Blood Screening Market Research, 2032

The global blood screening market size was valued at $2.4 billion in 2022, and is projected to reach $4.9 billion by 2032, growing at a CAGR of 7.5% from 2023 to 2032. The growth of the blood screening market growth is driven by surge in the donation of blood globally and rise in awareness about the transfusion transmitted diseases. According to 2023 report by World Health Organization, a total of 118.5 million blood donations were collected worldwide in 2022.

Key Takeaways

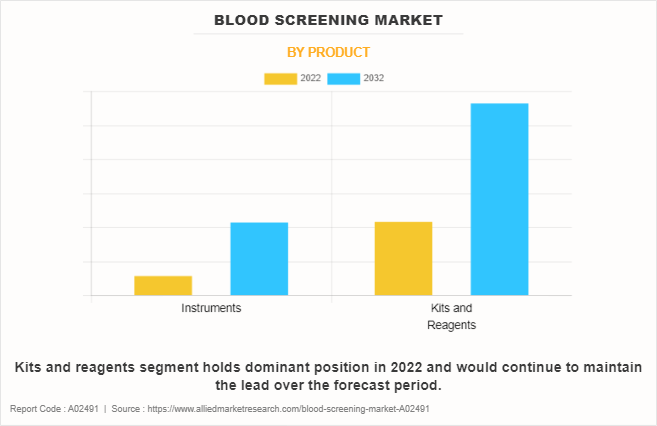

-By product, the kits and reagent segment was the highest contributor to the market in 2022.

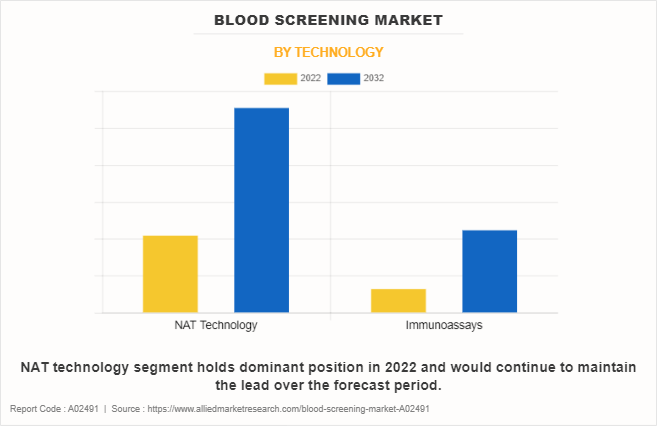

-By technology, the immunoassay segment dominated the market in 2022 and is expected to remain dominant during the forecast period.

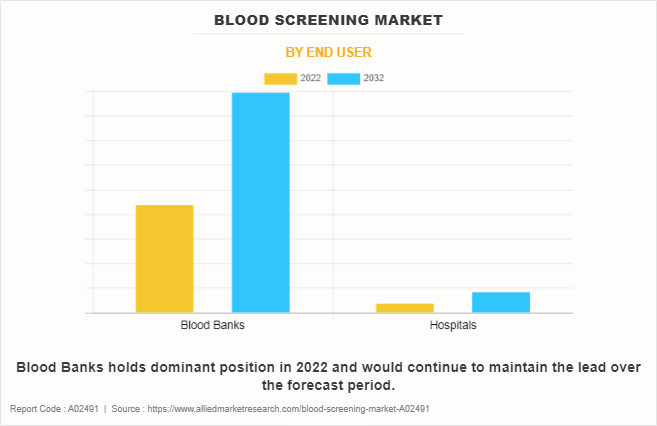

-By end user, the blood banks segment dominated the market in 2022, and is expected to remain dominant during the forecast period.

-By region, North America held the largest revenue share in 2022. However, Asia-Pacific is expected to grow at the fastest rate during the forecast period.

Blood screening is a crucial process undertaken to ensure the safety and quality of donated blood for medical use. This meticulous procedure involves a series of tests aimed at detecting infectious diseases and other potential risks associated with transfusions. The primary goal is to protect both the recipients of blood transfusions and the broader public health. During the screening process, donated blood is typically tested for a variety of infectious agents, including but not limited to HIV, hepatitis B and C, syphilis, and human T-lymphotropic virus (HTLV). In addition to infectious diseases, blood banks may also screen for markers such as antibodies and antigens to identify specific blood types and compatibility. Advancements in technology have enabled the development of highly sensitive and specific screening tests, enhancing the accuracy and reliability of the results.

Market Dynamics

The blood screening market size in expected to grow significantly, owing to surge in blood donations globally, rise in awareness about the transfusion transmitted diseases, and surge in demand for donated blood for medical applications. In addition, according to the blood screening market forecast the global surge in blood donations is expected to emerged as a pivotal driver propelling the growth of the blood screening market share. In recent years, there has been a notable uptick in awareness and campaigns promoting voluntary blood donations worldwide, spurred by a growing understanding of the critical need for safe and sufficient blood supplies.

For instance, according The American National Red Cross, each year, an estimated 6.8 million people in the U.S. donate blood. The demand for effective and advanced blood screening technologies has intensified as more individuals participate in blood donation drives. Blood screening plays a crucial role in ensuring the safety and reliability of donated blood by identifying potential infections, and other health concerns. Thus, the rise in blood donations globally is expected to contribute significantly in the growth of blood screening market share.

Furthermore, the increasing awareness about the transfusion transmitted diseases has emerged as a major driver propelling the growth of the blood screening industry. The escalating awareness surrounding transfusion-transmitted diseases (TTDs) has emerged as a pivotal driver propelling the growth of the blood screening industry. With a heightened understanding of the potential risks associated with blood transfusions, both among healthcare professionals and the general public, there has been an increase in demand for stringent screening measures to ensure the safety of the blood supply. Transfusion-transmitted diseases (TTD), including viral infections such as HIV, hepatitis B and C, and emerging threats like Zika virus, underscore the critical need for comprehensive blood screening protocols.

According to 2022 report by National Library of Medicine, blood transfusion transmissible infections increased from 4.72% to 4.86% from 2019 to 2021. The devastating consequences of TTDs have prompted healthcare authorities, regulatory bodies, and blood establishments to prioritize and enforce robust screening processes. As a result, the blood screening market analysis has witnessed a surge in technological advancements and innovations aimed at enhancing the detection capabilities of screening assays, thereby reinforcing the safety and efficacy of blood transfusions.

Thus, rise in awareness about TTDs not only fosters a culture of responsibility within the healthcare ecosystem but also serves as a catalyst for continuous improvements in blood screening methodologies, positioning it as a foundation in safeguarding public health.

In addition, the surge in demand for donated blood for various medical applications has emerged as a pivotal driver propelling the growth of the blood screening market. The need for safe and compatible blood transfusions has become increasingly crucial with the escalating prevalence of complex medical conditions, surgeries, and traumatic injuries. Various medical procedures, such as organ transplants, cancer treatments, and major surgeries, often necessitate substantial quantities of blood to ensure the well-being and recovery of patients.

For instance, according to according 2022 U.S. Blood Donation statistics, nearly 30,000 units of whole blood and RBCs are transfused each day in U.S. As healthcare systems globally strive to address the growing burden of chronic diseases, the reliance on blood transfusions as a life-saving intervention has become more pronounced. Blood screening has become an indispensable component of the healthcare infrastructure to ensure the safety of the blood supply and minimize the risk of transfusion-transmitted infections.

Blood screening not only detects infectious agents like HIV, hepatitis, and syphilis but also identifies potential contaminants, ensuring that donated blood is free from harmful pathogens. Consequently, the increased emphasis on maintaining a secure and reliable blood supply to meet the escalating demand for transfusions has highlighted the importance of blood screening technologies, thereby fostering its market growth.

However, the blood screening market faces substantial challenges in the form of regulatory hurdles, which blood screening market opportunity. Regulatory bodies play a crucial role in ensuring the safety and efficacy of blood screening products, but the stringent requirements they impose can create obstacles for companies operating in this sector. Obtaining regulatory approval for new blood screening technologies and products is a complex and time-consuming process, involving rigorous testing, documentation, and compliance with stringent standards. The need to navigate through these regulatory pathways can result in delays in bringing innovative products to market, stifling the pace of technological advancement within the industry.

Moreover, frequent updates and changes in regulatory frameworks can pose additional challenges, requiring companies to adapt swiftly to stay in compliance. These hurdles not only increase the time and cost involved in bringing blood screening products to market but also limit the ability of smaller companies with innovative solutions to compete effectively. As a result, the regulatory landscape serves as a formidable restraint, impacting the overall growth and dynamism of the blood screening market.

The 2023 global recession poses challenges for the blood screening market trends. As inflation escalates, the cost of raw materials, equipment, and technology required for blood screening may surge, thereby increasing the overall operational expenses for companies operating blood screening market. This financial strain could potentially lead to a slowdown in research and development efforts, hindering the introduction of innovative screening technologies. Moreover, the escalating cost of healthcare services may result in reduced healthcare budgets, impacting the funding available for blood screening programs and initiatives.

Segments Overview

The blood screening market is segmented on the basis of product, technology, end use, and region. By product, the market is classified into instruments, kits and reagents. By technology, the market is categorized into NAT technology, and immunoassay. By end user, the market is bifurcated into hospitals and blood banks. Region-wise, the market is analyzed across North America (the U.S., Canada, and Mexico), Europe (Germany, France, the UK, Italy, Spain, and rest of Europe), Asia-Pacific (Japan, China, Australia, India, South Korea, and rest of Asia-Pacific), and LAMEA (Brazil, South Africa, Saudi Arabia, and rest of LAMEA).

By Product

The blood screening market is categorized into instruments and kits and reagents. The kits and reagent segment dominated the global market in 2022 and is anticipated to remain dominant during the forecast period. This is attributed to the lower cost and portability of the kits and reagents to facilitate efficient blood screening at the small-scale blood banks and blood banks in remote areas.

By Technology

By technology, the market is categorized into NAT technology and immunoassay. The NAT technology segment dominated the global market in 2022 and is anticipated to remain dominant during the forecast period due to high adoption of NAT technology for detecting infectious diseases in donated blood.

By End User

On the basis of end user, the market is categorized into hospitals and blood banks. The blood banks segment dominated the market in 2022, owing to fact that majority of the blood is donated at the blood banks.

By Region

On the basis of region, the blood screening market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. On the basis of region, North America had the highest market share in 2022, owing to high number blood donation, and well-developed healthcare infrastructure and strong presence of major key players. However, Asia-Pacific is expected to exhibit fastest growth during the forecast period, owing to surge in demand for blood component for clinical applications.

Competition Analysis

Competitive analysis and profiles of the major players in the blood screening market, such as F. Hoffmann-La Roche Ltd., Grifols, S.A., Abbott Laboratories, Bio-Rad Laboratories, Inc., Danaher Corporation, DiaSorin S.p.A., Siemens AG, Avioq, Inc, QuidelOrtho Corporation and Alive DX. Major players have adopted product upgrade, product approval and product launch as key developmental strategies to improve the product portfolio and gain strong foothold in the blood screening market.

Recent Product Upgrade in the Blood Screening Market

- In November 2023, Diasorin announced it will develop the first fully automated diagnostic test for hepatitis delta virus (HDV) on the Diasorin LIAISON XL immunoassay system in the U.S

Recent Product Approval in the Blood Screening Market

- In June 2022, Grifols announced that its Procleix Plasmodium Assay has obtained the CE mark, the first for an automated nucleic acid test (NAT) system specifically validated for screening blood donors for malaria.

Recent Product Launch in the Blood Screening Market

- In May 2023 Bio-Rad Laboratories, Inc. announced the launch of the IH-500TM NEXT System, a fully automated system for ID-Cards. The IH-500 NEXT System is used with Bio-Rad's ID-Cards, offering a broad portfolio for both routine testing (type and screen) and specialized testing, including single antigen determination and newborn screening.

Blood Screening Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 4.9 billion |

| Growth Rate | CAGR of 7.5% |

| Forecast period | 2022 - 2032 |

| Report Pages | 240 |

| By Product |

|

| By End User |

|

| By Technology |

|

| By Region |

|

| Key Market Players | Grifols, S.A., DiaSorin S.p.A., Alive DX, Bio-Rad Laboratories, Inc. , QuidelOrtho Corporation., Siemens AG, Danaher Corporation, Avioq, Inc., Abbott Laboratories, F. Hoffmann-La Roche Ltd. |

Analyst Review

The blood screening market has witnessed significant growth and transformation in recent years, driven by a combination of technological advancements, increase in awareness of health and wellness, and the ongoing global focus on preventive healthcare. Blood screening products play a critical role in healthcare by aiding in the early detection of various diseases and ensuring the safety of blood transfusions. Opportunities for expansion and innovation are especially in areas such as point-of-care testing, and personalized medicine.

North America is the largest regional market for blood screening owing to rise in demand of donated blood for surgical applications and strong presence of major key players.

The forecast period for dental cartridge syringe market is 2023 to 2032..

The base year is 2022 in blood screening market.

The estimated industry size of dental cartridge syringe in 2022 is $2.4 billion.

The base year for blood screening market is 2022.

Loading Table Of Content...

Loading Research Methodology...