Automotive Lubricants Overview:

The global automotive lubricants market size was valued at $77.8 billion in 2022, and is projected to reach $116.1 billion by 2032, growing at a CAGR of 4.1% from 2023 to 2032.

Introduction

Automotive lubricants are specially formulated substances used to reduce friction, wear, and heat between moving parts in vehicles, ensuring smooth operation and enhanced performance. They include engine oils, transmission fluids, gear oils, greases, and coolants, each designed to serve specific functions in different vehicle components. These lubricants help extend the lifespan of engine and transmission systems by minimizing metal-to-metal contact, preventing corrosion, and maintaining optimal temperature control. Modern automotive lubricants are often enhanced with additives to improve viscosity, thermal stability, and resistance to oxidation, meeting the stringent requirements of contemporary vehicle technologies, including electric and hybrid models.

Lubricants are essential for all types of passenger vehicles, cars, SUVs, and motorcycles. The increasing complexity of internal combustion engines and growing consumer demand for performance and fuel efficiency have spurred the development of advanced synthetic lubricants in this segment. Regular maintenance with quality lubricants helps in achieving better mileage, reduced emissions, and extended vehicle life. Heavy-duty trucks, buses, and delivery vans operate under demanding conditions, often covering thousands of kilometers in a short span. These vehicles require robust lubrication solutions that can withstand high loads, long hours of operation, and variable environmental conditions. Specialized lubricants for diesel engines, transmission systems, and axle assemblies are widely used in this segment.

Key Takeaways:

The automotive lubricants market is fragmented in nature with few players such as include Royal Dutch Shell Plc., Fuchs Lubricants, Bp Plc., Total S.A., Indian Oil Corporation Limited, Chevron Corporation, Valvoline, Petrochina Company Limited, And Exxon Mobil Corporation, which hold a significant share of the market.

The report provides complete analysis of the market status across key regions and more than 15 countries across the globe in terms of value and volume.

Top winning strategies are analyzed by performing a thorough study of the leading players in the automotive lubricants market. Comprehensive analysis of recent developments and growth curves of various companies helps us to understand the growth strategies adopted by them and their potential effect on the market.

The report provides competitive dynamics by evaluating business segments, product portfolios, target market revenue, geographical presence and key strategic developments by prominent manufacturers.

Market Dynamics:

Technological advancements in engine design are expected to drive the growth of the market. Modern engines are being designed to meet stringent emission regulations, improve fuel efficiency, and enhance overall vehicle performance. These advancements, while beneficial for environmental and operational goals, also place greater stress on engine components, which in turn raises the expectations from lubricants in terms of thermal stability, oxidation resistance, and wear protection. In December 2024, the UK and Japan have merged their respective Tempest and F-X fighter development programs into the Global Combat Air Program (GCAP). This joint endeavor aims to develop a common multi-role fighter, incorporating advanced engine technologies and sensor capabilities.

Moreover, synthetic and semi-synthetic lubricants, with their superior chemical and thermal properties, have become essential to ensure smooth engine operation, reduce friction, and extend maintenance intervals. These lubricants perform well under extreme temperatures and pressures, offering better viscosity control and engine cleanliness, which are critical for the latest turbocharged, downsized, and hybrid engines. In July 2024, TotalEnergies completed the acquisition of Tecoil in mid-2024, enhancing its capabilities in recycling used synthetic lubricants and promoting a circular economy. Approximately 30% of its lubricant production now integrates regenerated materials.

However, adoption of electric vehicles (EV) is expected to hamper the growth of the automotive lubricants market. EVs do not require many of the traditional lubricants used in engines, such as engine oils, which constitute a major portion of the lubricant market. This fundamental difference in vehicle mechanics is expected to substantially reduce the volume demand for lubricants in the long term, particularly as EV adoption accelerates worldwide due to climate change policies, technological advancements, and government incentives.

According to Smithers Apex, the number of electric vehicles worldwide is anticipated to reach 470 million by 2029, driven by advancements in battery technology, manufacturing scale, and robust government policies supporting green transportation. The International Energy Agency (IEA) reported that over 14 million new EVs were sold in 2023 alone, marking a 35% increase from the previous year and signaling an accelerating trend in EV adoption. As a result, global engine oil demand could shrink by 30%–40% by 2040, depending on the pace of EV penetration.

Moreover, bio-based and environmentally friendly lubricants are expected to provide lucrative opportunities in the automotive lubricants market. As environmental concerns gain prominence across industries, the automotive lubricants market is witnessing a growing demand for sustainable and eco-friendly alternatives. This shift is being driven by stricter environmental regulations, increased consumer awareness, and corporate sustainability goals. In response, manufacturers are investing in the development of bio-based and biodegradable lubricants that offer similar or superior performance to conventional products while minimizing environmental impact. In April 2023, ExxonMobil announced a $110 million investment to establish a lubricant production facility in India, aiming to produce up to 159 million liters annually by the end of 2025.

Segment Overview:

The automotive lubricants market is segmented on the basis of base oil, vehicle type, application, and region. By base oil, the market is categorized into mineral oil, synthetic, semisynthetic, and bio-based lubricants. On the basis of application, the market is classified into engine oil, gear & brake oil, transmission fluids, greases, and others. By vehicle type, it is divided into passenger cars, light commercial vehicles (LCVs), heavy commercial vehicles (HCVs), and others. Region-wise, the market is studied across North America, Europe, Asia-Pacific, and LAMEA.

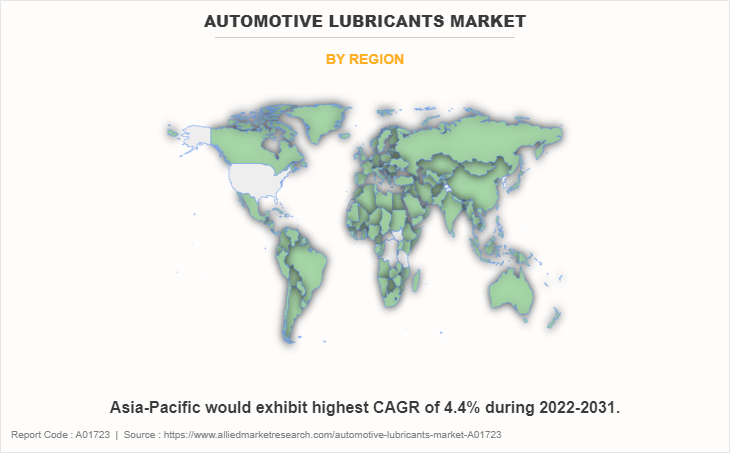

The Asia-Pacific automotive lubricants market accounted for a major market share in 2022 with 40% share in the global market and is projected to grow at the highest CAGR during the forecast period and. Increasing population-driven electricity consumption, expanding industrial expansion, and increased demand for automobiles are the region's primary drivers. The Asia-Pacific automotive lubricants market is anticipated to expand during the forecast period. India, China, and Japan are anticipated to contribute considerably to the Asia-Pacific automotive lubricants market.

In addition, population growth-driven increases in power consumption, industrial expansion, and demand for electric and hybrid automobiles are anticipated to stimulate regional market growth. China Implemented the China 6b emission standard in July 2023, making it the most stringent vehicle emissions standard globally. This regulation aims to reduce pollutants such as particulate matter (PM) and nitrogen oxides (NOx), necessitating the use of advanced lubricants to meet these stringent requirements.

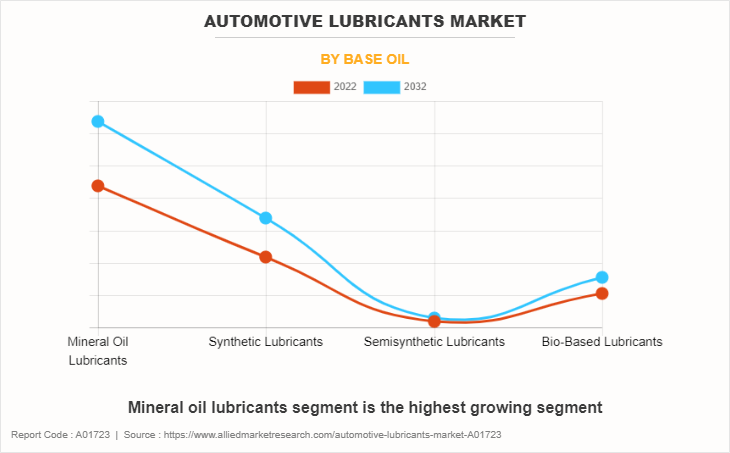

On the basis of base oil, the mineral oil lubricants segment was the largest revenue generator in the automotive lubricants market. Automotive lubricants play a crucial role in ensuring the smooth operation and longevity of vehicles by reducing friction, wear, and overheating of engine components. Among various types of lubricants, mineral oil-based lubricants remain dominant in the automotive sector due to their cost-effectiveness, availability, and satisfactory performance under standard operating conditions. Mineral oil lubricants are derived from refining crude oil and consist mainly of hydrocarbons with varying molecular structures.

In April 2025, BIS issued new standards for lubricants, including IS 19159 (Part 1):2025 for air compressor lubricants. These updates align Indian regulations with international benchmarks, enhancing safety, performance reliability, and environmental compliance. Moreover, in September 2024, India’s oil and gas company, ONGC Videsh Ltd (OVL), Oil India Ltd (OIL), and Khanij Bidesh India (Kabil) collaborated with United Arab Emirates (UAE)’s International Resources Holding RSC Ltd (IRH) under an MoU. The agreement focuses on acquiring and developing critical mineral projects globally, supporting India’s Critical Minerals Mission.

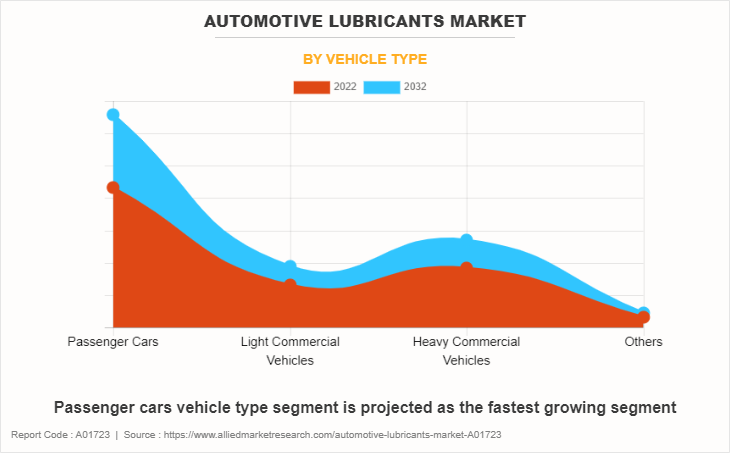

By vehicle type, the passenger vehicle segment dominated the global automotive lubricants market, in terms of revenue in 2022. The usage of automotive lubricants in passenger vehicles extends beyond the engine oil. Transmission fluids, for example, are vital in ensuring smooth gear shifts and preventing transmission wear. Automatic and continuously variable transmissions (CVTs) in newer vehicles demand specialized lubricants formulated to withstand varying pressure and temperature conditions.

Additionally, grease is used in wheel bearings, chassis, and suspension components to reduce friction and protect against corrosion, enhancing vehicle stability and safety. In November 2024, Mahindra launched two all-electric SUVs, the XEV 9e and the BE 6, as part of its 'Born Electric' BEV range. Deliveries commenced in early 2025, marking a significant step in Mahindra's EV portfolio expansion. In February 2024, Vietnamese automaker VinFast commenced construction of its first integrated electric vehicle (EV) manufacturing facility in India. The plant, located in Thoothukudi, Tamil Nadu, marks a significant step in VinFast’s global expansion, backed by a planned investment of up to $2 billion. Of this, an initial $500 million has been committed for development over the first five years.

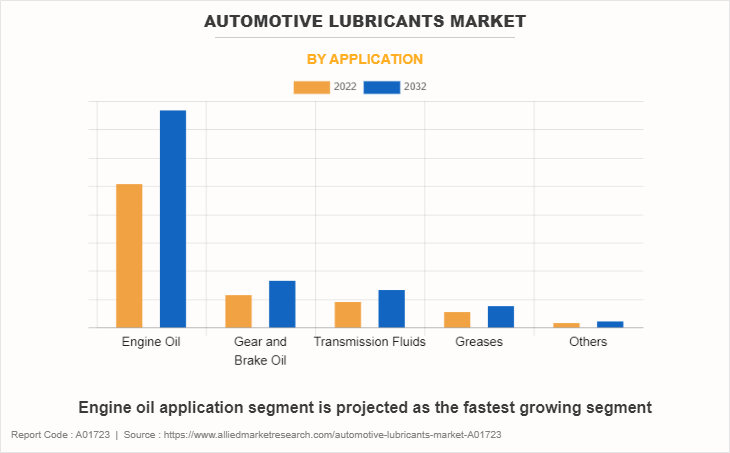

By application, the engine oil segment dominated the global automotive lubricants market, in terms of revenue in 2022. Modern engine oils contain a complex blend of base oils and performance-enhancing additives tailored to meet the demands of contemporary engines. These additives improve the oil viscosity, prevent oxidation, inhibit corrosion, and keep engine components clean by suspending contaminants and preventing sludge buildup. For example, detergents and dispersants keep harmful deposits in suspension, while anti-wear agents form protective films on critical parts to minimize metal-to-metal contact during engine start-up or heavy load conditions. As engines become more advanced and efficient, lubricants are engineered to meet stricter environmental standards by improving fuel economy and reducing harmful emissions, which highlights the evolving importance of lubricants in automotive technology. In June 2024, Castrol India launched new variants under the Castrol EDGE line, including EDGE Hybrid for hybrid engines, EDGE Euro Car for premium European brands, and EDGE SUV for high-performance SUVs, offering improved engine performance.

Competitive Analysis:

The major companies profiled in this automotive lubricants report include FUCHS, Indian Oil Corporation Limited, PetroChina Company Limited, Chevron Corporation, Exxon Mobil Corporation, TotalEnergies, BP p.l.c., Valvoline Inc., Royal Dutch Shell PLC.

Recent Key Developments in the Automotive Lubricants Market

In June 2024, TotalEnergies introduced its innovative Quartz EV3R lubricant for passenger cars and the Rubia EV3R lubricant tailored for trucks. Both lubricant ranges are crafted from premium regenerated base oils and have received endorsements from numerous vehicle manufacturers.

In September 2023, Liqui Moly GmbH introduced Dual Clutch Gear Oil 8100, designed for use in nearly all wet dual-clutch transmissions. This advanced formulation features a highly stable viscosity index, protective wear additives, and long-lasting friction modifiers, ensuring smooth and reliable shifting under all conditions.

In February 2025, BP was reported to be considering the sale of its Castrol lubricants business, valued at approximately $10 billion. This move is part of BP's strategy to streamline operations and focus on core areas.

In November 2022, Shell acquired the environmentally considerate lubricants business of the PANOLIN group to expand its portfolio of bio-based lubricants.

In December 2024, Chevron reported a significant increase in sales of its synthetic lubricants, indicating a growing demand for high-performance oils in North America and Europe.

In November 2024, Castrol introduced a line of carbon-neutral lubricants as part of its commitment to reducing its carbon footprint in the automotive lubricants sector.

Import and Export Analysis in Automotive Lubricants Market

Export Trends

India, the U.S., and Germany are the top exporters of automotive lubricant oils globally. India leads with 12,429 shipments, accounting for a 28% market share, followed by the U.S. with 10,253 shipments (23% share), and Germany with 4,833 shipments (11% share). Other significant exporters include South Korea, Mexico, and Belgium. The dominance of these countries is attributed to their strong manufacturing bases, established oil and petrochemical industries, and strategic investments in refining and lubricant production capacities. North America, particularly the U.S., has a well-developed automotive industry and is a major exporter of lubricants, with a stable pricing environment that supports steady export margins.

Import Patterns

The world’s largest importers of automotive lubricant oils include Peru (19,814 shipments), Russia (5,098 shipments), and Chile (5,040 shipments). Other importers are Bangladesh, Nepal, and Sri Lanka, reflecting the widespread need for lubricants in both developed and developing markets. India, despite being a leading exporter, is also a significant importer due to its limited domestic crude oil production and high demand for refined petroleum products. In 2024, India imported roughly 37,000 barrels of lube oil per day, highlighting its reliance on global supply chains. Asia Pacific has emerged as the fastest-growing market for lubricants, driven by rapid industrialization and automotive sector expansion in countries like China, India, and Indonesia. China, in particular, has become both a major consumer and exporter of lubricants and base oils, leveraging its position as a global manufacturing hub.

Key Benefits For Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the automotive lubricants market analysis from 2022 to 2032 to identify the prevailing automotive lubricants market opportunities.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the automotive lubricants market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global automotive lubricants market trends, key players, market segments, application areas, and market growth strategies.

Automotive Lubricants Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 116.1 billion |

| Growth Rate | CAGR of 4.1% |

| Forecast period | 2022 - 2032 |

| Report Pages | 462 |

| By Base Oil |

|

| By Vehicle Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | FUCHS, BP p.l.c., Royal Dutch Shell PLC, Indian Oil Corporation Limited, Valvoline Inc., Chevron Corporation, Exxon Mobil Corporation, PetroChina Company Limited, TotalEnergies |

Analyst Review

According to CXOs of leading companies, the global automotive lubricants market is expected to exhibit high growth potential. Automotive lubricants are extensively used for automotive parts, including body panels, chassis components, and other metal parts. The process provides a uniform and durable protective layer, helping to prevent corrosion and extend the lifespan of vehicles. Transportation and industrial equipment that require high strength, corrosion protection, and abrasion resistant properties can be accomplished with the use of automotive lubricants

In addition, automotive lubricants possess excellent significant properties such as high mechanical strength, adhesion to metals, thermal resistance, chemical resistance, and corrosion resistance that makes it best suited for transmission lubrication applications. CXOs further added that sustained economic growth and development of the automotive sector have increased the popularity of automotive lubricants.

Automotive lubricant is a specialized fluid designed to reduce friction and wear among moving parts in an automobile's engine and other mechanical components. These lubricants are essential for proper functioning and longevity of a vehicle's engine & various systems. Different types of automotive lubricants are available in the market such as engine oil, differential fluid, brake fluid, and others.

Asia-Pacific is the largest regional market for automotive lubricants market.

The automotive lubricants market is segmented on the basis of base oil, vehicle type, application, and region. By base oil, the market is categorized into mineral oil, synthetic, semisynthetic, and bio-based lubricants. On the basis of application, the market is classified into engine oil, gear & brake oil, transmission fluids, greases, and others. By vehicle type, it is divided into passenger cars, light commercial vehicles (LCVs), heavy commercial vehicles (HCVs), and others. Region-wise, the market is studied across North America, Europe, Asia-Pacific, and LAMEA.

Electronics and semiconductor industry is the leading application of automotive lubricants market.

FUCHS, Indian Oil Corporation Limited, PetroChina Company Limited, Chevron Corporation, Exxon Mobil Corporation, TotalEnergies, BP p.l.c., Valvoline Inc., Royal Dutch Shell PLC.

There has been a shift towards long-life lubricants that require less frequent changes, which can reduce maintenance costs and waste generation. This trend aligns with the desire for convenience and cost savings among consumers.

The Automotive Lubricants Market was valued for $77.8 billion in 2022 and is estimated to reach $116.1 billion by 2032, exhibiting a CAGR of 4.1% from 2023 to 2032.

Loading Table Of Content...

Loading Research Methodology...