Blockchain Finance Market Research, 2032

The global blockchain finance market size was valued at $792.3 million in 2022 and is projected to reach $79.3 billion by 2032, growing at a CAGR of 60.5% from 2023 to 2032.

Blockchain technology is a decentralized distributed ledger system that uses cryptography to securely store data. It allows users to transfer digital assets securely from one party to another without the involvement of intermediaries or third parties.

The data saved on the blockchain is immutable, which means that once it has been recorded on the ledger, it cannot be updated or altered. Data is stored in blocks that are linked together in a chain in a blockchain database. The data is chronologically consistent as the user cannot delete or change the chain without network consensus. Therefore, blockchain technology can be used to establish an immutable ledger for recording orders, payments, accounts, and other transactions. The system includes techniques for preventing unauthorized transaction submissions and ensuring consistency in the shared view of these transactions.

Blockchain technology has the potential to revolutionize the blockchain finance market by significantly improving settlement processes and expediting payment transactions. In traditional settlement periods, the time taken to fulfill all obligations after a trade execution, can be notably shortened through blockchain technology. Swift recording of trade submissions and their confirmation on a blockchain can lead to substantial reductions in settlement cycles. This has the potential to enhance liquidity in various types of trades that currently grapple with extended settlement timelines, thereby optimizing capital utilization. Unlike the current scenario where financial asset settlement typically occurs only during banking hours, blockchain can enable settlement against payment at any time, on any date, and in a matter of seconds. This also ensures legal finality and certainty in transactions. These factors are aniticipated to boost the blockchain finance industry growth.

While blockchain technology in blockchain finance market offers numerous advantages, it also presents certain challenges that are expected to impede its widespread adoption in the finance sector. One of the major significant challenges is scalability. Blockchain databases are permanently stored on all network nodes, which can lead to a storage issue. The amount of data a personal computer can accommodate is limited, and as transaction volumes increase, so does the size of the blockchain database. This means that blockchain ledgers have the potential to grow significantly over time. Scaling up distributed ledger systems, especially for permissionless blockchains that rely on a competitive process to confirm transactions, can be particularly challenging.

The computational race required for confirmation demands substantial computing power, which in turn limits the speed at which new transactions can be processed. Regardless of whether a blockchain is permissioned or permissionless, every node in the network must maintain its copy of the distributed ledger, necessitating substantial storage resources. These factors are anticipated to boost blockchain finance market growth.

The blockchain finance market is rapidly embracing blockchain, spanning from smaller enterprises to industry giants, with significant investments in blockchain stocks and technology implementation. To achieve optimal outcomes, widespread adoption of blockchains is essential. This is particularly critical in the realm of financial services, where seamless collaboration necessitates standardized transaction handling. In finance, blockchain facilitates peer-to-peer transactions, eliminating the need for intermediaries.

Smart contracts play a pivotal role in ensuring successful transaction management, thereby eradicating unnecessary intermediaries. The consolidation of the system's layers enables instant payment settlements, revolutionizing the speed of financial transactions. Moreover, the expertise of blockchain extends to cross-border payments, enabling instantaneous cross-border transactions through blockchain-based payment systems. These factors are anticipated to boost the blockchain finance market opportunity.

The blockchain finance market forecast key players profiled in this report include Deloitte Touche Tohmatsu Limited, R3, Alphabet, Circle Internet Financial Limited, JP Morgan Chase, Microsoft Corporation, Goldman Sachs, Global Arena Holding Inc. (GAHI), International Business Machines (IBM) Corporation, and Accenture.

The blockchain finance market players are continuously striving to achieve a dominant position in this competitive market using strategies such as collaborations and acquisitions. For instance, in July 2022, New Street Tech, a blockchain technology company, received approval from the RBI to take part in the Third Cohort of the Regulatory Sandbox for MSME financing. The co-lending product was evaluated in collaboration with Federal Bank and was launched on New Street Tech's MiFiX platform. The MiFiX project was developed to demonstrate the potential utilization of contemporary technologies like blockchain in restructuring the co-lending process. Collaborations with Federal Bank and other participants such as NBFCs played a pivotal role in accelerating processes, mitigating risks, and enhancing data security and operational efficiency.

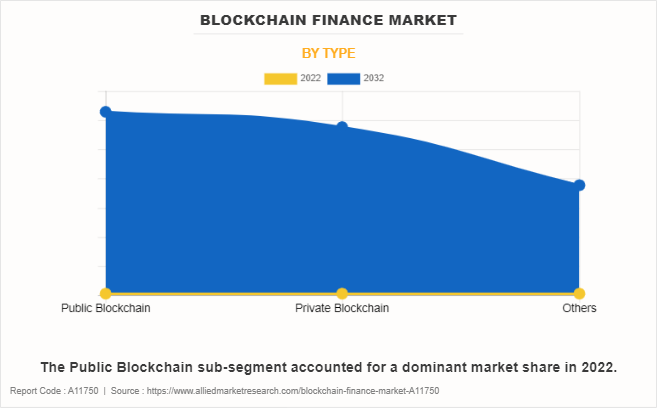

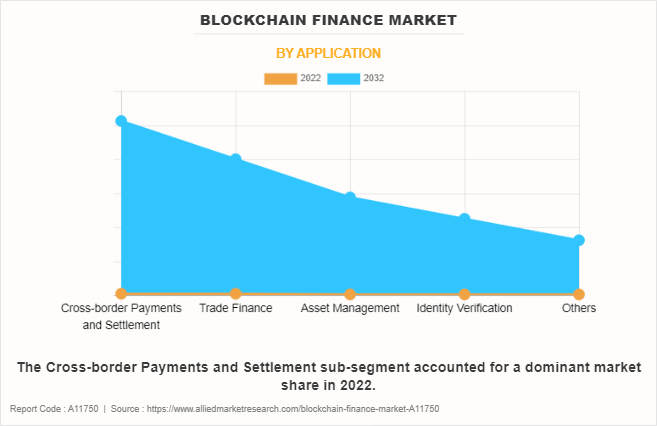

The blockchain finance market outlook is segmented on the basis of type, application, and region. By type, the market is divided into public blockchain, private blockchain, and others. By application, the market is classified into cross-border payments & settlement, trade finance, asset management, identity verification, and others. By region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Segment Review

The blockchain finance market is segmented into Type and Application.

By type, the public blockchain sub-segment dominated the blockchain finance market in 2022. A public blockchain is a permissionless and open network that allows for unfettered participation and involvement. As the system is decentralized, there is no need for a centralized authority to oversee or control operations, promoting a trustless environment. The immutability of public blockchains ensures the security of information—once validated, it stays unalterable. Ethereum and Bitcoin are prominent instances of public blockchains in the financial sector. Public blockchains leverage significant computational power, making them ideal for maintaining large distributed ledgers associated with financial transactions. These factors are anticipated to boost the blockchain finance market.

By application, the cross-border payments & settlement sub-segment dominated the global blockchain finance market share in 2022. Payments made across borders are referred to as cross-border payments. Individuals, enterprises, merchants, industries, and international development groups all rely on cross-border payments. Cross-border transactions, on the contrary, are frequently difficult due to excessive costs and lengthy processing delays. The usage of blockchain in cross-border payments will simplify the cross-border payment process. The use of blockchain technology for cross-border payments will benefit the global economy. The use of distributed ledger technology, sometimes known as blockchain technology, is a major game changer in cross-border money transfer. It uses encryption technology to speed up the payment procedure. All these are the major factors projected to drive the blockchain finance market.

By region, North America dominated the blockchain finance market in 2022. The region's improving economic situation and the government initiatives to expand infrastructure in the financial sectors are some of the reasons driving the growth of the regional market. Furthermore, blockchain technology in banking and finance enables cryptographic security and transparency, reducing fraud in banks and driving market growth in this region. This region is home to most banks and other financial institutions, as well as a number of large enterprises that provide banking and financial services. Due to its well-established financial infrastructure and features, North America stands as an ideal for implementing blockchain technology in the banking sector. All these are major factors projected to drive the regional blockchain finance industry revenue growth in the upcoming years.

Impact of COVID-19 on the Global Blockchain Finance Industry

- During the COVID-19 pandemic, the decentralized finance (DeFi) space experienced significant growth and attention, and it emerged as a viable alternative to traditional financial systems for individuals and businesses.

- The pandemic highlighted the importance of financial inclusion, especially when people faced challenges accessing traditional banking services due to lockdowns and restrictions. Major firms in the blockchain finance market responded to the pandemic's concerns by making significant investments and revamping their digital strategies.

- The COVID-19 pandemic caused the closure of most manufacturing plants, disrupting the whole economy and investments in digital technology. Furthermore, the pandemic had a profound impact on distributed ledger technologies. Key industry companies made considerable investments and restructured their digital strategy, which are expected to boost demand for digital ledger technology in the post-pandemic period. Furthermore, the pandemic led to deployment of digital technologies in industries ranging from government to retail.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the blockchain finance market analysis from 2022 to 2032 to identify the prevailing blockchain finance market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the blockchain finance market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global blockchain finance market trends, key players, market segments, application areas, and market growth strategies.

Blockchain Finance Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 79.3 billion |

| Growth Rate | CAGR of 60.5% |

| Forecast period | 2022 - 2032 |

| Report Pages | 290 |

| By Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | R3, Global Arena Holding Inc., Circle Internet Financial Limited, Microsoft Corporation, Accenture, GOLDMAN SACHS, International Business Machines Corporation, Deloitte Touche Tohmatsu Limited, JP Morgan Chase, Alphabet |

Continuous advancements in blockchain technology, such as scalability enhancements, consensus processes, and interoperability solutions, improve the viability and efficiency of blockchain-based financial systems. These innovations promise to boost the blockchain finance by providing secure, transparent, and efficient solutions for a wide range of financial applications.

The major growth strategies adopted by the blockchain finance market players are investment and agreement.

Asia-Pacific is projected to provide more business opportunities for the global blockchain finance market in the future.

Deloitte Touche Tohmatsu Limited, R3, Alphabet, Circle Internet Financial Limited, JP Morgan Chase, Microsoft Corporation, Goldman Sachs, Global Arena Holding Inc. (GAHI), International Business Machines (IBM) Corporation, and Accenture are the major players in the blockchain finance market.

The public blockchain sub-segment of the type acquired the maximum share of the global blockchain finance market in 2022.

Banks, non-banking financial institutions, and insurance companies are the major customers in the global blockchain finance market.

The report provides an extensive qualitative and quantitative analysis of the current trends and future estimations of the global Blockchain finance market from 2022 to 2032 to determine the prevailing opportunities.

Loading Table Of Content...

Loading Research Methodology...