Cash Management System Market Overview

The global cash management system market was valued at $3.7 billion in 2023, and is projected to reach $13.2 billion by 2032, growing at a CAGR of 15% from 2024 to 2032. Rising demand for automation, enhanced cash flow visibility, regulatory compliance, increasing online transactions, fraud prevention needs, and integration with ERP and banking systems are contributing to the growth of the market.

Market Dynamics & Insights

- The cash management system industry in Europe held the largest market share in 2023.

- By enterprises size, the large enterprises held the largest market share in 2023.

Market Size & Future Outlook

2023 Market Size: $3.7 Billion

- 2032 Projected Market Size: $13.2 Billion

- CAGR (2024-2032): 15%

- Europe: dominated the market in 2023

- North America: Fastest growing market

What is Meant by Cash Management System

Cash management system market are integrated technologies that assist firms with all aspects of cash processing. Cash handling operations of the cash management system market are automated by cash management services and solutions, benefiting cash management system market opportunity to businesses from the point of intake to reconciliation.

Market Introduction and Definition

The cash management system industry is the fundamental asset that corporations utilize to satisfy their commitments regularly. Having a healthy cash flow is essential for financial stability. An automated solution called a cash management system market is made to help businesses handle cash processing efficiently. It offers a 360-degree perspective, and clear financial visibility that facilitates the shift from cash preservation to cash excellence, timely reporting, precise and dependable cash forecasting, and effective working capital management. Cash management system industry provides businesses profit greatly from the streamlining process that these solutions provide.

Key Takeaways

- The cash management system market study covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

- More than 1,500 product literature, industry releases, annual reports, and other such documents of major cash management industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions to achieve their most ambitious growth objectives.

Key market dynamics

Firms manage handling cash using cash management system market which are automated. These cash management system market help save time, lower expenses, and increase accuracy. These also help increase efficiency, enhance security, and reduce the overall error percentage. Banks are spending a lot of money on banking software that guarantees usability, dependability and is strengthened with cutting-edge security features smaller banks and businesses are expected to experience a significant increase in cash management due to their expanding asset size and strength. There is an increase in the use of artificial intelligence (AI) and advanced analytics in the cash management system because it ensures that data and knowledge about the business are available to make well-informed decisions about liquidity. Forecasting of cash management system market patterns predicted by predictive analytical approaches like scoring, rich data modeling, predictive analysis, and real-time analytics foster the adoption of the cash management systems market.

Expanding digital payments infrastructure

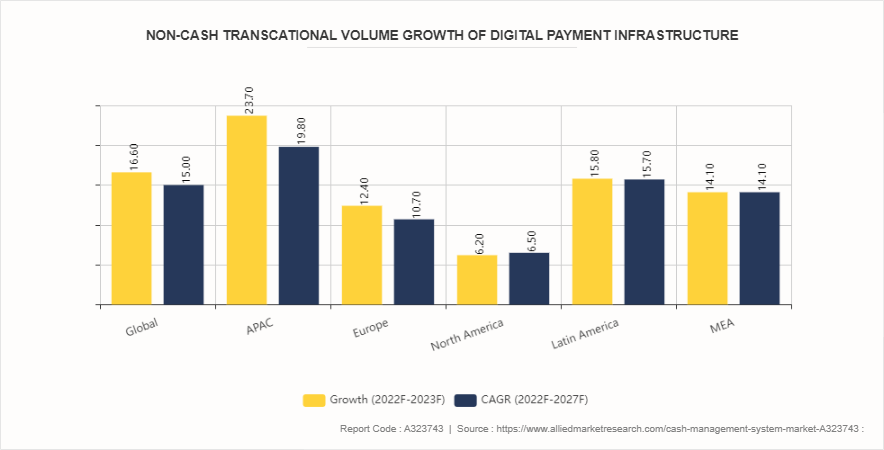

According to a survey by Capgemini Research Institute, non-cash transaction volumes of the cash management system market will reach 2.3 trillion by 2027, expanding at a rate of 15% annually as consumers and businesses adopt new digital payment solutions. Globally, the rate of increase in digital payments will vary by region. For example, the report states that by 2027, the digital payments of cash management system market will increase by 19.8% in the Asia-Pacific region, 10.7% in Europe, and 6.5% in North America. By 2027, new-age payment methods such as immediate payments, e-money, digital wallets, account-to-account payments, and QR (quick-response) codes will account for about 30% of total non-cash transaction volumes. In addition, almost 70% of all non-cash transaction volumes will be made up of conventional non-cash payment methods such as credit transfers, debit cards, direct debits, and checks. According to the 2023 World Payments Report Executive Survey, retail payments now account for 59% of all transaction volume worldwide, while commercial payments make up 41%. Retail payments make up about 44% of the overall number of payments, while commercial payments make up 56%.

The Capgemini report said that the split between commercial and retail payments value share was close to 50% each in the Asia-Pacific region. Throughout the cash management system market analysis 2022–2027 forecast period, non-cash volume is expected to increase at a compound annual growth rate (CAGR) of 15% due to the expansion of instant payment schemes, efforts to couple cross-border payment infrastructures, increasing adoption of ISO20022, and the proliferation of new payment instruments (such as wallets, QR code payments, A2A payments, and more) .

Cash Management System Market Segmentation Overview

The cash management system market is segmented into type operation, enterprise size, component, and region. On the basis of type operation, the cash management system market is divided into balance and transaction reporting, cash flow forecasting, corporate liquidity management, payables, receivables, and others. As per the enterprise's size, the market is segregated into small - medium-sized enterprises and large enterprises. On the basis of components, the market is divided into hardware, software, and services. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional/Country Cash Management System Market Outlook

The cash management software market is segmented across North America, Latin America, Western Europe, Eastern Europe, China, SEA, and others of APAC, Japan, and the Middle East & Africa. Europe is expected to be a large market for cash management systems as a majority of the industry vendors such as Finastra, Intimus International Group, and PEC Corporation are based in the region. The significant traction towards the adoption of financial management systems of the cash management system market to avoid liquidity crises is driving the adoption of the cash management system market in North American countries, such as the U.S. and Canada. The growing popularity of the cash management system market in developing regions, such as Latin America and parts of Africa, is characterized by the increased spending on management software in the regions. The rise in disposable income among people in the countries mentioned above is likely to increase the scope of penetration of the cash management system market in these regions soon.

- In January 2024, Hitachi Payment Services, an India-based payments and commerce solutions provider, acquired Writer Corporation's cash management business for an undisclosed sum. The company plans to rebrand the business as Hitachi operating as a wholly owned subsidiary. The acquisition will enhance Hitachi's payment and commerce solutions, including ATM services, cash recycling machines, white-label ATMs, POS solutions, payment gateways, and toll and transit solutions.

- In October 2022, The European Commission proposed making instant payments in euros available to all EU citizens and businesses, including those in Iceland, Norway, and Liechtenstein. The final legislative text agreed between the European Parliament and the Council, stipulates that transactions should be processed within 10 seconds, with a receipt provided. Payment service providers of the cash management system market must implement robust fraud detection measures and prevent criminal activities like money laundering. Instant payments should not cost more than traditional transactions in euros.

Industry Trends

- In January 2021, the thirty-eighth annual Cash Management Services (CMS) Survey, initiated by EY Cash Management, surveyed 44 financial institutions and top 100 bank holding companies in the US, including 90% of the top 20 targeted banks and 72% of the top 50 participating banks, to assess the health of the banking industry's corporate cash management businesses.

- In January 2024, according to BFSI Economic Times, Fintech platforms are expanding their mutual fund investor base, offering small-value systematic investment plans (SIPs) starting as low as a cash management system market Share of $5.98 a month. Data from asset management companies shows SIPs through platforms like Groww, Phone Pe, and ET Money range between cash management system market size $17.97 to$29.93

Competitive Landscape

The major players operating in the cash management system market include Scheider Electric, Infosys, Oracle, HCL Technologies, Finastra, Sage Intacct, intimus, Giesecke & Devrient, NTT DATA, Aurionpro, and Glory. Other players in the cash management system market include CMS Info Systems Ltd., Sage Intacct, Inc., Intimus International Group, PEC Corporation, Business Computer Projects Ltd., and others.

What are the Recent Key Strategies and Developments

- In September 2022, Finastra and Wipro announced a partnership in India to help corporate banks accelerate digital transformation by deploying Finastra’s leading solutions. Wipro is also one of Finastra’s preferred global partners for its Cash and Liquidity Management solutions.

- In January 2022, Oracle NetSuite introduced Oracle NetSuite Cash 360, an automated solution that helps businesses manage cash flow more effectively. The solution provides a real-time view of cash position and generates fast, accurate near-term forecasts. It also offers a configurable dashboard with links to key cash management activities of the cash management system market, including reminders, current cash balance, accounts payable and accounts receivable balances, cash flow trends, and a rolling six-month cash flow forecast.

- In September 2021, HCL Technologies and Finastra expanded their partnership to drive digital transformation across South Korea and Taiwan. As part of the engagement, HCL will use its next-generation digital transformation and service capabilities to bring two of Finastra’s strategic products, Fusion Cash Management and Fusion Summit, to the financial services of the cash management system market ecosystem in the region.

- In July 2021, Infosys’ digital core banking offering Finacle and Santander UK announced the rollout of an international cash management platform as part of the ongoing digital transformation program at the bank. Santander Global Connect will be powered by the Finacle Cash Management Suite which includes the Finacle Digital Engagement Hub, Finacle Online Banking, Finacle Payments, and Finacle Liquidity Management solutions.

Key Sources Referred

- European Parliament

- Oracle

- European commission

- Cash Management Services

- HCL technologies

- European commission

- Government of financial management

- International Monetory Fund

What are the Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the market outlook from cash management system market forecast between market analysis from 2024 to 2032 to identify the prevailing market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the cash management system market segmentation assists in determining the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global cash management system market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes an analysis of the regional as well as global cash management system market trends, cash management system market growth, key players, market segments, application areas, and market growth strategies.

Cash Management System Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 13.2 Billion |

| Growth Rate | CAGR of 15% |

| Forecast period | 2024 - 2032 |

| Report Pages | 200 |

| By Type Operation |

|

| By Enterprises Size |

|

| By Components |

|

| By Region |

|

| Key Market Players | GLORY LTD, AURIONPRO, FINASTRA, HCL Technologies, NTT (NTT Data), Sage Intacct, Infosys (India), Giesecke & Devrient, Scheider Electric, Oracle, Intimus |

$13.2 billion is the estimated market size of the Cash Management System by 2032.

The rise in the need to improve cash flow and enterprise visibility and the increase in the need for automated cloud-based solutions in banking are the upcoming drivers of the Cash Management System Market globally.

Improved financial health, enhanced liquidity, better control over cash flows, and optimized profitability for businesses are the leading opportunities of the Cash Management System Market.

North America is the fastest-growing region in the Cash Management System Market during the forecast period.

Scheider Electric, Infosys, Oracle, HCL Technologies, and Finastra are some of the key companies to hold the market share in Cash Management System.

Loading Table Of Content...