Beverage Stabilizer Market Outlook - 2025

Beverage stabilizers are additives that prevent degradation in beverages. They also help prevent sedimentation by keeping additional ingredients suspended in the solution. Beverage stabilizers also add viscosity to enhance flavor and improve consistency of a beverage. Modified starch, pectin, carrageenan, casein inulin, and hydrocolloids are among the most commonly use beverage stabilizers. The worldwide demand for beverage stabilizers is on the rise, which is governed by the performance quality and functionality of the products. Increase in demand for beverage stabilizers is one of the factors that supports market development and significant innovation. The beverage stabilizer market size was valued at $1,358.7 million in 2018, and is expected to garner $1,938.2 million by 2025, registering a CAGR of 6.1% from 2018 to 2025. The xanthan gum segment was the highest contributor to the global Beverage Stabilizer Market share, with $360.2 million in 2017, and is estimated to reach $611.0 million by 2025, at a CAGR of 6.6% during the forecast period.

There has been a rise in the number of quick service restaurants (QSRs) all around the world owing to increase in affinity of consumers toward fast food. Many fast food restaurants depend on beverage stabilizer to prolong the shelf life and improve visual appeal of food items. Thus, the surge in the number of QSRs and the development of the food & beverage industry are the major factors that drive the growth of the global beverage stabilizer market. Moreover, the usage of beverage stabilizers has increased due to the rise in the consumption of packaged and convenience goods around the world. This has also been a top impacting factor that drives the beverage stabilizers market demand. However, volatile prices of raw materials used in the production of beverage stabilizers majorly restrict the market growth. On the contrary, rise in consumption of functional beverages is expected to open avenues for the growth of the beverage stabilizer market in future.

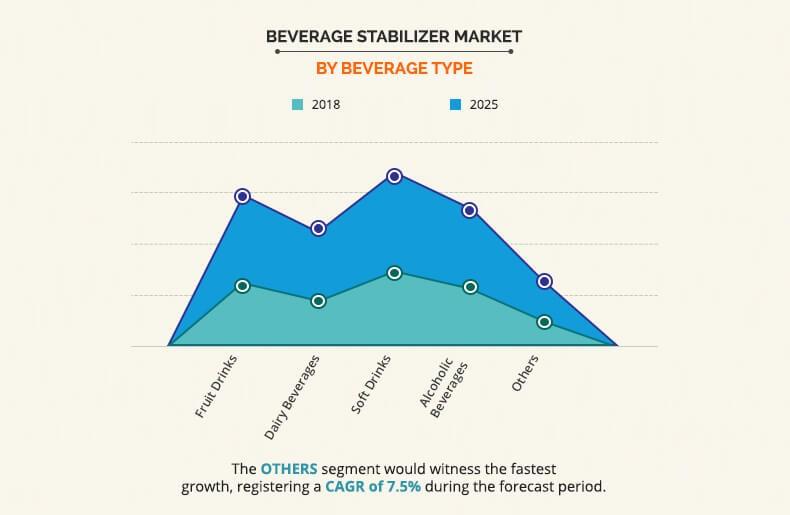

The report segments the global beverage stabilizer market based on product type, beverage type, and region. Based on product type, the market is divided into gum Arabic, carboxymethyl cellulose, xanthan gum, carrageenan, pectin, and others. Based on beverage type, the market is classified into fruit drinks, dairy beverages, soft drinks, alcoholic beverages, and others. Based on region, it has been studied and analyzed across North America, Europe, Asia-Pacific, and LAMEA.

According to the global beverage stabilizers market analysis, in 2018, the xanthan gum segment accounted for the highest share in the product type segment. Increase in usage of xanthan gum as an effective thickening agent and stabilizer to prevent separation of the ingredients in the food industry drives the beverage stabilizer market growth. Furthermore, development of the food industry also fuels the growth of the xanthan gum segment. The xanthan gum segment was the fastest growing segment in 2018 and is expected to witness substantial growth with a CAGR of 6.6% throughout the forecast period.

In 2018, the soft drinks classification in the beverage type segment dominated the beverage stabilizer market. This was attributed to increase in consumption of aerated drinks all around the world. However, the others segment is projected to grow at the highest CAGR of 7.5% throughout the forecast period. This was attributed to increased disposable income and rise in affinity of consumers to spend on packaged or convenient goods. Moreover, development of the beverage industry also helps achieve a high growth rate.

In 2018, Asia-Pacific dominated the beverage stabilizer market owing to the presence of large number of quick service restaurants (QSRs) and increase in dependency on convenience goods in this region. The advancement in retail infrastructure has allowed companies that produce packaged or convenience goods to easily make its product available to the customers, which in turn helps increase the overall sales of such products. This in turn boosts the beverage stabilizer market growth.

Players in the beverage stabilizer market have adopted acquisition as their key strategy to increase their market share and to remain competitive in the market. The leading players in the beverage stabilizer industry have also focused on acquisition and business expansion as their key strategies to gain a significant market share globally. The key players profiled in the report include Archer Daniels Midland Company, Ashland Global Holdings Inc., Cargill, Incorporated, CP Kelco, DowDuPont Inc., Ingredion, Inc., Kerry Group, Palsgaard A/S, Tate & Lyle Plc., and Royal DSM.

The other market players (not profiled in this report) include Acatris, BASF, Glanbia Nutritionals, Nexira, W.R. Grace & Co., Advanced Food Systems Inc., Chemelco International Bv, Lanxess Deutschland GmbH, Silvateam S.p.a., TIC Gums, Inc., and Brisan Group.

Key Benefits for Beverage Stabilizer Market:

- The report provides a quantitative analysis of the current beverage stabilizer market trends, estimations, and dynamics of the market size from 2017 to 2025 to identify the prevailing market opportunities.

- Porter’s five forces analysis highlights the potency of the buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier–buyer network.

- The report includes revenue generated from the sales and beverage stabilizer market and its forecast across North America, Europe, Asia-Pacific, and LAMEA.

- In-depth analysis of market size and segmentation assists in determining the prevailing beverage stabilizer market opportunities.

- Market player positioning segment facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the market analysis at regional as well as the global level, key players, market segments, application areas, and growth strategies.

- Competitive intelligence of the industry highlights the business practices followed by key players across geographies and the prevailing beverage stabilizer market opportunities.

Beverage Stabilizer Market Report Highlights

| Aspects | Details |

| By Product Type |

|

| By BEVERAGE TYPE |

|

| By Region |

|

| Key Market Players | Cargill Inc, Ashland Global Holdings Inc, Palsgaard A/S, Royal DSM N.V, J.M. Huber Corporation (CP Kelco ApS), Ingredion Incorporated, Kerry Group PLC (Kerry Group), DowDuPont, Tate & Lyle PLC. (Tate & Lyle), Archer-Daniels-Midland Company (ADM) |

Analyst Review

Beverage stabilizers are additives that prevent degradation in beverages. Globally, the beverage stabilizer market share is estimated to escalate at a higher growth rate due to increase in demand from the food and beverage industry.

Based on the interviews of various top-level CXOs of leading companies, the increase in sale of beverage stabilizer is driven by a rise in the number of QSRs and growth of the food & beverage industry globally. Furthermore, the usage of beverage stabilizers has also increased due to the rise in the consumption of packaged and convenience goods around the world. This factor majorly drives the growth of the beverage stabilizer market. Moreover, manufacturers across various regions focus on improving their existing products to cater to the requirements of the consumers. This in turn increases the demand for beverage stabilizer. Asia-Pacific was among the dominating regions holding a major share in the beverage stabilizer market in terms of value in 2018 and was closely followed by Europe and North America, respectively.

However, as per CXOs perspectives, volatile raw material prices and stringent government norms act as the major restraint for the growth of the global beverage stabilizer market

The beverage stabilizer market size was valued at $1,358.7 million in 2018, and is expected to garner $1,938.2 million by 2025,

The global Beverage Stabilizer market is projected to grow at a compound annual growth rate of 6.1% from 2018 to 2025 $1,938.2 million by 2025,

Ingredion Incorporated, Ashland Global Holdings Inc, Kerry Group PLC (Kerry Group), Tate & Lyle PLC. (Tate & Lyle), DowDuPont, Cargill Inc, Palsgaard A/S, J.M. Huber Corporation (CP Kelco ApS), Archer-Daniels-Midland Company (ADM), Royal DSM N.V

Asia-Pacific

Surge in number of quick service restaurants (QSRs), ever-evolving food & beverage industry, and increase in the consumption of packaged and convenience goods drive the growth of the market.

Loading Table Of Content...