Cell Culture Media Market Summary

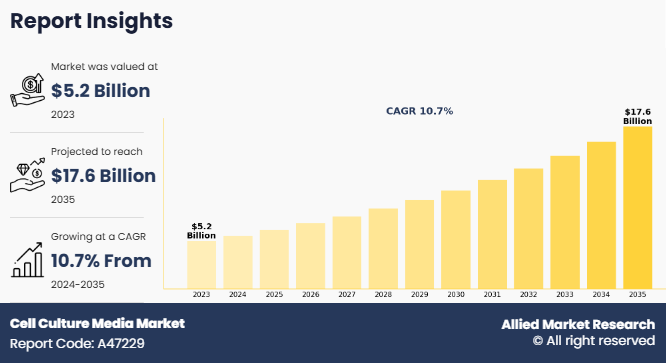

The global cell culture media market size was valued at $5,189.11 million in 2023, and is projected to reach $17,548.06 million by 2035, registering a CAGR of 10.7% from 2024 to 2035. The rising demand for biopharmaceuticals, including monoclonal antibodies and vaccines, increasing investments in cell-based research and regenerative medicine are the other factors that contribute to the growth of the market.

Market Dynamics & Insights

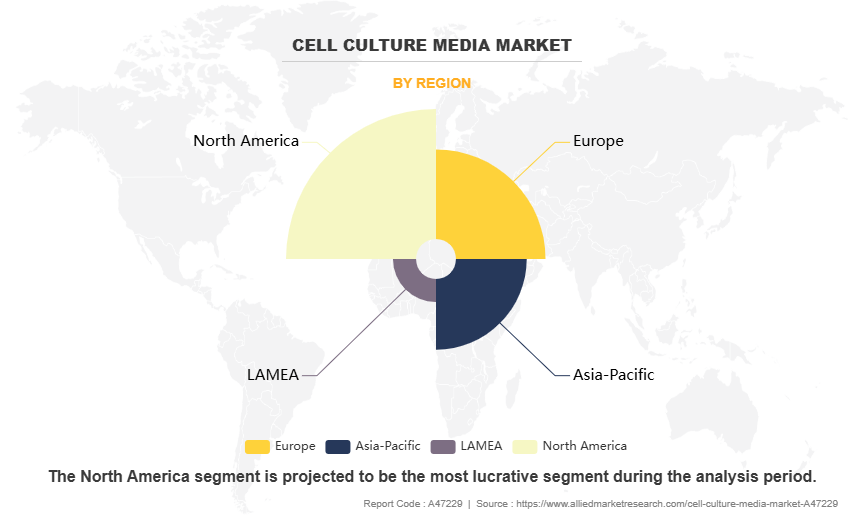

- The cell culture media industry in North America held a significant share of over 41.5% in 2021.

- The cell culture media industry in China is expected to grow significantly at a CAGR of 12.0% from 2024 to 2035.

- By type, serum free media is one of the dominating segment in the market and accounted for the revenue share of over 40% in 2023.

- By end user, the research and academic institute segment is the fastest growing segment in the market.

Market Size & Future Outlook

- 2023 Market Size: $5.2 Billion

- 2035 Projected Market Size: $17.5 Billion

- CAGR (2022-2035): 10.7%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

The increasing prevalence of chronic diseases such as cancer, autoimmune disorders, and infectious diseases has significantly driven the production of biopharmaceuticals, including monoclonal antibodies, vaccines, and gene therapies. As these therapeutic products require large-scale cell culture processes for development and manufacturing, the demand for high-quality cell culture media has surged which drive the cell culture media market growth.

Biopharmaceutical companies rely on cell culture media to ensure optimal cell growth, high-yield production, and consistent product quality. Moreover, the rise in global healthcare spending, coupled with advancements in bioprocessing technologies, has further accelerated the adoption of cell culture media in the large-scale production of life-saving biologics and personalized therapies.

Cell culture media is a nutrient-rich solution designed to support the growth, proliferation, and maintenance of cells in vitro by providing essential nutrients, growth factors, and an environment that mimics natural cellular conditions. It typically contains amino acids for protein synthesis, vitamins for metabolism, minerals and salts for osmotic balance, and glucose as an energy source. Buffers like bicarbonate or HEPES help maintain pH stability, while antibiotics and antifungals prevent microbial contamination. Some media include serum, such as fetal bovine serum (FBS), which provides additional growth factors and hormones.

Key Takeaways

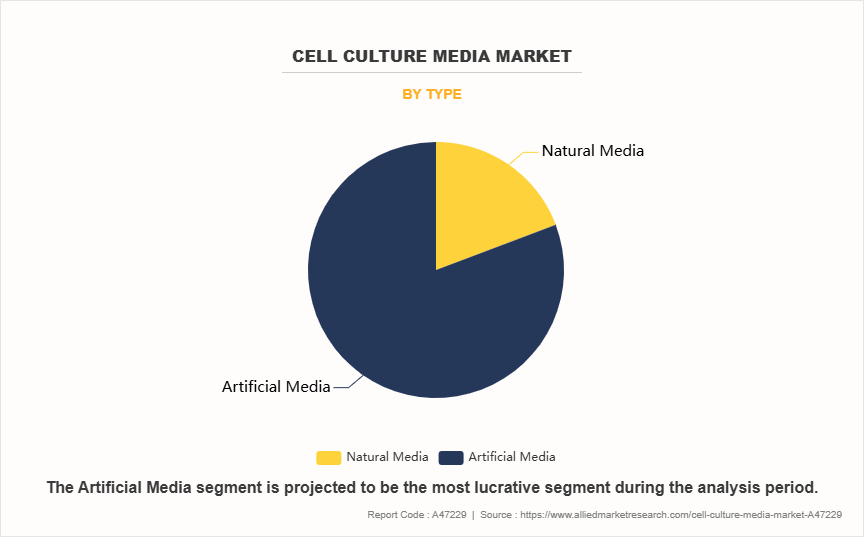

- On the basis of type, the artificial media segment dominated the market in terms of revenue in 2023 and is expected to remain dominant throughout the forecast period.

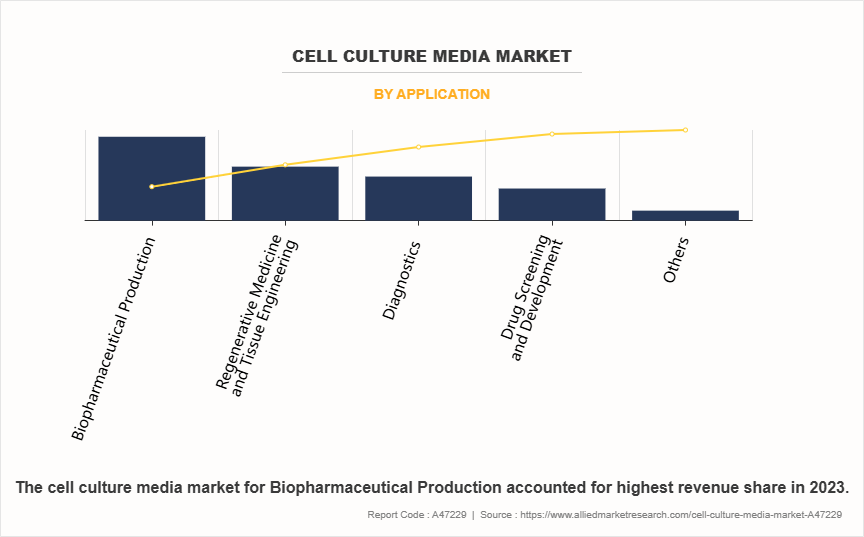

- As per application, the biopharmaceuticals production segment held largest market share in 2023 and is expected to remain dominant throughout the forecast period.

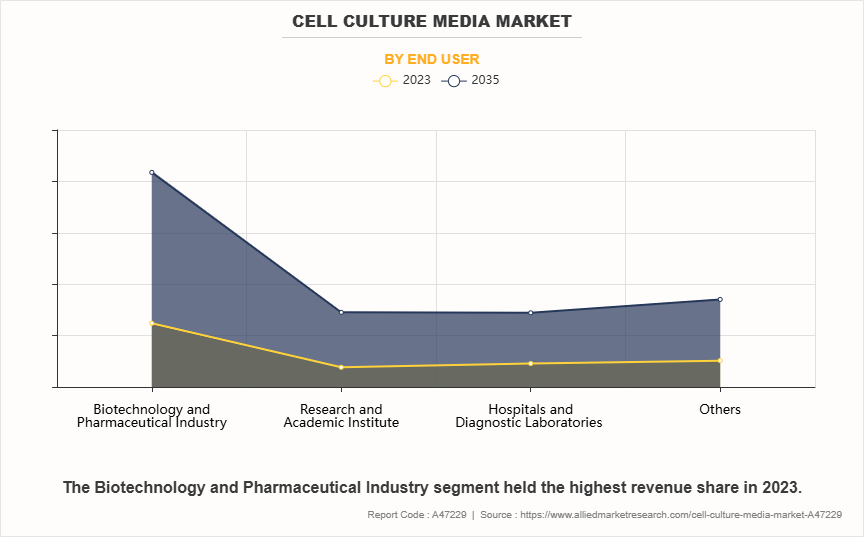

- Depending on end user, the biotechnology and pharmaceutical Industry segment held the largest market share in 2023. However, the research and academic institute segment is anticipated to grow at the fastest CAGR during the forecast period.

- Region wise, North America generated the largest revenue in 2023. However, Asia-Pacific is anticipated to grow at the highest CAGR during the forecast period.

Cell Culture Media Market Dynamics

Advancements in stem cell research, regenerative medicine, and personalized medicine have significantly increased the demand for specialized cell culture media which drive the cell culture media market growth. Stem cell research requires media formulations that support cell differentiation, proliferation, and maintenance of pluripotency. Similarly, regenerative medicine applications, such as tissue engineering and organ repair, depend on media that can sustain complex cellular processes under controlled conditions.

In personalized medicine, where patient-specific cells are cultured for diagnostics or therapeutic purposes, the need for highly specialized and customized media is critical to ensuring reproducible and clinically relevant results. These developments have prompted continuous innovations in media formulations, driving market growth in both research and clinical sectors which further drive the cell culture media market size.

The major restraint of the cell culture media market is the high production cost associated with its development and manufacturing. Producing cell culture media requires expensive raw materials, advanced processing technologies, and specialized facilities to ensure high quality and sterility. These factors contribute to increased operational expenses, making the final product costly. This can hinder market expansion, particularly in price-sensitive regions where affordability is a key concern for research institutions and smaller biotech companies.

In addition, the stringent regulatory environment governing the production and use of cell culture media further hamper the growth of the cell culture media market. Regulatory agencies impose strict quality, safety, and efficacy standards, especially for media used in biopharmaceutical production and clinical applications. Manufacturers must comply with rigorous testing protocols, adhere to good manufacturing practices (GMP), and undergo lengthy approval processes before launching products. These regulatory complexities can delay market entry, raise compliance costs, and limit the ability of new players to compete effectively.

The emerging opportunity in the cell culture media market lies in the growing adoption of 3D cell culture technologies. Unlike traditional 2D cultures, 3D cell cultures better mimic the natural cellular environment, making them increasingly popular in drug discovery, cancer research, and tissue engineering. This shift has created a demand for advanced, specialized media formulations designed to support 3D cell growth and complex cellular interactions.

Additionally, the expanding fields of organoid research and personalized medicine, where patient-specific tissues are cultured for therapeutic and diagnostic purposes, further drive the need for innovative cell culture media solutions. This trend presents significant growth prospects for companies investing in the development of customized, next-generation media products.

Cell Culture Media Market Segmental Overview

The cell culture media market is segmented on the basis of type, application, end user and region. On the basis of type, it is bifurcated into natural media and artificial media. The artificial media is further fragmented into serum-containing media, serum-free media, chemically defined media, and others. On the basis of application, it is divided into biopharmaceuticals production, regenerative medicine & tissue engineering, diagnostics, drug screening & development and others.

As per end user, it is categorized into biotechnology & pharmaceutical industry, research and academic institute, hospitals and diagnostic laboratories, and others. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific and LAMEA.

By Type

On the basis of type, the artificial media segment was the largest revenue contributor to the market in 2023. The artificial media segment has emerged as the largest revenue contributor to the cell culture market due to its critical role in biopharmaceutical production, including biologics, vaccines, and monoclonal antibodies. Its ability to be customized for specific cell lines and scaled for industrial production makes it essential in large-scale manufacturing and personalized medicine applications. The rising investment in cell-based research, such as cancer therapies, regenerative medicine, and drug discovery, further boosts demand.

Additionally, innovations like serum-free, chemically defined, and animal-free media enhance safety and efficacy, driving broader adoption. Artificial media’s widespread use across pharmaceuticals, biotechnology, and academic research, combined with its regulatory compliance benefits, solidifies its position as a dominant segment in the cell culture market.

By Application

On the basis of application, the biopharmaceutical production has largest cell culture media market share in 2023. It was the largest revenue contributor to the cell culture market due to its central role in producing vaccines, monoclonal antibodies, and recombinant proteins. The growing prevalence of chronic diseases such as cancer, diabetes, and autoimmune disorders has driven the demand for advanced biologics, fueling the need for cell culture technologies.

Biopharmaceutical companies rely heavily on cell culture systems for large-scale production due to their ability to ensure consistent product quality and meet regulatory standards. Additionally, the surge in personalized medicine and the expansion of biosimilar development have further boosted this segment. With continuous advancements in bioprocessing technologies and increased global investment in biopharmaceutical R&D, the biopharmaceutical production segment remains the largest revenue generator in the cell culture market.

By End User

On the basis of end user, the biotechnology & pharmaceutical industry segment was the largest revenue contributor to the market in 2023. This is due to its extensive use in drug development, biologics production, and vaccine manufacturing. This industry heavily relies on cell culture media for producing monoclonal antibodies, recombinant proteins, and gene therapies, driven by the rising prevalence of chronic and infectious diseases. The continuous development of biosimilars and personalized medicine further accelerates demand for high-quality cell culture media.

Additionally, increased investment in biopharmaceutical research and development, coupled with regulatory requirements for consistent and scalable production processes, has strengthened the segment’s market leadership which further drive the growth during cell culture media market forecast. The industry’s global expansion, supported by advancements in bioprocessing technologies, ensures sustained revenue growth for the cell culture media market.

By Region

Region-wise, the North America segment has largest cell culture media market share in 2023 due to the region’s well-established biotechnology and pharmaceutical industries, coupled with strong investment in research and development. The presence of leading biopharmaceutical companies and advanced healthcare infrastructure has driven significant demand for cell culture media in drug development, vaccine production, and regenerative medicine.

North America’s high adoption of innovative bioprocessing technologies and government funding for life sciences research further boost market growth. Additionally, the increasing prevalence of chronic and infectious diseases in the region has spurred the production of biologics and biosimilars, solidifying North America’s dominance in the global cell culture media market.

Competition Analysis

The major companies profiled in the cell culture media market include Thermo Fisher Scientific Inc., Merck KGaA, Danaher Corporation, STEMCELL Technologies Inc., Sartorius Stedim Biotech S.A, PromoCell GmbH, Lonza Group AG, Corning Incorporated, Fujifilm Holdings Corporation, and Takara Bio USA, Inc.

Whare are the Recent Developments in the Cell Culture Media Industry

- In July 2023, Lonza launched a new cell culture platform, TheraPro CHO media system. When used with GS-CHO cell lines, it simplifies media preparation processes and optimizes productivity.

- In July 2023, Merck KGaA announced the expansion of a new manufacturing facility in Kansas, U.S., for the expansion of production capacities for manufacturing cell culture media.

- In August 2022, Thermo Fisher Scientific Inc. announced the expansion of their dry powder media manufacturing facility in Grand Island, New York. The company expanded its production capacity to meet the increasing demand for culture media used for the manufacturing of new vaccines and biologics.

What are the Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the cell culture media market analysis from 2023 to 2035 to identify the prevailing cell culture media market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the cell culture media market segmentation assists to determine the prevailing cell culture media market opportunity.

- Major countries in each region are mapped according to their revenue contribution to the global cell culture media market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the cell culture media market players.

- The report includes the analysis of the regional as well as global cell culture media market trends, key players, market segments, application areas, and market growth strategies.

Cell Culture Media Market Report Highlights

| Aspects | Details |

| Market Size By 2035 | USD 17.6 billion |

| Growth Rate | CAGR of 10.7% |

| Forecast period | 2023 - 2035 |

| Report Pages | 423 |

| By Type |

|

| By Application |

|

| By End User |

|

| By Region |

|

| Key Market Players | Lonza Group AG, STEMCELL Technologies Inc. , TAKARA HOLDINGS INC., Danaher Corporation, PromoCell GmbH, Thermo Fisher Scientific Inc., Fujifilm Holdings Corporation, Sartorius Stedim Biotech S.A, Merck KGaA, Corning Incorporated |

Analyst Review

The cell culture media market presents both significant opportunities and challenges driven by key industry trends and technological advancements. The growth of biopharmaceuticals, personalized medicine, and regenerative medicine has led to increased demand for high-quality and specialized cell culture media, particularly in the production of biologic drugs, vaccines, and gene therapies. Technological innovations, such as 3D cell culture systems, are also creating new opportunities in drug discovery and development.

However, organizations face challenges such as the high cost of production, which stems from the need for specialized raw materials, advanced technologies, and regulatory compliance. The stringent regulatory environment governing cell culture media, particularly for biopharmaceutical applications, requires careful navigation to ensure safety and timely market entry. Additionally, the need for customized media formulations to support emerging fields like personalized medicine and stem cell research requires continuous innovation and investment. As such, companies must balance growth opportunities with managing costs, compliance, and innovation to stay competitive in this evolving market.

Thermo Fisher Scientific Inc., Merck KGaA, Danaher Corporation, STEMCELL Technologies Inc., Sartorius Stedim Biotech S.A, PromoCell GmbH, Lonza Group AG, Corning Incorporated, Fujifilm Holdings Corporation, and Takara Bio USA, Inc. are the top companies to hold the market share in Cell Culture Media market.

The cell culture media market was valued for $5.2 billion in 2023 and is estimated to reach $17.6 billion by 2035, exhibiting a CAGR of 10.7% from 2024 to 2035.

North America is the largest regional market for cell culture media, driven by advanced biotechnology and pharmaceutical industries, significant R&D investments, and a strong presence of key market players. The region benefits from high adoption rates of innovative technologies and a well-established healthcare infrastructure.

The leading application of the Cell Culture Media Market is biopharmaceutical production, driven by the growing demand for monoclonal antibodies, vaccines, and biosimilars. This segment dominates due to the increasing reliance on cell culture for scalable and efficient biologics manufacturing.

The global cell culture media market is driven by the increasing demand for biopharmaceuticals, advancements in 3D cell culture technologies, and the growing focus on personalized medicine. Emerging trends include the development of chemically-defined and serum-free media to enhance reproducibility and scalability in research and manufacturing processes.

Loading Table Of Content...

Loading Research Methodology...