Canned Lamb Market Research, 2032

The global canned lamb market size was valued at $1.6 billion in 2022, and is projected to reach $2.4 billion by 2032, growing at a CAGR of 4.1% from 2023 to 2032.

A canned lamb is a meat that has been prepared, salted, and stored in a can. In order to ensure that the products are sterilized and safe for long-term storage, it is usually done by placing cooked lamb meat in a can with all other ingredients or spice flavorings before sealing them and heating them at high temperatures. In several areas where fresh lamb is not easily available, or as an emergency food source, cannellini are frequently exploited as convenience and shelf-stable protein sources. In many dishes, including stews, soups, sandwiches, and casseroles, they are easy to use. Nevertheless, the texture and flavor of canned lamb do not appear to be very attractive to a lot of people.

Market Dynamics

Canned lamb offers the convenience of ingesting meals without having to prepare or thaw them. These products are simple to use and hence ideal for people who lead a hectic lifestyle. It also allowed people on tight budgets to save energy and keep things on shelves for longer periods of time. As a result, the ease of eating high-nutritional-value products with speedy delivery is a crucial element contributing to the increased demand for these items. Millennials desire high-quality food goods as well, but they lack essential cooking abilities and hence prefer products such as canned lamb. Several canned products are also available in stores and are marketed through the internet channels. These elements will contribute to market expansion.

COVID-19 had negatively impacted the canned lamb market since meat production and processing were hampered by disruption in the distribution channel causing difficulties in obtaining production inputs such as animal feed and restrictions on live animal transportation. Other challenges were seasonal such as border-crossing restrictions and limited access to professional services and labor. As a result of these concerns, there was a drop in meat supply and processing capacity, which led to worse sales conditions, thus delaying market activities. Furthermore, during the pandemic, the government’s capacity to prevent, control, and treat animal diseases decreased. Meat and meat products prices fluctuated due to a demand–supply discrepancy, owing to panic buying and lockdown limitations. It was wholly unexpected that COVID-19 would have an impact on the animal farming sector, and other industries like food chains and farmers. Infected cases of meat plant workers spread quickly, wreaking havoc on persons and the environment in other countries.

The longer shelf life of canned lamb meat compared to fresh meat is also expected to fuel canned lamb market growth. Heat sterilization is used to preserve canned lamb products, which destroys any bacteria or microbes that could cause deterioration. This means that canned lamb products can be stored without refrigeration for a lengthy period of time, making them a convenient and practical option for consumers.

The greater availability of canned lamb products is another advantage. In all areas, particularly in regions that do not traditionally consume lamb or where there is a shortage of available stocks, fresh lambs are not always readily available. On the other hand, it would be possible to manufacture and market canned lamb products in a wider variety of regions so as to make them more accessible to consumers. In addition, it is also possible to produce and keep for a longer period canned lamb products which may contribute to stabilizing the supply of this type of meat as well as avoiding shortages. This is especially relevant in regions where lamb production might be influenced by factors like seasonal changes, weather conditions or disease outbreaks. Therefore, the longer shelf life coupled with the increasing availability of canned lamb products is one of the factors behind the market growth. The canned lamb market is expected to be further increased and expanded, as more consumers become interested in convenience and availability of preparation options for lambs.

Veganism is a worldview trend that promotes compassion by avoiding the consumption of animal-derived goods. A vegan diet comprises entirely plant-based foods, with no eggs, milk, meat, or honey allowed. Processed and deli meat companies are grabbing the opportunity and are introducing new variants of plant-based meat in the market. For instance, in 2021, major plant-based meat brands under Maple Leaf Foods, Inc. launched a series of plant-based meat products to entice consumers and cater to market demand. On the other hand, an increase in awareness among health-conscious consumers about developing ailments by consuming meat is encouraging to shift toward plant-based meat. Thus, the increase in the vegan population and companies introducing new product lines of plant-based meat act as major hindrances to the growth of the canned lamb market.

The environmental impacts of the meat may also hamper the growth of the market. The meat can result in deforestation owing to pasture. For instance, according to an article by Generation Vegan, 83% of all farmland is used to raise animals but it gives us just 18% of our calories. The meat industry is one of the most damaging industries in terms of its climate impact. It is responsible for 14.5 percent of all human-generated greenhouse gas emissions, which is more than the fuel from every car, truck, plane, bus, ship, and train on the planet. Such harms of the meat industry on the environment may hamper the growth of the market owing to rising environmental concerns among the global population.

Expanding into new markets can be a significant source of growth for canned lamb manufacturers. As global demand for lamb products grows, particularly in emerging regions such as Asia and the Middle East, canned lamb producers have a chance to enter these markets and extend their client base. Lamb is not traditionally consumed as much in various countries of the world, such as Asia. However, as prosperity grows and consumer preferences shift, there is an increasing demand for lamb products in these markets. For example, rising disposable incomes and a growing interest in Western-style cuisine have increased the canned lamb market demand in China. Canning lamb manufacturers must understand local consumer preferences, legal regulations, and distribution channels in order to develop into new regions. This could entail collaborating with local distributors, building links with merchants and e-commerce platforms, and engaging in marketing and promotional efforts. Furthermore, canned lamb manufacturers may need to modify their products in order to fit the preferences of local consumers. This could include introducing new flavors or packaging formats that are more attractive to local preferences, or producing items specifically tailored to local cuisine. Therefore, expansion into new markets can be a key growth opportunity for canned lamb producers, as it enables them to penetrate new customer segments and increase their revenue streams. But there is a need for an exhaustive understanding of local market conditions, as well as adaptability to local consumers' preferences and regulatory requirements.

Segments Overview

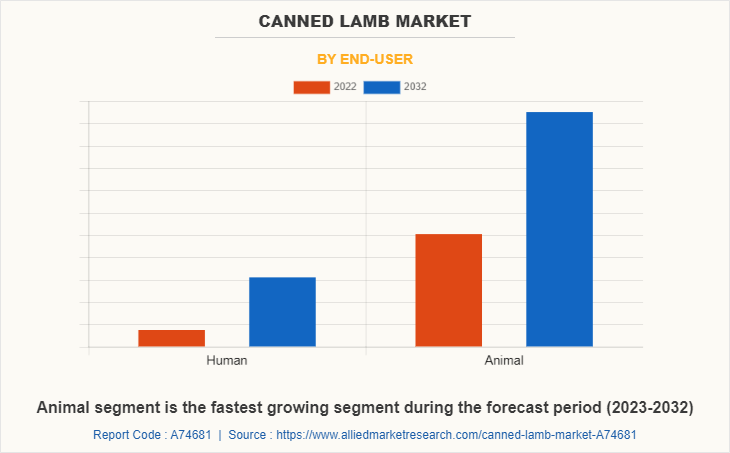

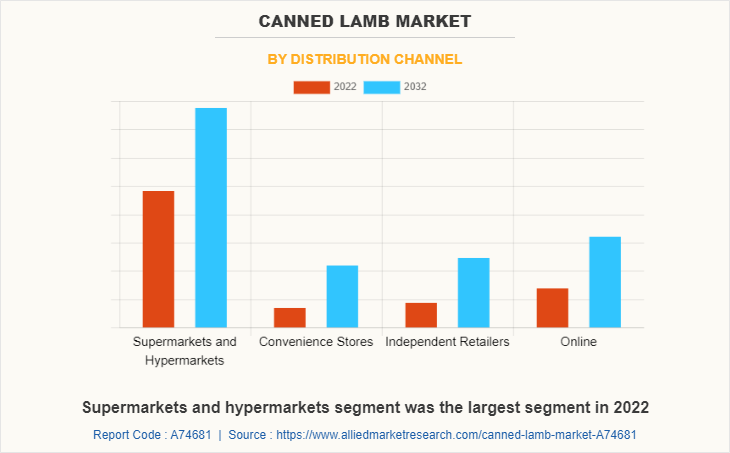

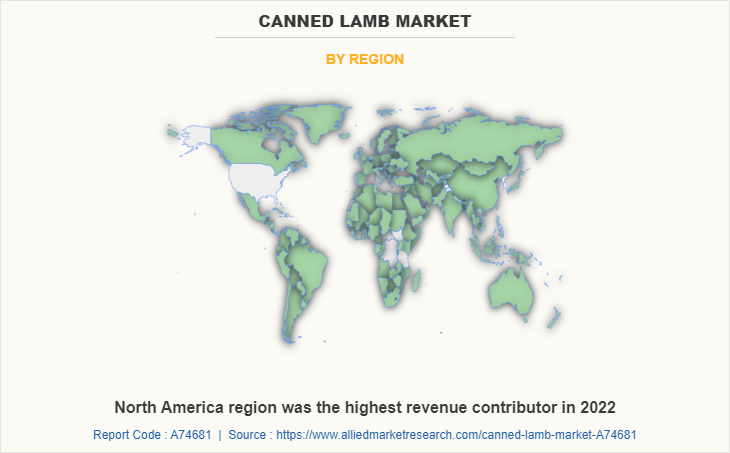

The canned lamb market is segmented on the basis of end-user, distribution channel, and region. On the basis of end-user, the canned lamb market is further segmented into human and animal. The animal segment is further segmented into dog and cat. On the basis of distribution channel, supermarkets/hypermarkets, convenience stores, independent retailers, and online. Region-wise the market is segmented into North America (U.S., Canada, and Mexico), Europe (UK, Germany, France, Italy, Russia, Spain, and Rest of Europe), Asia-Pacific (China, Japan, India, South Korea, Singapore, and Rest of Asia-Pacific), and LAMEA (Brazil, Argentina, South Africa, Egypt, and Rest of LAMEA).

On the basis of end-user, the market is segmented into human and animal. The animal segment dominated the market in 2022 and is expected to retain its dominance during the canned lamb market forecast period owing to its various advantages for animals as it is a great source of iron, is a great source of protein, and It contains omega-3 fatty acids. Moreover, it is made with the correct amount of dietary fat and zinc to boost your dog's immune system. Additionally, the rising pet humanization rate is also expected to boost the growth of the segment as pet owners are treating pets as family members and want the best for the pet.

On the basis of distribution channel, supermarkets/hypermarkets, convenience stores, independent retailers, and online. The supermarkets/hypermarkets segment dominated the canned lamb market in 2022 and is expected to retain its dominance during the forecast period due to the availability of a broad range of consumer goods and food & beverages under a single roof, in addition to ample parking space and convenient operation timings. Consumers prefer to buy products that are on sale. Moreover, products are arranged nearby, which aids buyers for easy comparison among similar products, thereby helping consumers to decide which product to buy. In addition, an increase in urbanization, a rise in the working-class population, and competitive pricing boost the popularity of supermarkets/hypermarket.

On the basis of the region, canned lamb market share is further segmented into North America (U.S., Canada, and Mexico), Europe (UK, Germany, France, Italy, Russia, Spain, and the Rest of Europe), Asia-Pacific (China, Japan, India, South Korea, Singapore, and Rest of Asia-Pacific), and LAMEA (Brazil, Argentina, South Africa, Egypt, and Rest of LAMEA). North America dominated the canned lamb market size in 2022 and is expected to maintain its dominance during the forecast period owing to the huge disposable income of the region’s population. Furthermore, the demand for packaged meat products is growing, as consumers switch to products that can be prolonged in shelf life. The demand for meat products in North America has significantly increased due to the growing consumer interest in healthy living, and also because meat is one of the main sources of iron, zinc, and other important minerals.

Competitive Analysis

The key players profiled in canned lamb market report are Calibra, Earth Paws Private Limited, Hound & Gatos, Muhubrands.com, FountainVest, MREdepot.com, SmartHeart Malaysia, Evangers Dog & Cat Food Company, Inc, Wellness Pet Company, Inc., Stahly Quality Foods, LemonSalt, Fromm Family Foods, LLC., Leos Pet Her Hakk Sakldr, Treats Unleashed, Fortan GmbH & Co. KG.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the canned lamb market share, segments, current trends, estimations, and dynamics of the canned lamb market analysis from 2022 to 2032 to identify the prevailing canned lamb market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the canned lamb market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global canned lamb industry.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global canned lamb market trends, key players, market segments, application areas, and market growth strategies.

Canned Lamb Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 2.4 billion |

| Growth Rate | CAGR of 4.1% |

| Forecast period | 2022 - 2032 |

| Report Pages | 250 |

| By End-User |

|

| By Distribution Channel |

|

| By Region |

|

| Key Market Players | LemonSalt, Calibra, Stahly Quality Foods, Leos Pet Her Hakk Sakldr, Fromm Family Foods, LLC., MREdepot.com, Fortan GmbH & Co. KG., FountainVest, Muhubrands.com, SmartHeart Malaysia, Wellness Pet Company, Inc., Earth Paws Private Limited, Evangers Dog & Cat Food Company, Inc, Treats Unleashed, Hound & Gatos |

Analyst Review

Since they are convenient and have a long shelf life, canned food items, including lamb, continue to be widely used. The demand for canned foods is being driven by hectic lifestyles and a desire for quick and simple dinner options. Consumers are increasingly searching for items that are high in protein, low in fat, and free of preservatives, driving up demand for healthier food options. Producing healthier formulations or organic choices may be necessary for canning lamb to meet these desires.

The demand for exotic flavors and ingredients is rising as customers' culinary preferences become more daring. This trend offers the canned lamb market a chance to provide goods that are suitable for various ethnic and gastronomic specialties. Customers are looking for items that coincide with their beliefs as they become more concerned about the effects that food production has on the environment. Brands obtain a competitive edge in the market by emphasizing humane animal welfare procedures, sustainable sourcing, and transparent labeling.

The global canned lamb market size was valued at USD 1.6 billion in 2022, and is projected to reach USD 2.4 billion by 2032.

The global canned lamb market is projected to grow at a compound annual growth rate of 4.1% from 2023-2032 to reach USD 2.4 billion by 2032.

The key players profiled in the canned lamb market report are Calibra, Earth Paws Private Limited, Evangers Dog And Cat Food Company, Inc, Fortan GmbH And Co. KG., FountainVest, Fromm Family Foods, LLC., Hound And Gatos, LemonSalt, Leos Pet Her Hakk Sakldr, MREdepot.com, Muhubrands.com, SmartHeart Malaysia, Stahly Quality Foods, Treats Unleashed, Wellness Pet Company, Inc.

North America dominated in 2022 and is projected to maintain its leading position throughout the forecast period.

Convenience & Time-Saving Benefits, Longer Shelf Life, Accessibility & Availability, Increased Demand for High-Quality, Easy-to-Prepare Meals, Cold Storage & Technological Advancements majorly contribute toward the growth of the market.

Loading Table Of Content...

Loading Research Methodology...