Autonomous Mobile Robot Market Insights, 2032

The global autonomous mobile robot market size was valued at USD 2.2 billion in 2021, and is projected to reach USD 18.9 billion by 2032, growing at a CAGR of 21.8% from 2022 to 2032.

Owing to their unique operational characteristics and patterns, the demand for autonomous robots has increased. Growth in application of autonomous robots in various sectors such as manufacturing & warehousing and rising awareness about the benefits of autonomous mobile robots fuel the demand for autonomous mobile robots. Growth in E-commerce and high efficiency of autonomous mobile robots leading to improved industrial productivity also boosts the autonomous mobile robot market growth. However, high costs associated with the setup and insufficient internet connectivity coverage in developing countries are projected to limit the adoption of autonomous mobile robots.

Key Report Highlighters:

- The autonomous mobile robot market report covers more than 15 countries. The research includes segment analysis of each country in terms of value ($million) for the projected period 2022-2032.

- The study integrates high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

- Over 3,700 product literature, annual reports, industry statements, and other comparable materials from major industry participants were reviewed to gain a better understanding of the autonomous mobile robot market.

- The autonomous mobile robot market is fragmented, with several players including Boston Dynamics, Clearpath Robotics Inc., Conveyco Technologies, Geekplus Technology Co. Ltd., IAM Robotics, KUKA AG, Fortna Inc., Omron Group, Teradyne Inc., and Locus Robotics. Key strategies such as acquisitions, product launches, mergers, and expansion of the players operating in the market are tracked and monitored.

Autonomous robots are intelligent machines that can accomplish tasks in real-life without intentional human control. Autonomous mobile robots (AMRs) can understand and navigate their surroundings without the direct supervision of a person. An autonomous mobile robot navigates using maps created on-site by its software or pre-loaded facility drawings. In addition, an autonomous mobile robot identifies the optimum path between waypoints using technology such as LiDAR sensors and simultaneous localization & mapping (SLAM).

LIDAR, cameras, and ultrasonic sensors are just a few of the sensors that AMRs can be equipped with to help them sense their environment and avoid obstacles. Remote sensing technology called LIDAR (Light Detection and Ranging) uses laser light to measure distances and create a three-dimensional image of the surrounding. LIDAR sensors are being utilized in AMRs to identify and avoid obstacles. For instance, in May 2022, MOV.AI announced a partnership with Ouster, a producer of high-resolution digital lidar sensors, to equip autonomous mobile robots (AMRs) with continuous autonomy in intralogistics and industrial environments. MOV.AI has integrated Ouster digital lidar into its Robotics Engine Platform for producers of industrial equipment who want to automate.

Moreover, an autonomous mobile robot automatically develops the shortest way depending on various conditions and requirements; if the task alters from day to day, an autonomous mobile robot changes route with it. In addition, to select the best route to its next waypoint, autonomous mobile robots automatically detect & avoid obstacles and restricted passageways.

On the contrary, the emergence of Industry 4.0 in logistics & warehousing and the greater demand for warehouse automation from emerging countries are projected to create new growth opportunities for prominent players.

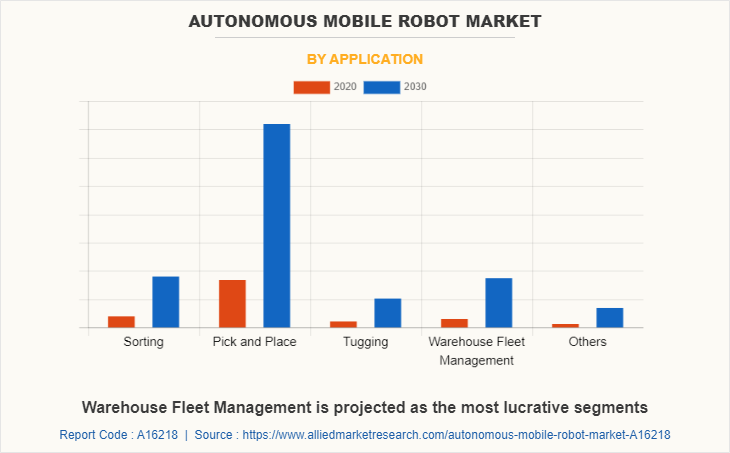

Pick and place application is largest application area for autonomous mobile robots industry. Pick and place robots enable companies to use automated solutions for lifting objects from one location and placing them at other locations. Pick and place solutions that are quick, accurate, and dependable are required in fast-paced production operations. Previously, only human operators could conduct this operation, however, with technological developments in robotic vision systems and end-of-arm equipment, even the most difficult or fragile products may now be handled safely and reliably by autonomous robots. High-speed pick and place autonomous mobile robots move merchandise with extreme precision from one area to another, with no disruptions or ergonomic difficulties.

In March 2022, Plus One Robotics, a leading manufacturer of 3D and AI-powered vision software, entered into a partnership with Tompkins Robotics, a company focused on the robotic automation of delivery and fulfillment operations. The two companies are working together to offer an automated picking solution combining Plus One Robotics 3D and AI software with the Tompkins Robotics TSort system. Moreover, automotive giants also developed and launched pick and place robots for factory assembly workstations. For instance, in May 2022, Hyundai WIA introduced a collaborative robot, autonomous mobile robot (AMR), and mobile picking robot (MPR) at the SIMTOS 2022 show. The adoption of new strategies by market players is expected to boost the growth of the autonomous mobile robot market in the forecast period.

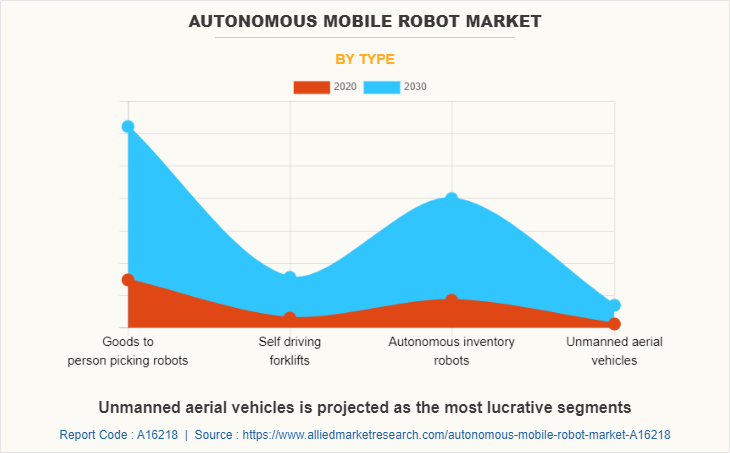

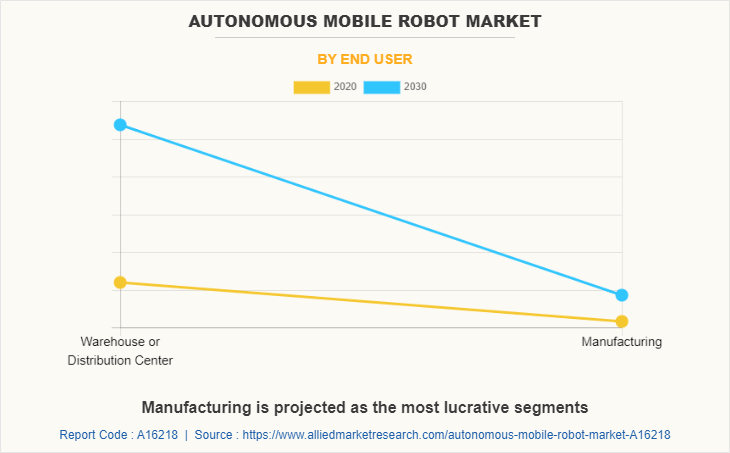

The autonomous mobile robot market is segmented on the basis of type, application, end-user, and region. By type, the autonomous mobile robot market has been categorized into goods-to-person picking robots, self-driving forklifts, autonomous inventory robots, and unmanned aerial vehicles. By application, the market has been classified into sorting, pick & place, tugging, warehouse fleet management, and others. As per end-user, the market has been divided into warehouse or distribution center, manufacturing, and others. Region wise, the autonomous mobile robot market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The North American autonomous mobile robot market is studied across the U.S., Canada, and Mexico. Developments in autonomous mobile robots and capabilities such as advanced sensors, command and control, and AI-powered systems are the factors propelling the market growth in the region. An increase in R&D activities is also directed toward warehouse applications.

North America has witnessed growth in the autonomous mobile robots sector in recent years. An increase in awareness of the features and efficiency of autonomous mobile robots is enhancing the need for autonomous mobile robots and is expected to support the market growth during the forecast period. Moreover, the rise in industrial automation is one of the major factors driving the market growth in the North American region. Developing operationally efficient autonomous mobile robots is expected to offer lucrative opportunities for autonomous mobile robot market growth. Several factors are driving the adoption of these robots in the U.S., including the need for faster and more accurate delivery of goods, lower labor costs, and increased productivity. Moreover, companies operating in the autonomous mobile robot market in the U.S. are adopting strategies such as acquisitions to expand their presence in the region.

Key players profiled in this report include Boston Dynamics, Clearpath Robotics Inc., Conveyco Technologies, Geekplus Technology Co. Ltd., IAM Robotics, KUKA AG, Fortna Inc., Omron Group, Teradyne Inc., and Locus Robotics.

Growing application of autonomous robots in various industrial sectors

Autonomous mobile robots are part of a developing class of technologies, which include mobile robots that may be programmed to execute tasks with little to no human interaction. They have superior mobility, compact size, varied capability, and dexterity, and can range from robotic process automation to picking vehicles with extensive data collection capabilities.

In addition, autonomous mobile robots are equipped with sensors and actuators, which have more capabilities than humans. These factors favor the deployment of autonomous mobile robots in various business sectors such as automotive, healthcare, agriculture, retail, hospitality, and others. For instance, in March 2023, CEVA Logistics and Geek+ collaborated to more effectively connect customers with their footwear and clothing through the adoption of autonomous mobile robots (AMR). A fleet of 27 Geek+ P-series picking robots and 5 workstations have been added to the warehouse. The goods-to-person solution developed by CEVA and Geek+ offers a high level of flexibility, prompt integration into the current processes, and the ability to handle daily quantities of more than 10,000 outgoing products.

The modernization work done at CEVA's Grobbendonk warehouse clearly illustrates the advantages of autonomous mobile robots (AMR) by creating a more comfortable working environment and boosting productivity while keeping accuracy. Moreover, major autonomous mobile robot (AMR) manufacturing companies recorded increased sales in early 2021. For instance, in July 2021, GeekPlus Technology Co. declared that it has sold 20,000 autonomous mobile robots worldwide, marking an industry milestone. According to the company, its technology offers the potential for quick expansion to hasten the transformation of the global supply chain.

In addition, in April 2021, Mobile Industrial Robots (MiR), declared a 55% increase in sales in Q1 2021 over the same period last year. A large number of Q1 sales are of the MiR250, MiR’s latest and most compact AMR, with multiple orders from multinational organizations. The automotive industry is dynamic, necessitating automakers' flexibility, including smart production and adaptable logistical solutions.

To achieve these needs, advanced production technologies and automated systems such as autonomous mobile robots are required. Because of their efficiency, productivity, adaptability, and other qualities, many car manufacturers have adopted autonomous mobile robots. For instance, in December 2021, Gefco, a European leader in automotive logistics started testing the Stanley Robotics autonomous mobile robot in real operating conditions on its Nanteuil-le-Haudouin platform in France. Stan robot is designed to optimize storage operations on finished vehicle logistics compounds.

Many manufacturing industries have started adopting autonomous mobile robots to build smart factories and improve productivity as they do not require permanent wire strips or magnetic tracks along the floor to guide their course. In addition, autonomous mobile robots navigate using light detection and ranging (LIDAR) technology, as well as onboard intelligence and collision-detection safety systems, which allow for the actual selection of the most suitable route to any destination area during any predetermined hour. For instance, in February 2022, LED display manufacturing giant Unilumin entered into collaboration with Geekplus Technology Co., Ltd., and PANGQI Technology. Under this collaboration, Geekplus Technologies' autonomous mobile robots are anticipated to power the LED industry's first fully automated smart factory, where the entire supply chain process will be powered by Geekplus Technologies' autonomous mobile robots, from raw material receiving, quality inspection, warehousing, discharging, production, to finished product warehousing and distribution (AMRs). Thus, the growth in the use of autonomous mobile robots in several industries is expected to propel the growth of the autonomous mobile robot market during the forecast period.

High Efficiency of autonomous mobile robots leading to improved industrial productivity

Autonomous mobile robots are integrated with sensors and cameras, as well as sophisticated software, to make them assess their surroundings and follow the most efficient path to their destination, safely avoiding people and objects, and eliminating the need to build or alter costly auxiliary sensing facilities. These features help to improve efficiency and productivity as compared to automated solutions and automated guided vehicles (AGVs).

Moreover, autonomous mobile robots (AMR) are being used in a variety of intra-logistics tasks, including manufacturing, warehouses, terminals, hospitals, and cross-dock. Their superior technology and control software allows them to operate autonomously in dynamic conditions.

In contrast to an automated guided vehicle system, in which a central unit controls dispatching, routing, and scheduling decisions for all automated guided vehicles (AGVs), AMRs can communicate independently with other resources such as systems and machines, allowing the decision-making process to be decentralized. Owing to this, many organizations have adopted autonomous mobile robots to improve the productivity and efficiency of their facilities.

Furthermore, industries frequently use AMRs to aid with inventory locating, picking, and shifting in order to free up employees to focus on high-value activities such as customer care. This helps to overcome challenges such as real-time fluctuations in demand & labor shortage and offer fleet performance data for productivity improvement. When productivity is critical, many firms resort to low-powered AMRs that use less energy to operate. As AMRs require less power to operate, they can recharge and return to work faster, decreasing downtime and allowing production & fulfillment to continue. Such factors are expected to drive the adoption of autonomous mobile robot market during the forecast period.

High cost associated with the implementation of autonomous mobile robots

Autonomous mobile robots are integrated with expensive components such as sensors, locomotion mechanisms, processors, gyroscopes, and others. Owing to this, autonomous mobile robots involve high costs in implementation and maintenance. Moreover, being deliberate in determining the quantity required and knowing related expenses is critical to avoiding spending overwhelms and surprise charges. Other costs to consider include software, installation, updates, and service contracts. These factors increase the overall implementation cost of autonomous mobile robots.

Furthermore, an autonomous mobile robot setup necessitates the construction of waypoints and missions. In addition, the installation of autonomous robots in a factory or workplace to work autonomously is a difficult procedure. This may result in hidden setup costs, such as the cost of employing a vendor or robotics to configure the robot, time lost in modifying or adapting the building, and time spent teaching personnel how to set up & use the robots. Moreover, the complexities involved in managing the value chain due to the low profits associated with the installation of such expensive systems and the surge in prices of micro-processing components are anticipated to hinder the growth of the autonomous mobile robot market during the forecast period.

Recent Developments

- In July 2022, Geek+ announced a partnership with Systemex Automation, a prominent Canadian systems integrator, to increase autonomous mobile robot (AMR) installations in North America. As part of the partnership, Systemex Automation will offer Geek+'s whole portfolio of Picking, Moving, Sorting, and Storage/ Automated Storage and Retrieval Systems (ASRS) AMR solutions to its customers.

- In March 2022, Locus Robotics, a manufacturer of autonomous mobile robots for fulfilment warehouses, launched the Locus Vector and Locus Max and expanded its line of warehouse AMRs.

- In September 2021, Locus Robotics acquired Waypoint Robotics, a manufacturer of industrial-strength, autonomous, omnidirectional mobile robots. The acquisition expands Locus' product line of AMR solutions, which caters to applications ranging from case-picking, and pallet-picking to scenarios requiring larger, heavier payloads and fulfillment modalities.

- In March 2021, Boston Dynamics launched Stretch, its new box-moving robot designed to support the growing demand for flexible automation solutions in the logistics industry.

- In March 2023, Barcodes Group launched its new autonomous mobile robotics portfolio with Plug-and-Play Integration Software, which provides businesses with intelligent automation that is simple to adopt and provides a quick return on investment.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the autonomous mobile robot market analysis from 2021 to 2032 to identify the prevailing autonomous mobile robot market opportunities.

- The autonomous mobile robot market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the autonomous mobile robot market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global autonomous mobile robot market.

- Autonomous mobile robot market player positioning facilitates benchmarking and provides a clear understanding of the present position of the autonomous mobile robot market players.

- The report includes the analysis of the regional as well as global autonomous mobile robot market trends, key players, market segments, application areas, and market growth strategies.

Autonomous Mobile Robot Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 18.9 billion |

| Growth Rate | CAGR of 21.8% |

| Forecast period | 2021 - 2032 |

| Report Pages | 306 |

| By End User |

|

| By Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | Geekplus Technology Co., Ltd., Conveyo Technologies, Clearpath Robotics Inc., KUKA AG, IAM ROBOTICS, Fortna Inc., Locus Robotics, Teradyne Inc., Boston Dynamics, OMRON Corporation |

Analyst Review

The global autonomous mobile robot market is projected to witness considerable growth, due to growth in the use of automation solutions in various industries such as healthcare, automotive, logistics, hospitality, and others.

Industry 4.0 is a new phase of the industrial revolution that emphasizes machine learning, interconnectedness, real-time data, and automation. In addition, Industrial 4.0 is causing a wave of disruption in both company models and the supply chains that sustain them. These large changes will certainly have an impact on logistics, which is a critical component of these operations. Industry 4.0 is distinguished by its speed, scale, and breadth. The changes are so dramatic that they will revolutionize the way humans live, perform, and interact with one another, affecting industries, governments, businesses, and civilization as a whole.

As a result, in order to remain competitive, the logistics processes in the coming years will strive for integrated information and effective resources and time, with major investment in innovation and the development of autonomous systems. Industry 4.0 technologies aid in logistics by optimizing transport routes, making maximum use of storage capacity, and planning. This factor is expected to fuel the adoption of autonomous mobile robots in the near future. For instance, in April 2023, WEG launched the first version of the WEG Mobile Robot (WMR), an autonomous robot designed to increase the operational efficiency of tasks performed in industries that need internal transportation. The new product broadens the breadth of WEG's Industry 4.0 offerings.

In addition, in December 2021, Bechtle, one of Europe’s most well-known IT providers, set a goal to boost its e-commerce business by 250%, which required handling approximately two times as many packages. To meet this high demand and to transform logistic services with Industry 4.0., Bechtle decided to deploy autonomous mobile robots in its warehouse to transform supply chain operations. In addition, the goal of Industry 4.0 is to employ technologies to optimize the core processes that occur in logistics and warehouse operations, such as pick & place, stock management, and loading & unloading.

Such operations are efficiently carried out by autonomous mobile robots with artificial intelligence (AI). Autonomous mobile robots can communicate with systems or other robots individually about their working status, transfer shipments throughout distribution centers, transport parts to manufacturing assembly lines, and deliver parts to manufacturing assembly lines without human interference. These features are expected to boost the market with emerging industry 4.0 in logistics and warehousing.

The global autonomous mobile robot industry generated $2.2 billion in 2021, and is anticipated to generate $18.9 billion by 2032, witnessing a CAGR of 21.8% from 2022 to 2032.

The leading companies in the market include Boston Dynamics, Clearpath Robotics Inc., Conveyco Technologies, Geekplus Technology Co. Ltd., IAM Robotics, KUKA AG, Fortna Inc., Omron Group, Teradyne Inc., and Locus Robotics.

Asia-Pacific is the largest regional market for autonomous mobile robots.

Pick and place is the leading application of autonomous mobile robots.

The upcoming trends in the autonomous mobile robot market include greater adoption of unmanned aerial vehicles and greater use of these robots in healthcare and agriculture sector.

Loading Table Of Content...

Loading Research Methodology...