Biorefinery Technologies Market Research, 2033

The global biorefinery technologies market was valued at $187.9 billion in 2023, and is projected to reach $476.4 billion by 2033, growing at a CAGR of 9.8% from 2024 to 2033.

Market Introduction and Definition

Biorefinery technologies offer a pioneering and sustainable method for converting biomass into valuable products. Biorefineries process raw materials to generate a variety of outputs. However, biorefineries utilize biomass sources such as agricultural residues, forestry byproducts, and dedicated energy crops, instead of using fossil fuels. The primary goal is to produce a diverse array of marketable products including fuels, power, and chemicals emulating the output of petrochemical refineries but with a significantly reduced environmental impact.

Biorefinery technologies encompass a wide array of processes, broadly classified into biochemical and thermochemical routes. The biochemical route includes fermentation, anaerobic digestion, and enzymatic hydrolysis, which are pivotal for converting biomass into bioethanol, biogas, and other biochemicals. On the other hand, thermochemical processes such as pyrolysis, gasification, and torrefaction are employed to transform biomass into bio-oil, syngas, and biochar, respectively. These technologies often work in synergy, utilizing different components of the biomass feedstock to optimize the yield and efficiency of the conversion process.

One of the primary applications of biorefinery technologies is in the production of bioenergy. Biofuels such as bioethanol and biodiesel are prominent substitutes for conventional fossil fuels in the transportation sector. Advanced biofuels, derived from lignocellulosic biomass, offer significant advantages in terms of greenhouse gas emissions and energy security. Additionally, biogas produced through anaerobic digestion can be used for electricity generation and heating, contributing to the reduction of dependency on natural gas.

Key Takeaways

- The biorefinery technologies market industry covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of the biorefinery technologies market overview and to assist stakeholders in making educated decisions to achieve their growth objectives.

- Over 3, 700 product literature, annual reports, industry statements, and other comparable materials from major industry participants were reviewed to gain a better understanding of the biorefinery technologies market size.

- The biorefinery technologies market share is highly fragmented, with several players including ADM, Valero, Green Plains Inc., NEXBTL Technology, CLARIANT, BP p.l.c., Cargill Incorporated, Louis Dreyfus Company, Novozymes A/S, Enerkem. Also tracked key strategies such as acquisitions, product launches, mergers, and expansion of the players operating in the biorefinery technologies market growth.

Market Segmentation

The biorefinery technologies market is segmented into feedstock type, technology type, end-use industry, and region. On the basis of feedstock type, the market is classified into lignocellulosic biomass, algae, and others. On the basis of technology type, the market is categorized into biochemical process, thermochemical process, and others. On the basis of the end-use industry, the market is fragmented into transportation, chemicals, energy, and others. Region-wise, the market is studied across North America, Europe, Asia-Pacific, and LAMEA.

Key Market Dynamics

Rise in the shift towards renewable energy sources is expected to boost the growth of biorefinery technologies market during ethe forecast period. The surge in demand for biofuels, spurred by global efforts to reduce greenhouse gas emissions and dependence on fossil fuels, has become a cornerstone of the biorefinery technologies market. Biofuels, derived from renewable biomass sources such as corn, sugarcane, and algae, offer a cleaner alternative to traditional transportation fuels such as gasoline and diesel. This shift is driven by the imperative to mitigate climate change and improve air quality, as biofuels generally produce lower levels of greenhouse gas emissions compared to their fossil fuel counterparts.

Governments around the world are increasingly implementing policies and incentives to promote the production and use of biofuels, further propelling the growth of biorefinery technologies. These policies often include mandates for blending biofuels into conventional fuels, tax incentives for biofuel producers, and funding for research and development in renewable energy technologies. Such supportive measures not only stimulate investment in biorefineries but also foster innovation in biomass conversion processes, making biofuels more competitive and accessible in the market. In May 2022, SGP BioEnergy unveiled plans for a pioneering biofuel distribution and production hub in Panama, in collaboration with the government. This initiative is projected to generate approximately 180, 000 barrels per day of biofuel. Concurrently, the U.S. Department of Energy allocated $118 million in 2023 to support 17 projects aimed at expanding ethanol and other biofuel production. These initiatives are poised to bolster the biofuel market significantly, addressing both transportation and manufacturing needs in the U.S.

Moreover, the biofuels sector contributes to energy security by diversifying fuel sources and reducing dependence on imported oil. This resilience is particularly valued amid fluctuating oil prices and geopolitical uncertainties. Biorefineries play a crucial role in this landscape by efficiently converting various biomass feedstocks into biofuels, thereby meeting the growing demand for sustainable transportation fuels while promoting economic growth and environmental stewardship.

However, high initial investment is expected to restrain the growth of the biorefinery technologies market. The establishment of biorefinery plants necessitates a substantial initial investment, presenting a formidable barrier for new entrants and small-scale companies aiming to enter the biorefinery market. This high capital requirement primarily stems from the complex and specialized nature of biorefinery infrastructure and technology needed to convert biomass into valuable products like biofuels, biochemicals, and bioplastics.

Biorefineries typically involve processing equipment and facilities tailored to handle diverse biomass feedstocks efficiently. These include biomass pre-treatment systems, fermentation tanks, distillation columns, and purification units, among others. Each component requires significant upfront capital expenditure for procurement, installation, and commissioning. Moreover, the cost of securing and preparing suitable biomass feedstock can contribute substantially to the initial investment. Depending on the feedstock's type and availability, biorefinery operators may need to invest in establishing or securing long-term supply agreements with farmers, waste management facilities, or other biomass suppliers. This adds another layer of financial commitment before operations can commence.

The surge of biorefinery co-products in sustainable product development is expected to offer lucrative opportunities in the market. Biorefinery co-products offer substantial opportunities for value addition and sustainable practices. These co-products, generated from biorefinery processes such as lignin, glycerol, and fermentation residues, can be utilized to develop a range of high-value bio-based products. For instance, lignin, a byproduct of cellulosic ethanol production, can be processed into bio-based adhesives used in wood products and construction materials. Glycerol, a byproduct of biodiesel production, has applications in the chemical industry for producing pharmaceuticals, cosmetics, and industrial chemicals. These value-added products not only enhance the overall economic viability of biorefinery operations but also contribute to reducing waste and promoting circular economy principles.

Biochar, produced through pyrolysis or other thermal processes, is utilized as a soil amendment in agriculture. It improves soil fertility, water retention, and nutrient availability, thereby enhancing crop yields and reducing the need for chemical fertilizers. Additionally, biochar contributes to carbon sequestration by storing carbon in the soil for hundreds to thousands of years, mitigating greenhouse gas emissions and combating climate change. Biocarbon, another form of carbon-rich material derived from biomass, finds applications in energy storage, filtration systems, and environmental remediation. In November 2023, BIOSORRA inaugurated a biochar production facility in Thika, located in Kiambu County, Kenya. The biochar produced will be supplied to Kenya Nut Company, a multinational agribusiness engaged in cultivating various agricultural products. In November 2023, Pyreg GmbH introduced its Biochar Carbon Removal (BCR) technology via advanced carbonization systems. The company aims to enhance its Climate Finance Solutions (PCFS) , focusing on expanding this technology across the agriculture sector.

Overall Energy Efficiencies of U.S. Petroleum Refineries Refinery for Producing Refinery Overall Energy Efficiency Low (%) Refinery Overall Energy Efficiency High (%) 340 ppm S conventional gasoline 88.4 88.4 150 ppm S reformulated gasoline with MTBE 87.7 87.9 5-30 ppm S reformulated gasoline with MTBE 87.7 89.5 5-30 ppm S reformulated gasoline with ethanol 87.4 88.9 5-30 ppm reformulated gasoline with no oxygenate 87.6 87.8

Regional Market Outlook

Based on region, the market is divided into North America, Europe, Asia-Pacific, and LAMEA. In North America, particularly in the U.S. and Canada, biorefinery technologies are actively utilized in various sectors. The region's advanced agricultural practices provide ample biomass feedstocks such as corn, soybeans, and forestry residues. Biorefineries here often focus on producing biofuels like ethanol and biodiesel, which are blended into transportation fuels to reduce greenhouse gas emissions. Additionally, biochemical production for industries like pharmaceuticals and cosmetics is also prominent, driven by strong research and development in biotechnology. According to the U.S. Department of Agriculture and the Economic Research Service, by the end of 2022, Texas had about 246, 000 farms, making it the largest US state in terms of agricultural production. As of 2022, Missouri ranked second among the top ten states, with 95, 000 farm holdings.

In the Asia-Pacific region, countries such as China, India, and Japan are increasingly investing in biorefinery technologies to address energy security and environmental challenges. Agricultural residues, algae, and municipal solid waste are key feedstocks used in biorefineries across these countries. China, for instance, has significant biorefinery operations focusing on bioethanol and biochemicals, spurred by its efforts to mitigate air pollution and achieve sustainable development goals outlined in its national policies.

Competitive Analysis

Key market players in the biorefinery technologies market include ADM, Valero, Green Plains Inc., NEXBTL Technology, CLARIANT, BP p.l.c., Cargill Incorporated, Louis Dreyfus Company, Novozymes A/S, and Enerkem

Industry Trends

- In June 2023, Enterra obtained USD 38 million in project financing from UniCredit for a biomass plant in Italy. Situated in Foggia, in the southern Apulia region, the 13 MW plant generates both electric and thermal energy from biomass.

- In June 2023, the Victorian government in Australia unveiled an $8 million bioenergy fund, marking the state's largest-ever investment in bioenergy. This initiative aims to substantially enhance the region's bioenergy capabilities by supporting 24 projects. The fund will facilitate the conversion of agricultural and food production waste such as cooking oil, dairy surplus, and vegetable scraps into electricity, heat, gas, or liquid fuel.

- In June 2023, Spain's Energy Ministry revealed plans to significantly increase its 2030 targets for biogas and green hydrogen production. The new objectives aim for 11 gigawatts (GW) of electrolyzer capacity, a substantial rise from the previous goal of 4 GW, and boost biogas production to 20 terawatt hours (TWh).

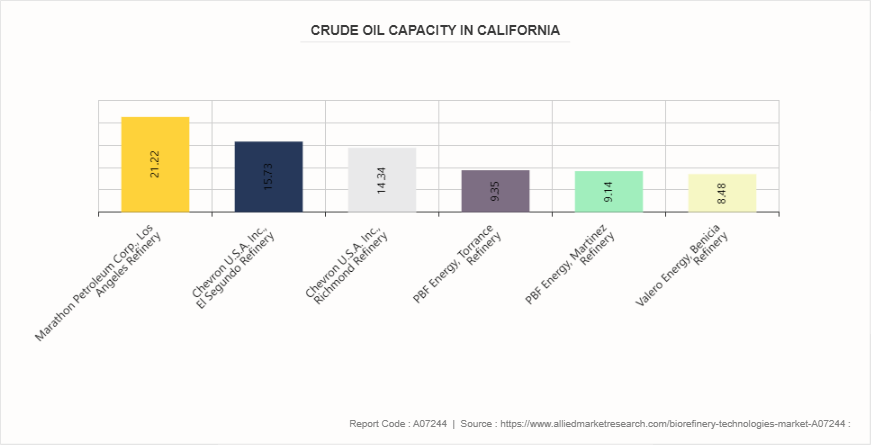

California Oil Refinery Locations and Capacities

California hosts several major oil refineries, each with significant capacities contributing to the state's oil production. Leading the pack is the Marathon Petroleum Corp. Los Angeles Refinery, which boasts an impressive capacity of 363, 000 barrels per day. This refinery is a key player in the region's energy sector, underscoring California's role in the national oil landscape.

Next, Chevron U.S.A. Inc. operates two substantial refineries in California. The El Segundo Refinery processes 269, 000 barrels per day, while the Richmond Refinery handles 245, 271 barrels per day. These facilities not only highlight Chevron's robust presence in the state but also contribute significantly to meeting the energy needs of California and beyond.

PBF Energy also plays a crucial role with its Torrance Refinery and Martinez Refinery. The Torrance Refinery has a capacity of 160, 000 barrels per day, and the Martinez Refinery is close behind with 156, 400 barrels per day. These refineries are vital components of PBF Energy's operations and add considerable volume to the state's overall refining capacity.

Key Sources Referred

- State of California

- SGP BioEnergy Holdings, LLC

- U.S. Department of Energy

- U.S. Department of Agriculture

- National Energy Technology Laboratory

- Oak Ridge National Laboratory

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the biorefinery technologies market analysis from 2024 to 2033 to identify the prevailing biorefinery technologies market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the biorefinery technologies market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global biorefinery technologies market trends, key players, market segments, application areas, and market growth strategies.

Biorefinery Technologies Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 476.4 Billion |

| Growth Rate | CAGR of 9.8% |

| Forecast period | 2024 - 2033 |

| Report Pages | 300 |

| By Feedstock Type |

|

| By Technology Type |

|

| By End-Use Industry |

|

| By Region |

|

| Key Market Players | BP p.l.c., Valero, Cargill, Incorporated, NEXBTL Technology, Novozymes A/S, Louis Dreyfus Company, Green Plains Inc., CLARIANT, ADM, Enerkem |

The global biorefinery technologies market was valued at $187.9 billion in 2023, and is projected to reach $476.4 billion by 2033, growing at a CAGR of 9.8% from 2024 to 2033.

Key market players in the biorefinery technologies market include ADM, Valero, Green Plains Inc., NEXBTL Technology, CLARIANT, BP p.l.c., Cargill Incorporated, Louis Dreyfus Company, Novozymes A/S, and Enerkem.

Asia-Pacific is the largest region market for biorefinery technologies.

Transportation is the leading end-use of biorefinery technologies market.

The surge of biorefinery co-products in sustainable product development are the upcoming trends of biorefinery technologies market.

Loading Table Of Content...