segment is expected to drive the growth of the automotive electric power steering market.

Asia-Pacific holds a prominent position as one of the foremost automotive manufacturing centers globally. Countries such as China, Japan, South Korea, and India have witnessed substantial growth in vehicle production. As the demand for vehicles continues to surge across the Asia-Pacific, there is a rise in the expansion of the market for automotive electric power steering systems. This growth can be attributed to the surge in adoption of electric power steering technology by manufacturers, aimed at improving vehicle performance and safety standards. The automotive industry has witnessed a notable increase in the replacement of hydraulic steering systems with electric power steering (EPS) systems, indicating a growing preference for EPS technology. For instance, in March 2019, China Automotive Systems (CAS), one of the leading automotive components and systems suppliers in China secured an exclusive contract for Electric Power Steering (EPS) from Great Wall Motors (GWM), one of China's largest automakers. In addition, the players aim to increase the automotive electric power steering market share with the development of EPS systems that offer improved performance, efficiency, and advanced features such as variable assist levels, customizable steering modes, or integration with other vehicle systems for enhanced driver assistance.

Factors such as stringent fuel efficiency & emission standards, the surge in demand for vehicle safety and enhanced vehicle handling and rise in demand for Advanced Driver Assistance Systems (ADAS) drive the growth of the automotive electric power steering market. However, high initial investment costs and technical challenges & complexity hinder the growth of the market. Furthermore, the development of autonomous driving technology and the rise in the development of compact and cost-effective motor control units for EPS offer remarkable growth opportunities for the players operating in the market.

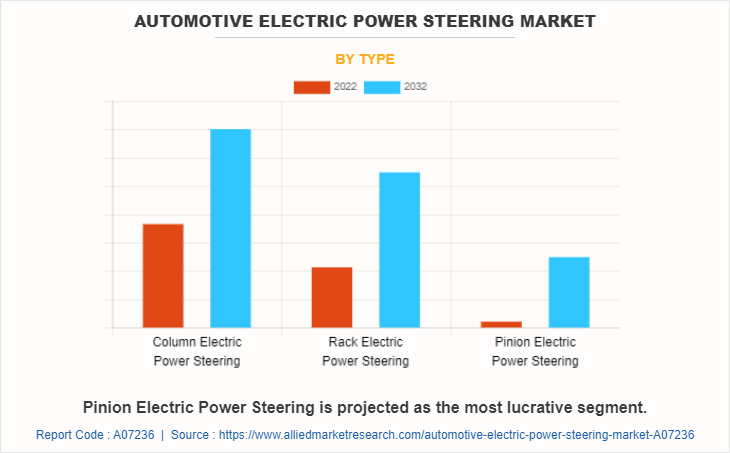

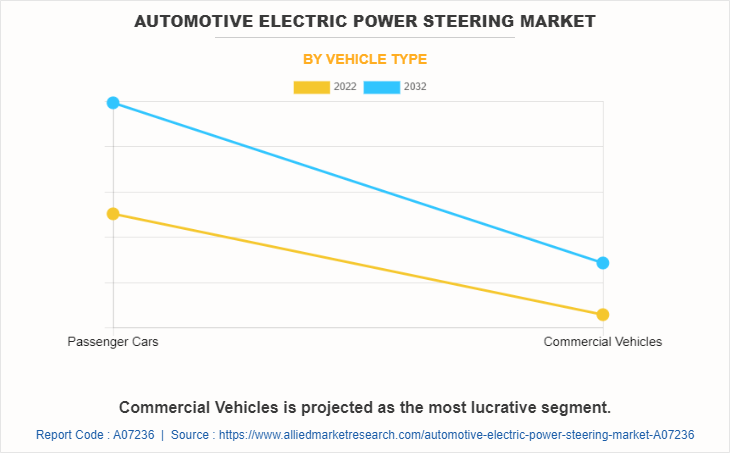

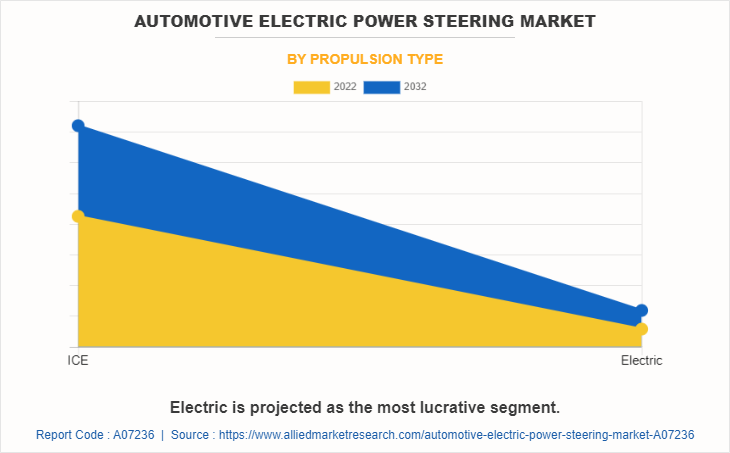

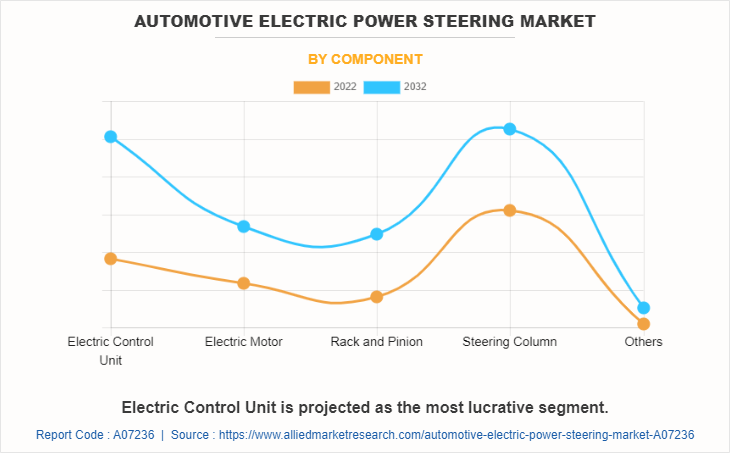

The automotive electric power steering market is segmented on the basis of type, vehicle type, propulsion type, component, and region. By type, it is categorized into column electric power steering, rack electric power steering, and pinion electric power steering. By vehicle type, the market is bifurcated into passenger cars and commercial vehicles. By propulsion type, it is fragmented into ICE and electric. By component, it is classified into electric control unit, electric motor, rack & pinion, steering column, and others. By region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The leading companies profiled in the electric power steering market report include JTEKT Corporation., HL Mando Corp., Nexteer Automotive, Robert Bosch GmbH, NSK Ltd., ZF Friedrichshafen AG, Hitachi Astemo, Ltd., ThyssenKrupp AG, Zhejiang Shibao Co., Ltd., and BBB Industries. The companies have adopted strategies such as collaboration, expansion, agreement, product launch, investment, and others to improve their market positioning.

Stringent fuel efficiency and emission standards

The growth of the automotive electric power steering (EPS) market is driven by stringent fuel efficiency and emission standards. EPS systems provide enhanced energy efficiency compared to traditional hydraulic power steering, leading to improved fuel economy in vehicles. Moreover, EPS systems contribute to the reduction of carbon emissions by eliminating the need for power steering fluid, minimizing the risk of fluid leaks and environmental pollution. Integration with vehicle control systems allows optimized energy usage, further reducing emissions. For instance, in April 2023, Environmental Protection Agency (EPA) announced that it aims to implement more stringent standards to reduce greenhouse gas emissions and improve fuel efficiency for passenger vehicles and light-duty trucks.

The proposed standards include more aggressive targets for reducing carbon dioxide emissions from vehicles, with a focus on increasing the average fuel economy of new vehicles sold. The EPA's plan is to gradually phase in these stricter standards over the coming years, leading to significant reductions in emissions and improved fuel efficiency by 2026. The proposed fuel efficiency and emission standards put forth by the U.S. Environmental Protection Agency (EPA) indirectly drive the demand for automotive Electric Power Steering (EPS) systems. EPS systems are recognized for their energy efficiency when compared to traditional hydraulic power steering systems. With the implementation of EPS, vehicles decrease energy consumption and enhance fuel efficiency, aligning with the objectives outlined in the EPA's proposed standards. Therefore, such factors are expected to potentially drive the growth of the automotive electric power steering market.

Surge in demand for vehicle safety and enhanced vehicle handling

The automotive electric power steering market has experienced significant growth driven by the rise in demand for vehicle safety and enhanced vehicle handling. This demand is fueled by the increase in emphasis on road safety by governments and consumers, driving the integration of advanced safety technologies in vehicles. Manufacturers aim to develop Electric Power Steering (EPS) systems that enhance safety by providing advanced steering control and improved handling capabilities. For instance, in October 2020, Nexteer Automotive, a global motion control technology company unveiled a new high-output Electric Power Steering (EPS) that features a high-output electric motor that delivers increased torque and power, allowing improved steering control and handling. EPS systems contribute to enhanced vehicle safety by offering several advantages. These include improved vehicle stability, enhanced steering response, and seamless integration with driver assistance systems. By providing precise and responsive steering inputs, EPS systems assist drivers in safely maneuvering their vehicles, particularly in critical driving situations. Therefore, the surge in demand for vehicle safety and enhanced vehicle handling are expected to propel the adoption of automotive electric steering technology.

Rise in demand for Advanced Driver Assistance Systems (ADAS)

ADAS technologies are aimed at improving vehicle safety and providing driver assistance in various driving situations, and EPS systems play a crucial role in enabling the functionality of these systems. ADAS systems rely on precise and responsive steering control to implement features such as lane-keeping assist, lane departure warning, and automated parking. EPS systems, known for their accurate and adjustable steering characteristics, provide the necessary control and feedback for these advanced safety features.

With the integration of EPS with ADAS systems, vehicles can enhance their ability to detect lane deviations, provide corrective steering inputs, and enhance overall safety on the road. Moreover, EPS systems facilitate the seamless integration of other ADAS technologies, such as adaptive cruise control and collision avoidance systems. These systems require accurate and timely steering inputs to maintain a safe distance from other vehicles and respond quickly to potential collision scenarios. EPS systems offer the agility and responsiveness needed to support these functionalities, thereby improving the effectiveness of ADAS systems, and enhancing vehicle safety. Therefore, such factors are expected to boost the growth of the market during the forecast period.

High initial investment costs

The implementation of electric power steering (EPS) systems in vehicles necessitates substantial investments in the research, development, and manufacturing infrastructure. The advancement of EPS technology necessitates extensive research and engineering to effectively design and optimize the various system components, such as the electric motor, control unit, sensors, and software. Meeting rigorous performance, reliability, and safety standards further adds to the complexity and cost of development. Furthermore, adherence to industry regulations and standards demands additional investments in testing and certification processes. The manufacturing process of EPS systems requires specialized equipment, tools, and production lines that require significant capital investments. To ensure the efficient and precise manufacturing of EPS components, production facilities must be equipped with advanced technologies and automation. Therefore, such factors are expected to restrict the growth of the market.

Technical challenges and complexity

Integration of EPS systems with various vehicle components, including sensors, ECUs, and powertrain systems, can be challenging due to the need for seamless compatibility and reliable communication. This is particularly complex in automotive architectures. EPS systems rely on electrical power sources such as batteries or alternators, which adds to the difficulty of maintaining sufficient power supply while maximizing efficiency. EPS systems are critical for vehicle safety as they directly impact steering control, making it essential to ensure their reliability, durability, and fail-safe operation. Meeting industry standards and regulations necessitates rigorous testing and validation procedures. Such factors are expected to hinder the growth of the market during the forecast period.

Development of autonomous driving technology

The rise in the development of autonomous driving technology fosters significant advancements in the automotive industry. For instance, in March 2023, May Mobility announced the launch of a third-generation autonomous driving system that incorporates advanced features and capabilities that enhance the safety and efficiency of autonomous vehicles. Autonomous vehicles require advanced steering capabilities to safely navigate and maneuver without direct driver input, and EPS systems play a vital role in enabling precise and reliable steering control for autonomous driving. The safe and efficient operation of autonomous vehicles relies on accurate and responsive steering control.

EPS systems provide the necessary functionality to interpret sensor data, make real-time steering adjustments, and maintain an optimal vehicle trajectory. By offering enhanced control and feedback, EPS systems meet the demanding requirements of autonomous driving, enabling vehicles to navigate complex road scenarios, execute lane changes, and perform precise maneuvers with utmost precision. EPS systems are essential for the seamless integration of autonomous driving features with existing driver assistance systems. With the incorporation of EPS technology, vehicles can smoothly transition between manual and autonomous driving modes. Therefore, such factors are expected to bring significant opportunities for the growth of the market.

Recent Developments

- In April 2023, Nexteer Automotive launched modular rack-assist electric power steering (mREPS) system. mREPS efficiently meets OEMs' wide-ranging requirements for advanced steering systems of heavier vehicles, such as EVs, light commercial vehicles, and others.

- In May 2022, ThyssenKrupp AG collaborated with NSK to explore a joint venture between Thyssenkrupp automotive and NSK's steering business. This strategic move includes technological and strategic alignment of the product areas in Thyssenkrupp's automotive business with NSK's steering business.

- In August 2022, ZF Friedrichshafen AG invested $47 million to expand the capacity for power steering systems in Shanghai to meet growing local demand. This led to an increase in additional production capacity for electric power steering systems.

- In July 2022, HL Mando Corp. expanded its production unit in the Georgia plant in the U.S. and started production of 50 million units of electric power steering (EPS). HL Mando is producing EPS in five countries such as Korea, China, U.S., India, and Mexico.

- In May 2022, Nexteer Automotive collaborated with Continental Automotive and CNX Motion for new software functions that provide backup safety layers for all variants of Electric Power Steering (EPS) and Steer-by-Wire (SbW) systems.

- In March 2021, NSK Ltd. signed an agreement with Volkswagen AG to develop a high-power single-pinion electric power steering (EPS) system for Volkswagen electric vehicles.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the automotive electric power steering market analysis from 2022 to 2032 to identify the prevailing automotive electric power steering market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the automotive electric power steering market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global automotive electric power steering market trends, key players, market segments, application areas, and market growth strategies.

Automotive Electric Power Steering Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 42 billion |

| Growth Rate | CAGR of 5.8% |

| Forecast period | 2022 - 2032 |

| Report Pages | 293 |

| By Type |

|

| By Vehicle Type |

|

| By Propulsion Type |

|

| By Component |

|

| By Region |

|

| Key Market Players | Robert Bosch GmbH, Hitachi, Ltd., ZF Friedrichshafen AG, Nexteer Automotive, Zhejiang Shibao Co., Ltd., NSK Ltd., ThyssenKrupp AG, JTEKT Corporation, BBB Industries, HL Mando Corp. |

The global automotive electric power steering market was valued at $23.97 billion in 2022, and is projected to reach $41.96 million by 2032, registering a CAGR of 5.8% from 2023 to 2032.

The largest regional market for automotive electric power steering is Asia-Pacific

The top companies to hold the market share in automotive electric power steering are JTEKT Corporation., HL Mando Corp., Nexteer Automotive, Robert Bosch GmbH, NSK Ltd., ZF Friedrichshafen AG, Hitachi Astemo, Ltd., ThyssenKrupp AG, Zhejiang Shibao Co., Ltd., and BBB Industries.

The leading vehicle type of automotive electric power steering market is passenger cars.

The upcoming trends of automotive electric power steering market are the development of autonomous driving technology, and the rise in the development of compact and cost-effective motor control units for EPS.

Loading Table Of Content...

Loading Research Methodology...