Cold Storage Construction Market Research, 2031

The global cold storage construction market size was valued at $9.1 billion in 2021, and is projected to reach $26.2 billion by 2031, growing at a CAGR of 10.6% from 2022 to 2031.

The growth of cold storage construction market is connected to the cold chain. Cold chain logistics solutions are widely used to transport and store vegetables, fruits, meat, medicines, and drugs. In addition, cold storage retains perishable goods' natural features for a long time by storing them in a refrigerated environment. A refrigeration system is used in a cold-storage facility to help maintain a suitable atmosphere and temperature in accordance with the requirements of each item being stored.

Cold Storage Construction Market Dynamics

The boost in the wealth of emerging economies is anticipated to trigger the accessibility of cold storage construction installation, which is anticipated to foster the growth of the cold storage construction market. In addition to that one of the key factors fueling the expansion of the cold storage construction market is the increase in global traffic for perishable goods. Additionally, users of temperature-controlled packaging and suppliers are constantly seeking to reduce the environmental impact of cold chain shipping. Moreover, the use of packaging products for storing solid, liquid, and semisolid forms of formulations, including capsules, topical drug formulations, tablets, and syrups, as well as the focus of various governments on improving healthcare infrastructure and insurance coverage have a significant impact on the cold storage construction market growth. The demand for cold storage construction is expected to be driven by the rise in demand for online grocery, the wider blending of retail & industrial space, and the rise in food takeaways from restaurants.

Furthermore, the cold storage construction market expansion is accelerated by the boom in the usage of warehouse automation, which includes, robots, conveyor belts, cloud technology, energy management, and automated truck loading. A well-known essential component of supply chain management is refrigerated storage. .

Major players have adopted various strategies such as expansion and acquisition to sustain the competition and improve the product portfolio. For instance, in July 2022, Americold Realty Trust, a global leader in temperature-controlled warehouses and logistics for the food industry, announced the grand opening of its newest facility in Dunkirk, New York with 181,000-square feet of cold storage and operational space, this LEED-certified facility features 25,000 pallet positions, to support cold storage needs in the western New York region.

The cold storage construction market is segmented into Storage type, Warehouse Type, End User, and REGION.

the cold storage construction market is segmented into production stores, bulk stores, ports, and others. On the basis of warehouse type, the market is divided into private and semi-private warehouses and public warehouses. On the basis of end-user, the cold storage construction market is divided into food & beverage, pharmaceuticals, chemicals, and others. Region-wise, the global cold storage construction market analysis is conducted across North America, Europe, Asia-Pacific, and LAMEA.

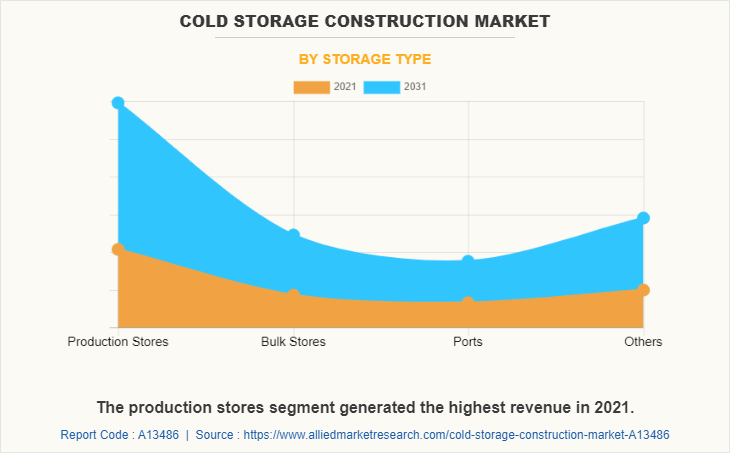

On the basis of storage type, the production stores segment generated the highest revenue in 2021, owing to tangible items protection throughout the production process including raw material, and semi-finished products. These are typically located in areas where the products are manufactured or procured.

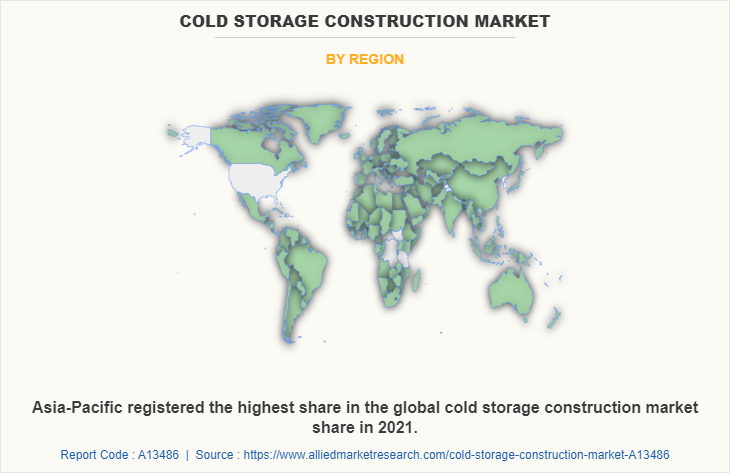

On the basis of region, Asia-Pacific registered the highest share of the global cold storage construction market share in 2021, owing to strong economic growth, rapid urbanization, and the presence of a large population base significantly contributing toward the growth of the cold storage construction market in Asia-Pacific. Furthermore, the majority of countries in the region are spending on the construction sector for the growth of their economies.

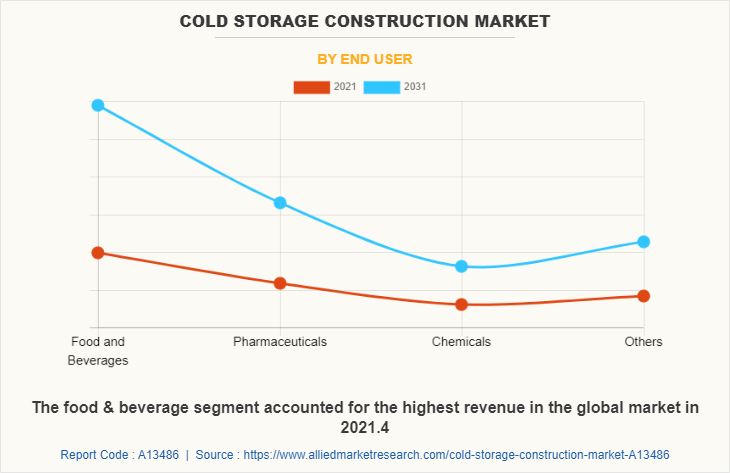

On the basis of end-user, the food & beverage segment accounted for the highest revenue in the global cold storage construction market in 2021, owing to numerous factors such as, increase in disposable income of people, availability of a large number of food & beverage options, rise in retail shops, and increase in e-commerce industry.

Competition Analysis

The key players that operate in the cold storage construction market are Americold Realty Trust, Burries Logistics, Emergent Cold LatAm Management LLC, Hansen Cold Storage Construction, Lineage Logistics Holdings, LLC, NewCold, Primus Builders, Inc., Tippmann Group, United States Cold Storage, Inc., and VersaCold Logistics Services.

Key Benefits For Stakeholders

The report provides an extensive analysis of the current and emerging global cold storage construction market trends and dynamics.

In-depth market global cold storage construction market analysis is conducted by constructing market estimations for key market segments between 2022 and 2031.

Extensive analysis of cold storage construction market overview is conducted by following key product positioning and monitoring of top competitors within the market framework.

A comprehensive analysis of all the regions is provided to determine the prevailing opportunities.

Cold storage construction market forecast analysis from 2022 to 2031 is included in the report.

The key players in the cold storage construction market are profiled in this report and their strategies are analyzed thoroughly, which helps understand the competitive outlook of the cold storage construction industry.

Cold Storage Construction Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 26.2 billion |

| Growth Rate | CAGR of 10.6% |

| Forecast period | 2021 - 2031 |

| Report Pages | 300 |

| By Storage type |

|

| By Warehouse Type |

|

| By End User |

|

| By Region |

|

| Key Market Players | Hansen Cold Storage Construction, Tippmann Group, VersaCold Logistics Services, Lineage Logistics Holdings, LLC, Emergent Cold LatAm Management LLC, Americold Realty Trust, NewCold, Primus Builders, Inc., United States Cold Storage, Inc., Burris Logistics |

Analyst Review

The cold storage construction market has observed huge demand in North America, Asia-Pacific, and Europe. Asia-Pacific registered the highest share of the global cold storage construction market share in 2021, owing to strong economic growth, rapid urbanization, and presence of large population base that significantly contribute toward the growth of the cold storage construction market in the region. Furthermore, the majority of countries in the region are spending on construction sector for the growth of their economies. The production stores segment generated the highest revenue in 2021, owing to tangible items protection throughout the production process including raw material and semi-finished products. These are typically located in areas where the products are manufactured or procured.

Various market players have adopted strategies such as business expansion and acquisition to expand their business and strengthen their market position. For instance, in October 2022, Emergent Cold LatAm Management LLC, which is the fastest growing refrigerated storage and logistics service provider in Latin America, announced the expansion of its temperature-controlled facility located in Panama City, Panama. This planned expansion is anticipated to add more than 8,300 pallet positions to the facility, bringing its total capacity to 28,300 pallets. As a result, such strategic moves are expected to provide lucrative growth opportunities in the global cold storage construction market.

The base year considered in the global Cold Storage Construction market report is 2021.

The Cold Storage Construction Market size was valued at 9,134.13 million in 2021 and is estimated to surpass 26,148.10 million by 2031.

Food and beverage is the leading end-user of the Cold Storage Construction Market.

Rising trade in fresh produce is expected to help boost the demand for cold storage construction in the coming years.

Asia-Pacific is the largest regional market for Cold Storage Construction.

Americold Realty Trust, Burries Logistics, Emergent Cold LatAm Management LLC, Hansen Cold Storage Construction, Lineage Logistics Holdings, LLC, NewCold, Primus Builders, Inc., Tippmann Group, United States Cold Storage, Inc., and VersaCold Logistics Services are the top companies to hold the market share in Cold Storage Construction.

The top 10 market players are selected based on two key attributes- competitive strength and market positioning.

The report contains an exclusive company profile section, where the leading 10 companies in the market are profiled. These profiles typically cover company overview, geographical presence, market dominance (in terms of revenue and volume sales), various strategies, and recent developments.

Loading Table Of Content...