Business Credit Cards Market Research, 2032

The global business credit cards market was valued at $33.5 billion in 2023, and is projected to reach $59.9 billion by 2032, growing at a CAGR of 7% from 2024 to 2032. The market is expanding rapidly due to rising demand for convenient financing solutions and enhanced rewards programs tailored for businesses. This growth is further propelled by the increasing adoption of digital payment methods and the need for efficient expense management tools.

Key Takeaways

The business credit cards market study covers 20 countries. The research includes a segment analysis of each country in terms of value ($Million) for the projected period 2023-2032.

More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major business credit cards industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Market Introduction and Definition

The business credit card market encompasses a range of financial products designed specifically for businesses, offering benefits tailored to business needs. These cards allow business credit cards industry to separate personal and business expenses, aiding in financial organization and accounting. They often come with higher credit limits than personal cards, accommodating larger purchases or cash flow needs. Business credit cards offer rewards and benefits such as cashback, travel rewards, and discounts on business expenses, incentivizing spending. With expense tracking tools and integration with accounting software, they streamline financial management. Additionally, features such as spending controls for employees help businesses maintain control over expenditures. This market serves businesses of all sizes, from startups to large corporations, providing financial flexibility, rewards, and management solutions crucial for business operations.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the business credit cards market size analysis to identify the prevailing business credit cards market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the business credit cards market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the Global Business Credit Cards Market Share.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as Global business credit cards market trends, key players, market segments, application areas, and market growth strategies.

Industry Trends

In April 2024, Klarna launched a credit card offering in the U.S. allowing users to buy goods with flexible payment options across both physical and e-commerce stores that accept Visa with the ability to pay back the cost of transactions in either three or six-month installments

In October 2023, NerdWallet, Inc., an American personal finance company that provides financial guidance to consumers and small and mid-sized businesses (SMBs) launched first financial product for consumers—NerdUp by NerdWallet—a secured credit card designed to help users build and improve their credit responsibly.

In September 2023, Owners Bank, a new digital bank created to meet the unique needs of small business owners, launched a business credit card designed for small businesses as it offers owners increased access to financing and the unique opportunity to earn rewards, empower employees, and increase efficiency across operations.

In June 2022, Verizon partnered with Mastercard and FNBO to launch a small business credit card that helps Verizon customers of all sizes transform their businesses and ensure they are truly future-ready.

Key Market Dynamics

One of the primary drivers for the business credit card market is the rise of small businesses globally. Small businesses often face challenges in obtaining traditional loans or lines of credit, making business credit cards an attractive financing option. With the increasing number of startups and entrepreneurial ventures, there is a growing demand for financial products that cater to their unique needs. Business credit cards offer small businesses access to funds for initial investments, working capital, and day-to-day expenses. Additionally, these cards provide flexibility, allowing businesses to manage cash flow fluctuations more effectively. The rise of small businesses creates a significant opportunity for credit card issuers to tap into this market segment by offering tailored products and services. Moreover, the ongoing digital transformation in financial services is another major driver for the business credit card market. Businesses are increasingly embracing digital tools and platforms for their operations, and credit card issuers are responding by offering enhanced digital features. These features include mobile apps with advanced expense tracking, real-time spending alerts, and integration with accounting software. Digitalization not only improves the user experience but also provides businesses with greater control and visibility over their finances. Furthermore, digital platforms enable credit card issuers to gather valuable data insights, allowing them to better understand their customers' spending patterns and preferences. This data-driven approach facilitates targeted marketing efforts and product customization, driving customer engagement and loyalty.

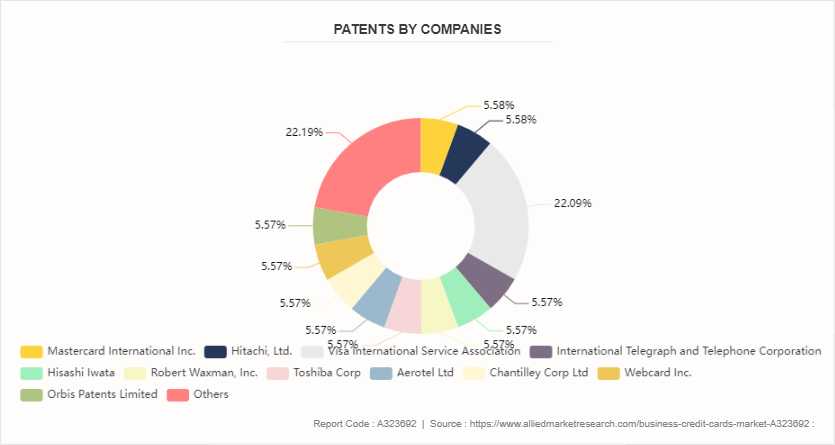

Patent Analysis of Global Business Credit Cards Market

Although the growth of the business credit cards market has been more rapid in recent years, The increasing number of small businesses globally is a significant growth factor for the business credit card market. Small businesses often rely on credit cards as a source of financing for their operations, especially during the early stages of business growth. For instance, in 2021, Chase announced a partnership with accounting software provider Xero to enable small business customers to link their Chase business credit card accounts with their Xero accounts. This integration allows businesses to automatically import their credit card transactions into Xero, simplifying expense tracking and reconciliation. Chase's initiative reflects the growth factor of technological advancements and integration with accounting software, as it enhances the value proposition of its business credit cards by providing businesses with tools to streamline their financial processes.

Market Segmentation

The business credit cards market is segmented into type, application, and region. On the basis of type, the market is divided into open-loop and closed loop cards. On the basis of application, the market is bifurcated into small business credit cards, and corporate credit cards. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional/Country Market Outlook

The business credit card market across different regions exhibits diverse trends and dynamics. In the U.S, major players such as American Express, Chase, and Capital One continue to dominate, with a focus on innovative rewards programs and tailored services. For instance, in December 2022, JPMorgan Chase & Co. launched Chase Ink business credit card that offers substantial sign-up bonuses and travel rewards, catering to the needs of small business owners who frequently travel for work. In Europe, regulatory changes like the Payment Services Directive (PSD2) have led to increased competition and innovation. UK-based companies like Revolut and Tide are leveraging digital platforms to offer business credit cards with real-time expense tracking and budgeting tools. Meanwhile, in Asia-Pacific, digital payment platforms are disrupting traditional banking models. Companies like Ant Group in China offer business credit cards integrated into their digital ecosystem, providing businesses with seamless payment solutions and access to credit. In Latin America, despite economic challenges, fintech startups like Nubank in Brazil are gaining traction by offering business credit cards with transparent fee structures and easy online application processes. In the Middle East, digital banking is on the rise, with companies such as Emirates NBD in the UAE offering business credit cards with features tailored to regional businesses, such as Sharia-compliant financing options. These real-time instances highlight how the business credit card market is evolving globally, with a focus on digitalization, convenience, and tailored services to meet the diverse needs of businesses across different regions.

In February 2024, Mastercard introduced AI-powered fraud detection technology for business credit cards. This advanced system analyzes transaction patterns in real time to identify and prevent fraudulent activity, enhancing security and peace of mind for businesses while minimizing disruptions.

In April 2023, Capital One Business introduced enhanced integration with accounting software, allowing businesses to automatically categorize expenses and generate customized reports. This integration with platforms like QuickBooks and Xero streamlines accounting processes, enabling businesses to track expenses more efficiently.

In June 2022, PayPal partnered with Mastercard and launched co-branded business credit cards for PayPal Business account holders. These cards offer enhanced cashback rewards on PayPal and Mastercard transactions, as well as exclusive discounts on business services like shipping and marketing.

Competitive Landscape

The major players operating in the business credit cards market include American Express Banking Corp., JPMorgan Chase Bank, Capital One, Bank of America Corporation, Citi Group Inc, Wells Fargo, U.S. Bancorp, Barclays Plc, Discover Bank, and The Hongkong and Shanghai Banking Corporation Limited.

Other players in the business credit cards market include BBVA, SunTrust, PNCBank and others.

Recent Key Strategies and Developments

In May 2023, Brex, a fintech company, enhanced its expense management tools by introducing real-time expense tracking and receipt capture features on its corporate credit cards. These tools, accessible via a mobile app, help businesses monitor spending and manage expenses more effectively on the go.

In December 2022, Visa launched the Visa Business Premium card to offer exclusive travel perks and rewards for business travelers. Cardholders receive benefits such as airport lounge access, travel insurance, and accelerated rewards on travel-related expenses, catering to the needs of frequent business travelers.

Key Sources Referred

HighRadius

tryjeeves

Bankrate

fundingoptions

BECU

U.S. News & World Report L.P.

Key Benefits for Stakeholders

This report provides a quantitative analysis of the business credit cards market segments, current trends, estimations, and dynamics of the business credit cards market analysis from 2022 to 2032 to identify the prevailing market opportunities.

The market research is offered along with information related to key drivers, restraints, and business credit cards market opportunity.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the business credit cards market outlook segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global business credit cards market statistics.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players, and business credit cards market forecast.

The report includes the analysis of the regional as well as global business credit cards market trends, key players, market segments, application areas, and business credit cards market growth strategies.

Business Credit Cards Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 59.9 Billion |

| Growth Rate | CAGR of 7% |

| Forecast period | 2024 - 2032 |

| Report Pages | 210 |

| By Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | U.S. Bancorp, Chase Corporation, The PNC Financial Services Group, Inc., The Hongkong and Shanghai Banking Corporation Limited, Wells Fargo & Company, Bank of America Corporation, Barclays Bank Plc, American Express Banking Corp, Citigroup Inc., Capital One Financial Corporation. |

The global business credit cards market is trending towards enhanced security features, digital transformation, tailored rewards, advanced analytics, sustainability, software integration, expanded credit access, contactless payments, globalization, and regulatory compliance.

The leading application of the business credit cards market is managing business expenses and cash flow efficiently.

North America is the largest regional market for Business Credit Cards in 2023.

$33.5 Billion is the estimated industry size of Business Credit Cards in 2023.

The major players operating in the business credit cards market include American Express Banking Corp., JPMorgan Chase Bank, Capital One, Bank of America Corporation, Citi Group Inc, Wells Fargo, U.S. Bancorp, Barclays Plc, Discover Bank, and The Hongkong and Shanghai Banking Corporation Limited. Other players in the business credit cards market include BBVA, SunTrust, PNCBank and others.

Loading Table Of Content...