The global Coffee Capsules Market Size was valued at $5.9 billion in 2022, and is projected to reach $11.9 billion by 2032, growing at a CAGR of 7.6% from 2023 to 2032.

Market Dynamics

Due to enormous coffee consumption, coffee makers are expanding their product portfolio to meet the local taste and adjusting their packaging designs to appeal to the local market. This, in turn, is anticipated to positively impact the coffee capsules market growth. Coffee consumption in European countries is expected to reach record-breaking levels by mid-2022. For instance, Finland is the largest coffee consumer with 12 kg per capita per year followed by Norway (9.9 kg). Moreover, consumption in China has grown by 16% per year over the last 10 years. This makes China the 17th largest coffee consumer in the world. According to a report of The National Coffee Association (NCA), 59% of coffee consumed daily is classified as gourmet. The young generation is driving this growth in coffee consumption outside the home. The demand for coffee makers is expected to increase at a rapid pace, owing to growth in the middle classes, urbanization, and rising incomes. Moreover, Europe is gaining remarkable traction in the coffee maker industry for various attributes such as high export, consumption, and production of coffee, which provides favorable market conditions and business environment for growth of the Coffee capsules market.

The coffee capsules market faces a stiff challenge from the availability of alternative products including but not limited to tea, fruit juices, vegetable juices, health drinks, kombucha, chocolate drinks, milkshakes, lattes made with beets, matcha, chicory, and kefir are some among others. Where ready to drink teas, fruit juices, and milk-based drinks are the highly consumed drinks in the market which are easily and widely available and can be consumed directly. Countries such as China, Turkey, Ireland, the UK, India, and Iran are heavy consumers of tea and milk products, proving to deter coffee drinking. Furthermore, these countries are also some of the largest producers of coffee alternatives, which severely hampers the consumption of coffee and in turn harms the coffee roasters market.

Coffee capsules are a popular way to brew coffee, especially for those who want a quick and convenient way to make a single serving. However, the environmental impact of coffee capsule packaging is a growing concern.

The main issue with coffee capsules is the waste they create. Many coffee capsules are made from a combination of plastic and aluminum, which are not easily recyclable. This means that a large number of coffee capsules end up in landfills, where they can take hundreds of years to decompose. In addition, the production and transportation of coffee capsules also contribute to carbon emissions and other environmental impacts.

Another issue is the use of resources in producing coffee capsules. The production of aluminum and plastic used in coffee capsules requires large amounts of energy and resources, such as water and oil. This contributes to environmental degradation and the depletion of natural resources.

Furthermore, the single-use nature of coffee capsules means that they are not a sustainable option in the long term. While some companies have developed recycling programs for their capsules, these programs are often limited in scope and not widely available.

Segmental Overview

The coffee capsules market is segmented based on material, end user and distribution channel, and region. Based on material the market is categorized into Aluminum, Compostable and PBT Plastic. On the basis of end users, the market is bifurcated into commercial and residential. Based on distribution channel, the market is categorized into hypermarkets/supermarkets, specialty stores, e-commerce, and business to business. Region-wise the market is classified into North America (U.S., Canada, and Mexico) Europe (UK, Germany, France, Italy, Sweden, Spain, Russia, the Netherlands, and the Rest of Europe), Asia-Pacific (China, Japan, India, South Korea, Thailand, Australia, New Zealand, and Rest of Asia-Pacific), and LAMEA (Brazil, Argentina, UAE, Saudi Arabia, South Africa, Egypt, and Rest of LAMEA).

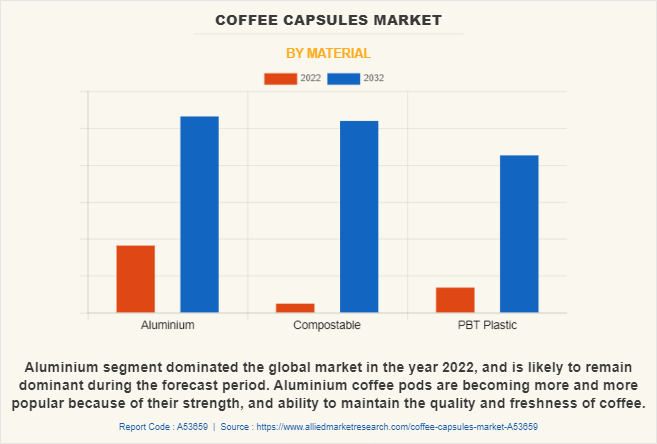

By Material

Based on material, the aluminum segment dominated the global market in the year 2021, and is likely to remain dominant during the forecast period. Due to its versatility and ease of use, aluminum coffee capsule demand has been rising significantly in recent years. Customers who want to prepare high-quality coffee fast and conveniently without having to grind beans or measure out coffee grounds have started to favor aluminum coffee capsules.

The rising popularity of single-serve coffee makers like Nespresso and Keurig is one of the key factors driving demand for aluminum coffee capsules. Customers can easily brew a single cup of coffee with these devices, which are made to use pre-packaged coffee capsules. Many of these machines are compatible with aluminum capsules, and the airtight seal they provide helps to keep the coffee fresh and flavorful.

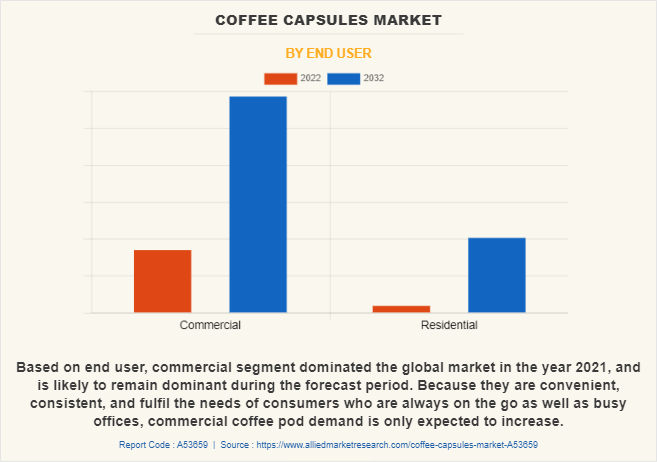

By End User

Based on the end-user, the commercial segment dominated the global market in the year 2022 and is likely to remain dominant during the forecast period. There are various benefits to using coffee capsules in the commercial sector. For instance, coffee capsules are practical, simple to use, and offer constant quality and flavor, all of which are crucial in a commercial setting where clients or staff members need a good standard of coffee.

Coffee capsules are also a budget-friendly and effective option for companies that wish to provide a variety of coffee options without investing in specialized equipment or hiring qualified baristas. Additionally, coffee capsules contribute to waste reduction and mess reduction, which is beneficial in busy commercial situations where efficiency and cleanliness are essential.

As more companies see the advantages of adopting single-use coffee capsules to provide high-quality coffee options to their clients or employees, the commercial market for coffee capsules has been expanding recently. However, there are also worries about the effects of single-use coffee items on the environment, which has prompted several companies to look for environmentally friendly substitutes such as composting or recyclable coffee capsules.

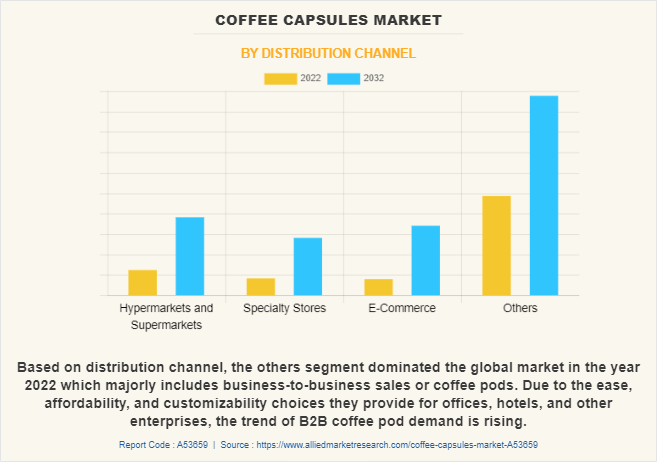

By Distribution Channel

Based on the distribution channel, the other segment which includes business to the business segment dominated the global market in the year 2022 and is likely to remain dominant during the forecast period. Business-to-business (B2B) coffee capsules demand refers to the demand for coffee capsules from businesses that purchase them to supply their own employees or customers with coffee. B2B coffee capsule demand can come from a variety of industries, including offices, hotels, restaurants, and cafes.

There has been a growing demand for coffee capsules in the B2B market in recent years, as more businesses are seeking convenient and cost-effective ways to provide high-quality coffee to their employees or customers. Coffee capsules offer several advantages for B2B customers, including consistency in flavor and quality, ease of use, and reduced waste compared to traditional brewing methods.

By Region

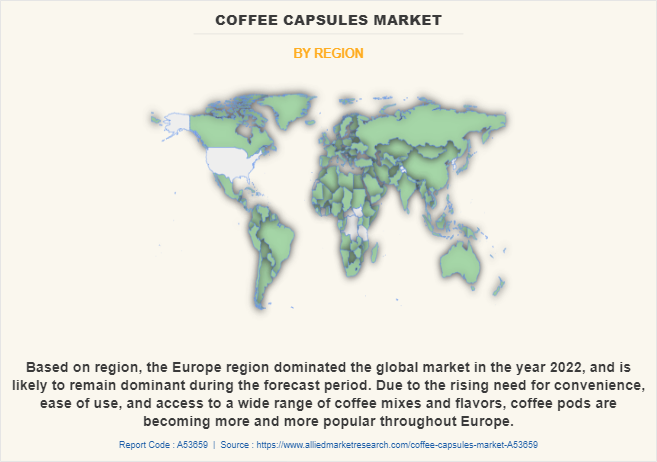

Based on region, Europe region had the dominating Coffee Capsules Market Size in the year 2022 and is likely to remain dominant during the Coffee Capsules Market Forecast period. The consumption of coffee capsules in Europe has been steadily increasing in recent years. Coffee capsules, also known as coffee pods, offer a convenient and easy way for consumers to brew a single cup of coffee at home or in the office.

The Coffee Capsules Market Demand in Europe has been driven by a number of factors, including the trend towards home brewing and the increasing popularity of single-serve coffee. Consumers are seeking out quick and easy ways to enjoy high-quality coffee at home, without the need for expensive and bulky coffee brewing equipment.

In addition, the convenience and ease of use of coffee capsules have contributed to their popularity. They are pre-measured, pre-ground, and pre-packaged, making them a hassle-free option for busy consumers. In terms of Coffee Capsules Market Share, the United Kingdom, Germany, and France are some of the largest coffee capsule markets in Europe. Nespresso and Keurig are two of the leading brands in the European coffee capsule market, with a strong presence and Coffee Capsules Market Share in the region.

Competition Analysis

The players operating in the global coffee capsules market have adopted various developmental strategies including but not limited to product launches, geographical expansion, and acquisitions to increase their market share, gain profitability, and remain competitive in the Coffee Capsules Industry. The key players operating in the coffee capsules market include JDE Peets N.V., Aumeeka Ventures LLP, Lavazza Group, Fresh Brew Co., Nestle S.A., Starbucks Corporation, Georg MENSHEN GmbH & Co. KG, Coffee Nirvana, Keurig Dr Pepper Inc., The J. M. Smucker Company, Coffeeza, Halo Coffee, Inspire Brands, Inc., illycaffe S.p.A., The Kraft Heinz Company, Tassimo and Dualit Ltd.

Recent Product Launch in the Coffee Capsules Market

- In May 2020, Nespresso part of Nestle S.A., launched new Coffee Capsules which are made from 80% percent recycled aluminum. This launch will be featured in Original Line Master Origin Colombia coffee. With this it has expanded its product offering and strengthened its business presence in the market.

- In February 2020, Nestle S.A., and Starbucks Corporation partnered to launch new range of Coffee Capsules for the Nespresso Original Systems. These products will incorporated developmental expertise and flavors of both the companies to expand their product offering.

- In November 2022, Nespresso part of Nestle S.A., launched new line of single-serve Coffee Capsules which are made from compostable material. This launch expanded its product offering and strengthen its business in paper based Coffee Capsules.

- In November 2022, Nescafé Dolce Gusto part of Nestle S.A., launched Neo, which is new line of coffee machines and pods. This includes coffee pods which are made from paper-based material. This launch has expanded its product offering in the Coffee Capsules market.

- In December 2021, Starbucks Corporation launched its Starbucks by Nespresso Pods in Mexico. This launch will expand its consumer base in the region through expanded product offering. These products will be available in the in the 170 stores in Mexico.

- In June 2022, JDE Peets N.V., brand L'OR launched L'Or Flavours Collection Aluminium Capsules. With this launch it has expanded its current portfolio of Coffee Capsules and consumer offering.

Recent Business Expansion in the Coffee Capsules Market

- In March 2021, Nespresso, part of Neslte S.A., expanded its Avenches production center in Switzerland in order to meet the growing demand for its coffee products.

- In April 2021, Halo Coffee launched new 100% compostable coffee pods. This launch will expand its business position in the Coffee Capsules market.

- In September 2021, Lavazza Group partnered with Yum China Holdings, Inc., which is a fast food restaurants company. Through this partnership it will expand its presence of its Lavazza Cafes in China and will further its product distribution through a join-venture.

- In October 2020, JDE Peets N.V., expanded its current global supply network with installation of new high-speed Coffee Capsules production lines. With this expansion it will meet the growing demands for its products.

Recent Partnership in the Coffee Capsules Market

- In February 2020, Keurig Dr Pepper Inc., partnered Nestle USA to manufacture, distribute, and Starbucks branded packaged coffee in K-Cup pods in the U.S. and Canada. Through this partnership it will expand its presence in the coffee category.

Recent Acquisition in the Coffee Capsules Market

- In October 2022, Nestle S.A., acquired Seattle's Best Coffee from Starbucks Corporation. This acquisition will expand its presence in the North American region and further expands its product portfolio.

- In June 2021, JDE Peets N.V., acquired Campos Coffee, which is primarily engaged in sales of various coffee and Coffee Capsules in Australia. This acquisition will enable it to expand its current business presence and will incorporate its network capabilities in various distribution channels.

Recent Merger in the Coffee Capsules Market

- In January 2020, Jacobs Douwe Egberts merged with Peet's Coffee. Through this merger it will incorporate market expertise and will gain access to broad portfolio of brands such as L'OR, Jacobs Coffee, Douwe Egberts, Senseo, Tassimo, and Moccona. This will strengthen its business position in the coffee industry.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the Coffee Capsules Industry segments, current trends, estimations, and dynamics of the coffee capsules market analysis from 2022 to 2032 to identify the prevailing coffee capsules market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the coffee capsules market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their Coffee Capsules Market Revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global coffee capsules market trends, key players, market segments, application areas, and market growth strategies.

Coffee Capsules Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 11.9 billion |

| Growth Rate | CAGR of 7.6% |

| Forecast period | 2022 - 2032 |

| Report Pages | 300 |

| By Distribution Channel |

|

| By Material |

|

| By End User |

|

| By Region |

|

| Key Market Players | Halo Coffee, The J. M. Smucker Company, Keurig Dr Pepper Inc., JDE Peets N.V., Lavazza Group, Fresh Brew Co. , Georg MENSHEN GmbH & Co. KG, Starbucks Corporation, Nestle S.A., Inspire Brands, Inc., illycaffe S.p.A., Coffeeza, Aumeeka Ventures LLP, Coffee Nirvana, The Kraft Heinz Company |

Analyst Review

Recent years have seen a great increase in expenditure on coffee and coffee related drinks, owing to an increase in product awareness, rise in the number of coffee shops, large-scale urbanization, surge in disposable income, and proliferation of online channels especially in developing countries. Also, an increase in demand for energy providing products to aid in the hectic lifestyles of the working and college going population is significantly contributing to coffee demand, and for coffee capsules.

Premiumization and innovation have been two key drivers of growth in the coffee capsule market, as they have helped to create new opportunities for coffee capsule manufacturers to differentiate themselves and meet the evolving needs of consumers.

By positioning their coffee capsules as a premium product, manufacturers are able to charge a higher price point, which can lead to increased revenue and higher profit margins. This allows manufacturers to invest in higher-quality coffee beans, more sophisticated packaging, and other premium features that help to differentiate their products from competitors. In addition, premiumization can help to create a strong brand identity and increase consumer loyalty, which can lead to long-term success in the market.

Innovation has been a key driver of growth in the coffee capsule market, as it allows manufacturers to develop new and unique blends and flavors that can attract new consumers and keep existing consumers engaged. This includes developing capsules with unique flavor profiles, introducing new brewing methods, and creating new packaging designs that enhance the consumer experience. In addition, innovation can help manufacturers to address emerging trends, such as sustainability and health and wellness, which can help to create a competitive advantage and meet the evolving needs of consumers.

The global Coffee Capsules Market Size was valued at $5.9 billion in 2022, and is projected to reach $11.9 billion by 2032

The global Coffee Capsules market is projected to grow at a compound annual growth rate of 7.6% from 2023 to 2032 $11.9 billion by 2032

The key players operating in the coffee capsules market include JDE Peets N.V., Aumeeka Ventures LLP, Lavazza Group, Fresh Brew Co., Nestle S.A., Starbucks Corporation, Georg MENSHEN GmbH & Co. KG, Coffee Nirvana, Keurig Dr Pepper Inc., The J. M. Smucker Company, Coffeeza, Halo Coffee, Inspire Brands, Inc., illycaffe S.p.A., The Kraft Heinz Company, Tassimo and Dualit Ltd.

Based on region, Europe region had the dominating Coffee Capsules Market Size in the year 2022

The surge in coffee consumption in the emerging nations, Rise in growth of HoReCa industry

Loading Table Of Content...

Loading Research Methodology...