Bank Kiosk Market Research, 2031

The global bank kiosk market was valued at $756.96 million in 2021, and is projected to reach $2.2 billion by 2031, growing at a CAGR of 11.5% from 2022 to 2031.

The word kiosk stands for Kommunikasjon Integrert Offentlig Service Kontor, and it denotes a small open-fronted hut or a cubicle. In terms of banking, a kiosk is a service introduced to cater to the banking needs of low-income sections of the society by bringing common banking services near their locality. Kiosks act as a touchpoint for banks and people. Furthermore, bank kiosks are used to bridge the gap and bring banking services under the reach of minority sections, which is boosts the market growth during. In addition to this, various other types of banking kiosk such as pgb kiosk banking, cheque deposit kiosk, union bank kiosk and others is also increasing the demand for the market.

The factor that drives the bank kiosk market trends incldue rise in demand for self-service in banking and financial services and enhanced customer services offered by bank kiosks propels growth of the market. In addition, reduction in overall operational cost fuels growth of the bank kiosk market size. However, increase in use of mobile devices for banking services and high installation costs and need for regular maintenance limit growth of the market. Conversely, increase in investments by companies in Asia-Pacific is anticipated to provide numerous opportunities for expansion of the market during the forecast period.

The bank kiosk market is segmented into Component, Type and Distribution.

Segment review

The global bank kiosk market is segmented into component, distribution, type, and region. Depending on the component, the market is divided into Hardware, software and services. Based on type, it is categorized into single-function kiosk, multi-function kiosk and virtual/video teller machine (VTM). Based on distribution the market is segmented into rural, urban, semi-urban and metropolitan. Region wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The global bank kiosk market is dominated by key players such as Auriga Spa, Cisco Systems, Inc., Diebold Nixdorf, Incorporated, GLORY LTD., GRGBanking, Hitachi Channel Solutions, Corp., KAL ATM Software GmbH, NCR Corporation, Oki Electric Industry Co., Ltd., and STAR MICRONICS CO., LTD. These players have adopted various strategies to increase their market penetration and strengthen their position in the industry.

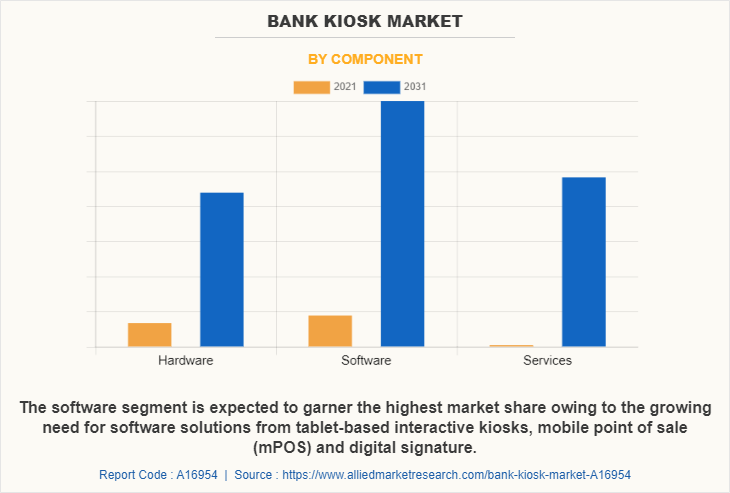

Depending on component, the hardware segment dominated the bank kiosk market share in 2022, and is expected to continue this trend during the forecast period owing to the rapid advancement in the bank kiosk industry technologies and offerings such as interactive kiosk, secure and personalized banking services. However, the software segment is expected to witness the highest growth in the upcoming years, owing to the growing demand for advanced and self-regulating software, as well as rising investments in R&D activities, are propelling the segment demand. This factor is expected to provide lucrative bank kiosk market opportunity in the upcoming year.

Region wise, the bank kiosk market was dominated by Asia Pacific in 2021 and is expected to retain its position during the forecast period, owing to the advent of high-speed networking technologies has been a key driving force in the bank kiosk industry. However, North America is expected to witness significant growth during the forecast period, owing to technological advancements and emergence of new business models in the banking industry which is expected to fuel the market growth in this region.

The report focuses on growth prospects, restraints, and analysis of the global bank kiosk market trend. The study provides Porter’s five forces analysis to understand the impact of various factors, such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers on the global bank kiosk market analysis.

COVID-19 impact analysis

The bank kiosk market has witnessed a significant growth in past few years, owing to growth in adoption of contactless payment technology and use of self-service machines for contactless payment. Moreover, during the COVID-19 pandemic outbreak, the bank kiosk market witnessed a sudden increase as millions of employees are working from home during and there is rise in cases of COVID-19 across the globe that led to restriction in traditional banking methods. In addition, bank kiosks minimize human-to-human interaction in day-to-day activities, which helps prevent spread of the virus. Hence, several banks across the globe are implementing self-service technologies to battle the COVID-19 pandemic. This is projected to fuel the global bank kiosk market.

Top impacting factors

Increase in demand for self-service in banking and financial services

The demand for self-service devices has been increasing in past few years, owing to its features such as interactive touchscreen display, cash handling, and core integrations to conduct transactions, which drives growth of the market. In addition, it allows financial institutions to transit from the teller model to the universal banker model, which is propels growth of the market. Moreover, it helps to transform business to be more customer-centric by meeting client needs and increasing quality time for transactions without any interruptions. Furthermore, it helps in serving customers faster and offering more convenient ways to make transactions, which, in turn, boost the market growth. Such applications proved essential in growth of bank kiosk solutions during the period of the COVID-19 pandemic, which is expected to grow in the coming few years.

Reduction in overall operational costs

Banks rely on self-service solutions to reduce their cost per transaction and operating costs, which, in turn, drives growth of the market. For instance, cost of personal teller machines is almost 50% less than that of an ATM and offers twice the number of transaction types. In addition, the adoption of self-service kiosks by the banks do not require any staff for operations which reduces the time and resources needed to train staff, thereby reducing the operational costs for the banking institutes. Moreover, by migrating day-to-day transactions to self-service bank kiosks, it allows financial institutes to focus on assisting customers in product purchases and other necessary works. In addition, bank kiosks offer alternatives for full-service locations to banking enterprises looking for expanding the market reach without requiring a full brick and mortar location, which reduces various expenses such as rent, electricity, and working labor and propels the demand for bank kiosk market growth.

KEY BENEFITS FOR STAKEHOLDERS

- The study provides an in-depth analysis of the global bank kiosk market forecast along with current & future trends to explain the imminent investment pockets.

- Information about key drivers, restraints, & opportunities and their impact analysis on global bank kiosk trends is provided in the report.

- Porter’s five forces analysis illustrates the potency of the buyers and suppliers operating in the industry.

- The quantitative analysis of the bank kiosk market outlook from 2022 to 2031 is provided to determine the market potential.

Bank Kiosk Market Report Highlights

| Aspects | Details |

| By Component |

|

| By Type |

|

| By Distribution |

|

| By Region |

|

| Key Market Players | Hitachi Channel Solutions, Corp., Diebold Nixdorf, Incorporated, GRGBanking, Oki Electric Industry Co., Ltd., STAR MICRONICS CO., LTD., NCR Corporation, Auriga Spa, Cisco Systems, Inc., Glory Ltd., KAL ATM Software GmbH |

Analyst Review

Bank kiosk is a recent development in banking technology after ATMs, which provides numerous additional features. Several features that differentiate a kiosk banking outlet from automated teller machine (ATM) include account inquiry; making cheque book request; checking account balances; printing mini statements; and customer support tool, where customer can clarify queries from help desk agent through chat process, management information systems (MIS) reporting leads to minimizing of bank’s workload by facilitating the creation of the customer’s database and MIS reports, and cheque deposit facility has made it easier for banks to deposit cheque. Such feature promotes the growth of the global bank kiosk market.

Key providers in the bank kiosk market include NCR Corporation, Huawei Technologies Co., Ltd., and Hitachi, Ltd. With the growth in in demand for bank kiosks, various companies have established partnerships to increase their offerings. For instance, in February 2022, NCR Corporation partnered with Texas-based EECU to improve digital banking for its members. EECU selected NCR ATM as a service to manage and modernize its ATM fleet as a complement to its existing NCR digital banking solutions.

Furthermore, with surge in demand for bank kiosks, various companies have expanded their current services to meet the demand for bank kiosk solutions. For instance, in June 2020, Auriga introduced Bank4Me, a new advanced remote banking solution as part of its ‘NextGenBranch’ offerings. Customers can use the new solution to access all services of the bank in self-service mode and communicate with bank experts through video support in a secure and personalized manner. In September 2020, Hitachi-Omron Terminal Solutions developed currency disinfector. The product is intended for use in locations where a significant number of banknotes are handled, such as bank cash centers and bank branch back offices.

Moreover, several market players have expanded their business operations and customer base by increasing their collaboration. For instance, in June 2022, GRGBanking collaborated with Viet Capital Bank, one of the commercial banking institutions in Vietnam, to launch its first innovative "Digimi+" in its branch network to provide an efficient and satisfactory banking experience to customers.

Rise in demand for self-service in banking and financial services and enhanced customer services offered by bank kiosks propels growth of the market. In addition, reduction in overall operational cost fuels growth of the bank kiosk market size.

Region wise, the bank kiosk market was dominated by Asia Pacific in 2021 and is expected to retain its position during the forecast period, owing to the advent of high-speed networking technologies has been a key driving force in the bank kiosk industry.

The global bank kiosk market size was valued at $756.96 million in 2021, and is projected to reach $2,221.15 million by 2031, growing at a CAGR of 11.5% from 2022 to 2031.

The global bank kiosk market is dominated by key players such as Auriga Spa, Cisco Systems, Inc., Diebold Nixdorf, Incorporated, GLORY LTD., GRGBanking, Hitachi Channel Solutions, Corp., KAL ATM Software GmbH, NCR Corporation, Oki Electric Industry Co., Ltd., and STAR MICRONICS CO., LTD. These players have adopted various strategies to increase their market penetration and strengthen their position in the industry.

Loading Table Of Content...