Citrus Fiber Market Research, 2032

The global Citrus Fiber Market Size was valued at $427.3 million in 2022, and is projected to reach $726.9 million by 2032, growing at a CAGR of 5.7% from 2023 to 2032.

Citrus fiber, also known as citrus pulp or citrus peel fiber, is a natural dietary fiber formed from citrus fruit waste byproducts, typically orange, lemon, and other citrus fruit peels. Because of its functional qualities, it is an important ingredient in the food sector. Citrus fiber is high in both soluble and insoluble fiber, and it has a variety of health benefits, including enhanced digestive health, lower cholesterol levels, and blood sugar management. It is commonly used as a thickener, stabilizer, and texturizer in a variety of food products such as sauces, dressings, baked goods, and meat products to improve texture, moisture retention, and shelf life. Furthermore, its propensity to absorb and retain water makes it a beneficial element in the formulation of low-fat and low-calorie foods.

Citrus fibers offer numerous health benefits and prevention of some serious diseases such as cardiovascular diseases, obesity, and type 2 diabetes. According to the International Diabetes Federation (IDF), in 2019, around 463 million people, aged between 20 to 79 years, were suffering from diabetes and this number is estimated to rise to 700 million by 2045. Moreover, around 374 million adults have higher chances of developing type 2 diabetes. This is a major factor that boosts the Citrus Fiber Market Demand for citrus fiber-based foods among the global population. Citrus fibers also help in improving heart health, curing irritable bowel syndrome, maintaining weight, boosting immunity, and regulating blood sugar levels. All these benefits are expected to foster the consumption of citrus fibers, which drives the global citrus fiber market growth.

The global citrus fiber market is experiencing significant growth, and is expected to grow considerably in next few years owing to the intensifying need for naturally derived dietary fibers to prevent various diseases. Citrus fiber is a mixture of soluble and insoluble fiber that is derived from pulp or peel or fruit. This is high in antioxidants and serves as dietary fiber. Insoluble citrus fiber contains bioactive compounds, carotene, polyphenols, and notable flavonoids that increase its demand in the processed food industry. It is one of the nutritional fibers which provide many health benefits such as lower risk of obesity, coronary heart disease, stroke, various gastrointestinal (GI) diseases, hypertension, and diabetes. Citrus fiber extracted from orange peel contains a considerable amount of insoluble dietary fiber. It has many health benefits including reducing adsorption of glucose, and starch digestion.

Usage of citrus fiber is gaining traction among processed and packaged food manufacturers due to several functional advantages, which influence the final products. Citrus fibers are neutral in flavor, taste, and fragrance and their inclusion enhances finished product texture and aroma. In certain cases, adding citrus fiber to foods like meat and cheese is cost-effective, as it is possible to reduce the cost of formulating by replacing expensive ingredients with citrus fibers. In addition, citrus fiber-added refined food is easier to cook.

Recent years of competition for natural food ingredients in processed food items have also increased demand for citrus fiber. Producers prefer to include citrus fibers in different food items, as it enables them to go for a clean label without worrying about the e-number. The growing health awareness among people is also helping the citrus fiber market to remain profitable.

Busy and hectic lifestyle of consumers is a major factor that boosts demand for fiber supplements across the globe. Presently, people often do not get enough time to properly take care of their diet, owing to their hectic schedule. This results in less intake of fiber, which gives rise to various diseases related to intestine, blood sugar, obesity, and heart. Adequate amount of fiber consumption not only prevents these health risks but also helps to build strong immunity. Therefore, to fulfil necessary requirements of dietary fiber, consumers opt for fiber supplements. This is one of the key factors that propels demand for fiber supplements among the global population, hence, propels growth of the citrus fibers market.

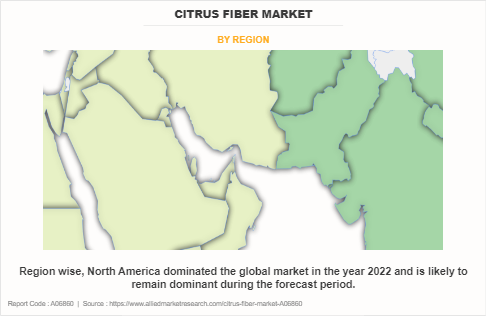

Citrus fibers have witnessed rapid growth in the Citrus Fiber Industryof North America and Europe. Rise in demand for health supplements, coupled with increase in consumer awareness about citrus fiber products has led to market expansion in North America.

Manufacturers are continuously investing in R&D programs to launch a variety of products related to health and nutritional supplements. New product launches have increased the demand for citrus fibers in developing regions such as Asia-Pacific and the Middle East. Nowadays, consumers prefer healthy diet, which results in increase in demand for citrus fiber rich foods such as oranges, grapefruits, limes, and lemons. As a result, surge in demand from developing regions provides lucrative opportunities for the growth of the citrus fiber market.

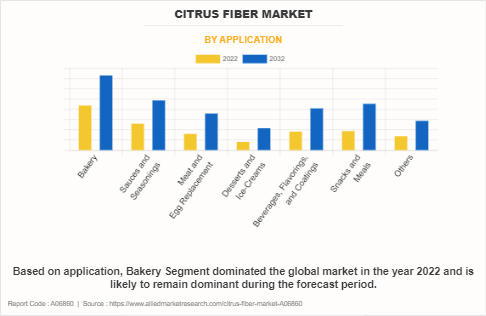

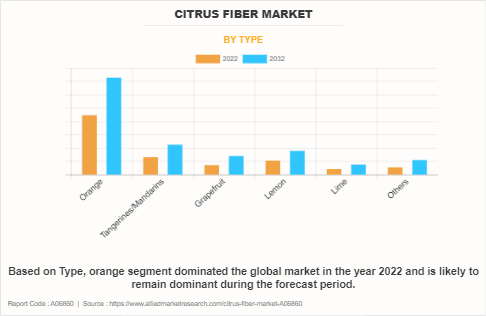

The citrus fiber market is segmented on the basis of application , source, and region. On the basis of application, the market is categorized into bakery, sauces & seasonings, meat & egg replacement, desserts & ice-creams, beverages, flavorings, and coatings, snacks & meals, and others. By source, it is fragmented into orange, tangerines/mandarins, grapefruit, lemon, lime, and others. Region-wise, the market is analyzed across North America (the U.S., Canada, and Mexico), Europe (the UK, Spain, Germany, France, Italy, and rest of Europe), Asia-Pacific (China, Japan, India, South Korea, Australia, and rest of Asia-Pacific), and LAMEA (Brazil, Argentina, the United Emirates Arab, South Africa, Saudi Arabia, and rest of LAMEA).

Bakery segment in the market held the major share and is likely to remain same throughout the citrus fiber market forecast period. Citrus fibers in the bakery industry increases bread product freshness over time by binding accessible water, particularly water released by starch gluten in wheat to minimize staling. Moreover, this natural ingredient has advantages in baked goods, including moisture retention, oil or fat reduction, emulsification, and shelf-life freshness. Hence, citrus fiber is predicted to grow during the forecast period.

Citrus fiber is made up of both, insoluble and soluble fibrous components found in citrus fruits including oranges, lemons, and limes. This fiber plays a vital role in the bakery industry. Surface area of citrus fiber is large, which ensures high-water holding capacity, which is important in baking. Citrus fiber binds water securely and absorbs water generated by other components due to its composition and surface area. As a result, bakery items maintain moisture for a longer period. Moreover, this natural ingredient has advantages in baked goods, including moisture retention, oil or fat reduction, emulsification, and shelf-life freshness.

Orange segment held the major share in the market. Oranges are low-calorie and high-nutrient citrus fruits. It is popular because of its inherent sweetness, range of varieties available, and variety of uses. Vitamin C content of this famous citrus fruit is particularly well-known. Oranges include a variety of different plant compounds and antioxidants that may help to reduce inflammation and fight diseases. Nutrients in oranges offer a range of health benefits such as antioxidant vitamin C aid to prevent development of cancer-causing free radicals. It is also high in fiber and potassium, both of which are beneficial for heart health.

Oranges are low-calorie and high-nutrient citrus fruits. It is popular owing to its inherent sweetness, range of varieties available, and variety of uses. Vitamin C content orange is particularly well-known. Oranges include a variety of different plant compounds and antioxidants that may help to reduce inflammation and fight diseases.

Nutrients in oranges offer a range of health benefits such as, antioxidant vitamin C aid to prevent development of cancer-causing free radicals. It is also high in fiber and potassium, both of which are beneficial for heart health.

By region, North America has the highest citrus fiber market share in 2022. Surge in demand for fortified foods & beverages in countries such as the U.S., Canada, and Mexico is leading new path for development of the citrus fibers market in North America. Change in dietary patterns among consumers, combined with growing population of urban people drive growth of the citrus fibers market. Rise in consumption of such fibers in North America lead the citrus fiber market growth. Surge in demand for fortified foods & beverages in countries such as the U.S., Canada, and Mexico is leading a new path for development of the citrus fiber market in North America. Change in dietary patterns among consumers, combined with growing population of urban people drives the growth of the citrus fiber market. Rise in consumption of such fibers in North America lead to growth of the citrus fiber market.

The players in the citrus fiber market have adopted acquisition as their key development strategy to increase profitability and improve their position in the citrus fiber market.

The key players profiled in the report include AMC Group, Cargill Incorporated, Carolina Ingredients, CEAMSA, Citrus Extracts LLC, CP Kelco, DuPont de Nemours, Inc., Edge Ingredients, FGF Trapani, Fiberstar, Inc., Golden Health, Hebei Lemont Biotechnology Co., Ltd., Herbafood Ingredients GmbH, Ingredients by Nature, JRS Silvateam Ingredients S.r.l., Lucid Colloids Ltd., Nans Products, Naturex SA, Quadra Chemicals Ltd, and Royal DSM.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the citrus fiber market analysis from 2022 to 2032 to identify the prevailing citrus fiber market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the citrus fiber market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global citrus fiber market trends, key players, market segments, application areas, and market growth strategies.

Citrus Fiber Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 726.9 million |

| Growth Rate | CAGR of 5.7% |

| Forecast period | 2022 - 2032 |

| Report Pages | 250 |

| By Application |

|

| By Type |

|

| By Region |

|

| Key Market Players | FGF Trapani, Cargill, Incorporated, Citrus Extracts LLC, Hebei Lemont Biotechnology Co., Ltd., AMC Group, EDGE Ingredients, Naturex SA, CP Kelco, Lucid Colloids Ltd., Herbafood Ingredients GmbH, CEAMSA, Fiberstar, Inc., Carolina Ingredients, Golden Health, Nans Products, Ingredients by Nature, Koninklijke DSM N.V., JRS Silvateam Ingredients S.r.l., Ingredion Incorporated, Quadra Chemicals Ltd. |

Analyst Review

On the basis of insights of top CXOs, the citrus fiber market is expected to grow rapidly in the future, owing to growing demand for functional foods among the global population. Rise in number of working women, increasing workload, and busy & hectic lifestyle of consumers propel the demand for functional foods across the globe.

Moreover, people prefer fiber supplements to fulfil their daily fiber requirements. Growth in awareness regarding consumption of citrus fibers among the global population is exponentially contributing toward the growth of the global citrus fiber market. The CXOs further added that Asia-Pacific is expected to be significant contributor toward the growth of the citrus fiber market during the forecast period.

One of the most significant impacts on the citrus fiber market was the surge in demand for healthier and functional food products during the pandemic. Consumers increasingly sought products with added nutritional benefits, and citrus fiber's reputation as a natural and clean label ingredient positioned it favorably in this context. Manufacturers leveraged its attributes to fortify a wide range of food and beverage products with dietary fiber, meeting the rise in demand for healthier options.

Moreover, the pandemic-driven trend of home cooking and baking boosted the retail sales of citrus fiber-based products. As more individuals experimented with cooking at home, they turned to citrus fiber to enhance the texture and shelf life of their homemade creations. This consumer-driven shift provided a unique opportunity for citrus fiber manufacturers to connect directly with end-users and promote the ingredient's applications in various recipes.

The global Citrus Fiber Market Size was valued at $427.3 million in 2022, and is projected to reach $726.9 million by 2032

The global Citrus Fiber market is projected to grow at a compound annual growth rate of 5.7% from 2023 to 2032 $726.9 million by 2032

The key players profiled in the report include AMC Group, Cargill Incorporated, Carolina Ingredients, CEAMSA, Citrus Extracts LLC, CP Kelco, DuPont de Nemours, Inc., Edge Ingredients, FGF Trapani, Fiberstar, Inc., Golden Health, Hebei Lemont Biotechnology Co., Ltd., Herbafood Ingredients GmbH, Ingredients by Nature, JRS Silvateam Ingredients S.r.l., Lucid Colloids Ltd., Nans Products, Naturex SA, Quadra Chemicals Ltd, and Royal DSM.

By region, North America has the highest citrus fiber market share in 2022

Citrus fibers are neutral in flavor, citrus fiber-added refined food is easier to cook.

Loading Table Of Content...

Loading Research Methodology...