Baby Food Market Research, 2031

The global baby food market size was valued at $67.8 billion in 2021, and is projected to reach $116.5 billion by 2031, growing at a CAGR of 5.7% from 2022 to 2031.

Traditionally, babies are fed with soft home cooked food, a practice that is still popular in underdeveloped and developing countries. However, rapid urbanization and changes in lifestyle have increased the demand for packaged baby food in different societies and cultures. These foods are fed to babies between the ages of four to six months and two years. Rise in awareness toward increased nutritional needs of babies, organized retail marketing, significant surge in female workforce are the key factors that boost the baby food market growth. However, concerns related to food safety, falling birth rates, and the practice of feeding home cooked food to babies are the key restraints of this market.

Market Dynamics

Increase in urban population and changes in lifestyles due to considerable rise in disposable incomes are the key factors that boost the overall growth of the global baby food market. In addition, increase in female workforce leaves less time for food preparation and breastfeeding the infants, which, in turn, escalate the demand for quality baby food. Packaged baby foods are popular in urban areas, as they provide adequate amount of nutrition for infants.

However, majority of the parents prefer home-cooked baby food compared to packaged baby food for their infants, which hamper the market growth. Moreover, high price of baby food products has restricted their adoption among middle-income groups. Furthermore, home-cooked food is preferred by consumers in the rural and isolated regions, due to lack of awareness about these products. However, promotional campaigns and availability of affordable baby food products are expected to increase in the revenue generation. In addition, time constraints for food preparation due to increased participation of women at workplace and rise in low nutritional value of home-cooked food is anticipated to increase the sale of packaged baby foods, thus strengthening the growth of the global baby food industry.

Furthermore, product innovations play an important role in the growth of the market. Intensive research and development activities have facilitated the launch of innovative products. In addition, safety of baby food is the prime concern among consumers and manufacturers. Tamper-proof packaging of baby food products ensures optimal safety of its contents. Innovations in improving safety of these products through process improvements and technological advancements drive growth of the baby food market share.

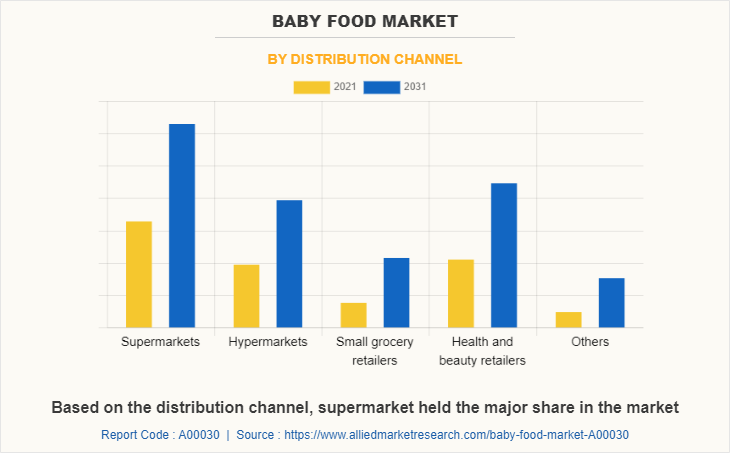

The retail industry has become more organized in some Asian countries, especially India and China. Improving economic conditions and changing lifestyle of consumers have increased popularity of supermarkets and other organized retail structures. In 2021, supermarkets and health & retail outlets accounted for maximum sales of baby food products in Asia-Pacific.

Sales of milk formula is highly concentrated in Asia-Pacific. Alternatively, the demand for prepared baby food is limited to developed regions. However, the market for prepared baby food in developing regions would pick pace during the forecast period, subsequently leading to the growth of the baby food market in Asia-Pacific.

Supermarkets, hypermarkets, small grocery retailers, and health & beauty retailers are the key distribution channels in the market. Supermarkets are the preferred distribution channel among consumers, followed by health & beauty retailers. However, considering the scenario in few Asian developing countries such as India, small grocery retailers and health & beauty retailers hold significant share. Small grocery retailers account for a comparatively smaller share in the market but would witness rapid growth during the forecast period. Other distribution channels include discounters, non-grocery retailers, and non-store retailing.

Segmentation Analysis

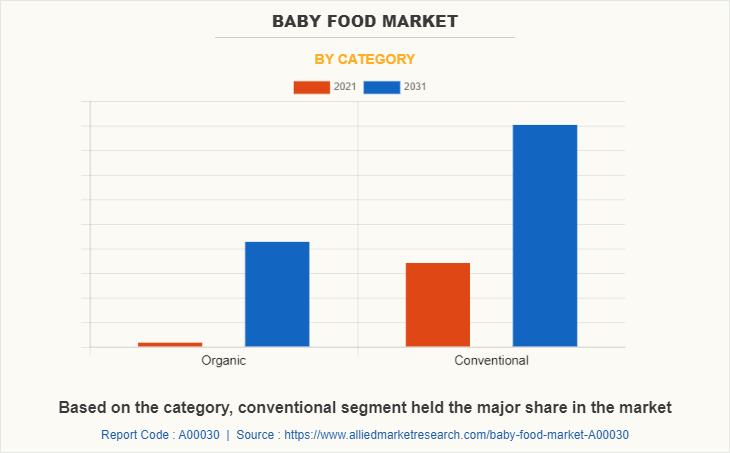

The global baby food market analysis into product type, distribution channel, category, and region. On the basis of product type, the market is divided into dried baby food, milk formula, prepared baby food, and others. Depending on distribution channel, it is fragmented into supermarkets, hypermarkets, small grocery retailers, health & beauty retailers, and others. By category, it is bifurcated into organic and conventional. Region wise, it is analyzed across North America (the U.S., Canada, and Mexico), Europe (Germany, France, the UK, Spain, Italy, Russia, and rest of Europe), Asia-Pacific (China, Japan, India, Australia, South Korea, Indonesia, and rest of Asia-Pacific), and LAMEA (Brazil, Argentina, United Arab Emirates, South Africa, Saudi Arabia, and rest of LAMEA).

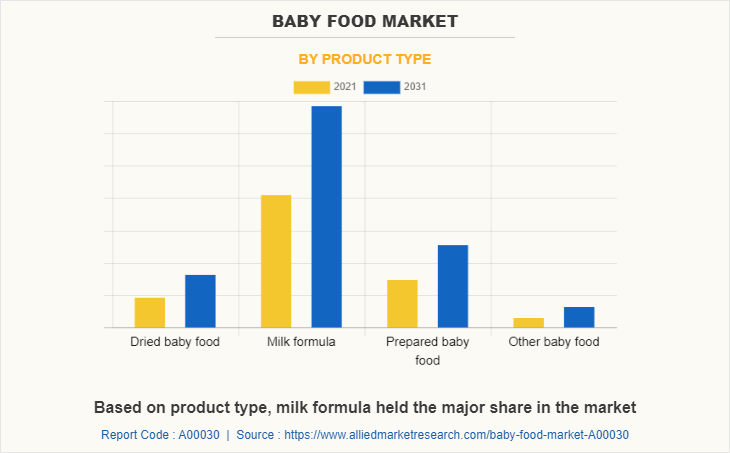

By Product Type

On the basis of product type, the milk formulations segment dominated the global baby food market in 2021, accounting for around half of the overall market revenue. This is attributed to increase in incidence of lactating issues in mothers, which increased the adoption of milk-based baby food products.

By Distribution Channel

By distribution channel, the supermarket segment held the significant share in 2021. This is attributed to the fact that supermarkets are gaining popularity owing to the availability of broad range of consumer goods under a single roof, ample parking space, and convenient operation timings. These stores offer a variety of brands in a particular product category, thus providing more options for consumers. Moreover, some of the supermarkets have company representatives to assist the consumers in their selection of baby food products.

By Category

Depending on category, the organic segment is expected to grow at the highest rate during the forecast period. As organic baby food is made of fruits, vegetables, and meat from animals with no antibiotics or growth hormones, organic baby food market demand is expected to surge.

By Region

Region wise, Asia-Pacific dominated the global market in 2021. High birth rates and rise in purchasing power of population in Asia-Pacific have significantly fostered the demand for baby food and milk formula-based products. In addition, intensive R&D activities by various companies in the baby food segment are expected to help the companies to offer affordable baby food products in this region.

Competitive Analysis

Leading players operating in the market launch innovative and superior baby food products to sustain in the competitive market. Competitive strength of these companies depend on collective analysis of factors such as geographical presence, focus areas of operation and key growth strategies adopted by these companies. Nestle S.A. dominates the global baby food market, with maximum market share, in terms of revenue. The company has adopted product innovation and acquisition as its main growth strategy to increase its market presence and expand its consumer base.

Players in the market have adopted business expansion and product launch as their key developmental strategies to expand their market share, increase profitability, and remain competitive in the market. The key players profiled in the report include Nestlé, Danone, Perrigo Company Plc, Mead Johnson & Company LLC, Abbott Laboratories, Hero Group, Bellamy Organics, Hain Celestial Group, Campbell Soups, and Friesland Campina.

Recent Developments in the Market

- In August 2022, Abbott Laboratories announced to restart its Similac infant formula production at its Sturgis manufacturing plant in Michigan in order to overcome the nationwide infant formula shortage.

- In November 2021, Abbott Laboratories launched the Similac 360 Total Care, which is infant formula with a blend of five different human milk oligosaccharides. This new formula provides nutrition to support the whole baby's health and development, including the developing immune system, digestive system and brain.

- In September 2022, Bellamys Organic Pty Ltd announced to sell its infant milk formula in the U.S., in order to address the country's ongoing, market-wide formula shortage and expand its consumer base.

- In January 2021, Hero AG acquired Baby Gourmet, which is a leading organic meal and snack brand for babies and toddlers based in Canada, in order to expand its portfolio and footprint in North America.

- In October 2020, Perrigo Company plc announced to establish a new North American corporate headquarters in the Grand Rapids city, Michigan. This new headquarters will augment its existing presence in West Michigan further including extensive operations in Allegan, Holland and Grand Rapids.

- In July 2022, Danone Inc., launched the new dairy and plants blend baby formula to meet the consumers demands for feeding options that are suitable for vegetarian, flexitarian and plant-based diets, and also meet their baby's specific nutritional requirements.

- In August 2020, Royal FrieslandCampina N.V., launched the ultra-premium organic milk formula that comprises with smart packaging for traceability.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the baby food market forecast from 2021 to 2031 to identify the prevailing baby food market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the baby food market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global baby food market trends, key players, market segments, application areas, and market growth strategies.

Baby Food Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 116.5 billion |

| Growth Rate | CAGR of 5.7% |

| Forecast period | 2021 - 2031 |

| Report Pages | 448 |

| By Product Type |

|

| By Distribution Channel |

|

| By Category |

|

| By Region |

|

| Key Market Players | Hero AG, Danone S.A., The Hain Celestial Group, Inc., Perrigo Company plc, Nestle S.A., Abbott Laboratories, Mead Johnson & Company, LLC., Sun-Maid Growers of California, Royal FrieslandCampina N.V., Bellamys Organic Pty Ltd |

Analyst Review

As per the opinion of the CXOs of leading companies, increase in R&D activities and innovations for improving the flavors and ingredients of baby food have the key players to increase their overall sale of baby food products in the market. In the past few years, urban people have started using packaged food products unlike the population in the semi-urban and urban areas. Busy lifestyle of individuals has influenced them to use prepared baby food and infant formula.

People in the rural and semi-urban areas have steadily started using packaged baby foods, owing to increased visibility due to the proliferation of media and other communication channels. Upsurge in online sale of baby food products is expected to further increase the overall revenue for the industry. Several government organizations have insisted on the use of baby food products to supplement mother’s milk.

The growth of baby food market is highly dependent on awareness among the consumers to provide complete nutrition to their child. Demand of baby foods is higher in the emerging countries such as China and India, as they are equally growing in terms of money and population. Acquisition and product launch are the key strategies to sustain in the ever-growing baby food market.

The global baby food market size was valued at $67.8 billion in 2021, and is projected to reach $116.5 billion by 2031

The global Baby Food market is projected to grow at a compound annual growth rate of 5.7% from 2022 to 2031 $116.5 billion by 2031

The key players profiled in the report include Nestlé, Danone, Perrigo Company Plc, Mead Johnson & Company LLC, Abbott Laboratories, Hero Group, Bellamy Organics, Hain Celestial Group, Campbell Soups, and Friesland Campina.

Region wise, Asia-Pacific dominated the global market in 2021

Increase in population of women professionals, Increase in awareness about adequate nutritional requirements of babies, Increase in organized retailing

Loading Table Of Content...

Loading Research Methodology...