B2C Payment Market Research, 2032

The global b2c payment market size was valued at $1.5 trillion in 2022, and is projected to reach $4.7 trillion by 2032, growing at a CAGR of 12.3% from 2023 to 2032.

The B2C payment market (business to consumer) refers to the sector of financial transactions where businesses, merchants, or service providers accept payments from individual consumers in exchange for goods and services. In this b2c payment market, the focus is on the direct interaction and transactions between businesses and end-users, typically consumers. The B2C payment landscape includes various payment methods such as credit cards, debit cards, digital wallets, online bank transfers, and other electronic payment options.

Growing e-commerce industry and rising consumer demand for digital payments boosts the growth of the global B2C payment market. In addition, factors such as technological advancements such as digital wallets, contactless payments driving innovation, and increased adoption of mobile payments and online banking have positively impacted the growth of the b2c payment market. However, cybersecurity threats and fraud risks and regulatory uncertainty hamper b2c payment market growth. On the contrary, advancing biometric authentication technologies such as facial recognition, fingerprints can enhance security and blockchain-based solutions could enable faster cross-border transactions, lower costs are expected to offer remunerative opportunities for the expansion of the b2c payment market during the forecast period. Each of these factors is projected to have a definite impact on the growth of the B2C payment market.

The study investigates growth prospects, b2c payment market forecast, constraints, and trends within B2C payment industry. It utilizes Porter's Five Forces model to analyze impacts of factors like supplier bargaining power, competitor rivalry, new entrant threats, substitute threats, and buyer bargaining power on the overall b2c payment market.

The B2C Payment Market Outlook is Segmented into Type and Industry Vertical

Segment review

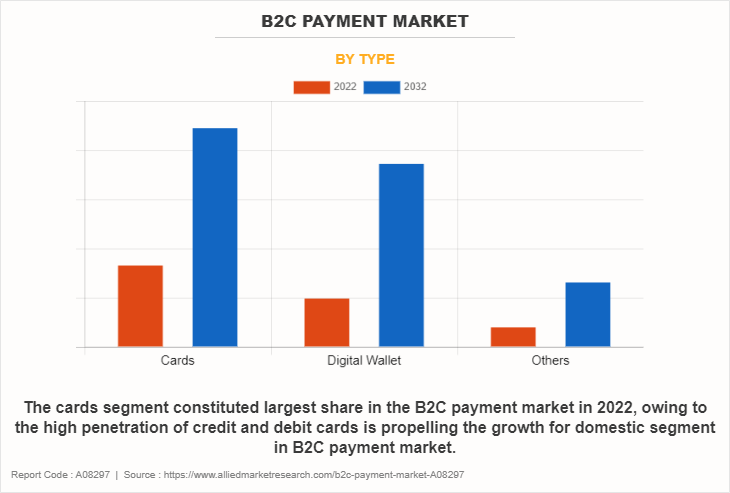

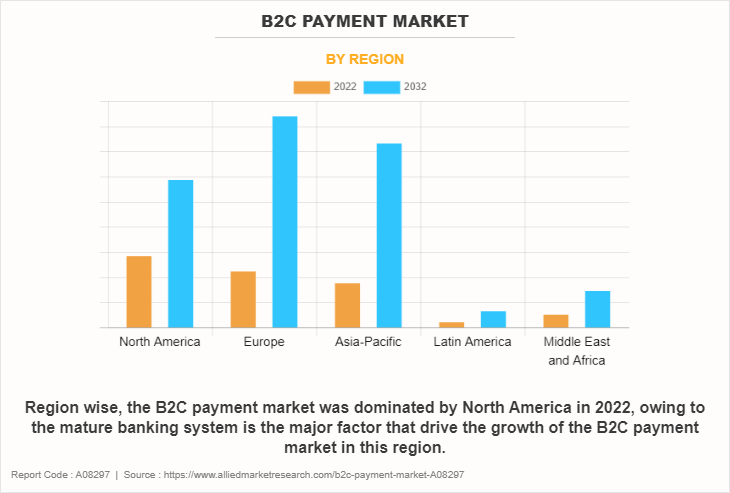

The B2C payment market is segmented by type, industry vertical, and region. In terms of type, the B2C payment marketis fragmented into cards, digital wallet, and others. Depending on industry vertical, it is segmented into BFSI, healthcare, hospitality & tourism, transportation & logistics, retail & e-commerce, energy & utilities, and others. Region-wise, it is analyzed across North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa.

By type, the cards segment has acquired the highest b2c payment market share in 2022. This is attributed to the fact that the high penetration of traditional debit and credit cards which, in turn, propels growth of the electronic payment industry.

Region wise, North America holds one of the major global shares on the back of high digital literacy, technology infrastructure and innovation hubs focused on payments. However, shift from magnetic stripe cards to contactless variants, integration with tokenization for security enhancement and form factors diversity through wearables adoption promises sustained technology investments.

Demand side drivers include proliferation of mobile commerce, shift towards app-based banking spurring electronic payments penetration. Expanding services economy sectors like healthcare, mobility also witnesses tailored payment solutions linking patient records, transit access to insurance and account management systems reflecting consumer centricity element in product evolution. Regulatory measures around open banking APIs interoperability to ease data sharing and enhance financial inclusion targets regional competitiveness.

The key players profiled in the B2C payment market analysis are MasterCard Incorporated, The American Express Company, Visa Inc., Apple Pay, PayPal Payments Private Limited, Capital One Financial Corporation, The Bank of America Corporation, Payoneer Inc., Stripe, and Due Inc. These players have adopted various strategies to increase their b2c payment industry penetration and strengthen their position in the industry.

Market Landscape and Trends

There is a growing demand from both individual shoppers and businesses for payment solutions that offer maximum convenience, speed, and flexibility. Consumers now expect checkout experiences everywhere they shop to be frictionless, whether online, in apps, or at physical retail locations.

Ubiquity of mobile devices expanding consumer appetite for fast one-click payments using biometrics or stored credentials. Merchants also aim to enable all relevant payment methods in a seamless manner to boost conversion rates. Smoother checkouts increase customer lifetime value. To capitalize on this dual-sided consumer and merchant demand, B2C payments providers are innovating through digital-first capabilities, value-added services beyond transactions, and harnessing data to provide personalized options catering to specific payment choice preferences.

The positive b2c payment market outlook provides a lucrative opportunity for capital equipment makers, project financing agencies, engineering consultants and allied stakeholders during forecasted period.

Competition Analysis

Recent Partnership in the B2C Payment Market:

In September 2022, Inswitch, a fintech technology company specializing in embedded solutions for banking and payments, partnered with Mastercard International Incorporated. The partnership aims to develop and implement digital payment solutions and issuing programs, initially focusing on selected countries across Latin America and the Caribbean (LAC). The partnership will involve Inswitch serving as a Mastercard Issuer in Mexico, integrating issuing capabilities to enhance the value proposition for both business-to-consumer (B2C) and business-to-business (B2B) clients of Inswitch and Mastercard.

In December 2021, the big software company Adobe announced partnership with Mastercard and the digital payment handler Bolt. These partnerships should make paying for Adobe products and services much faster and easier.

Connecting with Mastercard aims to help Adobe's slow business-to-consumer payments get quicker. These payments have not gotten much focus before. For example, health insurance claims often take over a month to get paid out. Adobe's digital signature and other tools can speed this up greatly.

Recent product launch in the B2C Payment Market:

In June 2021: Bank of America added a new business-to-consumer (B2C) payment service called Pay to Card. This lets companies pay people quickly by depositing money right into their bank account. Pay to Card uses the details of a bank debit card tied to an account to process the payment.

A big advantage of Pay to Card is speed. For US payouts, money typically arrives in near real-time - within 5 minutes. Applicable international payouts often get there within 30 minutes. This shows Bank of America's leading role in new payments and currency exchange. Pay to Card is expected to handle payments to about 170 countries in over 120 different currencies.

Top Impacting Factors

Growing e-commerce Industry and Rising Consumer Demand for Digital Payments

The rapid growth of the e-commerce industry globally has sprouted as a fundamental driver fostering digital payment penetration on the consumer side. Rising internet users, smartphone adoption and merchant acceptance beyond tier-1 cities has expanded the addressable landscape for online shopping activities necessitating digital payment deployment by retail platforms. The demand for simpler payments with maximum security and uptime requirements is also steering innovation around tokenized payments and biometric authentication adoption.

More people are using digital payments now. Therefore, buyers want their online checkout and money apps to be easy to use everywhere. People prefer paying digitally for shopping online for several main reasons. The payment works on any website or app and all the regions. Checkouts are fast and simple with one-click buying and fingerprint login. There are loyalty points and discounts as rewards for paying online. There are new ways to pay later in small amounts after getting the product now. People can pay bit-by-bit overtime instead of all at once. Biometric login makes digital payments very smooth. Tokenization tools also help make the process easy. Cashback and deals encourage consumers to use digital payment types. New finance offerings let buyers be flexible with spending. As more first-time users transact online, their comfort with digital payments rises, which in turn supports the growth of the b2c payment industry.

Technological Advancements such as Digital Wallets, Contactless Payments Driving Innovation

The B2C payments sector is experiencing a massive upgrade given the ongoing advancements around next generation technologies such as digital wallets that allow peer-to-peer fund transfers, contactless payments facilitating tap-and-go transactions using payment cards and others. Such innovations are driving increasing consumer adoption as they provide faster payments with enhanced security and convenience. For instance, in November 2023, VerityPay, Software-as-a-Service (SaaS) platform, introduced a new business-to-consumer payment tool, pay-by-text tool. This online service lets businesses pay people directly into their online money apps using text messages. Apps such as PayPal and Venmo can receive payments straight from a text. With digital wallet fraud on the rise, VerityPay emphasizes the security protections built into its new text-to-pay feature. Businesses can offer the convenience of instant wallet payouts while also keeping customer payment data safe.

Moreover, the entry of major providers such as Apple, Google and Amazon into the space has spurred added awareness and new use-cases given their ecosystems spanning device, platform, and merchant connectivity. Contactless card payments have also accelerated consistently. Contactless card payments where users can just tap their card or phone on POS terminals offer greater convenience and shorter transaction times. Advanced NFC and RFID technologies are enabling contactless payments via wearables such as smartwatches too. Therefore, such innovations drive the growth of the B2C payment market.

Restraints in B2C Payment Market

Cybersecurity Threats and Fraud Risks

While digital payments provide many benefits, their rapid b2c payment market growth also introduces heightened cybersecurity and fraud risks that must be addressed. As more sensitive financial data moves online, threats like data breaches, identity theft, phishing scams, and payment fraud also rise. Sophisticated hacking groups and organized crime targeting vulnerabilities in payments infrastructure, apps and backends that handle consumer funds. Attacks exploit weaknesses in legacy systems.

Growth of synthetic identity fraud using fake credentials and bot attacks to create fraudulent accounts to launder money. Such risks reduce consumer trust. Balancing advanced security layers with convenience and user experience is an ongoing challenge. Adding steps could increase cart abandonment and divert volume back to cash.

Regulatory Uncertainty

The B2C payments sector faces increasing but uncertain regulatory scrutiny and policy reforms across major markets. As the industry transforms, regulations around data privacy, payments oversight, cryptocurrencies, stablecoins, Big Tech's role and more remain in flux. Compliance costs and burdens for players across the payments value chain could rise significantly as more rules are enacted. Smaller fintech may struggle. Data localization mandates, transaction taxes, caps on interchange fees and other reforms need careful navigation and could curb global interoperability. The regulatory fate of emergent trends such as embedded finance, open banking APIs, cross-border stablecoins is still unclear, causing hesitation in full-scale adoption. While prudent regulation can promote healthy innovation, grappling with fast-moving changes on multiple fronts introduces risks and uncertainties. More regulatory coordination and public-private partnerships are increasingly vital.

Opportunities

Advancing biometric authentication technologies such as facial recognition, fingerprints can enhance security

Biometric authentication technologies are creating significant b2c payment market opportunity to enhance security and convenience for B2C payments. Methods such as fingerprint, facial, and voice recognition are advancing rapidly with continued R&D and growing adoption. Biometrics provides a convenient way for consumers to validate transactions and mitigate risks of fraud or unauthorized access.

Improved accuracy of sensors and matching algorithms enabling reliable, low-effort user verification across varied demographics. Standardization of biometric capture and storage approaches via FIDO Alliance and World Wide Web Consortium is overcoming fragmentation concerns. This expands ecosystem support for biometrics. Regulations such as PSD2 Strong Customer Authentication mandate and guidelines for card-not-present transactions are catalyzing issuers and merchants to implement biometric security layers.

As biometric technologies become ubiquitous across consumer devices and more seamlessly embedded into payments flows, they can strike the right balance between security and convenience to unlock growth.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the b2c payment market analysis from 2022 to 2032 to identify the prevailing b2c payment market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the b2c payment market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global b2c payment market trends, key players, market segments, application areas, and market growth strategies.

B2C Payment Market Report Highlights

| Aspects | Details |

| Forecast period | 2022 - 2032 |

| Report Pages | 249 |

| By Type |

|

| By Industry Vertical |

|

| By Region |

|

| Key Market Players | PayPal, BANK OF AMERICA CORPORATION, Apple Inc., Stripe, American Express Company, Capital One Financial Corporation., Payoneer Inc., Mastercard Incorporated., Due Inc., Visa Inc. |

MasterCard Incorporated, The American Express Company, Visa Inc., Apple Pay, PayPal Payments Private Limited, Capital One Financial Corporation, The Bank of America Corporation, Payoneer Inc., Stripe, and Due Inc.

Upcoming trends of B2C Payment Market are advancing biometric authentication technologies such as facial recognition, fingerprints can enhance security and blockchain-based solutions could enable faster cross-border transactions, lower costs.

Leading application of B2C Payment Market is Cards.

The B2C payment market was valued at $1507.9 billion in 2022 and is estimated to reach $4736.17 billion by 2032, exhibiting a CAGR of 12.3% from 2023 to 2032.

Largest regional market for B2C Payment Market is North America.

Loading Table Of Content...

Loading Research Methodology...