Cloud TV Market Overview

The global cloud tv market size was valued at USD 1.8 billion in 2022 and is projected to reach USD 11.5 billion by 2032, growing at a CAGR of 20.4% from 2023 to 2032.

Growing cord-cutting trends, in which consumers choose streaming services over traditional cable or satellite subscriptions, are propelling the expansion of the market. Users may choose and pay for the material they want using Cloud TV, which provides a more affordable and customisable option to traditional broadcasting. Furthermore, the constant innovation brought about by the many streaming platforms fighting for supremacy has led to the creation of unique material, user-friendly interfaces, and cutting-edge features. However, the lack of strong internet connectivity is limiting the expansion of cloud TV market. On the contrary, the convergence of improved internet infrastructure, widespread adoption of smart devices, changing consumer viewing habits is expected to create lucrative opportunities for the market to grow in upcoming years.

Introduction

A television service known as "Cloud TV" uses cloud computing technologies to send programmes to viewers via the internet. Cloud TV uses internet-based servers and storage systems as opposed to traditional cable or satellite TV, which distributes programming through physical infrastructure. The content—which includes movies, TV series, and live broadcasts—is handled and stored in data centres when it comes to cloud TV. Consumers can watch live streaming or on-demand video of this content online. Fans can now watch their favourite shows on a range of gadgets, such as smart TVs, tablets, computers, and smartphones.

The report focuses on growth prospects, restraints, and trends of the cloud TV market forecast. The study provides Porter’s five forces analysis to understand the impact of various factors such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers on the cloud tv market outlook.

Top Impacting Factors

Growing Adoption of Smart Devices

The proliferation of intelligent gadgets, namely intelligent televisions, smartphones, tablets, and streaming devices, serves as a principal catalyst for the expansion of the cloud TV market. These intelligent devices afford users the convenience and flexibility to access cloud-based television services at their discretion, regardless of location. Moreover, the widespread usage of intelligent devices, including intelligent televisions, smartphones, tablets, and popular streaming devices like Roku and Amazon Fire Stick, offers users uncomplicated access to cloud TV services.

The convenience of consuming content across various devices plays a pivotal role in the market's upward trajectory. Given the escalating prevalence of high-speed internet connectivity, users can relish uninterrupted streaming experiences on a diverse array of devices. The adaptability and user-centric interfaces of intelligent devices add to the allure of cloud TV, empowering consumers to liberate themselves from conventional cable or satellite TV subscriptions. As more households embrace intelligent technology, the demand for portable, personalized, and on-demand content experiences facilitated by cloud TV services continues to burgeon, thereby fostering cloud tv market expansion.

Rising Demand for Cloud Streaming Services

The increasing demand for cloud streaming services is a crucial factor driving the expansion of the cloud TV market. As individuals progressively desire on-the-go and customized content experiences, cloud streaming services provide an unparalleled level of convenience and accessibility. The emergence of high-speed internet connectivity worldwide has facilitated seamless streaming, enabling users to access a wide range of TV content without the limitations of traditional broadcasting schedules.

A wide range of audiences can access a vast library of on-demand programming through cloud TV, which also makes use of the scalability and flexibility of cloud infrastructure. By enabling content consumption across several platforms, such as smart TVs, smartphones, tablets, and streaming devices, this model accommodates the desires of modern consumers. The appeal of cloud streaming services is mostly due to its user-friendly design and range of available subscription options. Thus, the growing market for cloud television is being propelled by the rising demand for cloud streaming services.

Growing Trend for Over-the-top (OTT) Services

Over-the-top (OTT) services, which enable users to access online video content without needing to subscribe to traditional cable or satellite TV, are largely responsible for the rise of cloud TV. Cloud TV platforms like Netflix, Hulu, Amazon Prime Video, and Disney+ are now accepted by the general population.

Moreover, viewers are favouring on-demand TV over scheduled shows more and more. Customers may view their preferred TV series and films whenever it's convenient for them thanks to the vast on-demand content libraries provided by cloud TV providers. Cloud TV service providers have also been able to expand their offers due to the global spread of cloud infrastructure. The market for cloud TV is expanding because cloud-based solutions are more affordable, flexible, and scalable. Therefore, the over-the-top (OTT) services trend is driving the expansion of the cloud television industry.

Segment Review

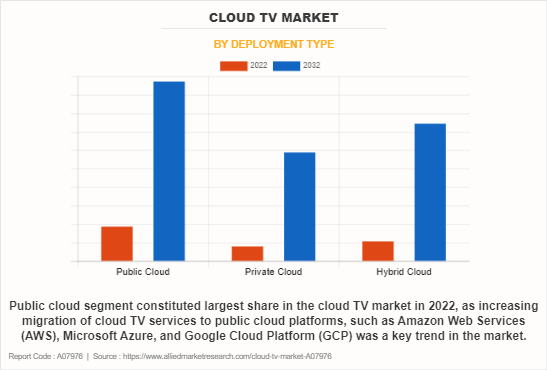

The cloud TV is segmented on the deployment type, device, and application and region. On the basis of deployment type it is categorized into public cloud, private cloud, and hybrid cloud. On the basis of device, it is classified into static testing and dynamic testing. By interface, the cloud TV market is segmented STB, mobile phones, and connected TV. Based on application, the market is divided into telecom, media & entertainment, consumer television, and others. On the basis of region, it is analysed across North America, Europe, Asia-Pacific, and LAMEA.

By deployment type, the public cloud segment acquired a major cloud TV market size in 2022. The is attributed to the fact that the adoption of serverless computing models within the public cloud framework is gaining traction, allowing cloud TV providers to focus on developing and delivering content without managing underlying infrastructure. Moreover, the growing emphasis on hybrid and multi-cloud strategies offers flexibility and resilience to Cloud TV services, allowing them to optimize performance and address regional variations in demand.

By region, the North America dominated the cloud TV market share in 2022. This is attributed to the fact that streaming platforms in North America are heavily investing in original content production to differentiate themselves and attract subscribers. In addition, the inclusion of live streaming and sports content on streaming platforms became more prominent, addressing the demand for real-time and event-based entertainment.

The key players operating in the global cloud TV market include Brightcove Inc., Amino Communications, Oracle, Kaltura Inc., Muvi, Amagi, Comcast Technology Solutions, dacast, MatrixStream Technologies, Inc., and MediaKind. These players have adopted various strategies to increase their market penetration and strengthen their position in the Cloud TV industry.

Regional Insights

The Cloud TV Market is experiencing robust growth globally, driven by advancements in cloud technology and increasing consumer demand for on-demand content.

In North America, the market is highly developed with significant investments from major players like Netflix and Amazon Prime, leading to widespread adoption of cloud tv platforms and cloud DVR services.

Europe follows with strong growth, particularly in Western Europe, where there is a rising demand for multi-device access and integration of cloud technologies with traditional TV services.

In the Asia-Pacific region, rapid growth is fueled by rising internet penetration, expanding middle-class populations, and increasing smartphone usage, which boost mobile TV and streaming services.

Latin America is seeing steady growth, driven by improvements in internet connectivity and a growing preference for affordable streaming options. Meanwhile, in the Middle East & Africa, the market is emerging with increased investments in cloud infrastructure and expanding consumer interest in OTT services. Such factors drive the market.

Market Trends and Landscape

Increase in product launched to enhance cloud TV and adoption of the advance technologies are some of the trends flourishing the cloud TV market growth. For instance, in April 2022, QYOU Media Inc. has announced that The Q India, the company's Hindi language youth oriented channel, now available in over 125 million TV households and to over 680 million users via OTT, mobile and app based platforms in India, has launched flagship channel The Q, along with new channels Q Marathi, Q Kahaniyan and Q Comedistaan on 63 new Smart TV systems in partnership with CloudTV.

Furthermore, increasing partnerships in the market by key players is expected to boost the growth of cloud TV market during the forecast period. For instance, in August 2022, 24i partnered with Swisscom Broadcast to launch FokusOnTV, 24i's new TV-as-a-Service (TVaaS) streaming. The end-to-end, fully cloud-based FokusOnTV solution is a managed service built on 24i's proven middleware, which is expected to be offered as a pre-integrated solution with Swisscom Broadcast's premium headend infrastructure.

The cloud television market has experience a surge during the pandemic owing to the increased time spent at home during lockdowns and social distancing measures. With traditional entertainment options limited, more consumers turned to streaming platforms for their diverse content offerings. This uptick in demand resulted in a notable expansion of the market. Further, the economic challenges induced by the pandemic influenced consumer spending habits, prompting some to reevaluate discretionary expenses, including entertainment subscriptions. Thus, the pandemic had a positive effect on cloud TV industry.

Recent Partnerships in the Market

In July 2023, Brightcove, Inc. announced that it has entered into a strategic agreement with PubMatic, an independent technology company delivering digital advertising’s supply chain of the future. The partnership combines PubMatic’s programmatic advertising solutions with Brightcove’s innovative video platform to enhance and bolster demand for the recently launched Brightcove Ad Monetization, a service designed to help media companies better monetize their content.

In September 2022, Evergent, the customer management and monetization leader for streaming and digital subscription businesses announced an expanded partnership with Brightcove Inc., a leader in streaming technology. The new integration will see the introduction of Evergent’s agile monetization solution to Brightcove Beacon for over-the-top video streaming, making it possible for Brightcove customers to test and implement flexible monetization approaches within the platform.

In November 2023, Amino Communication, a leader in innovative media and entertainment technology solutions, has announced a new distribution partnership with Northamber PLC, a leading distributor of AV, IT, Cyber Security, and Document Management solutions. This collaboration marks a significant step forward in Amino's mission to provide cutting-edge technology to businesses and organizations throughout the UK.

Recent Product Launches in the Market

In May 2022, Amino Communication, a media and entertainment technology solutions provider, announced the launch of the Amino Orchestrate suite of tools designed for simplifying management of Enterprise Video and Digital Signage services. This Software-as-a-Service (SaaS) solution makes it easy to manage services and devices, through powerful management and troubleshooting tools, including the ability to assign firmware by provisioning and configuring profiles and apps with a few simple clicks.

In September 2023, Comcast Technology Solutions announced the launch of a new cloud-based managed channel origination service for customers across EMEA. Combining Sky's regional infrastructure and operations with the capabilities of CTS, it enables media companies to outsource and modernize the creation, management, and distribution of linear TV and OTT video channels via a fully managed 24x7 service.

Key Benefits for Stakeholders:

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the cloud TV market analysis from 2022 to 2032 to identify the prevailing cloud TV market share.

The cloud television market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the cloud TV market size segmentation assists to determine the prevailing cloud TV market opportunity.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global cloud TV market trends, key players, market segments, application areas, and market growth strategies.

Cloud TV Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 11.5 billion |

| Growth Rate | CAGR of 20.4% |

| Forecast period | 2022 - 2032 |

| Report Pages | 280 |

| By Deployment Type |

|

| By Device |

|

| By Application |

|

| By Region |

|

| Key Market Players | MatrixStream Technologies, Inc., Muvi, Kaltura Inc., Amino Communications, Brightcove Inc., Dacast, Comcast Technology Solutions, Amagi Media Labs, Oracle, Mediakind |

Analyst Review

The extensive adoption of high-speed internet drives the market growth, enabling seamless streaming across diverse devices. Cord-cutting continues to gain momentum, with consumers favoring the flexibility and cost-effectiveness of on-demand cloud TV services over traditional cable subscriptions. Original content creation has become a focal point for providers, intensifying competition and fostering user loyalty. The convergence of advanced technologies, such as improved streaming quality and interactive features, enhances the viewing experience. However, challenges persist, notably in regions with limited internet access and concerns over data privacy. Overall, the cloud TV market reflects a dynamic landscape shaped by changing consumer behaviors, technological innovations, and fierce competition among service providers.

The key market players have adopted strategies such as partnership for enhancing their services in the market and improving customer satisfaction. For instance, in October 2022, WeWatch, a leading carrier-grade cloud TV and video streaming entertainment platform, announced a new deal with Cambodia’s premium internet service provider, Online (COGETEL Ltd), which is expected to deliver next-generation cloud TV services over internet to both residential and business users.

Moreover, some of the key players profiled in the report are Brightcove Inc., Amino Communications, Oracle, Kaltura Inc., Muvi, Amagi, Comcast Technology Solutions, dacast, MatrixStream Technologies, Inc., and MediaKind. These players have adopted various strategies to increase their market penetration and strengthen their position in the industry.

The cloud TV market is projected to reach 11.50 billion by 2032.

The cloud TV market is estimated to grow at a CAGR of 20.4% from 2023 to 2032.

Growing adoption of smart devices, rising demand for cloud streaming services, and growing trend for over-the-top (OTT) services majorly contribute toward the growth of the market.

The key players profiled in the report include cloud TV market analysis includes top companies operating in the market such as Brightcove Inc., Amino Communications, Oracle, Kaltura Inc., Muvi, Amagi, Comcast Technology Solutions, dacast, MatrixStream Technologies, Inc., and MediaKind.

The key growth strategies of Cloud TV players include product portfolio expansion, mergers & acquisitions, agreements, geographical expansion, and collaborations.

Loading Table Of Content...

Loading Research Methodology...