Bakery Ingredients Market Summary

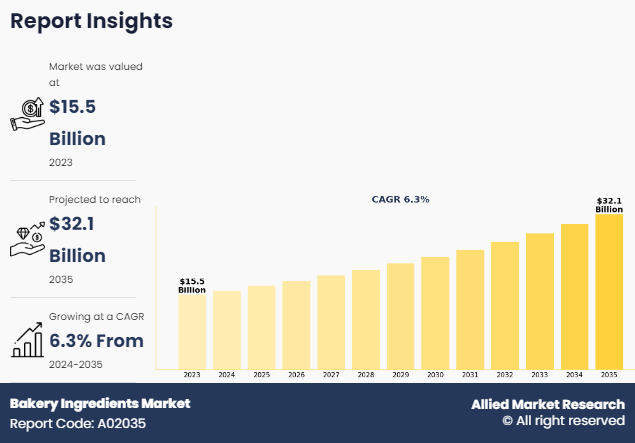

The global bakery ingredients market size was valued at $15.5 billion in 2023, and is projected to reach $32.1 billion by 2035, growing at a CAGR of 6.3% from 2024 to 2035. Cultural and global influence along with the growth of sustainable and eco-friendly practices in the baking industry are expected to positively impact the growth of the bakery ingredients Market.

Key Market Trends and Insights

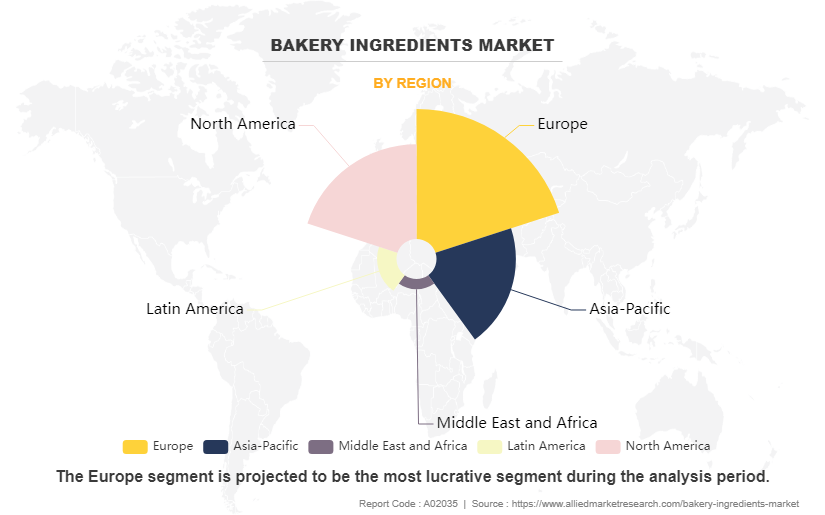

Region wise, Europe generated the highest revenue in 2023.

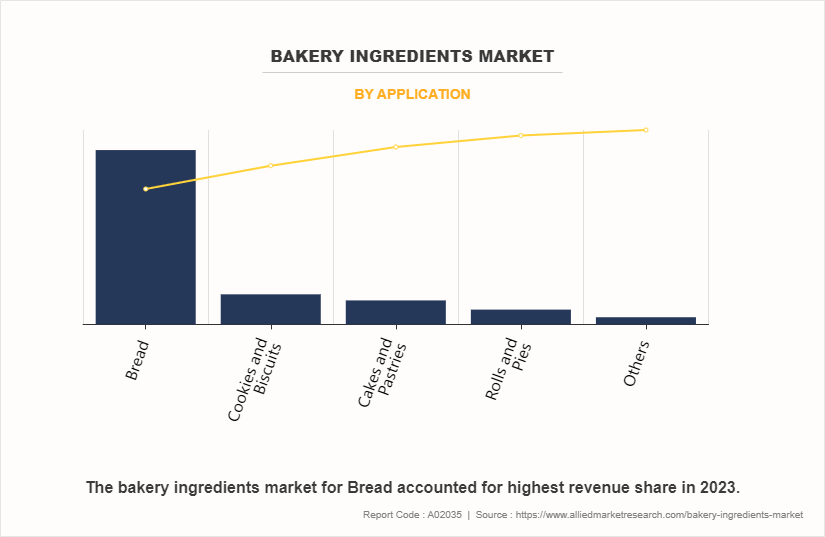

The global bakery ingredients market share was dominated by the bread segment in 2023 and is expected to maintain its dominance in the upcoming years

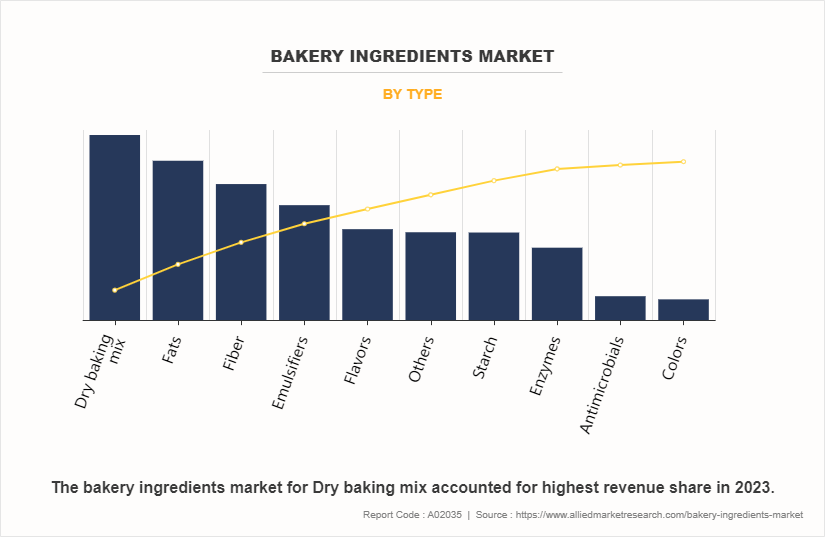

The dry baking mix segment is expected to witness the highest growth during the forecast

Market Size & Forecast

- 2023 Market Size: USD 15.5 Billion

- 2035 Projected Market Size: USD 32.1 Billion

- Compound Annual Growth Rate (CAGR) (2024-2035): 6.3%

- Europe: Generated the highest revenue in 2023

Bakery ingredients or baking ingredients are food products that help maintain freshness, softness, & taste; improve shelf life, and increase the protein content in the baked items. These items are available in different varieties in the market and contribute to the flavor, texture, structure, and appearance of the final product. The choice of the ingredients and the compositions determine the flavor & texture of the baked food product. The demand for products, such as bread and biscuits, is increasing at a significant rate and is anticipated to provide lucrative growth opportunities for the growth of the global bakery ingredients industry during the forecast period. In the mature bakery ingredients markets of North America and Europe, the demand for bakery ingredients exhibiting health benefits and containing lesser or negligible artificial constituents is increasing massively, thus increasing the bakery ingredients market size.

Key Takeaways

By type, dry bakery mix segment dominated the market in 2023.

By application, the bread segment dominated the bakery ingredients market in 2023.

By region, Europe dominated the market in 2023.

Top Impacting Factors:

Consumer preference for healthier bakery products

The global bakery ingredients market is driven by factors such as busy lifestyles and changes in dietary habits, which in turn result in higher consumption of bakery products. Moreover, changes in the culture and routines of people in developing nations and growth in demand for low trans-fat & gluten-free baking ingredients products are expected to foster the growth of the market. In addition, the rapid rise in obesity rates and rise in fitness-related concerns have fueled the demand for healthy bakery food products. Conversely, growth in the trend of replacing baked products with cereals, such as oats, is expected to hamper the growth of the global market.

Furthermore, stringent regulations and implementation of international quality standards are anticipated to restrain the market growth. However, the potential market for frozen bakery food along with proactive efforts of key players to reduce production costs and increase the shelf life of products are anticipated to provide lucrative opportunities for the bakery ingredients market growth.

Rise in urbanization and workforce participation

As urban areas expand and populations migrate from rural to urban settings, the demographic shift leads to several changes that impact consumer behavior and food preferences. Moreover, urbanization tends to increase the pace of life, with people in cities often working longer hours and having less time for meal preparation. This shift in lifestyle leads to a growing demand for convenience food, including bakery products such as bread, pastries, cakes, and other baked goods. These items are easy to consume on the go or as quick meals, making them an attractive option for busy urbanites. In addition, workforce participation plays a crucial role in driving this trend. As more people enter the workforce, particularly women and younger generations, they often have less time for cooking and are more likely to seek ready-to-eat or easily prepared food items. Bakery products fit this need, providing convenient and tasty options for breakfast, lunch, or snacks.

Furthermore, these changes in consumer behavior influence the bakery ingredients market by creating increased demand for high-quality, versatile ingredients that can be used to produce a wide range of bakery items. To meet these demands, manufacturers of bakery ingredients must innovate and offer a variety of products that cater to different tastes, dietary preferences, and health considerations. As a result, the bakery ingredients industry experiences growth and diversification, driven by urbanization and workforce participation.

Health and wellness trends

The increasing focus on health and wellness among consumers is a significant restraint for the bakery ingredients market. As people become more health-conscious, they often look for food with reduced sugar, fat, and calorie content, as well as those free from artificial additives or preservatives. This trend can negatively impact the demand for traditional bakery ingredients, such as sugar, refined flour, and artificial flavorings, which are often associated with unhealthy eating habits. To adapt, manufacturers must innovate to create healthier ingredient alternatives, which can increase costs and reduce profit margins.

Regulatory compliance and food safety concerns

The bakery ingredients market is subject to various regulations and food safety standards, which can be a restraint. Regulatory bodies often impose strict rules on food ingredients, requiring manufacturers to meet specific safety, labeling, and quality standards. Compliance with these regulations can be costly and time-consuming, potentially reducing the profitability of bakery ingredient producers. Moreover, any incidents related to food safety, such as contamination or recalls, can damage the industry's reputation and lead to decreased consumer trust, further restraining market growth. Manufacturers must invest in rigorous quality control and food safety measures, which can increase operational costs and limit the flexibility to experiment with new ingredients or formulations.

Growth in demand for gluten-free and specialty products

As consumer awareness of dietary restrictions and health-related food choices increases, there is a rising demand for gluten-free, dairy-free, and other specialty bakery products. This trend creates an opportunity for bakery ingredient manufacturers to develop innovative products that cater to specific dietary needs. According to bakery ingredient market analysis, the gluten-free market, in particular, has seen substantial growth due to a combination of factors, including the increase in diagnosed celiac disease cases and the broader adoption of gluten-free diets by health-conscious consumers. Bakery ingredients such as gluten-free flour, starches, and alternative binders are in high demand to meet the needs of these consumers.

This shift presents an opportunity for bakery ingredient manufacturers to develop a diverse range of products that align with these emerging trends. By offering high-quality, versatile, and health-focused ingredients, companies can attract a broader customer base and capitalize on the growing market segment and present market opportunities. Additionally, this trend opens doors for innovation in ingredient formulation, allowing manufacturers to create unique products that differentiate themselves from competitors, further driving market growth and is expected to increase bakery ingredients market share.

Segment Review:

The bakery ingredients market share is segmented on the basis of type, application, and region. On the basis of type, it is divided into enzymes, starch, fiber, colors, flavors, emulsifiers, antimicrobials, fats, dry baking mix, and others. On the basis of application, it is fragmented into bread, cookies & biscuits, rolls & pies, cakes & pastries, and others. Region wise, it is analyzed across North America (the U.S., Canada, and Mexico), Europe (Germany, France, the UK, Spain, Italy, Russia, and rest of Europe), Asia-Pacific (China, Japan, India, Australia, South Korea, Indonesia, and rest of Asia-Pacific), and LAMEA (Brazil, Argentina, United Arab Emirates, South Africa, Saudi Arabia and rest of LAMEA).

By Type

On the basis of type, dry baking mix segment dominated the global bakery ingredients market in 2023, accounting for around 18.4% of the overall market revenue. Fats in bakery products help to retain gases released during baking, thus ensuring richness, flavor, and moisture of the bakery products. Emulsifiers act as an intermediary between oil and water, thus preventing the separation of oil from water. They are also used for conditioning dough and increasing shelf life of bakery products. According to the market trend, this segment is expected to grow at a significant rate during the forecast period. Dry baking mixes offer a convenient solution for consumers who want to bake at home without the need for extensive preparation. The time-saving aspect appeals to busy individuals and families, allowing them to create a variety of baked goods with minimal effort. This convenience factor significantly contributes to the growing popularity of dry baking mixes.

By Application

On the basis of application, the bread segment dominated the global bakery ingredients market in 2023, accounting for around 18.9% of the overall market revenue. These ingredients are used in bread due to aroma, taste, and conditioning of dough required in bread making. On the other hand, cookies & biscuits are consumed as snacks and are gaining popularity among youth due to their taste, texture, and health benefits. Moreover, bread is a staple food item in many cultures around the world, forming a fundamental part of daily meals. Its wide acceptance across different regions and cuisines contributes to the sustained demand for bakery ingredients used in bread production. In addition, it has a high consumption rate due to its versatility and affordability. It serves as a basic food item for a broad range of consumers, from individuals and families to institutions such as schools and hospitals. This high demand drives the need for large quantities of bakery ingredients.

By Region

On the basis of region, Europe dominated the global market, registering a CAGR of around 5.3% during the market forecast period. Europe has a long-standing tradition of baking, with diverse baking cultures across different countries. Bread, pastries, and other baked goods are integral to European cuisine, creating a high demand for bakery ingredients to support this tradition. Moreover, Europeans are among the largest consumers of bread and pastries in the world. This high consumption drives the need for a steady supply of bakery ingredients to meet Bakery Ingredients market demand. In addition, European regulations emphasize food safety and quality, driving innovation and high standards in the production of bakery ingredients. This focus on quality helps European products gain a strong reputation in the global market, attracting international buyers and investors.

European regulations emphasize food safety and quality, driving innovation and high standards in the production of bakery ingredients. This focus on quality helps European products gain a strong reputation in the global market, attracting international buyers and investors.

Competitive Analysis

The key players profiled in the report include Archer-Daniels-Midland Company, Associated British Foods Plc., Cargill Incorporated, E.I. Du Pont De Nemours and Company, Ingredion Incorporated, Kerry Group, Plc., Koninklijke DSM N.V., Dawn Food Products, Inc., Bakels Group, and Lallemand Inc. The other players in the value chain include Sdzucker, Taura Natural Ingredients Ltd., AAK AB, Tate & Lyle PLC, Corbion N.V., IFFCO Corporate, CSM Bakery Solutions, Novozymes, and Puratos Group.

Players in the market have adopted business expansion and product launch as their key developmental strategies to expand their market share, increase profitability, and remain competitive in the market and in the bakery ingredients market forecast period.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the bakery ingredients market analysis from 2023 to 2035 to identify the prevailing bakery ingredients market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the bakery ingredients market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global bakery ingredients market trends, key players, market segments, application areas, and market growth strategies.

Bakery Ingredients Market Report Highlights

| Aspects | Details |

| Forecast period | 2023 - 2035 |

| Report Pages | 290 |

| By Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | DAWN FOOD PRODUCTS, INC, Associated British Foods PLC, ARCHER-DANIELS-MIDLAND COMPANY, KONINKLIJKE DSM N.V, BAKELS GROUP, LALLEMAND INC, INGREDION INCORPORATED, KERRY GROUP PLC, Cargill, Incorporated, E. I. DU PONT DE NEMOURS AND COMPANY |

Analyst Review

According to the CXOs of leading companies, the bakery ingredients market is expected to grow at a significant rate during the forecast period, owing to various factors such as change in lifestyle patterns of consumers, increase in demand for convenience food, and consumer preferences for healthier bakery products. In addition, rise in the number of bakeries & outlets, such as in-store bakeries, convenience stores, supermarket & hypermarket bakeries, café bakers, and artisan bakeries, has fueled the demand for baking ingredients across the globe. According to the CXOs, Asia-Pacific is projected to register a significant growth as compared to the saturated markets of Europe and North America, due to increase in penetration of a wide range of bakery products in tier 2 & 3 cities of India and rise in disposable incomes.

From a CXO perspective, regulatory compliance is a critical factor in the bakery ingredients market. Companies are also involved in navigating a complex landscape of food safety regulations, labeling requirements, and quality standards. Moreover, organizations are also focused on risks associated with ingredient shortages and are exploring ways to ensure a stable supply of key ingredients. Sustainable sourcing and ethical procurement practices are also a priority.

The global bakery ingredients market was valued at $15.5 billion in 2023, and is projected to reach $32.1 billion by 2035

The global bakery ingredients market is projected to grow at a compound annual growth rate of 6.3% from 2024 to 2035, $32.1 billion by 2035

The key players profiled in the report include Archer-Daniels-Midland Company, Associated British Foods Plc., Cargill Incorporated, E.I. Du Pont De Nemours and Company, Ingredion Incorporated, Kerry Group, Plc., Koninklijke DSM N.V., Dawn Food Products, Inc., Bakels Group, and Lallemand Inc. The other players in the value chain include Sdzucker, Taura Natural Ingredients Ltd., AAK AB, Tate & Lyle PLC, Corbion N.V., IFFCO Corporate, CSM Bakery Solutions, Novozymes, and Puratos Group.

On the basis of region, Europe dominated the global bakery ingredients market, registering a CAGR of around 5.3% during the bakery ingredients market forecast period.

Consumer Preference for Healthier Bakery Products, Rise In Urbanization and Workforce Participation, Rise in consumer demand for allergen-free food

Loading Table Of Content...

Loading Research Methodology...