Batter and Breader Premixes Market Outlook - 2025

The global batter and breader premixes market was valued at $1,155.7 million in 2017 and is expected to grow at a CAGR of 5.9% to reach $1,819.3 million by 2025.

Batter and breader premixes are food coating that can be applied on meat, poultry, vegetables, fish, and seafood in order to improve its taste, texture, and maintain its moisture level while frying or grilling. Batter is typically a thin coating to retain the moisture of food during deep frying. It is a mixture of flour and liquids such as water, milk, or eggs. Moreover, it can also be prepared by soaking grains in water or other liquid and grinding them. Leavening agents, such as baking powder, are used with batters to aerate or increase fluffiness. Occasionally, beer is also used to achieve enhanced fluffiness. Breader also known as breading is made using cereal-flour-based blends or thermally processed wheat-flour dough-based dry bread crumbs. They often contain seasonings and chemical leavening agents and are applied as coatings to fried or baked foods to obtain desired texture.

The global batter and breader premixes market is driven by the increase in demand for ready-to-cook meals and processed meat products among consumers. Convenience food such as packaged or processed meat & seafood is one of the major segments in batter and breader premixes market. The consumption of processed meat & seafood is growing at a significant pace all around the globe, which, positively influences the growth of the batter and breader premixes market during the forecast period. Moreover, rapid adoption of fast food culture coupled with rise in number of fast food outlets and quick service restaurant fuel the growth of this market. However, volatile raw materials cost is expected to be the key restraint for the market growth throughout the forecast period. Batter and breader premixes industry players are developing new and innovative products such as gluten and Genetically Modified Organism (GMO) free batter and breader premixes in order to cater the specific need of the consumer regarding healthy and better-quality food, which are expected to provide opportunities for the batter and breader premixes market growth in the future.

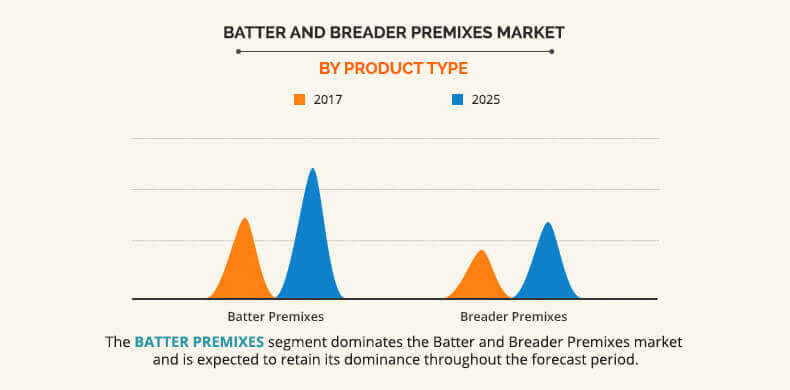

In 2017, by product type, the batter premixes segment had the highest share in the batter and breader premixes market and is expected to retain its dominance across the forecast period. Batters are an essential ingredient used in the preparation of deep-fried food across various food outlets. Fried food being the major attraction for such food outlets it is imperative that the demand for batter is high all around the world. Moreover, batter is also an essential ingredient in many convenience foods such as ready to eat meals and, thus, accounts for a higher Batter and Breader Premixes Market share. The breader segment is expected to have higher CAGR in the product type segment and is expected to garner greater share in the future with the increase in number of fast food outlets and quick service restaurants.

Based on application, the meat segment accounted for the highest share in the batter and breader premixes market in 2017. This dominance in the share is due to rise in consumption of meat and meat products all around the world. The meat segment is also driven by the trend of healthy eating. This is because meat is readily available and is dense in micro and macronutrients and owing to this property it is widely being consumed by a wide range of customers to promote good health. Vegetable segment is expected to grow at the highest CAGR of 6.5% during the forecast period due to adoption of veganism and restrictions over consumption of certain meat products in some countries.

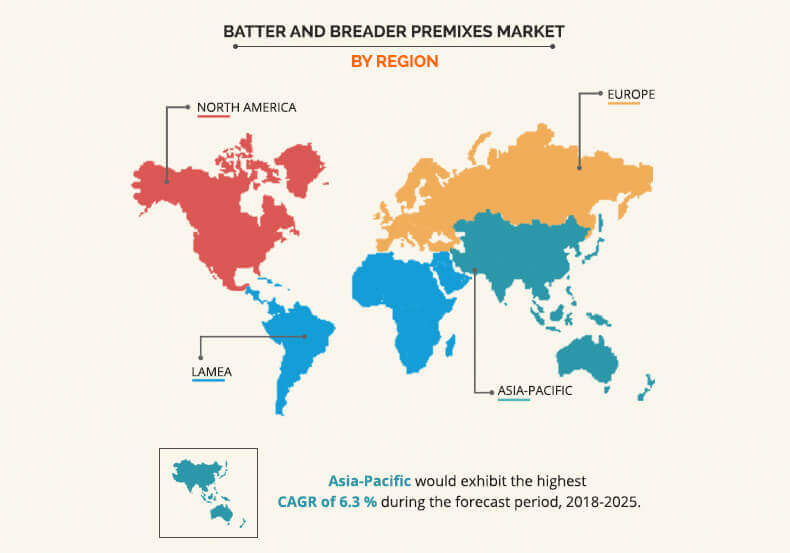

In 2017, North America is expected to remain dominant region in the batter and breader premixes market followed by Asia-Pacific.This high market share is attributed to higher consumption of meat, poultry, and fried food in the region. In addition, North America is a mature region with higher number of fast food outlets and quick service restaurants, which further boosts the growth of the batter and breading premixes market. However, Asia-Pacific is expected to grow at the highest CAGR of 6.3% throughout the forecast period.

The meat segment is expected to dominate the application segment in the Batter and breader premixes market owing to higher consumption of fried and packaged meat all around the world. Moreover, meat is rich in micro and macro nutrient and due to the busy lifestyle people have turned to consuming more processed meat, which has further added to the popularity of meat in restaurants and food outlets. This in turn has positively affected the market of Batter and breader premixes.

Popular Asian cuisines such as prawn tempura, and sushi requires Batter and breader premixes to enhance characteristics such as taste, size, and texture. Asia-Pacific is one of the largest meat markets owing to high Use of meat products in many of the countries in this region. In the past few years, the annual meat consumption has increased for most of the economies, which has resulted in higher sales of fish and seafood products, which in turn marks the growth of the Batter and breader premixes market.

The poultry sector has undergone major structural changes during the past two decades due to the introduction of modern intensive production methods, genetic improvements, improved preventive disease control and biosecurity measures, increase in income and human population, and urbanization. These changes offer tremendous. opportunities for poultry producers, particularly smallholders, to improve their farm income.

The key players in the batter and breader premixes market focused on acquisition and new product launch as the key strategies to overcome competition and improve their share in the world market. The key players profiled in the report include Archer-Daniels-Midland Company, Bowman Ingredients, Cargill Inc, Coalescence LLC, Dutch Protein & Services B.V., Ingredion Incorporated, Kerry Group PLC, McCormick & Company, Inc, Newly Weds Food, Inc., and Solina Group.

Key Benefits for Batter And Breader Premixes Market:

- The report provides a quantitative analysis of the current batter and breader premixes market trends, estimations, and dynamics of the market size from 2018 to 2025 to identify the prevailing batter and breader premixes market opportunity.

- The key countries in all the major regions are mapped based on their market share.

- Porters five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplierbuyer network.

- In-depth analysis and the batter and breader premixes market size and segmentation assists in determining the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global industry. Market player positioning segment facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes revenue generated from the sales of the batter and breader premixes market forecast across North America, Europe, Asia-Pacific, and LAMEA.

- The report includes the batter and breader premixes market analysis at regional as well as the global level.

Batter and Breader Premixes Market Report Highlights

| Aspects | Details |

| By Product Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | Cargill Inc., McCormick & Company, Inc, Bowman Ingredients, Coalescence LLC, Kerry Group PLC, Archer-Daniels-Midland Company, Dutch Protein & Services B.V., Ingredion Incorporated, Solina Group, Newly Weds Food, Inc. |

Analyst Review

Batter and breader premixes are food coatings used as an ingredient while preparing deep-fried foods.

Based on the interviews of various top-level CXOs of leading companies, rise in the demand for convenience meat and seafood products has been the major factor driving the growth of the batter and breader premixes market. This rise in demand is attributed to busy lifestyle and increase in disposable income of consumer all around the world.

There has been a rise in the number of fast food outlets and quick service restaurants. These food outlets often use batter and breader as food coating to prepare deep fried food. Therefore, increase in the number of fast-food outlets and quick service restaurants positively impact the growth of the batter and breader premixes market.

However, the varying prices of raw materials used to manufacture batter and breader hinder the growth of the market and act as the major restraint for this industry.

The global batter and breader premixes market was valued at $1,155.7 million in 2017 and is expected to reach $1,819.3 million by 2025.

The global Batter and Breader Premixes market is projected to grow at a compound annual growth rate of 5.9% to reach $1,819.3 million by 2025.

Cargill Inc., Ingredion Incorporated, Bowman Ingredients, Kerry Group PLC, Coalescence LLC, McCormick & Company, Inc, Newly Weds Food, Inc., Dutch Protein & Services B.V., Solina Group, Archer-Daniels-Midland Company

North America is expected to remain dominant region in the batter and breader premixes market

Increase in demand for ready-to-cook meals and processed meat products among consumers, rise in adoption of fast food culture coupled with growth in number of fast food outlets and quick service restaurants all around the world have fueled the growth of the global batter and breader premixes market.

Loading Table Of Content...