Blockchain-as-a-Service Market Overview

The global blockchain-as-a-service market size was valued at USD 829 million in 2021, and is projected to reach USD 84.6 billion by 2031, growing at a CAGR of 59.3% from 2022 to 2031.

The growing number of cyber threats post the outbreak of the COVID-19 pandemic aided in propelling the growth of the global blockchain as a service (BaaS) solutions during the period, hence empowering the demand for blockchain as a service (BaaS) solution. Moreover, the growing complexity of the global financial sector during the period has positively impacted the need for the blockchain as a service (BaaS) industry. However, the initial development and implementation costs of blockchain services can hamper the blockchain as a service (BaaS) market forecast. On the contrary, the growing adoption of blockchain technologies in the global economy is expected to offer remunerative opportunities for the expansion of the blockchain as a service (BaaS) market during the forecast period.

Blockchain-as-a-service (BaaS) is the implementation and operation of cloud-based networks by a third party for firms that develops blockchain applications. Third-party services are a relatively recent phenomenon in the rapidly expanding field of blockchain technology. The application of blockchain technology has expanded well beyond its most well-known usage in bitcoin transactions, addressing safe transactions of all types. The blockchain-as-a-service market is segmented into Application, industry Vertical, Offering and Enterprise Size.

Segment Review

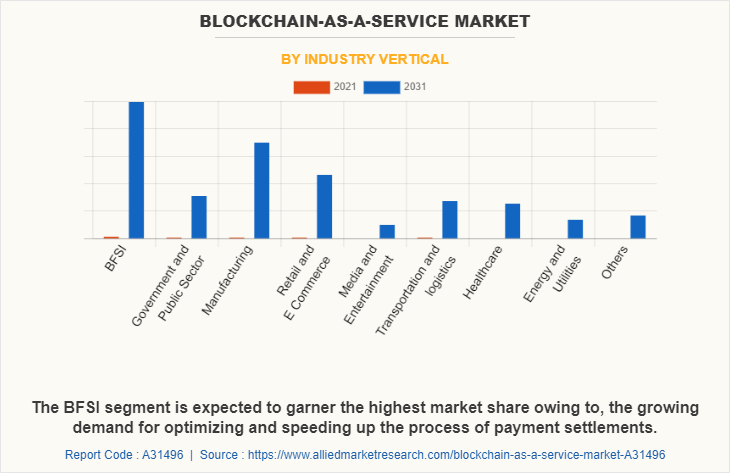

The blockchain-as-a-service market is segmented on the basis of offering, enterprise size, application, industry vertical, and region. On the basis of offering, the industry is divided into tools and services. Based on enterprise size, the market is bifurcated into large enterprises and SMEs. Based on the application the market is divided into payments, smart contracts, supply chain management, compliance management, trade finance, and others. The industry vertical covered in the study include BFSI, government and public sector, manufacturing, retail and e-commerce, media and entertainment, transportation and logistics, healthcare, energy and utilities, and others. Region-wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Depending on industry vertical, the BFSI segment dominated the blockchain-as-a-service market share in 2021, and is expected to continue this trend during the forecast period owing to the large-scale accounting operations being maintained by BFSI sector businesses, which are incentivizing banking and financial firms to invest in effective blockchain solutions and services for their organization. However, the manufacturing segment is expected to witness the highest growth in the upcoming years, owing to the rising technological investments and upscaling of the sector, which is expected to aid in driving investments in blockchain as a service (BaaS) industry.

Region wise, the blockchain-as-a-service market was dominated by North America in 2021, and is expected to retain its position during the forecast period, owing to its high concentration of blockchain solutions and services vendors in the region. which is expected to drive the market for blockchain as a service (BaaS) solutions within the region during the forecast period. However, Asia-Pacific is expected to witness significant growth during the forecast period, owing to the rapid economic and technological transformation of the region, which is expected to fuel the growth of blockchain as a service (BaaS) solutions in the region in the coming few years.

The report focuses on growth prospects, restraints, and analysis of the global blockchain-as-a-service market trends. The study provides Porter’s five forces analysis to understand the impact of various factors, such as the bargaining power of suppliers, the competitive intensity of competitors, the threat of new entrants, threat of substitutes, and bargaining power of buyers on the global blockchain-as-a-service market share.

Key Players

The key players profiled in the blockchain-as-a-service market analysis are Accenture, Plc, Altores, AWS, Bitfury, Factom, HPE, Huawei, IBM Corporation, Infosys Limited, Leewayhertz, Microsoft, Oracle, Oodles Technologies, R3, SAP SE, Salesforce, and Wipro. These players have adopted various strategies to increase their market penetration and strengthen their position in the blockchain-as-a-service industry.

Top Impacting Factors

Growing adoption of blockchain technology in the financial sector

The growing adoption of blockchain and distributed ledger technology (DLT) in the banking and financial sectors over the past few years have led to positive growth in the blockchain technologies market. Blockchain systems enable banking and finance to create more transparent, inclusive, and stable business networks, shared operating models, more productive processes, lower costs, and new products and services. It allows for the issuance of digital securities in less time, at lower unit costs, and with greater levels of customization. As a result, digital financial instruments can be customized to meet the needs of investors, widening the market for investors, lowering issuer costs, and lowering counterparty risk. These benefits of blockchain technologies drive the overall blockchain-as-a-service market growth.

Adoption of blockchain in authentication systems

Every company has hundreds of programs and databases, and its employees use their credentials to access them every day (that is, their username and password). Since they appear to be a legitimate user, an intruder with such valid credentials can get around established security measures. According to the Verizon Data Breach study from 2019, compromised credentials were involved in more than 63% of successful breaches. As a solution to this rapidly increasing challenge, two-factor authentication (2FA) adds another layer of security to the current credential-based device defense. Blockchain authentication services on crypto wallets further this principle by encrypting credentials using a public key.

Moreover, blockchain authentication applies to systems that validate users' access to services on Bitcoin and other digital currencies’ underlying technologies. To encrypt wallets, or instances on the blockchain where value or work is safely stored, the blockchain employs public-key cryptography (PKC). As a result, there are some fascinating parallels between blockchain technology and its application in the security sector. In addition, many organizations are using non-fungible tokens (NFT) to create unique digital items which can be used to create unique identifications of various entities. Such factors are great opportunities for the growth of the Blockchain-as-a-Service Industry.

COVID-19 Impact Analysis

The COVID-19 global pandemic has disrupted business-as-usual, hence, affecting sustained economic development across countries. However, economic uncertainties following the outbreak of the COVID-19 pandemic and various containment measures helped in the growth of cryptocurrencies during the period. Moreover, the growing demand for non-fungible tokens (NFTs) and the rising popularity of the metaverse and virtual marketplaces helped in supporting the demand for blockchain-based solutions during the period. In addition, the supply chain challenges during the period further enabled businesses to invest in blockchain solutions to maximize the operational efficiency of their business, driving the growth of the blockchain as a service market.

Key Benefits For Stakeholders

This report provides a quantitative analysis of the Blockchain-as-a-Service Market Forecast, current trends, estimations, and dynamics of the blockchain-as-a-service market analysis from 2021 to 2031 to identify the prevailing blockchain-as-a-service market opportunities.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the blockchain-as-a-service market segmentation helps determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global blockchain-as-a-service market trends, key players, market segments, application areas, and market growth strategies.

Blockchain-as-a-Service Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 84.6 billion |

| Growth Rate | CAGR of 59.3% |

| Forecast period | 2021 - 2031 |

| Report Pages | 345 |

| By Application |

|

| By industry Vertical |

|

| By Offering |

|

| By Enterprise Size |

|

| By Region |

|

| Key Market Players | Oracle Corporation, infosys limited, Oodles Technologies, Accenture plc, leewayhertz, HPE, IBM CORPORATION, Factom, Bitfury, Altores, huawei technologies, Microsoft Corporation, AWS |

Analyst Review

The demand for blockchain as a service (BaaS) solutions has been on a rise for the past few years and the market is expected to continue this trend in the coming years as well, owing to growth in number of businesses and the adoption of blockchain & distributed ledger technologies, which are promising new opportunities for the growth of the blockchain as a service (BaaS) solutions, as they can provide efficient data management and optimization techniques for businesses and corporations over a decentralized network.

Key providers of the blockchain as a service (BaaS) market such as Microsoft, IBM Corporation, and R3, account for a significant share of the market. With larger requirements for blockchain as a service (BaaS) tools and services, various companies have established partnerships to increase their blockchain service capabilities. For instance, in May 2021, Accenture Plc., announced a partnership with Digital Dollar Foundation. As a part of this partnership, the Digital Dollar Project (DDP) launched at least five pilots with interested stakeholders and DDP participants to measure the value of and inform the future design of a U.S. central bank digital currency (CBDC), or digital dollar.

In addition, with the increase in demand for blockchain as a service (BaaS) solutions, various companies are expanding their current product portfolio with increasing diversification among customers. For instance, in February 2022, Bitfury Group, announced the launch of a new 28MW digital asset mining data center in Sarnia, Ontario. The facility has commenced operations with an expected capacity of 16MW by the end of February and an additional 12MW of capacity to be completed by the end of May. The project has an expansion potential of up to 200MW. The Sarnia facility is equipped with Bitfury’s proprietary blockchain software and hardware solutions, including its specialized ASIC chips and other high-performance mining equipment. The new facility expands Bitfury’s hosting capacity and adds to the Company’s existing active digital asset mining sites in North America, Scandinavia, and Eastern Europe/Central Asia.

Moreover, market players are expanding their business operations and customers by increasing their acquisitions. For instance, in October 2021, R3, announced the acquisition of technology and team financial asset tokenization solutions provider, Ivno, expanding its capabilities in the digital assets and currency space.

The growing number of cyber threats post the outbreak of the COVID-19 pandemic aided in propelling the growth of the global blockchain as a service (BaaS) solutions during the period, hence empowering the demand for blockchain as a service (BaaS) solution.

Region wise, the blockchain-as-a-service market was dominated by North America in 2021, and is expected to retain its position during the forecast period, owing to its high concentration of blockchain solutions and services vendors in the region. which is expected to drive the market for blockchain as a service (BaaS) solutions within the region during the forecast period.

The global blockchain-as-a-service market size was valued at $0.82 billion in 2021, and is projected to reach $84.63 billion by 2031, growing at a CAGR of 59.3% from 2022 to 2031.

The key players profiled in the blockchain-as-a-service market analysis are Accenture, Plc, Altores, AWS, Bitfury, Factom, HPE, Huawei, IBM Corporation, Infosys Limited, Leewayhertz, Microsoft, Oracle, Oodles Technologies, R3, SAP SE, Salesforce, and Wipro. These players have adopted various strategies to increase their market penetration and strengthen their position in the industry.

Loading Table Of Content...