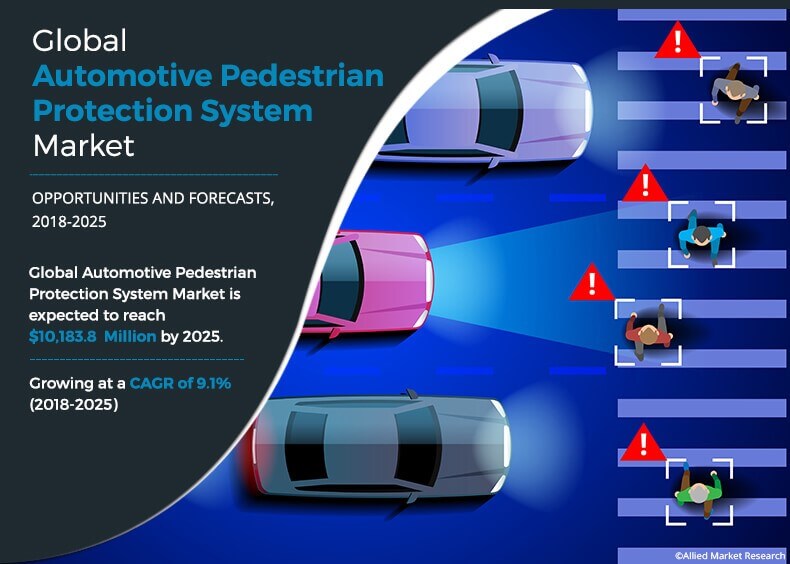

Automotive Pedestrian Protection System Market Outlook - 2025

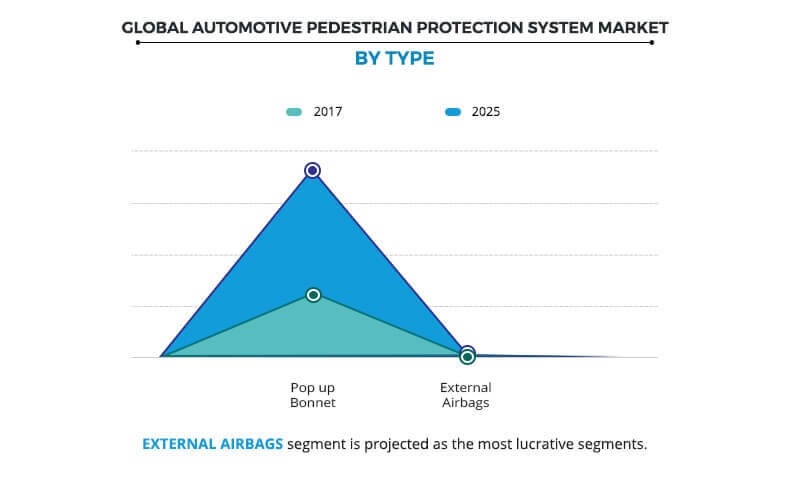

The global automotive pedestrian protection system market was valued at $5,133.2 million in 2017, and is projected to reach $10,183.8 million by 2025, registering a CAGR of 9.1% from 2018 to 2025. The pop-up bonnet segment was the highest contributor to the market, with $ 5,084.5 million in 2017, and is estimated to reach $ 10,040.1 million by 2025, at a CAGR of 9.0% during the forecast period. In 2017, Europe accounted for the highest share in the global automotive pedestrian protection system market.

A pedestrian protection system is used to protect the pedestrians in the event of a sudden collision so that it leads to less harm. This system has sensors that are designed for detecting collisions with pedestrians and an airbag control unit that can trigger the actuators for lifting the engine hood. When the system is activated, the rear section of the bonnet gets raised and the driver receives an automatic alarm. Systems such as popup hood & speed airbags and flexible air tubes are used for pedestrian safety during the time of sudden accidents. The various systems majorly concentrate on protecting the pedestrians heads and limbs. Moreover, as per the core definition, the automotive pedestrian protection system industry is only depending on the sales and latest innovation is done in active hoods and external airbags to save the pedestrian from the collision.

The automotive pedestrian protection system market is segmented on the basis of considering type, component type, distribution channel, and vehicle type. The latest automotive pedestrian protection system market trends boost the market growth. The pedestrian protection system trends is decided on the basis of the market forecast from 2018 to 2025. One of the major factors that driving the automotive pedestrian protection system market share is increase in number of accidents, and advanced collision avoidance based system with major advanced safety & security features.

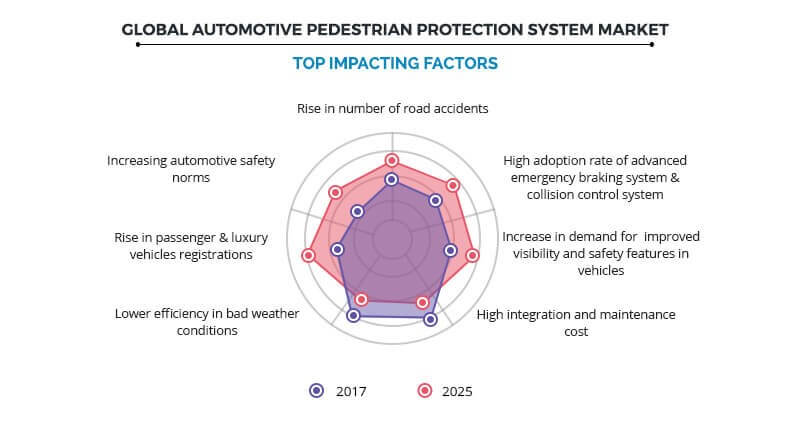

The global automotive pedestrian protection system market is driven by rise in number of road accidents, high adoption rate of advanced emergency braking system & collision control system, and increase in demand for improved visibility and safety features in vehicles. Furthermore, the shifting consumer preference to enhance driving experience and rise in demand for premium cars fuel the growth of the automotive pedestrian protection system market. In addition, technological steps taken by giant companies for the development of safety features further boost the growth of the global market. The market forecasted from year 2018-2025 by considering all the driving factors that influence equally to the automotive pedestrian protection system market report.

High installation cost and lower efficiency in bad weather conditions are some of the major factors that restrain the growth of the automotive pedestrian protection system market. Moreover, onetime use of external airbags adds up to cost, which is further expected to impend the market growth.

Furthermore, rise in consumer demand for safety & comfort and increase in global demand for premium & luxury vehicles registration provide growth opportunities for the automotive pedestrian protection system market globally. This can be attributed to rise in the sale of automated vehicles globally, which further offers lucrative opportunities for the automotive pedestrian protection systems market globally. The automotive pedestrian protection system market size includes the macroeconomic concerns such as the government support for the safety norms, rising interest rates among people and increase in sales and others.

The key players operating in the global automotive pedestrian protection system market include Autoliv, Robert Bosch GmbH, Magneti Marelli SpA, Denso Corporation, ZF Friedrichshafen AG, Mobileye N.V., Nissan Motor Corporation, Audi AG, Continental AG, and Valeo.

Rise in number of road accidents

According to the fact sheet of World Health Organization (WHO), road traffic injury is the leading cause of death among people aged between 15 and 29 years, and 1.25 million people die every year because of road accident. In addition, 90% of the world's fatalities on the roads occur in low & middle economical countries, though such countries have approximately 54% of the world's vehicles. Moreover, for most of the countries, road accidents cost 3% of their gross domestic product (GDP). Such factors result in increased demand for the vehicles equipped with autonomous emergency braking system (AEBS) and pedestrian protection systems for safety & security of the vehicle, driver, and people. Furthermore, road accidents cause considerable economic losses to individuals, their families, and nations. Thus, there is a growing demand for safety features in vehicles. Many automobile companies have introduced safety features to cater to the needs of the consumers. The automotive pedestrian protection system market is driven by the growing demand for safety features in automobiles, which in turn fuels the demand for pedestrians protection-based solutions to avoid road accidents.

High adoption rate of advanced emergency braking and collision control system

The AEBS possess high potential in case of crash avoidance & crash mitigation. BCollision Avoidance system functions of collision controls are to either avoid or at least mitigate a collision with a vehicle ahead with external airbags. This can be achieved either by warning to the driver or, if applicable, by autonomous braking of the vehicle. Systems with enhanced functions also respond for pedestrians, bicyclists, and other road users. Such advantages of pedestrian protection-based solutions are increasing its adoption globally. For instance, Nissan started offering GPS based ITS for pedestrian safety. This intelligent transport system cooperates with GPS mobile phones to detect pedestrians and alert drivers of the presence of pedestrians using voice and display messages on the car navigation monitor. In addition, the European general safety regulation has mandated AEBS for Hatchbacks (with the exemption of category N1) and for buses and coaches.

Increase in demand for improved visibility and safety features in vehicles

The demand for safety features such as parking assistance, collision avoidance systems, lane departure warnings, traction control, electronic stability control, tire pressure monitors, airbags, and telematics is expected to increase due to increase in the number of road accidents, worldwide. According to the Association of Safe International Road Travel (ASIRT), nearly 1.3 million people died in road crashes, worldwide, every year, with an average of 3,287 deaths per day. Thus, there is an increase in demand for safety features in vehicles. Automobile companies have introduced safety features to cater to the needs of the consumers. In addition, reduced visibility conditions, such as fog, frequently causes multiple vehicles crashes with serious consequences. The Radar and Lidar sensor used for pedestrian identifications warn the driver, whenever vehicle is in a condition to collide or crash on the upfront object, which helps in the avoidance of collision/crash, particularly in reduced visibility conditions. Such upgraded technology boost the market growth to some extends. The automotive pedestrian protection system market is driven by the growing demand for safety features in automobiles. The demand for driver assistance applications has significantly increased in the recent years due to increase in the purchasing power of consumers. This factor has influenced consumers to shift from normal driving to comfort driving. Moreover, the governments compulsion for safety rating and stop the crash campaign from various countries are creating awareness regarding safety parameters in vehicle. This factors are responsible to fuel the the automotive pedestrian protection system market opportunity in near future.

High integration and maintenance cost

The high cost associated with installing applications such as external airbags and highly precise collision avoidance sensors in vehicles restrains the growth of the automotive pedestrian protection system market as this factor leads to higher cost of the car. For instance, Subarus EyeSight starts at $1,195. Moreover, for standard brands, less expensive systems are implemented. For instance, Toyotas system costs as little as $500. The prospect of providing premium features in vehicles incurs additional expenses to consumers in the form of hardware, components. Moreover, the serviceability of the vehicle is difficult and requires skilled workers due to several electronic components and sensors. Thus, these factors are expected to have a significant impact on the growth of the automotive pedestrian protection systems market.

Lower efficiency in bad weather conditions

Environmental changes largely act as a restraint for pedestrian protection systems. The applications of pedestrian protection system do not work effectively in bad weather conditions. Vision-based systems especially have poor outcomes in bad weather and low light conditions. Moreover, the market is affected by other environmental factors such as lightning & thundering, storm, and others. These parameters are responsible to hinder the automotive pedestrian protection system market growth.

Increase in automotive safety norms

According to WHO, 1.25 million people die due to road accidents and millions more are injured. The safety of the vehicle plays a critical role in averting the crash or reducing the impact. Vehicles equipped with such standards are least anticipated to be involved in the accident. The minimum bCollision Avoidance system safety standards for the vehicle manufacturer and industry include standards on frontal and side impact protect occupants, electronic stability control, pedestrian protection, seat-belts, and ISOFIX child restraint anchorage point. Furthermore, there is an increase in trend and campaigns to include safety standard as bCollision Avoidance system feature, which creates lucrative opportunities for the market expansion. For instance, National Highway Traffic Safety Administration (NHTSA) Insurance Institute for Highway Safety (IIHS) announced that 99% of auto manufacturers in the U.S. have signed an agreement to include automatic emergency braking (AEB) systems as a standard feature by 2022 for all new vehicles. Such initiatives are expected to provide lucrative opportunities for the growth of the automotive pedestrian protection system market in the coming years.

Rise in passenger & luxury vehicles registrations

New SUV registrations increased in Europe, Russia, Japan, Brazil, India, and China, though it was sharply down in the U.S. In July 2017, the U.S. was the only major car market in the world with weaker growth with new light vehicle sales down 7%. The Indian and Russian car markets expanded rapidly with double-digit growth, while the recovery in Brazil continued at a more moderate pace. New passenger registrations in Japan increased for the ninth consecutive month. Moreover, in Europe and China, car sales was stronger but the UK recorded the fourth consecutive month of weaker car sales. Also, the luxury vehicles are more expensive than comparable vehicles. A record 28,500 of luxury vehicles were sold in 2016, a 15.9% increase with the demand fueled by China in particular. This is expected to create lucrative opportunities for the expansion of the automotive pedestrian protection system market.

Key Benefits for Automotive Pedestrian Protection System Market:

- This study presents analytical depiction of the automotive pedestrian protection system market analysis along with the current trends and future estimations to depict the imminent investment pockets.

- The overall market potential is determined to understand the profitable trends to gain a stronger foothold.

- The report presents information related to key drivers, restraints, and opportunities of the market with a detailed impact analysis.

- The current automotive pedestrian protection system market size is quantitatively analyzed from 2018 to 2025 to benchmark the financial competency.

- Porters five forces analysis illustrates the potency of the buyers and suppliers in the automotive pedestrian protection system industry.

Automotive Pedestrian Protection System Market Report Highlights

| Aspects | Details |

| By Type |

|

| By VEHICLE TYPE |

|

| By COMPONENT TYPE |

|

| By DISTRIBUTION CHANNEL |

|

| By Region |

|

| Key Market Players | ZF Friedrichshafen AG, DENSO Corporation, Nissan Motor Co., Ltd, Mobileye, Autoliv, Inc, Continental AG, VALEO, Robert Bosch GmbH, Audi AG, Fiat Chrysler Automobiles N.V |

Analyst Review

Automotive pedestrian protection systems are designed to decrease the accidental injuries due to crashes between the pedestrian and a vehicle. Such systems involve technologies such as LiDAR, RADAR, ultrasonic, control units, eternal airbags, pop up bonnet, and camera, which monitor the environment of the vehicle constantly and assist the driver in order to avoid collision with the pedestrian.

The pedestrian protection system monitors pedestrian’s sudden collision with the front bumper and the acceleration sensor detects that motion (in terms of acceleration). It then sends the corresponding signal to the control unit. The control unit then sends a signal to the motor and actuators to lift the engine hood so that pedestrian can safely land on the bonnet and airbags without any injury.

The global automotive pedestrian protection system market is driven by growth in number of road accidents, high adoption rate of advanced emergency braking system & collision control system, and increase in demand for improved visibility and safety features in vehicles. Furthermore, shifting consumer preference to enhance driving experience and rise in demand for premium cars boost the growth of the automotive pedestrian protection system market. In addition, technological advancements for the development of safety features further boost the demand for the global automotive pedestrian protection system market.

High installation cost and lower efficiency in bad weather conditions are some of the major restraining factors of this market. Moreover, onetime use of external airbags adds up to the cost, which further impedes the growth of the market.

Furthermore, rise in consumer demand for safety & comfort and increase in global demand for premium & luxury vehicles registration provide growth opportunities for the market globally. This can be attributed to rise in the sale of automated vehicles globally, which further offers lucrative opportunities for the automotive pedestrian protection system market globally.

Among the analyzed geographical regions, currently, Europe is the highest revenue contributor, and is expected to remain dominant during the forecast period, followed by Asia Pacific, North America, and LAMEA. This growth is attributed to increase in demand for pop up hoods.

Loading Table Of Content...