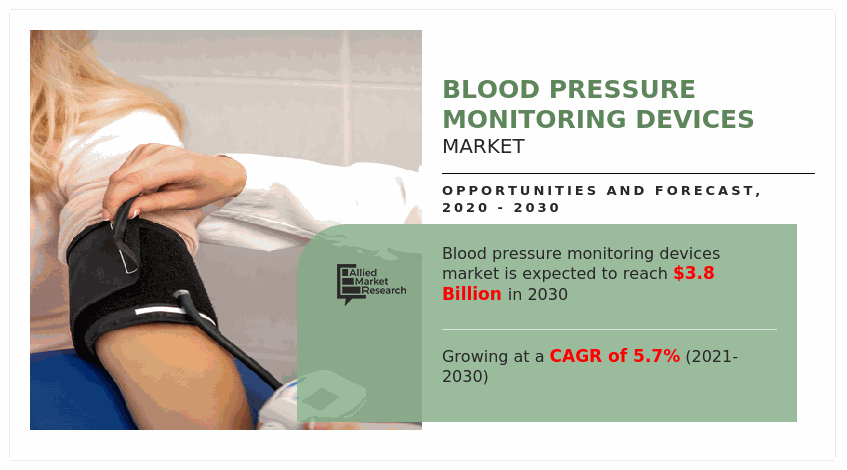

Blood Pressure Monitoring Devices Market Research, 2030

The global blood pressure monitoring devices market was valued at $2.2 billion in 2020, and is projected to reach $3.8 billion by 2030, growing at a CAGR of 5.7% from 2021 to 2030. Blood pressure is measured using a device called sphygmomanometer, or blood pressure monitor. It consists of an inflatable cuff that is wrapped around the arm, roughly leveled with the heart, and a monitoring device that measures the cuff's pressure. The monitor measures two pressures: systolic and diastolic. Blood pressure monitoring devices are used to assess hypertension in a patient’s body. Blood pressure is one of the main risk factors for chronic heart diseases and strokes, which are the leading cause of death around the world.

This is due to the surge in importance of blood pressure monitoring devices in home care settings and emergence of advanced technologies. In addition, the major driving factors of blood pressure monitoring market are rise in aging population, change in lifestyles, and emergence of advanced technologies. The demand for blood pressure monitoring devices is expected to increase in forthcoming years, as they can facilitate early diagnosis of a patient’s deteriorating health condition. In addition, advanced blood pressure monitoring devices are designed for personal use, which help to track the health status of a patient remotely.

The demand for blood pressure monitoring devices is anticipated to increase globally during market analysis, owing to rise in incidence of chronic diseases and rapid increase in geriatric population. Moreover, surge in healthcare expenditure in emerging economies and high demand for proactive monitoring is expected to provide new opportunities for market players. However, lack of awareness in developing regions is anticipated to hamper the blood pressure monitoring devices market growth. In addition, high blood pressure is a major cause of several diseases such as heart attack, stroke, and renal failure; thus, blood pressure monitoring is important to determine the severity of a patient’s condition. The increase in the adoption of blood pressure monitoring devices is due to increase in the incidence of cardiovascular diseases such as hypertension, risk of high BP in geriatric population, and expanding base of lifestyle diseases including obesity & diabetes.

The blood pressure monitoring devices market is segmented into Product Type and End User.

Global Blood Pressure Monitoring Devices Market Segmentation

The BP monitoring devices market is segmented on the basis of product type and region. On the basis of product type, the market is classified into aneroid BP monitors, digital BP monitors, blood pressure instrument accessories, and ambulatory BP monitors. Furthermore, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By Product Type

By product type, the blood pressure monitoring devices market size is classified into aneroid BP monitors, digital BP monitors, blood pressure instrument accessories, and ambulatory BP monitors. The digital BP monitors segment is expected to dominate the market throughout the blood pressure monitoring devices market forecast period. In addition, this segment registers the highest CAGR of 6.0% during the forecast period, this segment accounted for the major chunk of the market owing to rise in the global incidence of hypertension. Digital BP monitors devices facilitate easy and early detection of a patient’s deteriorating health condition, thereby, enabling speedy intervention and diagnosis of diseases. However, the BP monitoring devices used in ambulatory surgical centers (ASCs) is projected to be the fastest growing segment, owing to increase in the number of outpatient cases.

By Product Type

Digital BP Monitors segment held a dominant position in 2020 and would continue to maintain the lead over the forecast period.

By End User

By end user, the blood pressure monitoring devices market size is classified into hospital, home and others. The hospital segment is expected to dominate the blood pressure monitoring devices market share throughout the forecast period. owing to presence of large patient pool.

By End User

Hospitals segment is projected as one of the most lucrative segment.

By Region

Region wise, in blood pressure monitoring devices industry, North America dominated the market in 2020, accounting for the highest share, and is anticipated to maintain this trend throughout the forecast period. This is attributed to the increase in prevalence of hypertension, growth in awareness among patients about cost-effective blood pressure monitoring devices, and availability of advanced healthcare facilities in North American countries. However, Asia-Pacific is expected to grow at the highest rate, owing to its high population base, incomes, and improvement in patient awareness about advanced blood pressure monitoring devices.

By Region

North America was holding a dominant position in 2020 and would continue to maintain the lead over the analysis period.

Competition Analysis

The major companies profiled in the blood pressure industry report include A&D Company, Limited, Contec Medical Systems Co., Ltd., General Electric Company, Halma plc, Hill-Rom Holdings, Inc., Koninklijke Philips N.V., Masimo Corporation, Nihon Kohden Corporation, Omron Corporation, and Smiths Group Plc.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the blood pressure monitoring devices market analysis from 2020 to 2030 to identify the prevailing blood pressure monitoring devices market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the blood pressure monitoring devices market segmentation assists to determine the prevailing market blood pressure monitoring devices market opportunity.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global blood pressure monitoring devices market trends, key players, market segments, application areas, and market growth strategies.

Blood Pressure Monitoring Devices Market Report Highlights

| Aspects | Details |

| By Product Type |

|

| By End User |

|

| By Region |

|

| Key Market Players | Smith & Nephew Plc., CONTEC MEDICAL SYSTEMS CO., LTD., Koninklijke Philips N.V., GE HEALTHCARE (A HEALTHCARE DIVISION OF GE COMPANY), HILL-ROM HOLDINGS, INC., OMRON CORPORATION, MASIMO CORPORATION, NIHON KOHDEN CORPORATION, A & D Company, Limited, HAlmA plc. |

Analyst Review

This section provides the opinions of top-level CXOs of companies operating in the global blood pressure monitoring devices market. On the basis of interviews conducted, the utilization of blood pressure monitoring devices is going to increase owing to rise in utilization of these devices, upsurge in incidence of chronic diseases including hypertension, and growth in awareness about the development of blood pressure monitoring devices for personal use. The blood pressure monitoring devices market has enhanced the interest of healthcare professionals owing to the recognition of risk factors associated with high blood pressure such as stroke and heart attack, which is expected to help the physicians for prior determination of the severity of any disease. Moreover, the market is driven by growth in geriatric population and rise in prevalence of hypertension. According to the CXOs, the use of blood pressure monitoring devices is the highest in the North American region, followed by Europe and Asia-Pacific, as a result of high government expenditure on healthcare and supportive reimbursement policies.

The upcoming trends of Blood Pressure Monitoring Devices Market in the world are rise in incidence of chronic diseases and rapid increase in geriatric population.

The leading application of Blood Pressure Monitoring Devices Market are cardiovascular diseases such as hypertension, risk of high BP in geriatric population, and expanding base of lifestyle diseases including obesity & diabetes.

North America is the largest regional market for Blood Pressure Monitoring Devices.

The Blood Pressure Monitoring Devices is projected to reach $ 3789.76 million by 2030, registering a CAGR of 5.7% from 2021 to 2030.

The top companies to hold the market share in Blood Pressure Monitoring Devices include A&D Company, Limited, Contec Medical Systems Co., Ltd., General Electric Company, Halma plc, Hill-Rom Holdings, Inc., Koninklijke Philips N.V., Masimo Corporation, Nihon Kohden Corporation, Omron Corporation, and Smiths Group Plc.

Loading Table Of Content...