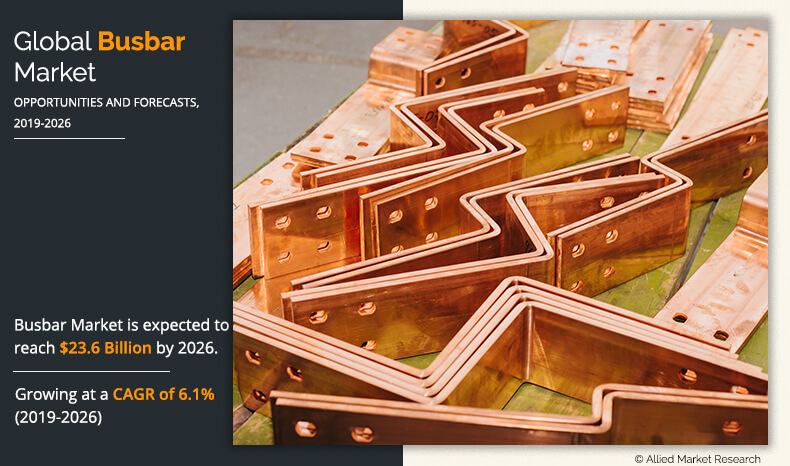

Busbar Market Outlook - 2026

Global busbar market accounted for revenue of $14.0 billion in 2018 and is anticipated to generate $23.6 billion by 2026. The global busbar market is projected to experience growth at a CAGR of 6.1% from 2019 to 2026. Busbar is a metallic strip or bar that acts as medium to distribute power in a system. The metals used are aluminum, copper, bronze, or other efficient alloys that are capable of offering high conductivity and low energy loss during transmission. Aluminum is majorly preferred owing to its higher electrical conductivity. Busbar is fully or partly insulated for protection. It is a commonly enclosed in switchgears, panel boards, switch panels, and busway enclosures. Busbar is capable of enduring high temperature environment, dissipating the heat, and great mechanical strength.

The need for efficient conductor and lower energy loss during transmission has replaced the conventional methods of power distribution by busbar made from highly conductive metals. Hence, it acts as driving factor for the growth of the market. Moreover, smart & green city concepts boost the busbar market growth. The integration of busbars in the newly developed or upcoming projects for city or town developments by replacing cables and wired connectivity positively impacts market growth. In addition, the wind power generation & distribution industry is experiencing a surge, which results in high demand for busbars used at different levels of power distribution process, hence driving the market growth. The busbar offers easy and faster installation which offers cost benefits to the end-users. This acts as driving factor for the market as conventional methods takes up time and labor for the same.

Moreover, busbar largely cuts down the facility costs as they replace the cables and other related components acting as another factor for the growth of the busbar market. Furthermore, busbars are secure, reliable, and environment friendly which further contribute toward the growth of the busbar market. However, availability of the cheap and low-quality products in the market restrain the market growth. In-addition, lack of R&D activities and volatile raw material pricing also hampers the market growth.

Global busbar market is segmented based on materials type, application, and region. Depending on materials type, it is divided into aluminum, copper, and brass. The application covered in the study are industrial, commercial, and residential. By region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA (Latin America, Middle East and Africa).

The key players in busbar industry are Siemens AG, ABB Ltd., Schneider Electric SE, Eaton Corporation Plc., Rogers Corporation, TE Connectivity Ltd., Legrand S.A., Friedhelm Loh Group, Mersen S.A., and Chint Group. The key players adopted several strategies such as new product launch, agreement, acquisition, and expansion to sustain the intense competition in the market.

Busbar Market, by Material Type

By type, the market is divided into aluminum, copper, and brass. Copper dominates the market in terms of revenue owing to high price of raw material. Aluminum is expected to grow at a higher CAGR during the forecast period. Aluminum has high conductivity and efficiency. It is 70% lighter than copper making preferable by the end users. In-addition the loss of energy during the transmission is also lower in comparison to other materials, which results in increased demand for aluminum.

By Type

Aluminum is projected as the most lucrative segment.

Busbar Market, by Application

By application, the market is further segmented into industrial, commercial, and residential. The industrial segment dominated the market by holding large market share in terms of revenue. However, the commercial segment is expected to grow at higher CAGR owing to smart & green city concepts. As the busbars are easy to install and saves space, the commercial sector is rapidly replacing the conventional cables with busbars. The commercial sectors such as buildings, corporate offices, departmental stores, shopping malls, offices and banking are adopting busbars.

By Application

Commercial is projected as the most lucrative segment.

Busbar Market, by Region

By region, Asia-Pacific has the highest busbar market share owing to the increased investments in the emerging economies in the busbar industry. China dominates the Asia-Pacific busbar market followed by India. India is expected to experience highest growth in the region owing to increased investments in the market. North America is expected to be the fastest growing region in the busbar market owing to the presence of major corporation in the region. U.S. dominates the market in the North America region and is expected to grow at a higher pace followed by Canada.

By Region

North America is projected as the most lucrative market.

Key Benefits for Busbar Market:

- The report provides an in-depth analysis of the forecast along with the current and future busbar market trends

- This report highlights the key drivers, opportunities, and restraints of the busbar market along with the impact analyses during the forecast period

- Porter’s five forces analysis helps analyze the potential of the buyers & suppliers and the competitive scenario of the busbar industry for strategy building

- A comprehensive analysis of the factors that drive and restrain the busbar market growth is provided.

- The qualitative data in this report aims on busbar market trends, dynamics, and developments

- The busbar market size is provided in terms of revenue

Busbar Market Report Highlights

| Aspects | Details |

| By Material |

|

| By Application |

|

| By Region |

|

| Key Market Players | ABB, Rogers Corporation, CHINT Group, TE Connectivity, Friedhelm Loh Group, Eaton Corporation plc, Siemens AG, Legrand S.A., Schneider Electric, Mersen |

Analyst Review

The global busbar market is anticipated to grow at a considerable rate during the forecast period. This is attributed to the rise in demand for busbar from various end-use industries. There is an increase in the demand from developing economies such as China and India, which fosters the market growth. Demand for busbar from developed regions such as Europe also contributed largely to the market growth owing to the presence of key market players in the region. The replacement of cables by the busbar is driving the market growth. The busbar market is anticipated to grow at steady pace as they are highly conductive and lower the energy loss during transmission. Busbar is commonly enclosed in switchgears, panel boards, switch panels, and busway enclosures. As they are capable of enduring high temperature environment, dissipating the heat, and great mechanical strength, they are majorly used in automotive, aerospace, mining, electricity distribution, energy & power generation, and other industries. However, the availability cheap and low-quality products, lack of R&D activities, and volatile raw material pricing hampers the market growth. Meanwhile, emerging switchgear market and integration in energy & power market offer lucrative opportunities for busbar industry.

Loading Table Of Content...