Barley Flour Market Research, 2032

The global barley flour market was valued at $1.4 billion in 2022, and is projected to reach $2.4 billion by 2032, growing at a CAGR of 5.5% from 2023 to 2032.The increase in consumer demand for gluten-free alternatives has led to a rise in the popularity of barley flour, which is naturally gluten-free in nature. Moreover, the rise in awareness of the health benefits associated with barley, such as high fiber content and low glycemic index, has fueled the adoption of barley flour in various food products.

Barley flour is a versatile, nutrient-rich flour made from grinding whole barley grains. It possesses a slightly sweet, nutty flavor and a light brown color. As a gluten-containing grain, barley flour offers a unique flavor profile and texture in baking. Barley flour contributes to a balanced diet and promotes digestive health owing to the rich content of fiber, vitamins, and minerals such as manganese, selenium, and phosphorus in it. Barley flour is commonly used in a variety of culinary applications, including bread, pancakes, muffins, and cookies, imparting a hearty texture and wholesome taste to baked goods.

Key Takeaways of Barley Flour Market Report

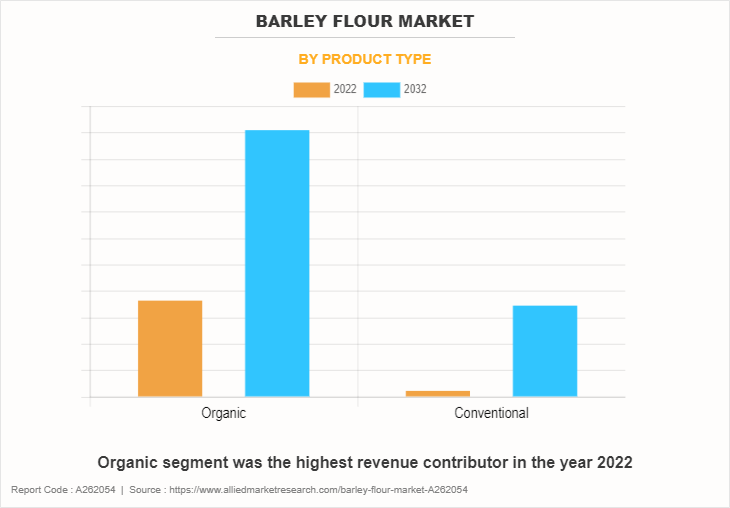

- By type, the organic segment was the highest revenue contributor to the market in 2022 owing to the increase in preference of consumers for barley flour products free from synthetic pesticides, chemicals, and genetically modified organisms.

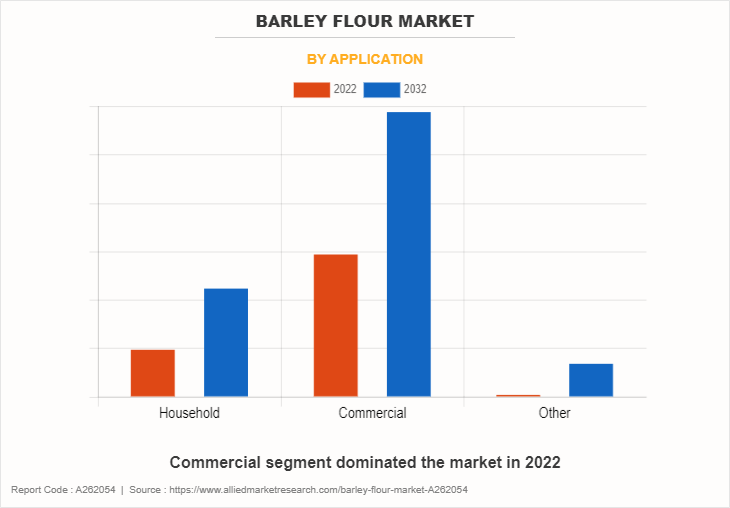

- As per application, the commercial segment was the largest segment in the global barley flour market during the forecast period.

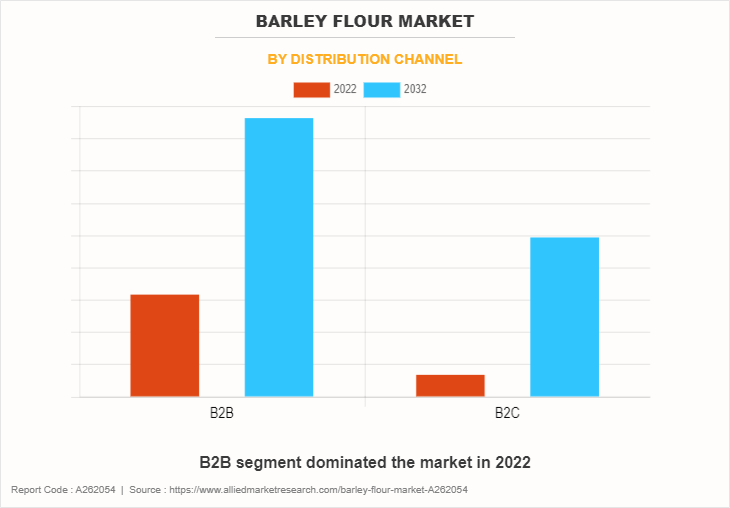

- By distribution channel, the B2B segment was the largest segment in 2022 owing to the bulk purchases by food manufacturers, bakeries, and retailers.

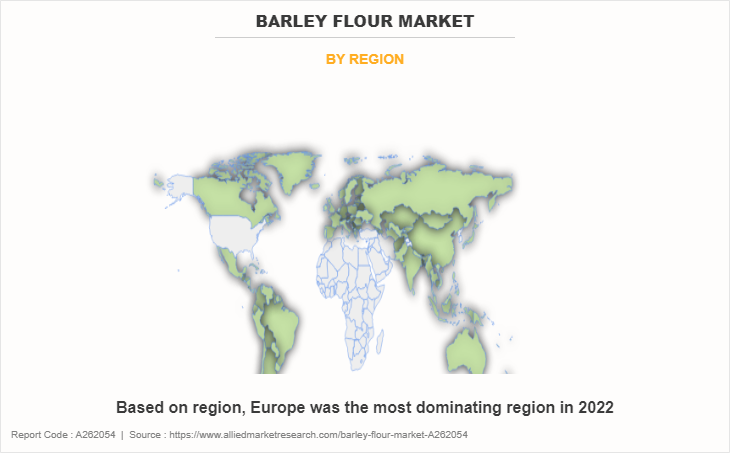

- Region-wise, Europe was the highest revenue contributor in 2022 due to strong tradition of utilizing barley, growing consumer awareness of health benefits associated with barley, and demand for gluten-free and organic products.

Market Dynamics

Increase in health awareness among individuals

Rise in health awareness significantly surges the market demand for barley flour as consumers continuously prioritize nutritious dietary choices. With increased focus on wellness, individuals seek wholesome ingredients that offer health benefits beyond basic diet. Barley flour emerges as a preferred choice due to its impressive nutritional profile, possessing high levels of dietary fiber, vitamins, and minerals essential for overall well-being. As consumers become more aware of the importance of incorporating whole grains into their diets, barley flour stands out as a versatile and nutrient-rich alternative to refined flours.

Moreover, as health-conscious consumers actively seek out products that support digestive health, weight management, and disease prevention, barley flour's fiber-rich composition becomes particularly appealing. Fiber not only aids in digestion but also promotes satisfaction, making barley flour an excellent choice for individuals who compete to maintain a balanced diet and manage their weight effectively. In addition, the presence of vitamins and minerals in barley flour, such as B vitamins, selenium, and manganese, further enhances its nutritional value, catering to the diverse needs of health-conscious consumers who prioritize nutrient-dense foods. As a result, the growing health awareness among consumers drives the demand for barley flour, positioning it as a main ingredient in health-focused diets and culinary creations.

Limited awareness and familiarity to restrain the market growth

However, limited consumer awareness poses a significant restraint on the barley flour industry. Despite its nutritional benefits and versatile culinary applications, many consumers remain unfamiliar with barley flour as a feasible ingredient. This lack of awareness arises from a variety of factors, including a historical inclination for more commonly used flours such as wheat or rice flour, as well as limited exposure to barley-based products in mainstream food markets. As a result, consumers may overlook barley flour when making purchasing decisions, opting instead for familiar alternatives without fully realizing the potential benefits of incorporating barley flour into their diets.

Furthermore, lack of promotion and education about barley flour's nutritional value and culinary versatility contributes to its limited consumer awareness. Without targeted marketing campaigns or educational initiatives to highlight its benefits and showcase its potential uses, barley flour struggles to gain traction in the competitive food market. As a result, its market demand remains constrained, particularly among consumers who may be unaware of its existence or unsure of how to integrate it into their cooking and baking routines.

Growing popularity of gluten-free food products

In addition, health and wellness trends are driving significant opportunities in the market for barley flour. With increasing emphasis on nutritious eating habits, consumers are actively seeking out whole-grain alternatives to refined flours. Barley flour, renowned for its high fiber content, vitamins, and minerals, aligns well with these dietary preferences. As consumers become more health-conscious, they are drawn to barley flour for its potential to enhance the nutritional profile of their meals while providing essential dietary fibers that support digestive health and overall well-being.

Moreover, the growing popularity of gluten-free diets has expanded the market for barley flour as a suitable option for individuals with gluten sensitivities or celiac disease. Despite containing gluten, barley flour is often tolerated by those with mild sensitivities and offers a flavorful alternative to gluten-free baking. This niche market segment presents a valuable opportunity for barley flour producers to cater to the needs of gluten-sensitive consumers who seek nutritious, gluten-free ingredients for their culinary endeavors. As health and wellness continue to drive consumer choices, barley flour market growth assured to capitalize on these trends by offering a versatile and nutrient-rich option for health-conscious individuals seeking wholesome dietary alternatives. With regards to the barley flour market forecast, it is anticipated to experience significant growth, driven by the increasing demand from health-conscious consumers.

Segmental Overview

The barley flour market is analyzed on the basis of type, application, distribution channel, and region.

By Type

By type, the organic segment dominated the global barley flour market share in 2022 and is anticipated to maintain its dominance during the forecast period owing to several factors. Organic barley flour is produced without the use of synthetic pesticides, herbicides, or genetically modified organisms (GMOs), aligning with consumer preferences for natural and sustainable food options. Furthermore, organic barley flour often has superior nutritional qualities, as organic farming methods prioritize soil fertility and crop diversity, resulting in grains with higher levels of vitamins, minerals, and antioxidants compared to conventionally grown counterparts. These combined factors contribute to the growing dominance of organic barley flour in the market as consumers increasingly prioritize health, sustainability, and transparency in their food choices.

By Application

By application, the commercial segment dominated the global barley flour market size in 2022 and is anticipated to maintain its dominance during the forecast period. The commercial segment typically includes large-scale food manufacturers, bakeries, and restaurants that require bulk quantities of barley flour for their production processes. These entities drive significant demand for barley flour due to the scale of their operations and the wide variety of products they produce. In addition, the commercial segment often prioritizes factors such as cost-effectiveness, consistency, and availability, which align well with the offerings of large-scale barley flour suppliers. Furthermore, commercial buyers may have specific requirements or certifications, such as organic or gluten-free, which are more readily fulfilled by established suppliers in the commercial segment. Overall, the dominance of the commercial segment in the barley flour market can be attributed to its substantial purchasing power, demand for large volumes, and preference for reliable and efficient supply chains.

By Distribution Channel

By distribution channel, the B2B segment dominated the global barley flour market demand in 2022 and is anticipated to maintain its dominance during the forecast period. Direct sales between businesses offer streamlined and efficient procurement processes, enabling bulk purchases and ensuring consistent supply chains for commercial buyers such as food manufacturers and bakeries. In addition, B2B sales often involve contractual agreements and long-term partnerships between barley flour suppliers and commercial customers, promoting loyalty and reliability in business relationships. Furthermore, the B2B segment is characterized by customized solutions and tailored offerings that meet the specific requirements and preferences of commercial buyers, including product specifications, packaging options, and delivery schedules. This customization and flexibility cater to the diverse needs of commercial customers and contribute to the dominance of the direct sale segment in the global barley flour market.

By Region

Region-wise, Europe is anticipated to dominate the market with the largest share during the forecast period. Barley has been a staple crop in Europe agriculture for centuries, leading to a well-established infrastructure for barley cultivation, processing, and distribution across the region. This extensive agricultural network enables Europe to produce significant quantities of barley, including barley flour, to meet domestic and international demand. In addition, Europe's strong tradition of baking and culinary excellence has created a robust market for barley flour in various food products, including bread, pastries, and snacks.

Furthermore, strict regulations and standards regarding food safety and quality control in Europe contribute to consumer confidence in barley flour products originating from the region. These regulations ensure that barley flour meets high standards of purity, nutritional content, and labeling accuracy, enhancing its appeal both domestically and in export markets in Europe.

Competitive Analysis

The key players include Bob’s Red Mill Natural Foods, Inc., Ardent Mills, Cereal & Malt, Bio-Kinetics, Shiloh Farms, Great River Organic Milling, Mirfak Pty Ltd., Richardson Milling (UK) Ltd, FairhavenMill, and To Your Health Sprouted Flour Co.

Several well-known and up-and-coming brands are competing for market dominance in the expanding barley flour industry. Smaller, niche firms have become more well-known for catering to consumer demands and tastes. Large conglomerates, however, control most of the market and often buy creative start-ups to broaden their product lines.

Private label brands created by merchants and e-commerce platforms are another aspect of the competitive market. While they provide more affordable options, they might have different recognition or range of products than well-known companies. An important competition component is innovation in formulations, ingredient sourcing, and sustainability policies. Brands that are able to change the tastes of their target market and align with their ethical and environmental values have an advantage over rivals.

Recent Developments in Barley Flour Market

- In Dec, 2021 – Ardent Mills, the premier flour-milling and ingredient company, announced that it has successfully completed the acquisition of substantially all the business assets of Firebird Artisan Mills, a leading gluten-free, specialty grain and pulse milling company. Over the next several months the Firebird Artisan Mills brand and products will be fully integrated into Ardent Mills as the company continues to bolster its emerging nutrition offerings.

- In July, 2023 – Richardson Malting (UK) Limited, a subsidiary of Richardson International Limited (‘Richardson’), announced that it has successfully acquired Ragleth Limited, the parent organization of Anglia Maltings (Holdings) Limited (‘Anglia Maltings’).

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the barley flour market analysis from 2022 to 2032 to identify the prevailing barley flour market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the barley flour market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global barley flour market trends, key players, market segments, application areas, and market growth strategies.

Barley Flour Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 2.4 billion |

| Growth Rate | CAGR of 5.5% |

| Forecast period | 2022 - 2032 |

| Report Pages | 289 |

| By Product Type |

|

| By Application |

|

| By Distribution Channel |

|

| By Region |

|

| Key Market Players | Bio-Kinetics, Richardson Milling (UK) Ltd, Shiloh Farms, FairhavenMill, Bob’s Red Mill Natural Foods, Inc., Great River Organic Milling, Cereal & Malt, Mirfak Pty Ltd., To Your Health Sprouted Flour Co., Ardent Mills |

Analyst Review

Consumers are increasingly choosing barley flour due to its rich nutritional profile, including high fiber content and essential minerals. In addition, as more people adopt gluten-free diets, barley flour offers a viable alternative, catering to individuals with celiac disease or gluten sensitivities. Its versatility in baking and cooking applications, coupled with its unique flavor and texture, makes it an appealing choice for those seeking wholesome and flavorful ingredients for their culinary creations.

Moreover, the growing awareness for barley flour in the international market is driven by increasing recognition of its nutritional benefits and versatility. With rising interest in whole-grain alternatives, consumers are seeking out barley flour for its high fiber content and rich array of vitamins and minerals. In addition, heightened awareness of gluten-related issues has expanded the market for barley flour as a gluten-free option. Culinary influencers and food manufacturers are also promoting barley flour's unique flavor profile and diverse culinary applications, further boosting its visibility and appeal on the global stage.

Furthermore, there are lucrative growth opportunities for the barley flour industry in the global market. Rise in demand for nutritious and sustainable food options has positioned barley flour as a wholesome alternative to refined flours. Also, rise in gluten-free diets globally has expanded the market for barley flour, catering to individuals with celiac disease or gluten sensitivities. In addition, the versatility of barley flour in various culinary applications, coupled with its unique flavor and texture, has garnered attention from consumers and food manufacturers globally. Moreover, efforts to promote barley flour's health benefits, culinary versatility, and sustainability credentials are enhancing its visibility and market potential on a global scale.

The global barley flour market was valued at $1.4 billion in 2022, and is projected to reach $2.4 billion by 2032

The global Barley Flour market is projected to grow at a compound annual growth rate of 5.5% from 2023 to 2032 $2.4 billion by 2032

To Your Health Sprouted Flour Co., Cereal & Malt, FairhavenMill, Shiloh Farms, Mirfak Pty Ltd., Bio-Kinetics, Great River Organic Milling, Richardson Milling (UK) Ltd, Bob’s Red Mill Natural Foods, Inc., Ardent Mills

Region-wise, Europe is anticipated to dominate the market with the largest share during the forecast period.

Growth In Health Awareness, Diverse Culinary Applications, Functional Properties

Loading Table Of Content...

Loading Research Methodology...