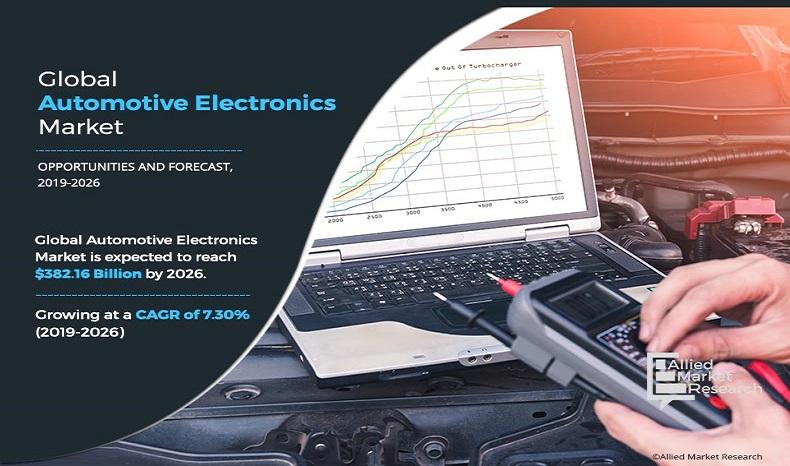

Automotive Electronics Market Outlook - 2026

The global automotive electronics market size was at $228.34 billion in 2019 and is projected to reach $382.16 billion by 2026, registering a CAGR of 7.30% from 2020 to 2026. The automotive electronics industry deals in equipping vehicles with digital and automatic controls. The features such as power windows, changing ride modes, lighting, safety features, driver assistance, automatic ride controls, infotainment, and other such functionality use automotive electronics. The electronics are installed in various categories of vehicles such as passenger cars, LCVs, and HCVs.

According to the automotive electronics market, factors such as the adoption of IoT and AI in automobiles, vehicles equipped with automated driving, the demand for in-vehicle safety features, increase in demand for infotainment features drive the automotive electronics market share. On the other hand, the low adoption of automotive electronics in newly industrialized countries and the increase in the overall cost of end-products due to the integration of automotive electronics hampers the automotive electronics market growth. Further, the investment in autonomous driving of vehicles in smart grids is expected to provide a lucrative opportunity for the automotive electronics market.

Segment Overview

The automotive electronics market is segmented based on vehicle type, components, application, distribution channel, and region. By vehicle type, it is categorized as passenger cars, LCVs, and HCVs. Based on components, it is categorized into sensors, actuators, processors, microcontrollers, and others. The application segment is divided into ADAS, infotainment, body electronics, safety systems, power trains, and others. The distribution channel in the market is segmented as OEM and aftermarket. Based on region, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA.

Based on vehicle type, the passenger car segment generated the highest revenue in 2019 and is also expected to account for the highest revenue in the forecast period. Based on components, microcontrollers had the highest revenue in 2019 and are expected to lead the category by 2026. The infotainment category of the end-use accounts for the highest revenue in 2019 and is expected to maintain the lead through the forecast period.

Top Impacting Factors

The dynamics such as penetration of IoT and AI in automobiles, vehicles offered with autonomous driving features, the need for in-vehicle safety features, rise in demand for infotainment features drive the automotive electronics market. On the contrary, a lower level of penetration of automotive electronics in newly industrialized countries and an increase in the overall cost of end-products due to the integration of automotive electronics hampers the automotive electronics market share. Further, the investment in autonomous driving of vehicles in smart grids is expected to provide lucrative opportunities in the automotive electronics market.

By Components

Microcontrollers segment is projected as one of the most lucrative segments.

Some major factors impacting the automotive electronics market are given below:

Adoption of IoT and AI in automobiles

As per automotive electronics market trends, the advancement of IoT and AI has changed the way functionalities in automobiles operate. Over the past year, it has increased driver connectivity with the vehicle and has enhanced the ride assistance features. For instance, the vehicles are provided with cameras and sensors that assist drivers in car parking or any other proximity features, which is expected to drive the automotive electronics industry growth globally.

Rise in vehicles equipped with automated driving

Their advancement has made cars smarter with artificial intelligence. These autonomous cars sense danger and detect the driver’s stress level. Self-driving automatic cars combine a variety of sensors to perceive their surroundings, such as radars, and advanced control systems interpret sensory information to identify appropriate navigation paths as well as obstacles and relevant signage.

By Application

Infotaiment segment is expected to secure leading position during forecast period.

The demand for in-vehicle safety features

An increase in strictness over car safety standards across various regions around the world and a rise in consumer awareness towards automobile safety features demand the use of automotive electronic components. For instance, an economical range of cars is installed with airbags for accidental safety; further, a premium range of cars has advanced safety features such as sleep detection, automatic braking systems, and others. This is expected to offer lucrative automotive electronics market opportunities globally.

Investment towards autonomous driving of vehicles in smart grids

The construction of smart cities and the parallel advancement of the automotive industry is expected to build smart autonomous transportation systems for automobiles. The increased investment in the sectors is lucrative to create market opportunities. For instance, technology company Continental on December 18, 2019, announced a big step toward creating safer, smarter cities: a Smart City Mobility and Transportation Hub in Auburn Hills, Michigan.

Competitive Analysis

Key players operating in the global automotive electronics market are Robert Bosch, Renesas Electronics Corporation, Infineon Technologies AG, STMicroelectronics N.V., Texas Instruments, NXP Semiconductors N.V., Continental AG, NVIDIA Corporation, Hitachi Ltd., and Aptiv PLC. The companies follow various market strategies such as product launch, product development, collaboration, partnership, and others that lead to market growth. Nvidia launched a simulator that leverages cloud computing power to test autonomous vehicles. The software can simulate sunlight during sunset, snowstorms, poor road surfaces, and dangerous situations to test the vehicle's ability to react.

Historical Data & Information

The global automotive electronics market is highly competitive, owing to the strong presence of existing vendors. Vendors of the automotive electronics market with extensive technical and financial resources are expected to gain a competitive advantage over their competitors because they can cater to market demands. The competitive environment in this market is expected to worsen as technological innovations, product extensions, and different strategies adopted by key vendors increase.

Key Developments/ Strategies

Robert Bosch, Renesas Electronics Corporation, Infineon Technologies AG, STMicroelectronics N.V., Texas Instruments, NXP Semiconductors N.V., Continental AG, NVIDIA Corporation, Hitachi Ltd., and Aptiv PLC are the top companies holding a prime share in the automotive electronics market. Top market players have adopted various strategies, such as product launch and product development, to expand their foothold in the automotive electronics market.

- In December 2022, NXP and Delta Electronics formed a strategic partnership to develop platforms for future automobiles. The two companies' collaboration labs have also been made public. This partnership’s goals include improving electrification alternatives and implementing real-time products based on NXP S32E and S32Z processors. The S32E microcontroller is used to develop smart actuation, safety processing, domain and zonal control, and EV control.

- In July 2021, Bosch Engineering created a high-voltage Lab Rig (HVLR) that can be used to efficiently test the power electronics of electric vehicles. The test can be performed in a high-voltage lab rather than on the bench, which is intended to minimize development costs and time.

Key Benefits for Stakeholders:

- This report provides an extensive analysis of the current and emerging market trends and dynamics in the global automotive electronics market.

- In-depth automotive electronics market analysis is conducted by semiconductor and electronics market estimations for the key market segments between 2019 and 2026.

- Extensive analysis of the market is conducted by following key product positioning and monitoring the top competitors within the market framework.

- Key players are profiled, and their strategies are analyzed thoroughly to understand the competitive outlook of the global automotive electronics market.

Automotive Electronics Market Report Highlights

| Aspects | Details |

| By Vehicle Type |

|

| By Component |

|

| By Application |

|

| By Distribution Channel |

|

| By Region |

|

| Key Market Players | NXP SEMICONDUCTORS N.V., Continental AG, TEXAS INSTRUMENTS, RENESAS ELECTRONICS CORPORATION, INFINEON TECHNOLOGIES AG, Hitachi, Ltd. (Hitachi Automotive Systems, Ltd.), Aptiv PLC (Delphi Automotive PLC), Robert Bosch, STMICROELECTRONICS N.V., NVIDIA Corporation |

Analyst Review

GaN is a high electron mobility transistor. with a higher critical electric field strength than silicon. This high electron mobility means that GaN has a higher electric-field strength than silicon does, and also means that a GaN device will have a smaller size for a given on-resistance and breakdown voltage than a silicon semiconductor. GaN also offers extremely fast switching speed and excellent reverse-recovery performance, critical for low-loss, high-efficiency performance. Therefore, the benefits of GaN in comparison to SiC power devices make them preferable for usage as power devices.

Factors that assist the market growth include decline in prices, better performance as compared to SiC devices, rise in demand of GaN devices for wireless charging, increase in installation of GaN devices in electric vehicle, and growth in requirement of GaN devices in commercial RF applications. However, lack of availability of GaN material restrains the market growth. Government initiatives in HVDC and smart grid is anticipated to provide numerous opportunities for market growth during the forecast period.

Key players operating in the global automotive electronics market are Efficient Power Conversion Corporation (EPC), GaN Systems, On Semiconductors, Panasonic Corporation, VisIC, Texas Instruments Inc., Toshiba Corporation, Fujitsu Limited, Infineon Technologies AG, and Taiwan Semiconductor Manufacturing Company.

The global automotive electronics market was valued at $228.34 billion in 2019. It’s projected to reach $382.16 billion by 2026, representing significant market expansion.

The market is expected to grow at a compound annual growth rate (CAGR) of 7.30% between 2020 and 2026.

Leading players include Robert Bosch; Renesas Electronics Corporation; Infineon Technologies AG; STMicroelectronics N.V.; Texas Instruments; NXP Semiconductors N.V.; Continental AG; NVIDIA Corporation; Hitachi Ltd.; and Aptiv PLC.

While the report details the market by region (North America, Europe, Asia-Pacific, and LAMEA), it doesn’t explicitly state which region leads in share. However, given the advanced technology adoption trends, regions like North America and Europe are typically dominant. Unfortunately, the exact largest region isn’t specified in the summary.

Key growth drivers of the automotive electronics market include the adoption of IoT and AI for enhanced connectivity and assistance features, the rise of vehicles with automated driving technologies such as sensors and radars, increasing demand for advanced in-vehicle safety systems, and growing investments in autonomous driving and smart city infrastructure.

Loading Table Of Content...