Biometric Payment Market Research, 2033

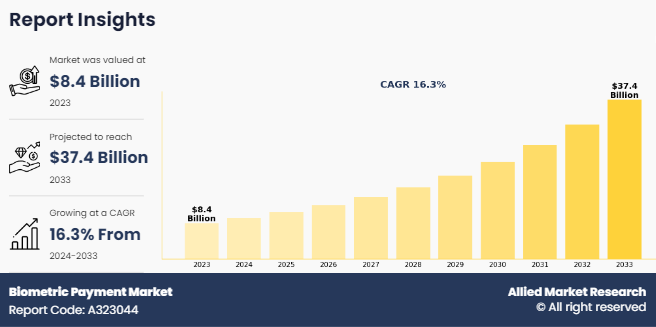

The global biometric payment market was valued at $8.4 billion in 2023, and is projected to reach $37.4 billion by 2033, growing at a CAGR of 16.3% from 2024 to 2033.

Biometric payment is a point-of-sale (POS) technology that involves using unique physical or behavioral attributes, such as fingerprints or facial recognition, to authenticate transactions securely. There has been increased adoption of biometric payment in recent years because it is generally considered more secure than password- or PIN-based systems. Biometric payment may be used for in-person and online transactions.

Key Takeaways of Biometric Payment Market Report

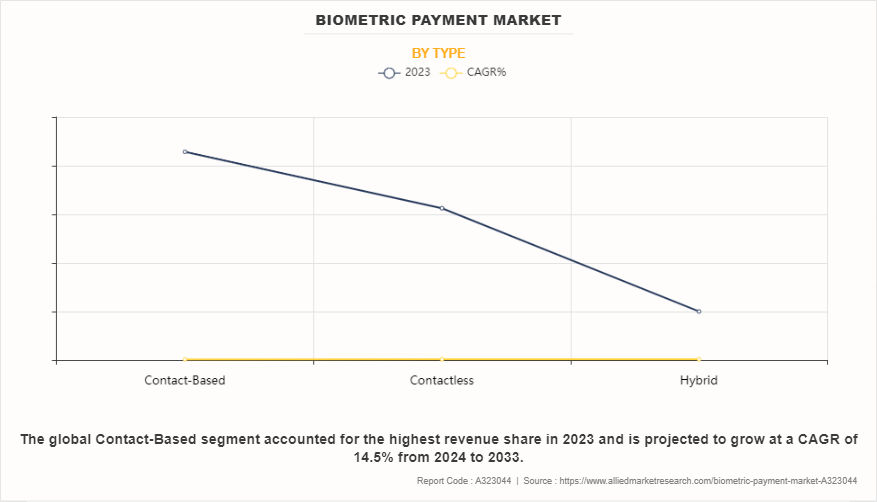

- On the basis of type, the contact-based segment dominated the biometric payment market size in terms of revenue in 2023.

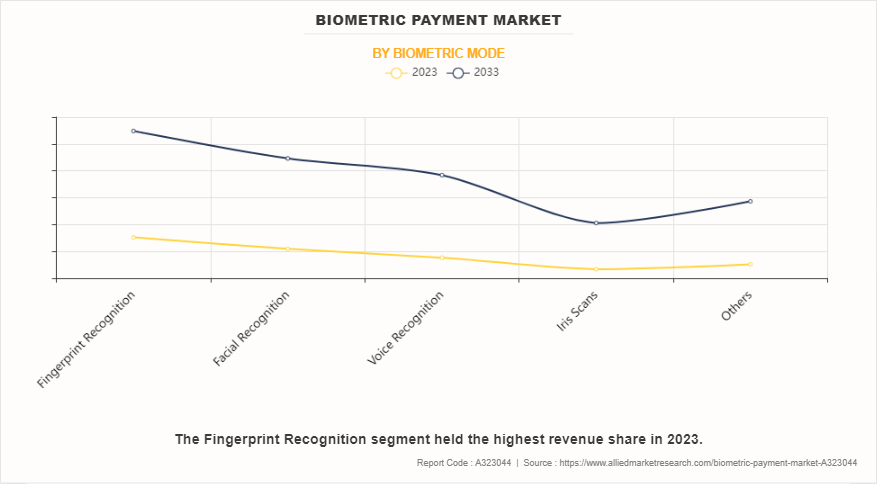

- On the basis of biometric mode, the fingerprint recognition segment dominated the biometric payment market in terms of revenue in 2023.

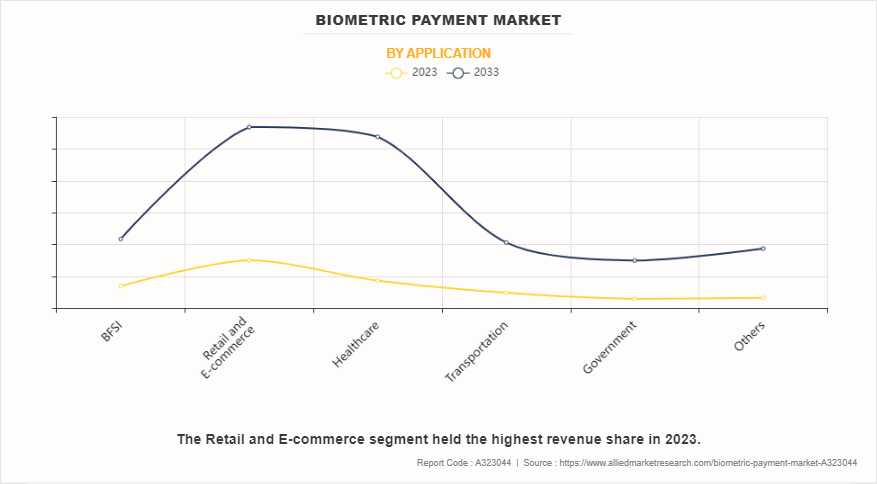

- On the basis of application, the healthcare segment is anticipated to grow at the fastest CAGR during the forecast period.

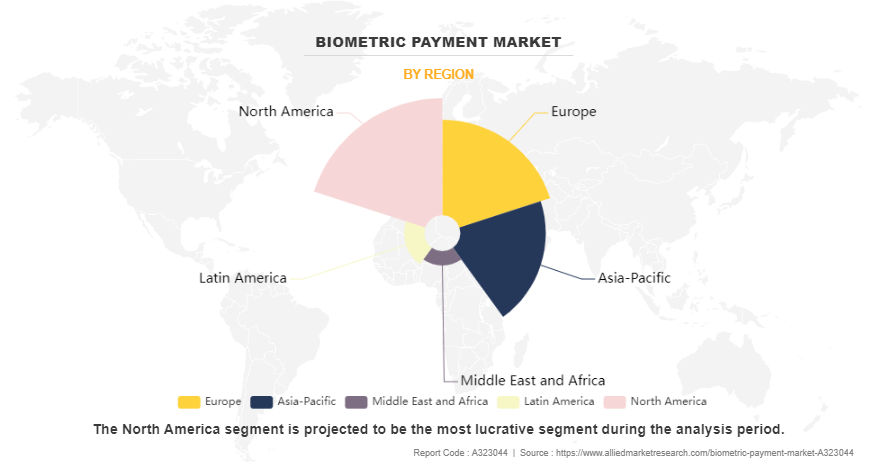

- Region wise, North America region dominated the biometric payment market in terms of revenue in 2023. However, the market in Asia-Pacific is anticipated to grow at the highest CAGR during the forecast period.

The growth of the biometric payment market is driven by the increasing demand for secure and convenient payment methods which is a major driver propelling the adoption of biometric payment systems. Traditional authentication methods face vulnerabilities such as identity theft and fraud, leading to a surge in the adoption of biometric payment systems that offer a higher level of security by leveraging technologies such as fingerprint recognition, iris recognition, facial recognition, voice recognition, and others. Furthermore, the growing penetration of smartphones equipped with biometric sensors and the rise of wearable biometric devices are further driving the growth of the biometric payment market as consumers seek seamless and hassle-free payment experiences. Moreover, factors such as financial inclusion, government initiatives, and the escalating threat of cybersecurity contribute to the expansion of the biometric payment market globally. However, privacy and data security concerns, as well as operational challenges related to privacy, security, and ROI, hinder the widespread adoption of biometric payment solutions and influence decision-making processes within the biometric payment market. On the contrary, opportunities are emerging in the market such as the rising use cases and formats of authentication devices and government initiatives promoting financial inclusion. These opportunities present avenues for growth and innovation within the biometric payment market, offering potential for expansion and development.

Market Dynamics

Increase in smartphone usage

The increasing use of smartphones equipped with biometric sensors has led to a surge in the adoption of biometric payment systems. Consumers are seeking seamless and hassle-free payment experiences, and biometric payment solutions offer a higher level of security by leveraging technologies such as fingerprint recognition, iris recognition, facial recognition, and voice recognition. Furthermore, the proliferation of mobile phone use has contributed to the growth of the biometric payment market. The widespread use of smartphones has created a conducive environment for the adoption of biometric payment solutions, as consumers increasingly rely on mobile devices for their financial transactions.

Rise in cybersecurity threats

The escalating threat of cybersecurity is a significant driver behind the growth of the biometric payment market. As hackers employ sophisticated methods to trick and bypass biometric technology, the need for enhanced security measures becomes paramount. Biometric payment systems offer a higher level of security by leveraging technologies such as fingerprint recognition, iris recognition, facial recognition, and voice recognition, making them more resilient to cyber threats. Moreover, the surge in cyberattacks targeting traditional payment methods has underscored the importance of adopting biometric authentication to enhance transaction security and protect against fraud. This growing threat landscape has propelled the adoption of biometric payment systems as one of the most effective tools available to authenticate and protect individuals' identities throughout the payment process.

Increase in demand for secure and convenient payment methods

The rising concerns regarding identity theft and fraud have led to a surge in the adoption of biometric payment solutions, as they offer advanced security features and utilize unique biological traits that are challenging to duplicate. Traditional payment methods, such as passwords and PINs, are increasingly perceived as vulnerable to hacking and unauthorized access, making biometric payment systems a more secure alternative. In addition, the widespread usage of smartphones and other mobile devices has revolutionized the payment landscape, with mobile wallets and contactless payment solutions gaining popularity due to their convenience and speed. Biometric payment technology seamlessly integrates with these devices, enabling users to authorize transactions using fingerprints, facial recognition, or other biometric data. This eliminates the need for physical cards or PINs, streamlining the payment process and enhancing the overall user experience, hence, driving the biometric payment market opportunity.

Segment Review

The biometric payment market is segmented into type, biometric mode, application, and region. On the basis of type, the market is divided into contact-based, contactless, and hybrid. As per biometric mode, the biometric payment market is categorized into fingerprint recognition, facial recognition, voice recognition, iris scans, and others. On the basis of application, the market is differentiated into BFSI, retail and e-commerce, healthcare, transportation, government, and others. Region wise, the biometric payment market is analyzed across North America (the U.S., and Canada), Europe (the UK, Germany, France, Italy, Spain, and rest of Europe), Asia-Pacific (China, Japan, India, Australia, South Korea, and rest of Asia-Pacific), Latin America (Brazil, Argentina, and rest of Latin America), and Middle East and Africa (GCC Countries, South Africa, and rest of Middle East and Africa).

By type, the contact-based segment held the highest biometric payment market share in 2023. This is attributed to the fact that contact-based biometric payment systems offer enhanced security, reduce the risk of fraud, and provide a seamless user experience, which is driving their growth in the market. However, the contactless segment is expected to be the fastest-growing segment during the forecast period. This is attributed to the fact that the growing number of people using the contactless payment method, which increases security and shortens transaction processing time, is a significant factor driving the biometric payment market growth.

By biometric mode, the fingerprint recognition segment acquired a major share in 2023. This is attributed to the fact that as part of biometric payment systems, fingerprint authentication is widely adopted due to its reliability, security, and ease of use. This technology utilizes unique biological traits that are difficult to replicate, making it a preferred choice for secure transactions in an era where identity theft and fraud are on the rise. The convenience and security provided by fingerprint recognition have made it increasingly popular among consumers, especially with the widespread use of smartphones that integrate biometric authentication for payment systems, simplifying transactions and enhancing user experience. However, the iris scans segment is expected to be the fastest-growing segment during the forecast period. This is attributed to the high scalability, non-invasiveness, and stability offered by iris recognition technology. In addition, the accuracy and reliability of iris recognition, its high-security features, and its applications in various sectors such as healthcare, consumer electronics, automotive, and government contribute to the growth of this segment within the biometric payment market.

By application, the retail and e-commerce segment acquired a major share in 2023. This is attributed to the increasing adoption of contactless payment methods, the rise of e-commerce and digital payments, advancements in biometric technology for enhanced security, regulatory compliance, and the need to provide a better customer experience through secure and convenient payment solutions. However, the healthcare segment is expected to be the fastest-growing segment in the biometric payment market forecast period. This is attributed to the fact that the healthcare industry has unique requirements and challenges when it comes to implementing secure payment solutions, making biometric payment systems an attractive option for enhancing security and streamlining transactions within the healthcare sector.

Region-wise, North America dominated the biometric payment market in 2023. This is attributed to the heightened emphasis on security and fraud prevention which is driving the adoption of biometric payment systems as a more secure alternative to traditional methods. The escalating threat of cybersecurity has also played a significant role in propelling the demand for advanced authentication technologies such as biometrics, enhancing transaction security, and reducing the risk of fraud. Moreover, technological advancements enable biometric payment in North America to adopt innovative investment strategies, optimize portfolio management, and enhance operational efficiency, further fueling market expansion. However, Asia-Pacific is considered to be the fastest-growing region during the forecast period. This is attributed to the increasing prevalence of digitalization efforts and the rapid adoption of advanced technologies. The region's expanding middle class, coupled with a growing emphasis on secure payment solutions, has further fueled the demand for biometric payment systems. The Asia-Pacific region showcases immense growth potential in the biometric payment market, with increasing consumer awareness and acceptance of innovative payment methods driving this growth trajectory. The need for enhanced security measures and convenient payment solutions in both regions has been a significant driver behind the growth of the biometric payment market in North America and Asia-Pacific.

Competition Analysis

Competitive analysis and profiles of the major players in the biometric payment market include Fujitsu, NEC Corporation, Mastercard, Visa Inc., IDEMIA, Fingerprint Cards AB, Alibaba Group Holding Limited, VeriFone, Inc., Thales Group, and Google LLC. These players have adopted various strategies to increase their market penetration and strengthen their position in the industry.

Recent Developments in the Biometric Payment Industry

- In March 2024, Fingerprint Cards AB (Fingerprints) announced the first biometric payment card roll-out in Türkiye, supporting Thales, a worldwide leader in digital security, and Garanti BBVA and its customers. The launch marks Fingerprints’ and Thales’ eleventh commercial roll-out globally for biometric payment cards.

- In December 2023, FortressPay announced the launch of its biometric payment platform using the Amazon Web Services Independent Software Vendor (AWS ISV) program.

- In November 2023, Mastercard teamed with NEC to bring biometric checkout to the Asia-Pacific region. The partnership combines NEC’s facial recognition and liveness verification technology with Mastercard’s payment operations and comes as consumers and businesses are increasingly embracing biometrics.

- In September 2023, IDEX Biometrics and KL HI-TECH, a global card manufacturer and prominent provider of secure printing products and smart cards for central and state governments, joined forces to introduce biometric payment cards to the Indian market.

- In April 2023, TBHP Co Ltd., one of the largest bureau and service providers of cards in Vietnam, partnered with Zwipe to launch biometric payment cards in Vietnam. With this partnership, Zwipe provides commercialization support, expertise, and technical guidance to help TBHP integrate biometric payment cards into its portfolio.

- In January 2023, Ingenico revealed a palm vein biometric payment solution in partnership with Fujitsu Frontech North America, through its subsidiary Fulcrum Biometrics. The new solution is designed as part of Ingenico’s AXIUM line of Android payment terminals, and it provides contactless transactions while reducing queues with faster check-outs. It also minimizes fraud risk and streamlines the customer experience.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the biometric payment market analysis from 2024 to 2033 to identify the prevailing market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- The Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network on the biometric payment market outlook.

- In-depth analysis of the biometric payment market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as biometric payment market trends, key players, market segments, application areas, and market growth strategies.

Biometric Payment Market Report Highlights

| Aspects | Details |

| Forecast period | 2023 - 2033 |

| Report Pages | 436 |

| By Type |

|

| By Biometric Mode |

|

| By Application |

|

| By Region |

|

| Key Market Players | Google LLC, VeriFone, Inc., Fingerprint Cards AB, Visa Inc., Thales Group, Mastercard, NEC Corporation, IDEMIA, Fujitsu, Alibaba Group Holding Limited |

Analyst Review

According to PYMNTS, the adoption of palm biometric payments is gaining momentum across various sectors, especially by retailers, financial institutions, and tech firms. Leading the charge, Amazon introduced Amazon One Enterprise, a corporate iteration of its palm-based identity service tailored for authenticating employees and authorized individuals entering locations such as offices, airports, hotels, and educational facilities. By replacing traditional methods such as badges, fobs, PINs, and passwords, Amazon aims to address common security vulnerabilities inherent in traditional authentication methods, such as loss, theft, or being easily guessed or forgotten.

Key players in the biometric payment market adopt partnership, acquisition, and product launch, as their key development strategies to sustain their growth in the market. For instance, in November 2023, Mastercard teamed with NEC to bring biometric checkout to the Asia-Pacific region. The partnership combines NEC’s facial recognition and liveness verification technology with Mastercard’s payment operations and comes as consumers and businesses are increasingly embracing biometrics. Furthermore, in December 2023, FortressPay announced the launch of its biometric payment platform using the Amazon Web Services Independent Software Vendor (AWS ISV) program. Therefore, such strategies adopted by key players propel the growth of the biometric payment market.

The key players in the biometric payment market include Fujitsu, NEC Corporation, Mastercard, Visa Inc., IDEMIA, Fingerprint Cards AB, Alibaba Group Holding Limited, VeriFone, Inc., Thales Group, and Google LLC. These players have adopted numerous strategies to increase their marketplace penetration and strengthen their position in the biometric payment market.

The size of the global biometric payment market was valued at $8,413.33 million in 2023 and is projected to reach $37,390.83 million by 2033.

The key players operating in the global biometric payment market include Fujitsu, NEC Corporation, Mastercard, Visa Inc., IDEMIA, Fingerprint Cards AB, Alibaba Group Holding Limited, VeriFone, Inc., Thales Group, and Google LLC.

North America is the largest regional market for Biometric Payment.

Partnership and product launch are the key strategies opted by the operating companies in this market.

The biometric payment market is segmented into type, biometric mode, and application. On the basis of type, the market is divided into contact-based, contactless, and hybrid. As per biometric mode, the market is categorized into fingerprint recognition, facial recognition, voice recognition, iris scans, and others. On the basis of application, the market is differentiated into BFSI, retail and e-commerce, healthcare, transportation, government, and others.

Loading Table Of Content...

Loading Research Methodology...