Bauxite Mining Market Size & Insights:

The global bauxite mining market size was valued at $18.1 billion in 2022, and is projected to reach $26.9 billion by 2032, growing at a CAGR of 4.1% from 2023 to 2032. The growth of the bauxite mining market is driven by increasing demand for aluminum production and expanding construction and infrastructure projects. As aluminum is a key material in construction, automotive, and packaging industries due to its lightweight and durable properties, there is an increased demand for bauxite, its primary ore. This growth is further supported by large-scale infrastructure developments globally, thus fueling the need for more bauxite extraction

Report Key Highlighters:

The bauxite mining market is fragmented in nature with few players such as Alcoa Corporation, Rio Tinto, Rusal, Norsk Hydro ASA, NALCO India, Hindalco Industries Ltd., Emirates Global Aluminium PJSC, south32, Aluminum Corporation of China Limited (CHALCO), and Tata Steel Group, which hold a significant share of the bauxite mining industry.

The report provides complete analysis of the market status across key regions and more than 15 countries across the globe in terms of value ($ Million).

Top winning strategies are analyzed by performing a thorough study of the leading players in the cristobalite market. Comprehensive analysis of recent developments and growth curves of various companies helps us to understand the growth strategies adopted by them and their potential effect on the bauxite mining market forecast.

The report provides competitive dynamics by evaluating business segments, product portfolios, target market revenue, geographical presence and key strategic developments by prominent manufacturers.

How to Describe Bauxite Mining

Bauxite mining is the process of extracting bauxite ore, which is the primary source of aluminum. Bauxite is a sedimentary rock that is rich in aluminum minerals, particularly gibbsite, boehmite, and diaspore. The aluminum extracted from bauxite ore is used in a wide range of industrial and consumer products, including aluminum metal, aluminum compounds, and aluminum-based products.

The primary driver of bauxite mining market growth is the global demand for aluminum products. Aluminum is a versatile and lightweight material used in various industries, including automotive, aerospace, construction, packaging, and consumer goods. As these industries continue to grow, the demand for aluminum and, by extension, bauxite, is likely to increase

Aluminum prices influence the profitability of bauxite mining. When aluminum prices are high, bauxite mining becomes more attractive, and companies invest in expanding their operations. However, volatile price fluctuations impact investment decisions.

The expansion of construction and infrastructure projects is a key driver for the growth of the bauxite mining market. Bauxite, the primary raw material for aluminum production, is in high demand due to its crucial role in manufacturing aluminum products used extensively in construction, such as windows, doors, roofing, and structural components. As of January 2023, the U.S. construction industry's revenue was valued at around $2.8 trillion, with a 12.8% increase from January 2022. The industry's revenue has risen at an annual rate of 2.7% from 2016 to 2021. As global urbanization and infrastructure development accelerate, particularly in emerging economies, the demand for aluminum continues to rise, thus driving the need for more bauxite extraction. Additionally, large-scale infrastructure projects, such as bridges, airports, and commercial buildings, require durable, lightweight materials such as aluminum, thereby further boosting bauxite mining activities. As reported by the India Brand Equity Foundation, India’s Smart Cities Mission is a key government initiative aimed at building over 100 smart cities to drive rapid urbanization. In the 2021-2022 budget, the mission received $864.5 million, a significant increase from $455.7 million in 2020-2021. This trend contributes significantly to the market's expansion, as the construction sector increasingly relies on aluminum for sustainable and long-lasting solutions.

However, the extraction and refining of bauxite ore into aluminum are energy-intensive processes. The energy required for the Bayer Process and aluminum smelting contributes to high energy consumption, which is a disadvantage when energy costs are high. Some countries or regions heavily dependent on bauxite mining face economic vulnerabilities. Their economies become overly reliant on the aluminum industry, leaving them susceptible to fluctuations in aluminum prices and market demand. This factor is projected to restrain market growth.

Collaborative efforts among mining companies, local communities, and governments lead to mutually beneficial partnerships. Such partnerships enhance the social and economic development of mining regions. Investments in technologies and practices for remediating & rehabilitating mined areas have created opportunities for companies specializing in land reclamation and environmental restoration. These factors are anticipated to offer remunerative opportunities for the bauxite mining market during the forecast period.

Bauxite Mining Market Segment Review:

The bauxite mining market is segmented on the basis of type, application, and region. On the basis of type, the market is categorized metallurgy and refractory. By application, it is segregated into alumina for metallurgical purposes, abrasives, refractory, cement, and others. Region-wise, the market is studied across North America, Europe, Asia-Pacific, and LAMEA.

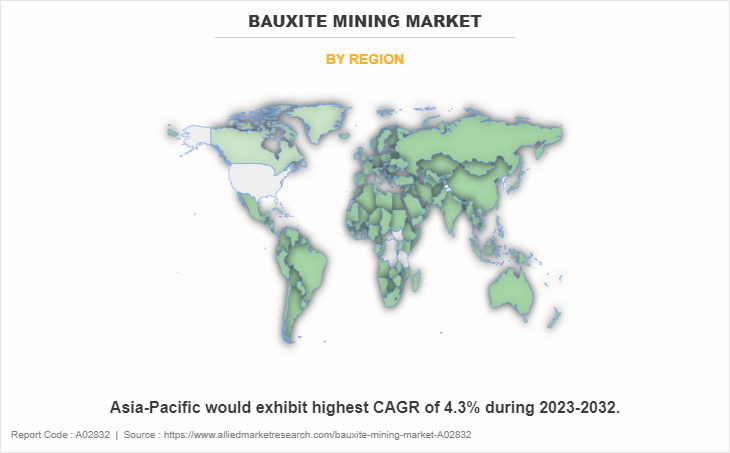

Bauxite Mining Market By Region

The Asia-Pacific bauxite mining market size is projected to grow at the highest CAGR of 4.3% during the forecast period of bauxite mining market share in 2022. Increasing population-driven electricity consumption, expanding industrial expansion, and increased demand for automobiles are the region's primary drivers. The development of advanced aluminum alloys for a wide range of applications is anticipated to get substantial investment. The expanding expenditure in the construction and infrastructure industry are expected to increase the demand for bauxite mining.

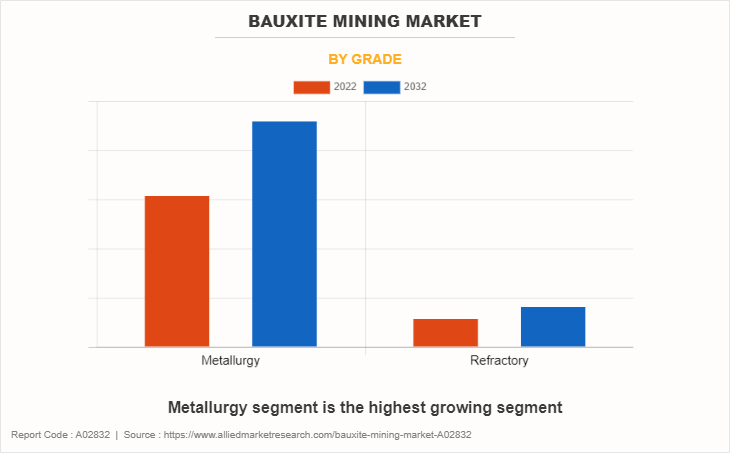

Bauxite Mining Market By Grade

By grade, the metallurgy segment dominated the global market in 2022, and is anticipated to grow at a CAGR of 4.1% during the forecast period. The primary driver for metallurgical bauxite mining is the demand for aluminum metal. As the global economy continues to expand, the demand for aluminum products in industries such as automotive, aerospace, construction, packaging, and electrical engineering is expected to grow, driving the need for metallurgical bauxite.

Metallurgical grade bauxite is a crucial raw material in the aluminum smelting industry. It is used to produce aluminum metal through the Hall-Héroult process. The growth of aluminum smelting facilities, particularly in regions with abundant bauxite resources, is expected to contribute to market expansion.

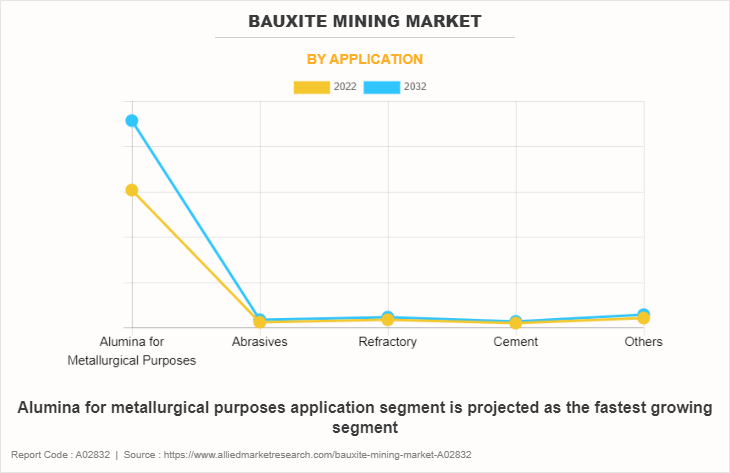

Bauxite Mining Market By Application

In 2022, the alumina for metallurgical purposes segment was the largest revenue generator. Economic growth and industrial development in regions with significant aluminum consumption have a direct impact on market growth. Regions like China, India, and Southeast Asia are key drivers. While primary aluminum production relies on alumina from bauxite, recycling of aluminum scrap reduce the demand for primary alumina. Market growth is influenced by trends in aluminum recycling rates.

Investment in transportation and logistics infrastructure, including ports and railways, facilitate the efficient movement of alumina from refining facilities to aluminum smelters and export markets. Responsible mining and refining practices, as well as adherence to environmental regulations, are increasingly important in the alumina production industry. Companies that prioritize sustainable practices benefit from their commitment to environmental responsibility.

Which are the Leading Companies in Bauxite Mining:

The global bauxite mining market profiles leading players that include Anhui Sealong Biotechnology Co., Ltd., Bartek Ingredients Inc., Changmao Biochemical Engineering Company Limited., FUSO CHEMICAL CO., LTD., ISEGEN South Africa (Pty) Ltd., POLYNT SPA, Prinova Group LLC., Thirumalai Chemicals Ltd., YONGSAN CHEMICALS, INC., and Hydro Alunorte. In the bauxite mining market, companies have signed contracts to expand the market. For instance, in February 2023, Hydro Alunorte and Wave Aluminium signed a contract to construct a facility in Brazil for processing bauxite residue. The plant will focus on extracting commercially valuable materials, thus promoting sustainability and resource recovery in the bauxite industry. The global bauxite mining market report provides in-depth competitive analysis as well as profiles of these major players.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the bauxite mining market analysis from 2022 to 2032 to identify the prevailing bauxite mining market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the bauxite mining market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global bauxite mining market trends, key players, market segments, application areas, and bauxite mining market growth strategies.

Bauxite Mining Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 26.9 billion |

| Growth Rate | CAGR of 4.1% |

| Forecast period | 2022 - 2032 |

| Report Pages | 380 |

| By Grade |

|

| By Application |

|

| By Region |

|

| Key Market Players | Hindalco Industries Ltd., Norsk Hydro ASA, Alcoa Corporation, South32, Aluminum Corporation of China Limited (CHALCO), Rio Tinto, Emirates Global Aluminium PJSC, RusAL, Tata Steel Group, NALCO India. |

Analyst Review

According to CXOs of leading companies, the global bauxite mining market is expected to exhibit high growth potential. The bauxite mining industry is expected to continue growing in response to the increasing demand for aluminum, particularly in the automotive and aerospace sectors. Bauxite mining have environmental impacts, including habitat disruption, deforestation, and water pollution. Sustainable mining practices and environmental regulations are becoming increasingly important for industry. In addition, there is a growing focus on sustainable and responsible mining practices within the industry.

Alcoa Corporation, Rio Tinto, Rusal, Norsk Hydro ASA, NALCO India, Hindalco Industries Ltd., Emirates Global Aluminium PJSC, South 32, Aluminum Corporation of China Limited (CHALCO), and Tata Steel Group

The bauxite mining market is segmented on the basis of grade application, and region. By grade, metallurgy, and refractory. By application, it is segregated into alumina for metallurgical purposes, abrasives, refractory, cement, and others. Region-wise, the market is studied across North America, Europe, Asia-Pacific, and LAMEA.

he bauxite mining market was valued at $18.1 billion in 2022, and is estimated to reach $26.9 billion by 2032, growing at a CAGR of 4.1% from 2023 to 2032.

Alumina for metallurgical purposes is the leading application of bauxite mining market.

Bauxite mining is the process of extracting bauxite ore from the earth's crust. Bauxite is a rock that is primarily composed of various aluminum-containing minerals, with gibbsite, boehmite, and diaspore being the most common minerals in bauxite deposits. Bauxite is the primary source of aluminum, and the extraction of aluminum from bauxite is a critical step in the aluminum production process.

To mitigate supply chain risks, aluminum producers and consumers may seek to diversify their sources of bauxite. This trend involves exploring and developing new mining sites to reduce dependency on a specific region.

Asia-Pacific is the largest regional market for Bauxite Mining.

Loading Table Of Content...

Loading Research Methodology...