Automotive Semiconductor Market Insights, 2032

The global automotive semiconductor market size was valued at USD 59.7 billion in 2022, and is projected to reach USD 153.9 billion by 2032, growing at a CAGR of 10.1% from 2023 to 2032.

An automotive semiconductor is a specialized type of semiconductor used in vehicles for various functions, including body electronics, power electronics, chassis systems, safety features, and comfort and entertainment units. Semiconductors possess a conductivity level between conductors (such as metals) and insulators. Their integration in vehicles has facilitated the creation of features such as cell phone connectivity, heads-up displays, autonomous driving assistance, and improved comfort and performance.

Report Key Highlighters:

- The automotive semiconductor market study covers 15 countries. The research includes regional and segment analysis of each country in terms of value ($million) for the automotive semiconductor market forecast is projected for period 2023-2032.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

- Over 3,700 product literature, annual reports, industry statements, and other comparable materials from major industry participants were reviewed to gain a better understanding of the market.

- The automotive semiconductor market share is moderately fragmented among several players including Analog Devices, Inc., Infineon Technologies AG, Micron Technology, NXP Semiconductors, Semiconductor Components Industries, LLC, Renesas Electronics Corporation, Robert Bosch GmbH, ROHM Co., Ltd., STMicroelectronics and Texas Instruments Incorporated.

![]()

The automotive semiconductor market is segmented into Component, Vehicle Type, Propulsion Type and Application.

The development of autonomous vehicles presents a unique opportunity for semiconductor manufacturers to participate in an innovative technological shift. The future of transportation is expected to be influenced significantly by businesses that can provide reliable, high-performance, and energy-efficient semiconductor solutions suited to the unique requirements of autonomous driving

Factors such as rise in adoption of electric and hybrid vehicles, surge in demand for advanced vehicle safety and comfort systems, and intervention of innovative technologies for advanced user interface (UI) drive the growth of the market across the globe. In addition, factors such as operational failures in extreme climatic conditions and challenges posed by the worldwide chip shortage act as a barrier for the growth of the market across the globe.

However, factors such as increase in demand for advanced power semiconductors for enhanced performance and operational efficiency and the rise of the autonomous vehicle creates ample opportunities for the growth of the market during the forecast period.

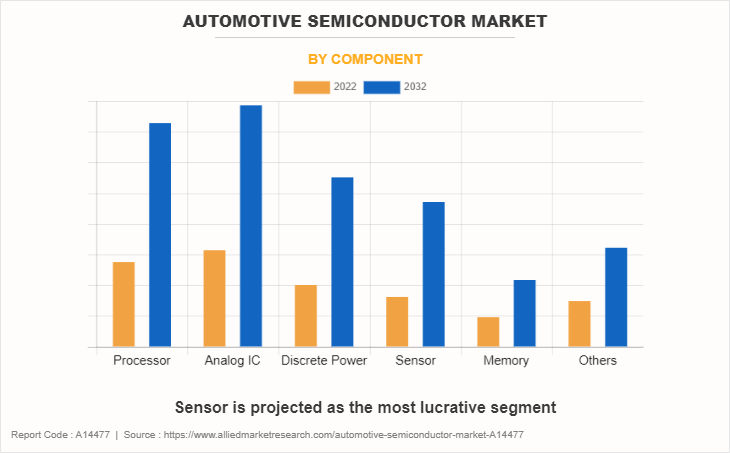

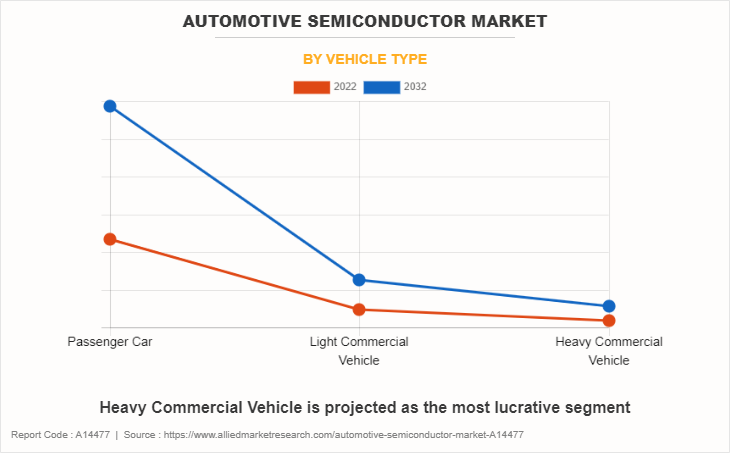

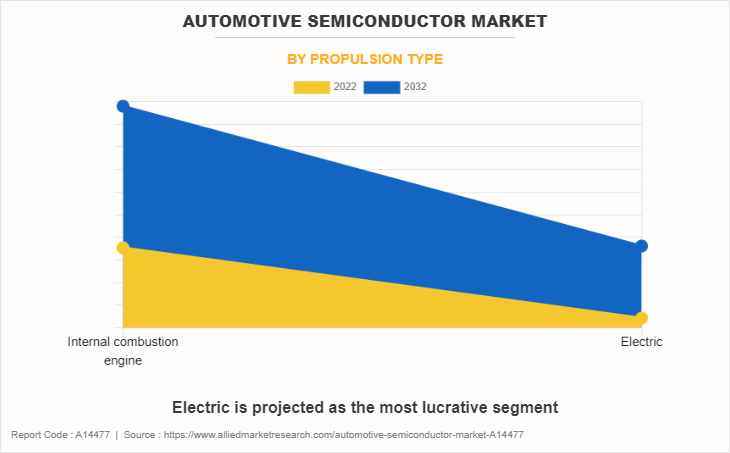

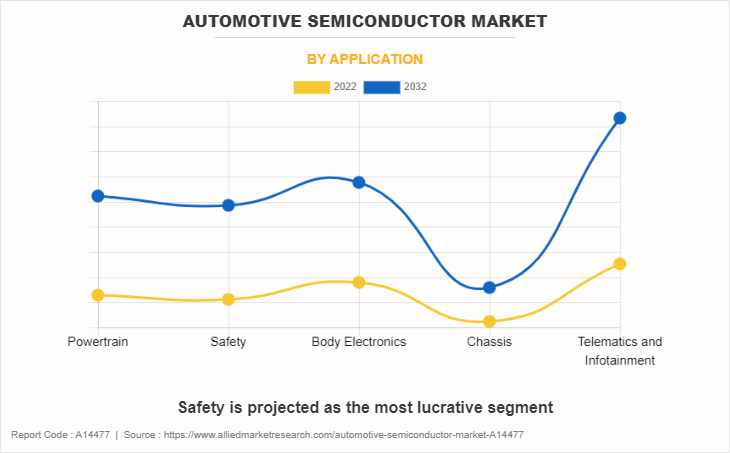

The automotive semiconductor market has been segmented on the basis of component, vehicle type, propulsion type, application, and region. By component, the global market has been segmented into processor, analog IC, discrete power, sensor, memory, and others. By vehicle type, the market has been segmented into passenger cars, light commercial vehicles, and heavy commercial vehicles. By propulsion type, the market has been segmented into internal combustion engine and electric. By application, the market has been segmented into powertrain, safety, body electronics, chassis, and telematics & infotainment. By region, the market has been studied across North America, Europe, Asia-Pacific and LAMEA.

Asia-Pacific holds a prominent share in the automotive semiconductor market, comprising the U.S., Canada, and Mexico. The penetration of IoT and AI in the automotive industry in the region is expected to drive the market. The advanced features such as power windows, on-steering driver control, infotainment displays with navigation systems, and other such features has increased the demand for automotive semiconductor. The Asia-Pacific region stands as a dynamic force in the global automotive semiconductor market outlook, led by China's remarkable growth through its rapid adoption of electric vehicles and autonomous driving technologies. Chinese automakers and tech giants are fueling demand for semiconductor components, driving connectivity and battery management advancements. With the largest electric vehicle market share globally, China is a key driver of the industry.

As its automakers pioneer enhanced semiconductor integration in sensors and robots, Japan's reputation for innovation and safety remains intact. India's expanding middle-class population, combined with government-backed programs, is driving semiconductor demand in infotainment and electric powertrains.

Furthermore, infotainment systems are already common in cars because to advances in technology. Processors are used in these infotainment electronics to manage their functionality. In addition, the installation of processors in advanced automobiles is required for autonomous systems like driver monitoring, sensor fusion, and parking assistance cameras.

In addition, the need for analog integrated circuits, particularly motor driver ICs, is rising as the use of electric vehicles and advanced driver assistance systems increases. In order to suit the varied requirements of automotive applications, semiconductor suppliers have worked together to address the demand for adaptable automotive analog ICs.

Key Developments

The leading companies are adopting strategies such as collaboration, agreement, partnership, and product launches to strengthen their market position.

- In August 2023, Robert Bosch GmbH partnered with TSMC, Infineon Technologies AG, and NXP Semiconductors N.V. to jointly invest in European Semiconductor Manufacturing Company (ESMC) GmbH, in Dresden, Germany to provide advanced semiconductor manufacturing services. ESMC marks a significant step towards the construction of a 300mm fab to support the future capacity needs of the fast-growing automotive and industrial sectors.

- In July 2023, Analog Devices, Inc. expanded its semiconductor wafer fab in Beaverton, Oregon. with an investment of more than $1,000 million. The facility investment expands cleanroom space to about 118,000 sq. ft. and nearly doubles the internal manufacturing of products running on the 180-nanometer technology node and above.

- In June 2023, Micron Technology, Inc. expanded its assembly and test facility in Gujarat, India. The new facility enables assembly and test manufacturing for both DRAM and NAND products and addresses demand from domestic and international markets.

- In May 2023, Infineon Technologies AG entered into partnership with Hon Hai Technology Group (Foxconn) to jointly develop advanced electromobility with efficient and intelligent features in EVs. IT focuses on silicon carbide (SiC) development, leveraging Infineon's automotive SiC innovations and Foxconn's know-how in automotive systems.

- In June 2022, Renesas Electronics Corporation collaborated with Nidec Corporation for the development of semiconductor solutions for a next-generation E-Axle (X-in-1 system) that integrates EV drive motor and power electronics for electric vehicles (EVs). X-in-1 integrates with multiple functions and increases in complexity, and maintaining a high level of quality in vehicles becomes challenging.

- In May 2022, NXP Semiconductors partnered with TSMC to deliver the industry's first automotive-embedded MRAM (Magnetic Random Access Memory) in 16 nm FinFET technology. MRAM provides a highly reliable technology for automotive mission profiles by offering up to one million update cycles, a level of endurance 10x greater than flash and other emerging memory technologies.

- In May 2022, Semiconductor Components Industries, LLC. planned to invest $2,000 million in boosting the production of silicon carbide chips that are widely used to help extend the range of electric vehicles. Furthermore, it also planned to expand its industry either in the U.S., the Czech Republic, or Korea.

Rise in adoption of electric and hybrid vehicles

The demand for electric and hybrid vehicles is growing globally. The decreasing cost of components such as lithium-ion battery, sensors, and microcontrollers are the major factors that is anticipated to develop a mass market for electrical vehicles in the near future. Furthermore, as electrical vehicles play a vital role in cutting carbon emissions and dealing with air pollution, it is getting heavily promoted by governments of all countries. Electric car sales, which include both battery electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs), surpassed 10 million units in 2022, marking a 55% increase compared to 2021.

According to Bloomberg, the electrical vehicle market is expected to grow by 35%, by 2040. These increasing numbers of EVs across globe encouraged the semiconductor manufacture invest in semiconductor foundry to fulfil further demand from EVs. For instance, in April 2023, Germany based Bosch Group acquired crucial assets from California-based chip manufacturer TSI Semiconductors. The company also committed a substantial investment of $1.5 billion to enhance U.S. production capabilities for silicon carbide chips used in electric vehicles. As part of this strategy, Bosch intends to reconfigure TSI's chip production facilities in Roseville, California, with the goal of commencing the production of silicon carbide chips by the year 2026. Thus, it is major driver for semiconductor manufacturers to grow globally, as semiconductor are integral part of electric vehicles. Thus, surge in demand of electric and hybrid vehicles coupled with investment from semiconductor suppliers propel the automotive semiconductor market.

Surge demand for advanced vehicle safety and comfort systems

The demand for safety features, such as parking assistance, collision avoidance systems, lane departure warnings, traction control, electronic stability control, tire pressure monitors, airbags, and telematics is experiencing an upward trend, owing to increase in number of road accidents worldwide. Automotive semiconductors are a major component used in numerous advance driver assistance systems (ADAS) technologies, which helps ADAS systems perform efficiently and can detect and classify objects on the path of vehicle, and accordingly alert the driver of the nearby surroundings and road conditions. In addition, these systems can also automatically decelerate or stop the vehicle depending on the road conditions based on the calculations made through semiconductors & associated components.

Road accidents are a major cause of death globally and tremendous increase in the death rates due to road accidents has been observed in last few years. For instance, according to World Health Organization’s report published in 2022, nearly 1.3 million people died in road traffic crashes each year. Moreover, road traffic injuries leading to death are higher among teenagers. These factors are leading to surge in demand for safety features in vehicles. Companies operating in the automobile sector are developing and introducing the safety features to meet the needs of the customers. For instance, in February 2020, HELLA (company that manufacturers cutting-edge lighting and electronics components) announced the production plan for the latest 77 GHz radar technology.

As a crucial application of complementary metal oxide semiconductors (CMOS) radar, automotive radar is evolving as a key technology supporting the functioning of smart and autonomous features in modern vehicles, for instance, reducing driver stress, relieving drivers from repetitive tasks, and adding life-saving automatic interventions. These benefits are expected to increase the penetration of automotive semiconductors during the forecast timeframe.

Moreover, automotive companies and semiconductor providers joined hands to further adoption of ADAS for more safety. For instance, in March 2022, Renesas Electronics Corporation, a leading provider of advanced semiconductor solutions, announced the expansion of its collaboration with Honda in the adoption of advanced driver-assistance systems (ADAS). Honda opted for Renesas' R-Car automotive system on a chip (SoC) and RH850 automotive MCU for integration into the Honda SENSING 360 omnidirectional safety and driver assistance system. Moreover, the R-Car S4 will integrate with Honda SENSING 360 system as the primary SoC within the electronic control unit (ECU), the central component of the ADAS. This collaboration signifies an extension of Renesas and Honda's joint efforts to enhance safety technologies within the ADAS domain.

In addition, semiconductor suppliers have spread awareness regarding safety in automobiles. For instance, in December 2022, Valens Semiconductor, a prominent provider of high-speed connectivity solutions for the automotive and audio-video sectors, unveiled its plans to present the advantages of its automotive high-speed connectivity product suite. This presentation will include an array of demonstrations involving partners within the growing MIPI A-PHY compliant VA7000 chipset family ecosystem. The collaborative efforts will feature contributions from Tier-1 suppliers, camera sensor manufacturers, radar and LiDAR providers, component makers, and testing equipment companies. These collaborations collectively address the escalating need for enhanced safety features in both current and future automotive vehicles. Thus, developments like this support the growth of the automotive semiconductor industry.

Operational failures in extreme climatic conditions

The major restraint of the automotive semiconductor market is its operational failures in extreme climatic conditions such as extreme cold and extreme heat. In the presence of extreme heat, semiconductor tend to melt down or break, the resistance increases, and it makes the signal too weak, which is why failures occur. Whereas, when it is moved to an optimal temperature, resistance is reduced, and it gets stable. Furthermore, extreme cold is also not favourable for semiconductor, as they stop performing.

Its minimum operational temperature on an average is -25°C and maximum is +150°C. Therefore, countries such as Russia and Canada prefer fewer semiconductor. This makes consumer’s shift to the use of mechanical devices, thereby affecting the growth of the automotive semiconductor market.

The development of semiconductor materials with improved temperature tolerance, the use of effective thermal management systems, and the incorporation of protective coatings to protect against environmental aggressors are just a few examples of the advanced engineering solutions needed to address these operational challenges. However, these solutions might increase the complexity and cost of the production process, affecting profit margins and potentially limiting the rate of market innovation.

Increase in demand for advanced power semiconductors for enhanced performance and operational efficiency

One of the significant opportunities within the automotive semiconductor market lies in the increasing demand for advanced power semiconductors, driven by the pursuit of enhanced vehicle performance and operational efficiency. Modern vehicles are evolving to meet higher standards of performance, efficiency, and environmental sustainability. As a result, there is a growing need for advanced power semiconductor technologies that can effectively manage and optimize energy consumption and distribution within vehicles.

Advanced power semiconductors, including wide-bandgap (WBG) devices like silicon carbide (SiC) and gallium nitride (GaN) semiconductors, offer several advantages over traditional silicon-based components. These advantages include higher efficiency, faster switching speeds, and the ability to operate at higher temperatures, resulting in reduced energy losses and improved overall system efficiency.

These added benefits further promote the development of power semiconductor technologies. For instance, in April 2023, Denso Corporation, a major automotive components manufacturer developed an inverter using silicon carbide (SiC) semiconductors. These semiconductors, which combine silicon and carbon, significantly reduce power loss compared to traditional silicon semiconductors. Addition of trench-type metal-oxide-semiconductor (MOS) structure further enhances efficiency by minimizing heat-related power loss. This innovation enables the semiconductors to operate at high voltage while maintaining low resistance.

The adoption of these advanced power semiconductors may lead to benefits such as extended electric vehicle (EV) range, more efficient hybrid powertrains, and enhanced power management in internal combustion engine vehicles. This creates opportunities for semiconductor manufacturers to develop innovative solutions and collaborate with automakers to integrate these technologies effectively.

Impact of Russia-Ukraine war

- The ongoing Russia-Ukraine war has had a notable impact on the automotive semiconductor market. The tensions and disruptions caused by the conflict have led to significant consequences for the industry

- Large corporations including Volkswagen, Toyota, Ford, and Renault have shut down (or sold) factories in Russia, backed out of joint ventures, or stopped importing into the nation as a result of sanctions and public pressure.

- Geopolitical events have a significant impact on the automotive semiconductor market, and businesses are trying to navigate these difficulties while reconsidering their plans to assure stability and continuity in an environment of these risky situations.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the automotive semiconductor market analysis from 2022 to 2032 to identify the prevailing automotive semiconductor market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the automotive semiconductor market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global automotive semiconductor market trends, key players, market segments, application areas, and market growth strategies.

Automotive Semiconductor Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 153.9 billion |

| Growth Rate | CAGR of 10.1% |

| Forecast period | 2022 - 2032 |

| Report Pages | 351 |

| By Component |

|

| By Vehicle Type |

|

| By Propulsion Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | Renesas Electronics Corporation, Analog Devices, Inc., Robert Bosch GmbH, NXP Semiconductors, Texas Instruments Incorporated, Semiconductor Components Industries, LLC., ROHM Co., Ltd., Infineon Technologies AG, Micron Technology, Inc., STMicroelectronics |

The global automotive semiconductor market size was valued at $59.7 billion in 2022, and is projected to reach $153.9 billion by 2032.

The global automotive semiconductor market is projected to grow at a compound annual growth rate of 10.1% from 2023 to 2032 to reach $153.9 billion by 2032.

The key players that operate in the automotive semiconductor market such as Renesas Electronics Corporation, Analog Devices, Inc., Micron Technology, Inc., STMicroelectronics, Robert Bosch GmbH, ROHM Co., Ltd., Semiconductor Components Industries, LLC., Texas Instruments Incorporated, NXP Semiconductors, Infineon Technologies AG.

Asia-Pacific is the largest regional market for automotive semiconductor

Factors such as rise in adoption of electric and hybrid vehicles, surge in demand for advanced vehicle safety and comfort systems, and intervention of innovative technologies for advanced user interface (UI) drive the growth of the market across the globe.

Loading Table Of Content...

Loading Research Methodology...