Bioplastic Composites Market Research, 2030

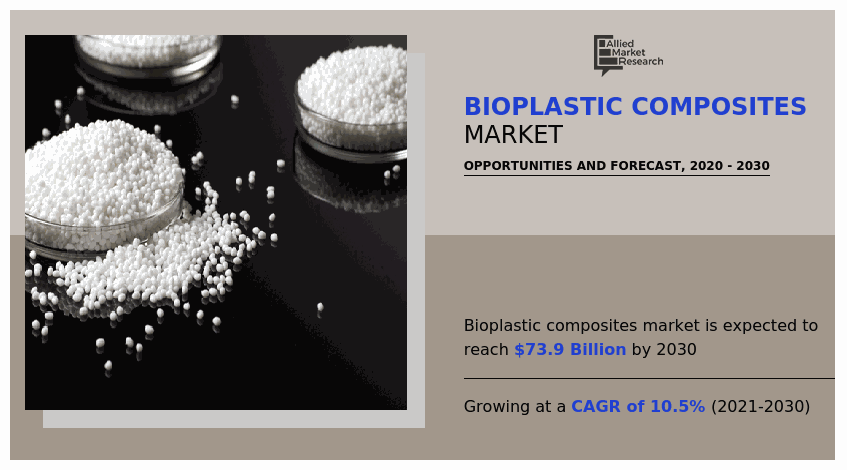

The global bioplastic composites market forecast was valued at $27.3 billion in 2020, and is projected to reach $73.9 billion by 2030, growing at a CAGR of 10.5% from 2021 to 2030.

Bioplastics are type of plastic materials that are manufactured with use of natural resources or from the renewable feedstocks such as corn, sugarcane, and cellulose. Tableware, films, toys, and injection-molded & extrusion molded profile parts are some applications of bioplastic composites.

Rise in use of petroleum-based plastic is anticipated to drive the demand of global bioplastic composites market for. Petroleum-based plastic products pose several threats to the environment as these are manufactured with use of fossil fuels. In addition, extraction and production of fossil fuel is a cost expensive process that is widely used for production of plastics. In order to overcome this, bioplastic composites are used as these contribute toward minimizing the use of non-renewable feedstock materials for plastic production. Starch is a type of composite material that is used for production of bioplastic products. In addition, starch based composite material reduces the use of petroleum-based feedstock products by 65%. These are the major bioplastic composites market growth factors.

Poly (lactic acid) (PLA) and poly (hydroxybutyrate) (PHB) are used during production of bioplastic. These composites are derived from plant based materials due to which their properties are inferior as compared to synthetic materials used for production of plastics. Moreover, few bioplastic products are not decomposed easily in soil and seawater that in turn increases the risk of chemical breakdown during recycling, which is anticipated to hamper the market growth.

On the contrary, bioplastics have evolved as sustainable and eco-friendly alternatives to synthetic plastic. Bio-based plastics can be natural or synthetic polymer, made from organic macromolecules derived from biological resources. Natural polymer is the plastics that can be broken down/decomposed by microorganisms, such as fungi and bacteria into carbon dioxide, water, and other biomaterials. The decomposition of these materials occurs during a specified period, especially under composting conditions in industrial facilities. Biodegradable plastic is manufactured not only from biomaterial however; synthetic source is also used during its production. Rise in awareness about environment safety and surge in price of substitutes &raw materials of substitutes such as petrochemicals are the major factors that drive the bioplastic composites market. Furthermore, government across the world have imposed ban on the use of synthetic plastic bags, thereby simultaneously providing incentives for polylactic acid (PLA) production process, which encouraged the plastic manufacturers to shift toward PLA production. Apart from packaging, PLA is also useful for fiber industry and is thus expected to benefit the consumer directly. For instance, a consumer prefers to wear a shirt made of natural fiber instead of synthetic fiber owing to its intrinsic properties. All these factors collectively surge the demand in the global market and are thereby anticipated to offer new opportunities during the forecast period.

The bioplastic composites market is segmented into Fiber Type, Polymer and End-use Industry.

The bioplastic composites market analysis is done on the basis of fiber type, polymer, end-use industry, and region. Depending on fiber type, the market is divided into wood fiber composites and non-wood fiber composites. On the basis of polymer, the global bioplastic composites market is divided into natural polymer and synthetic polymer. The end-use industries covered in the study include transportation, electrical & electronics, building & construction, aerospace & defense, consumer goods, and others. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By Region

Asia-Pacific would exhibit highest CAGR of 11.8% during 2021-2030.

Bioplastic Composites Market, By Region

The Asia-Pacific bioplastic composites market size is projected to grow at the highest CAGR of 11.8% during the forecast period and accounted for 26% of bioplastic composites market share in 2020. Government policies supporting the use of bioplastic fuels the growth of the bioplastic composites market in Asia-Pacific. Furthermore, in Asian countries injection-molded bioplastics are used in several end-use applications such as automotive components, consumer goods, electronics components, agriculture, medical devices, and packaging. Increase in popularity of packaged foods in the developing countries, such as China and South East Asian countries, also drive the bioplastic composites market.

By Polymer

Wood fiber composites segment is the most lucrative segment

Bioplastic Composites Market, By Type

In 2020, the wood fiber composite type was the largest revenue generator, and is anticipated to grow at a CAGR of 9.5% during the forecast period. Automotive, construction, packaging, and consumer products are the key segments for wood fiber composite applications. The light weight characteristics of wood fiber composites help increase the fuel efficiency in automobile, thereby reducing the carbon footprint. Furthermore, German-based Company, Ravensburger, which is a European jigsaw puzzle market, uses 100% bio-based compounds, based on bioplastics with wood fiber along with injection molding to produce toys. The use of wood fiber composites in construction industry in North America has experienced a healthy growth in recent y ears. Whereas, the European region mainly uses wood fiber composite in automobile sector due to the light weight of the wood fiber composites.

By Fiber Type

Natural polymer segment is the most lucrative segment

Bioplastic Composites Market, By Segment

In 2020, the synthetic polymer segment was the largest revenue generator, and is anticipated to grow at a CAGR of 10.4% during the forecast period. Synthetic polymer is a non-biodegradable plastic made from renewable resources. The petro-chemical based polymers are valuable to the society as they are used in different applications such as packaging, construction, automobiles, electronics, medical applications, and others. Commercially available bio-polyamide includes PA10, PA11, PA6, PA66, and PA12. These are used for different applications in the market. These partially bio-based polyamides are used in the production of Nordic walking pole, spectacles, sunglasses, and others. PA11 is a completely bio-based polyamide, which is available in the market from last 60 years and is mainly used in different automotive applications.

By End-use Industry

Transportation application is the most lucrative segment

Bioplastic Composites Market, By End-Useindustry

In 2020, the building & construction end-use industry was the largest revenue generator, and is anticipated to grow at a CAGR of 10.0% during the forecast period. Bio-based polyamide, bio-based polyesters, bio-PE, Bio-PET, Bio-PA11, and PLA blends are common types of bioplastics, used in automobiles. Furthermore, the bioplastic are used to manufacture seat cushions, glove box door, gear shift knob, steering wheel, fuel line sand connectors, accelerator pedals, horn buttons, carpet, dashboard, and body panel along with distributor heads. Companies involved in bioplastics for automotive application include Ford Motor Company, Toyota, Fiat, Mercedes, and Volkswagen. Ford is the first automotive company, which uses bioplastics for automotive applications. Company uses wheat and soya-based bioplastics for manufacturing arm rests, head rests, and seats. Toyota is using PLA for producing spare wheel cover.

The major companies profiled in this report include Mitsubishi Chemical Holdings Group, NatureWorks LLC, Corbion NV, Braskem, FKuR, Arkema S.A., BASF SE, Dow, Solvay, and Toray Industries, Inc.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the bioplastic composites market analysis from 2020 to 2030 to identify the prevailing bioplastic composites market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the bioplastic composites market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global bioplastic composites market trends, key players, market segments, application areas, and market growth strategies.

Bioplastic Composites Market Report Highlights

| Aspects | Details |

| By Fiber Type |

|

| By Polymer |

|

| By End-use Industry |

|

| By Region |

|

| Key Market Players | Owens Corning, Arkema S.A., Braskem, Dow, Toray Industries, Inc., Corbion NV, Mitsubishi Chemical Holdings Group, BASF SE, Solvay, NatureWorks LLC |

Analyst Review

The global bioplastic composites market is expected to exhibit high growth potential owing to its use in wide range of industries such as rigid packaging, flexible packaging, textiles, consumer goods, agriculture, construction, and electrical & electronics. Bioplastics are also used in construction and housing applications. Polylactic acid (PLA) and Polyhydroxyalkanoate (PHA)-based carpets are used in house and buildings. Bio-based foams such as polyurethane are suitable for the production of upholstered furniture and PLA-based particle foams are used for building insulation. The cellulose-based blow-in insulation is widely used in the construction industry. Bio-PVC is used to manufacture water and sewage pipelines. Moreover, bio-based polymers are also used to produce wallpaper paste, paints & varnishes, and linseed oil paints that are anticipated escalate the demand of the global market. Architects, engineers, and developers focus more on the usage of bioplastics components in building & construction owing to their strength, durability, appearance, and increase in number of building and construction projects, due to rise in industrialization and use of green building technique. This is projected to provide growth opportunity for this market.

The lightweight and high performance properties of bioplastics components play a pivotal role in the aerospace & defense industry. Thermoplastic components and resins are used to enhance the performance of aerospace & defense vehicles, which drive the demand of the global market. Moreover, consumer goods segment is one of the largest users of bioplastics. Some of the consumer products where bioplastics are used are lipstick cases, crucibles for powders & creams, service ware, and toys & shampoo bottles. Polylactic Acid (PLA) is one of the most common bioplastics used in consumer products. PLA provides consumer products with excellent color, gloss, and resistance against dishwashers. Moreover, application of bioplastics in consumer goods includes disposable food service ware, lawn & garden equipment, personal care products, toys, and sporting goods

The global bioplastic composites market was valued at $27.3 billion in 2020, and is projected to reach $73.9 billion by 2030, growing at a CAGR of 10.5% from 2021 to 2030

Building and construction is the leading application of Bioplastic Composites Market

North America is the largest regional market for Bioplastic Composites Market

Mitsubishi Chemical Holdings Group, NatureWorks LLC, Corbion NV, Braskem, FKuR, Arkema S.A., and BASF SE are the top companies to hold the market share in Bioplastic Composites Market

Bioplastics are also used in construction and housing applications. Polylactic acid (PLA) and Polyhydroxyalkanoate (PHA)-based carpets are used in house and buildings. Bio-based foams such as polyurethane are suitable for the production of upholstered furniture and PLA-based particle foams are used for building insulation. The cellulose-based blow-in insulation is widely used in the construction industry. Bio-PVC is used to manufacture water and sewage pipelines. Architects, engineers, and developers focus more on the usage of bioplastic components in building & construction owing to their strength, durability, appearance, and increase in number of building and construction projects due to rise in industrialization and use of green building technique. These are the upcoming trends of Bioplastic Composites Market in the world

The growth of the global bioplastic composites market is driven by increase in use of bioplastic composites in consumer goods, packaging, and healthcare end-use industries. Packaging is the biggest application market of bioplastic and is used in almost all types of packaging applications. Bioplastic composites are widely used in packaging applications, encompassing food & beverages, health care &cosmetics, chemical industry, and household cleaning products is the Main Driver of Bioplastic Composites Market

The global bioplastic market has been negatively impacted due to the wake of the COVID-19 pandemic, owing to its dependence on transportation, electrical & electronics, building & construction, aerospace & defense, consumer goods end-use sectors

Loading Table Of Content...