Champagne Market Research, 2033

Market Introduction and Definition

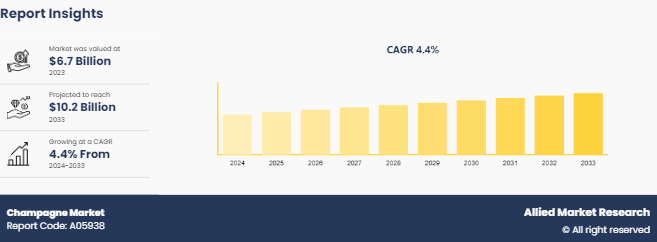

The global champagne market was valued at $6.7 billion in 2023, and is projected to reach $10.2 billion by 2033, growing at a CAGR of 4.4% from 2024 to 2033. Champagne refers to a sparkling wine produced in the Champagne region in France. This alcoholic drink is produced from specific types of grapes Pinot Noir, Pinot Meunier, Chardonnay, and Pinot Blanc with specific vineyard practices. It has been consumed for decades as a celebration drink at sport events, anniversaries, parties, weddings, joyous occasions, and corporate events.

Key Takeaways

The champagne market study covers 20 countries. The research includes a segment analysis of each country in terms of value ($Million) for the projected period 2023-2033.

More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major energy storage system industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Key Market Dynamics

The surge in demand for luxury goods, especially in emerging markets such as China, India, and the broader Asia-Pacific region, drives the growth of the champagne market. As the middle class expands and disposable incomes rise, consumers in these regions increasingly seek premium experiences and products, with champagne being viewed as a symbol of celebration, status, and sophistication, increasing the Champagne Market Size.

Consumers are increasingly willing to spend more on high-quality, premium products, which has led to a rise in demand for vintage and limited-edition champagne offerings. Champagne producers innovate new flavors, blends, and packaging, attracting both traditional consumers and younger generations seeking unique experiences.

The production of champagne is highly regulated, with stringent controls on the region of production (Champagne, France) , methods of production, and aging processes. This adds to production costs and limits flexibility in scaling production. In addition, the reliance on specific geographic indicators restricts supply and creates restrictions when demand surges.

Climate change poses a significant threat to the champagne industry, as changing weather patterns affect the quality and yield of grapes. The Champagne region is particularly vulnerable to extreme weather events such as frost, drought, and hail, which severely impact grape production and, consequently, champagne supply.

The rise in consumer focus on sustainability presents a major opportunity for champagne producers. Moreover, there is a surge in demand for organic, biodynamic, and sustainably produced champagne, particularly among environmentally conscious consumers. Producers who embrace eco-friendly practices, such as reducing carbon emissions and eliminating chemical pesticides, tap into this expanding market segment and differentiate their brands.

Value Chain of Champagne Market

The value chain of the champagne market begins with grape cultivation, which is highly regulated and concentrated in the Champagne region of France. Grapes, primarily Pinot Noir, Chardonnay, and Pinot Meunier, are grown under strict appellation rules that govern the viticulture practices, including pruning, harvesting, and yield limits. The next stage is production, where the traditional method known as “Méthode Champenoise” is followed, involving a secondary fermentation in the bottle to create carbonation. Once bottled, champagne undergoes an aging process that lasts several years, adding complexity and quality to the product. Packaging and branding play crucial roles, as champagne is often positioned as a luxury product, with producers investing heavily in unique designs and premium presentations to attract high-end consumers. The champagne then moves into distribution channels, which include high-end retail, specialty wine shops, online platforms, and direct sales to restaurants, hotels, and event venues. Finally, marketing and sales are essential, with many producers leveraging exclusive partnerships, sponsorships of high-profile events, and digital campaigns to emphasize the luxury, celebratory nature of champagne, catering to both traditional markets in Europe and growing consumer bases in regions such as Asia-Pacific and North America., increasin the Champagne Market Size. The value chain is tightly interconnected, ensuring quality and exclusivity at each stage.

Market Segmentation

The champagne market is segmented into price point, distribution channel, and region. By price point, the market is divided into economy, mid-range, and luxury. By distribution channel, it is segregated into supermarket/hypermarket, specialty stores, on trade, and others. Region wise, the champagne market analysis is analyzed across North America (U.S., Canada, and Mexico) , Europe (Germany, France, UK, Italy, Spain, and rest of Europe) , Asia-Pacific (China, Japan, Australia, India, and rest of Asia-Pacific) , and LAMEA (the Middle East, Latin America, and Africa) .

Regional/Country Market Outlook

The U.S. market has shown steady growth, driven by an increase in demand for premium and luxury products among consumers. According to the U.S. Alcohol and Tobacco Tax and Trade Bureau (TTB) , U.S. imports of sparkling wine, including champagne, reached approximately 26.6 million cases in 2022, reflecting a growing appreciation for high-quality champagne among American consumers. The market is significantly influenced by trends toward premiumization, where consumers are willing to spend more on high-end products for special occasions. In addition, events such as weddings, holidays, and celebrations have been pivotal in boosting sales, particularly for brands positioned in the luxury segment. Micro factors, including the rise of social media and influencer marketing, have further propelled consumer interest in champagne, with younger demographics increasingly seeking authentic and unique experiences associated with luxury champagne brands, increasing the Champagne Market Share.

China has emerged as one of the fastest-growing markets for champagne, with a rise in middle class population and a strong appetite for luxury goods. According to the National Bureau of Statistics of China, the market for imported wine, including champagne, is expected to reach over $10 billion by 2025, driven by changing consumer behaviors and an increase in preference for Western lifestyles. Champagne is often associated with celebration and status, making it a popular choice for gifting and events. The market in China has witnessed a growing interest in premium and vintage offerings, with consumers willing to pay a premium for high-quality champagne. Macro factors influencing this growth include the expansion of e-commerce platforms, which facilitate easier access to luxury products, and government efforts to reduce import tariffs on wine, making champagne more affordable for Chinese consumers.

Industry Trends

The champagne market has experienced notable industry trends driven by evolving consumer preferences and shifts in global demand for sparkling wine. One key trend is the rise in popularity of premiumization and luxury offerings. As consumers, particularly in Europe and North America, increasingly seek high-quality, luxury experiences, there is a surge in demand for premium and vintage champagne labels. This trend is fueled by the association of champagne with celebratory occasions and exclusivity, prompting producers to focus on limited editions, rare vintages, and artisanal production methods to cater to affluent consumers. Moreover, as affluent middle-class population expands in regions such as Asia-Pacific, particularly in China and Japan, luxury champagne has become more accessible, driving export growth, and expanding global markets and Champagne Market Growth.

According to Champagne Market Demand, with heightened awareness around environmental issues and sustainable agriculture, champagne producers increasingly adopt eco-friendly practices, such as organic and biodynamic viticulture, to meet surge in consumer demand for ethically produced beverages. Several champagne houses embrace sustainable certifications, reducing chemical inputs in vineyards and implementing green packaging solutions to minimize their environmental impact. Consumers, particularly millennials and Gen Z, increasingly prioritize sustainability when making purchasing decisions, leading champagne brands to differentiate themselves by emphasizing their environmental credentials. These trends respond to evolving consumer preferences and align with broader global efforts to promote sustainability in luxury goods production.

Competitive Landscape

The players in the champagne market have adopted product launch and business expansion as their key developmental strategies to expand their share, increase profitability, and remain competitive. The key players profiled in the report include Laurent Perrier, Centre Vinicole - Champagne Nicolas Feuillatte, Louis Vuitton SE, Taittinger, Pernod Ricard, LANSON-BCC, Thiénot Bordeaux-Champagnes, Piper-Heidsieck, Pommery, and Veuve Clicquot Ponsardin.

Recent Key Strategies and Developments

In 2020, Moet & Chandon announced its newly launched brand identity with packaging design and logo.

In 2020, Veuve Clicquot announced its newly launched Champagne Extra Brut Extra Old.

In 2021, Veuve Clicquot announced its first eco-friendly packaging, a recyclable paper bottle with 100% biodegradability. The product is called ‘The Eco-friendly Future Bottle.’

In 2020, Taittinger announced its first Champagne collaboration with Sylvie Fleury.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the champagne market analysis from 2024 to 2033 to identify the prevailing market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the champagne market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global champagne market trends, key players, market segments, application areas, and market growth strategies.

Champagne Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 10.2 Billion |

| Growth Rate | CAGR of 4.4% |

| Forecast period | 2024 - 2033 |

| Report Pages | 155 |

| By Price Point |

|

| By Distribution Channel |

|

| By Region |

|

| Key Market Players | LANSON-BCC, Laurent Perrier, Veuve Clicquot Ponsardin, Centre Vinicole, Pernod Ricard, Taittinger, Louis Vuitton SE, Piper-Heidsieck, Thiénot Bordeaux-Champagnes, Pommery |

The global champagne market was valued at $6.7 billion in 2023, and is projected to reach $10.2 billion by 2033

The global Champagne market is projected to grow at a compound annual growth rate of 4.4% from 2024 to 2033 to reach $10.2 billion by 2033

The key players profiled in the report include Laurent Perrier, Centre Vinicole - Champagne Nicolas Feuillatte, Louis Vuitton SE, Taittinger, Pernod Ricard, LANSON-BCC, Thiénot Bordeaux-Champagnes, Piper-Heidsieck, Pommery, and Veuve Clicquot Ponsardin.

Europe dominated the market share in 2023 and is expected to register the highest CAGR during the forecast period.

Increase in demand for premium quality luxury products and rise in disposable income due to rapid urbanization, increase in the drift of vending standardized premium products among retailers

Loading Table Of Content...