Baby Electrolyte Market Research, 2031

The global baby electrolyte market size was valued at $1.2 billion in 2021, and is projected to reach $2.9 billion by 2031, growing at a CAGR of 9.4% from 2022 to 2031.

The baby electrolyte market is segmented into Form, Distribution Channel, Flavor and Application.

Baby electrolyte is a solution of water and essential minerals such as sodium, potassium, and chloride, specifically formulated for infants and young children to help prevent dehydration caused by vomiting, diarrhea, or other illnesses.

Significant rise in the prevalence of diarrheal disease among infants is the key driver of the global baby electrolyte market growth. Diarrheal disease is the second leading cause of death among children, globally. According to the World Health Organization (WHO), diarrhea kills around 525,000 children aged 5 years or below every year. It accounted for around 9% of global child deaths in 2019. Major causes of diarrhea among infants includes use of antibiotics by baby or mother if breastfeeding, change in diet, bacterial infection, parasite infection, and cystic fibrosis. Therefore, growth in prevalence of diarrhea among infants is expected to drive the growth of the baby electrolyte industry during the forecast period. Moreover, rise in awareness of dehydration and its symptoms among parents is boosting the demand for baby electrolytes across the globe.

Over the past decade, there has been a notable increase in the number of women working around the globe. The females' demanding work schedules provide very less time to care for their infants properly, which has led to a decline in breastfeeding rates. The market for infant electrolytes is anticipated to expand as a result of the fact that insufficient breastfeeding causes babies to lack vital electrolytes. Furthermore, growing emphasis on women's jobs and education has led to rise in disposable income and raised awareness of the advantages of baby electrolyte products. The population of working women has particularly grown in countries such as the U.S., the UK, India, and China.

According to the U.S. Bureau of Labor Statistics, in 2019, 57.4% of all women participated in the labor force Moreover, the UK saw a rise in the proportion of female employees. Hence, growth in number of working women has boosted parents’ affordability, which in turn, fuels the demand for baby electrolyte products around the globe, thereby contributing to the expansion of the industry.

Customers are drawn to newly launched baby electrolyte drinks with innovative flavors & ingredients. For instance, Abbott Laboratories, under the trademark Pedialyte, introduced four new products in December 2020 to broaden its product line, including Pedialyte with immune support, Pedialyte sport, Pedialyte organic, and Pedialyte electrolyte water with no added sugar. Moreover, KinderFarms' Kinderlyte oral electrolyte solution is a ready-to-drink product with no artificial additives. It comes in a number of flavors, including orange, cherry, and lemonade. The addition of fresh ingredients & flavors to infant electrolyte solutions could have a favorable impact on market expansion in the near future. Moreover, the manufacturers are embracing the primary trends of organic, non-GMO, and plant-based ingredients to improve the flavor of the electrolyte and attract customers. The overall goal of these improvements is to enhance the efficiency & safety of baby electrolyte products for infants and young children while meeting the changing demands and preferences of parents.

However, to prevent fraud and guarantee the health & safety of infants, the government has established stringent safety requirements that must be followed while manufacturing baby electrolyte products. There are several governmental organizations such as the U.S. Food and Drug Administration (FDA) and the European Medicines Agency that establish the rules, standards, and regulations to guarantee the ingredients used in the production of baby electrolytes and assure the safety of infants. Although these regulations are significant from the standpoint of the consumer, they could impose restrictions on manufacturers. These rules call for a drawn-out approval procedure, which might lengthen the release of new products. Moreover, it may restrict product innovation and differentiation. In addition, regulatory expenses may be a challenge for small producers of infant electrolyte products as they may limit their profitability and their ability to invest in R&D. Hence, the different challenges brought on by the safety standards may have a long-term negative effect on the growth of the baby electrolyte market.

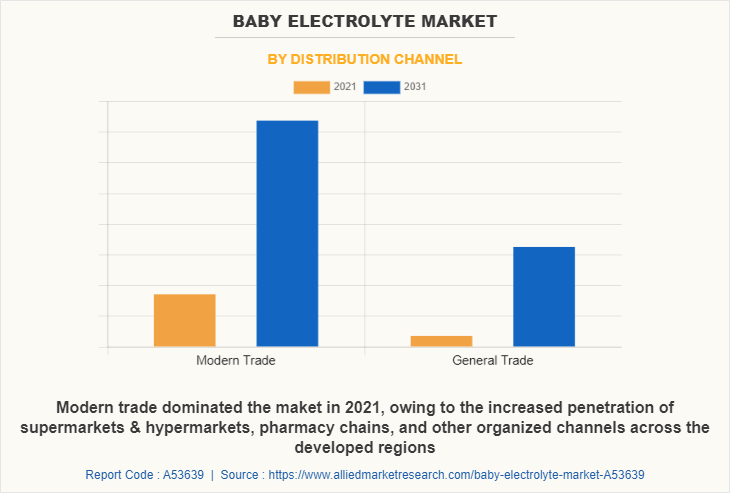

The baby electrolyte market is analyzed on the basis of form, application, flavor, distribution channel, and region. By form, the market is classified into liquid, powder, and others. Depending on application, the market is categorized into up to 12 months, 12 to 36 months, and 36 to 60 months. On the basis of flavor, the market is segmented into grape, apple, strawberry, orange, unflavored, and others. As per distribution channel, the market is categorized into modern trade and general trade. The modern trade segment is further divided into supermarkets & hypermarkets, pharmacy or medical stores, convenience stores, and online stores. General trade is categorized into pharmacy or medical stores, convenience stores, and others. Region-wise, the market is analyzed across North America (the U.S., Canada, and Mexico), Europe (Germany, UK, France, Italy, Spain, and the rest of Europe), Asia-Pacific (China, India, Japan, Australia, South Korea, and rest of Asia-Pacific), and LAMEA (Brazil, Argentina, Saudi Arabia, South Africa, and rest of LAMEA).

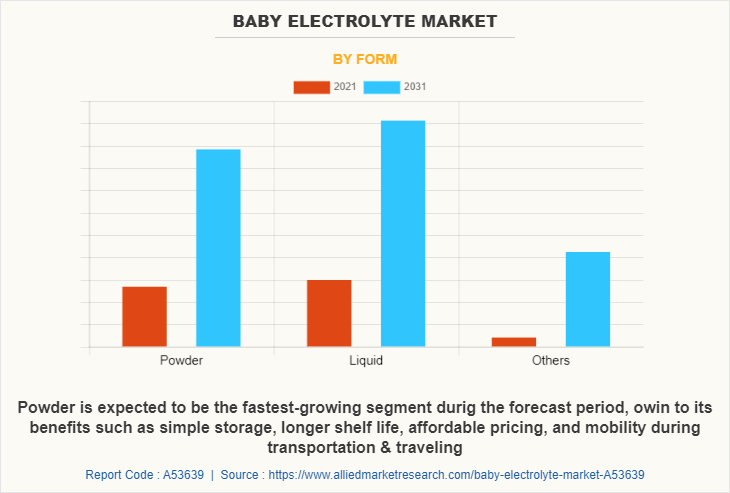

As per the baby electrolyte market forecast, depending on the form, the powder segment is anticipated to grow at a significant pace during the forecast period. It accounted for 38.7% of the baby electrolyte market share in 2021. The demand for powder baby electrolyte has grown tremendously as a result of their easy accessibility and increased customer awareness. Moreover, there are numerous advantages of using items in powder form, including simple storage, longer shelf life, affordable pricing, and mobility during transportation & traveling. These advantages are driving the powder segment's expansion in the global baby electrolyte market.

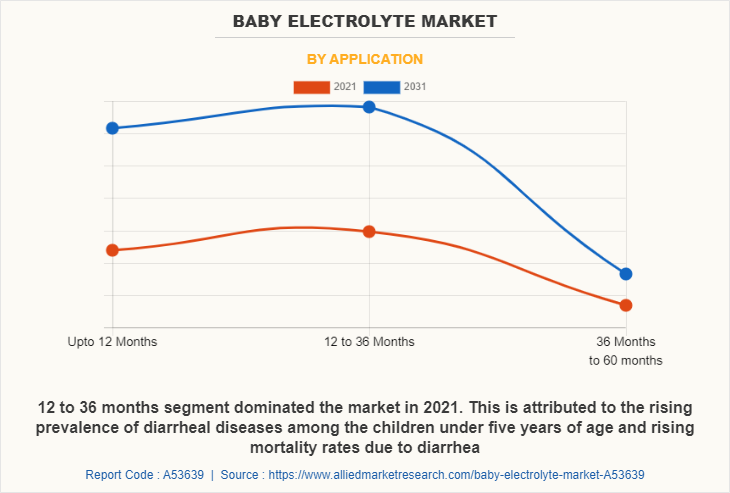

As per the application, 12 to 36 months was the leading segment in 2021, accounting for nearly half of the market share, and is expected to retain its significance during the forecast period. Children under the age of five years are particularly susceptible to diarrheal disease. The World Health Organization (WHO) estimates that every day, approximately 6,700 newborns under the age of five die due to diarrhea. Oral rehydration solutions are now more popular than ever owing to rise in healthcare costs, creation of cutting-edge medical facilities, and improving affordability. In addition, the penetration of retail pharmacies, convenience stores, and other modern trade channels has increased, which has significantly accelerated the growth of this segment over the past few years.

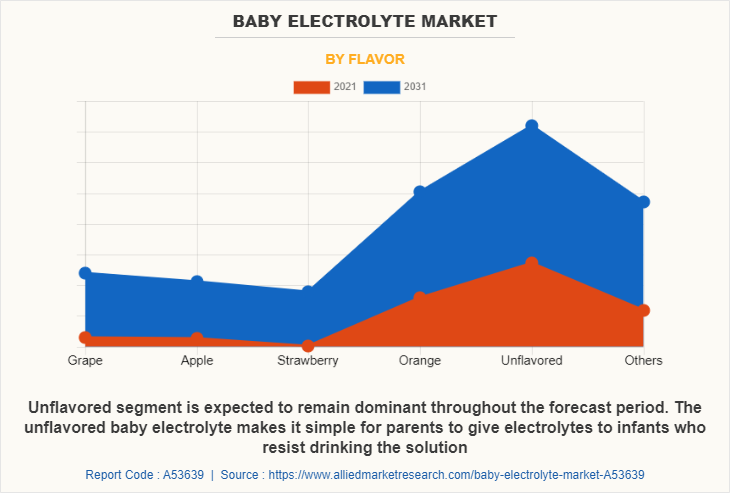

On the basis of flavor, the unflavored segment is expected to witness significant growth during the forecast period. The unflavored baby electrolyte makes it simple for parents to give electrolytes to infants who resist drinking the solution. The unflavored baby electrolyte can be easily mixed with other food item without altering its taste and administered to the baby. Further, this may be appropriate for kids who are diarrheic or vomiting as they might not be able to consume anything with a strong or sweet flavor. Moreover, unflavored electrolytes can be easily mixed with other food or beverage items to feed the baby without changing the taste of the feed.

According to distribution channel, the modern trade segment dominated the market in 2021. This is attributed to the fact that modern trade channels allow producers to sell & advertise their baby electrolyte products through in-store promotions, online advertising, and other marketing strategies that can increase consumer awareness and increase sales. These channels can simultaneously encourage product innovation by motivating producers to develop novel formulas & flavors that satisfy consumers' fluctuating needs & preferences. Overall, ease of use, accessibility, and affordable pricing of modern trade channels are promoting the growth of the baby electrolyte market by making it easier for parents to provide their children with the nourishment & hydration they need. Moreover, growth in penetration of the internet and rise in popularity of online shopping platforms across the globe are expected to drive the growth of online stores during the forecast period. Online store modern trade channel is expected to grow at the fastest rate during the forecast period.

Region wise, the baby electrolyte market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. Asia-Pacific dominated the market in 2021. This growth is attributed to increased prevalence of diarrhea and other illnesses that can lead to dehydration, in Asia-Pacific. Ingestion of unhygienic food and tainted water is the main cause of diarrhea. The baby electrolyte market is expanding in Asia-Pacific due to rising rates of diarrhea and related mortality among children, as well as increased awareness of the health benefits of ORS in infants.

North America was the second leading market in 2021. The market is anticipated to rise as a result of the increased awareness of the value of nutrition and hydration for infants. Parents are becoming increasingly aware of the necessity and significance of giving their infants electrolyte-rich liquids to replace the fluids lost as a result of vomiting, diarrhea, and other ailments. Due to the availability of many flavors and formats, such as liquid, popsicles, and tablets, the industry is expanding by attracting a wider range of consumers. These forms give parents more practical options for giving their babies electrolyte liquids. The market is expanding as a result of increase in new product launches as well as the ongoing development of new flavors & formulae to meet consumer demands and preferences.

Abbott Laboratories, The Hain Celestial Group, Inc., Johnson & Johnson, Cipla Ltd., Sanofi, Cera Products, Inc., Monico S.p.A., Mead Johnson & Company, LLC., Kinderfarms, LLC., FDC Limited, Unilab, Inc., Prestige Consumer Healthcare, Inc., Halewood Laboratories Pvt. Ltd., Goodonya, and Otsuka Holdings Co., Ltd. are the major companies profiled in the baby electrolyte market report. These players are constantly engaged in various developmental strategies such as partnerships, mergers, acquisitions, and new product launches to gain a competitive edge and exploit the prevailing baby electrolyte market opportunities.

Some examples of product launches include:

- In December 2020, Abbott Laboratories through its brand Pedialyte, launched four new product namely, Pedialyte with immune support, Pedialyte sport, Pedialyte organic and Pedialyte electrolyte water with zero sugar in order to expand its portfolio.

- In September 2020, Kinderfarms, LLC., launched two new doctor-formulated functional hydration powders namely, Kinderlyte sleep and Kinderlyte immunity to expands its product offering.

- In March 2020, Kinderfarms, LLC., launched the Kinderlyte Advanced Electrolyte in both liquid and convenient powder formulations in order to expand its portfolio.

Some examples of product launches include:

- In January 2020, Otsuka Holdings Co., Ltd., through its subsidiary Otsuka Pharmaceutical Co., Ltd., established Otsuka Nutraceutical Mexico S.A., in Mexico in order to develop and expand the market for health & functional beverages in Mexico.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the baby electrolyte market analysis from 2021 to 2031 to identify the prevailing baby electrolyte market demand.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the baby electrolyte market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global baby electrolyte market trends, key players, market segments, application areas, and market growth strategies.

Baby Electrolyte Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 2.9 billion |

| Growth Rate | CAGR of 9.4% |

| Forecast period | 2021 - 2031 |

| Report Pages | 300 |

| By Application |

|

| By Form |

|

| By Distribution Channel |

|

| By Flavor |

|

| By Region |

|

| Key Market Players | Unilab, Inc., Prestige Consumer Healthcare Inc., FDC Limited, Goodonya, Abbott Laboratories, Mead Johnson & Company, LLC., Sanofi, Cera Products Inc., Kinderfarms, LLC., Otsuka Holdings Co., Ltd., Monico spa, Cipla Ltd, The Hain Celestial Group, Inc., Johnson & Johnson, Halewood Laboratories Pvt. Ltd. |

Analyst Review

Active launch operations and advertising of infant drinks in the U.S. and UK result in the market growth in the Western region. Furthermore, growth in the number of female professionals in emerging nations, such as China, India, Indonesia, the Philippines, Brazil, and Saudi Arabia increases the use of infant beverages in these regions. China contributes to the largest share of the baby electrolyte market. This is attributed to Chinese Government's repeal of the one-child restriction. Thus, the market is likely to be driven by growth in the population aged 0–5 years, particularly in India, China, and Indonesia.

Growth in preference of health-conscious parents for minimally processed and natural drinks for their children majorly drives the market growth. Furthermore, the market is fueled by the high nutritional, vitamin, and electrolyte content of infant beverages, such as iron, zinc, and potassium which prevents diarrhea. On the other hand, probiotic-enriched baby electrolytes prevent diarrhea, alleviate colic, and reduce the likelihood of food allergies. The advantages of baby electrolytes are anticipated to have a substantial influence on market growth during the forecast period.

The global baby electrolyte market size was valued at $1.2 billion in 2021, and is projected to reach $2.9 billion by 2031

The global Baby Electrolyte market is projected to grow at a compound annual growth rate of 9.4% from 2022 to 2031 $2.9 billion by 2031

Abbott Laboratories, The Hain Celestial Group, Inc., Johnson & Johnson, Cipla Ltd., Sanofi, Cera Products, Inc., Monico S.p.A., Mead Johnson & Company, LLC., Kinderfarms, LLC., FDC Limited, Unilab, Inc., Prestige Consumer Healthcare, Inc., Halewood Laboratories Pvt. Ltd., Goodonya, and Otsuka Holdings Co., Ltd. are the major companies profiled in the baby electrolyte market report.

Asia-Pacific dominated the market in 2021

Rise in global population, Rise in prevalence of a diarrheal disease among infants, Rise in the number of working women population

Loading Table Of Content...

Loading Research Methodology...