Collision Avoidance Sensor Market Research, 2030

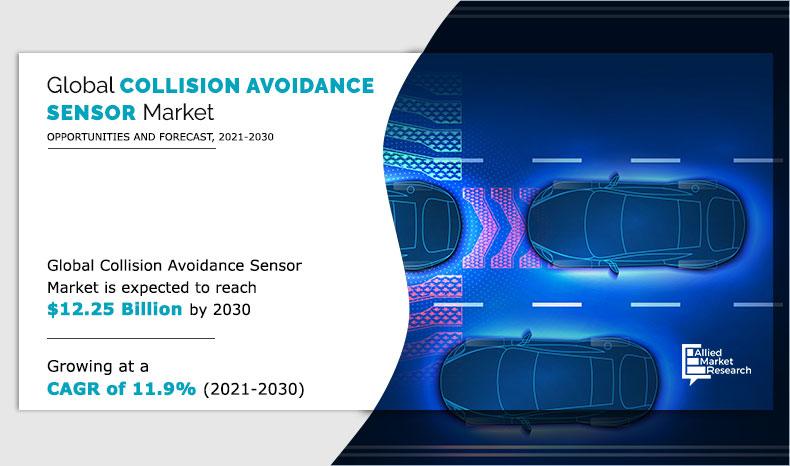

The global collision avoidance sensor market size was valued at $4.00 billion in 2020 and is projected to reach $12.25 billion by 2030, registering a CAGR of 11.9% from 2021 to 2030.

A collision avoidance sensor is a device that is used to sense an object in the path of a moving vehicle so the vehicle’s automated system or human operator can take action to avoid a collision. The most widely recognized vehicle application is a reverse sensor that makes drivers aware of obstacles in their way when backing up.

The growth of the global collision avoidance sensor market size is anticipated to be driven by factors such as a surge in sales of sports utility vehicles (SUVs), high-end luxury vehicles, and utility vehicles. In addition, rising improvements in the fields of the camera boost the overall market growth. However, the cyclic nature of automotive sales and production is a major restraint of the global collision avoidance sensor industry. On the contrary, the rise in the automotive safety norms, and installing advanced driver assistance systems in passenger cars is expected to create lucrative opportunities for the collision avoidance sensor industry.

The global collision avoidance sensor market share is segmented based on technology, function type, application, industry vertical, and region. By technology, the market is classified into radar, camera, ultrasound, lidar, and others. The market is categorized into adaptive, automated, monitoring, and warning depending on function type. The applications covered in the study include adaptive cruise control (ACC), blind spot detection (BSD), forward collision warning system (FCWS), lane departure warning system (LDWS), parking assistance, night vision (NV), autonomous emergency braking, and others. Based on industry vertical, the market is classified into automotive, rail, marine, aerospace & defense, and others.

Region-wise, the collision avoidance sensor market trends are analyzed across North America (U.S., Canada, and Mexico), Europe (UK, Germany, France, Italy, and the rest of Europe), Asia-Pacific (China, Japan, India, Australia, South Korea, and rest of Asia-Pacific), and LAMEA (Latin America, Middle East, and Africa). Europe dominated the collision avoidance sensor market share in 2020 and is projected to register a significant growth rate during the forecast period, owing to the growth of the aerospace & defense sector. However, Asia-Pacific is expected to witness a significant growth rate by the end of the forecast period, followed by LAMEA.

By Region

Asia-Pacific would exhibit the highest CAGR of 13.8% during 2021-2030

Leading collision avoidance sensor market manufacturers such as Robert Bosch GmbH, Honeywell International Inc., and Texas Instruments Inc., are focusing on their investment in technologically advanced, cost-effective, and more secure products and solutions for various applications.

By Type

Autonomous Emergency Braking segment is projected as one of the most lucrative segments.

Top Impacting Factors

The prominent factors that impact the collision avoidance sensor market growth are an increase in demand for automated vehicles and an increase in automotive safety norms. In addition, growth in electronic integration in the transportation sector drives the collision avoidance sensor market. However, high installation cost restricts the market growth. On the contrary, the surge in the automotive sector is expected to create lucrative opportunities for the market.

By Offering

Radar segment is expected to secure leading position during forecast period.

Competition Analysis

Competitive analysis and profiles of the major collision avoidance sensor market players such as Denso Corporation, General Electric Company, Honeywell International Inc., Infineon Technologies AG, Murata Manufacturing Co., Ltd., NXP Semiconductors N.V., Robert Bosch GmbH, Saab AB, Siemens AG, and Texas Instruments Inc. have been covered in the report.

Covid-19 Impact Analysis

- The outbreak of COVID-19 has significantly affected the electronics and semiconductor sector. Business and manufacturing units across various countries were closed, owing to an increase in the number of COVID-19 cases, and are expected to remain closed in 2021. Furthermore, partial or complete lockdown has disrupted the global supply chain posing challenges for manufacturers to reach customers.

- The COVID-19 pandemic is impacting the society and overall economy across the globe. The impact of this outbreak is growing day by day as well as affecting the overall business globally. The crisis is creating uncertainty in the stock market and is resulting in falling business confidence, massive slowing of the supply chain, and increasing panic among the customer segments.

- Asian and European countries under lockdowns have suffered major losses of business and revenue, due to the shutdown of manufacturing units. The operations of the production and manufacturing industries have been heavily impacted by the outbreak of the COVID-19 disease, which further impacted the growth of the global collision avoidance sensor market.

- In addition, the COVID-19 pandemic has impacted the electronics sector, as production facilities have stalled, which, in turn, has boosted the demand for electronics and semiconductor products in the industries. Its major impact includes a large manufacturing interruption across Europe and an interruption in Chinese parts exports, which may hinder the collision avoidance sensor market.

Key Benefits For Stakeholders

- This study comprises an analytical depiction of the global collision avoidance sensor market size along with the current trends and future estimations to depict the imminent investment pockets.

- The overall collision avoidance sensor market analysis is determined to understand the profitable trends to gain a stronger foothold.

- The report presents information related to key drivers, restraints, and opportunities with a detailed impact analysis.

- The current collision avoidance sensor market forecast is quantitatively analyzed from 2020 to 2030 to benchmark financial competency.

- Porter’s five forces analysis illustrates the potency of the buyers and the collision avoidance sensor market share of key vendors.

- The report includes the market trends and the market share of key vendors.

Key Market Segments

By Technology

- Radar

- Camera

- Ultrasound

- Lidar

- Others

By Function Type

- Adaptive

- Automated

- Monitoring

- Warning

By Application

- Adaptive Cruise Control (ACC)

- Blind Spot Detection (BSD)

- Forward Collision Warning System (FCWS)

- Lane Departure Warning System (LDWS)

- Parking Assistance

- Night Vision (NV)

- Autonomous Emergency Braking

- Others

By Industry

- Automotive

- Passenger Cars

- Commercial Vehicle

- Rail

- Marine

- Aerospace & Defense

- Others

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia-Pacific

- LAMEA

- Latin America

- Middle East

- Africa

Key Players

- DENSO Corporation

- General Electric Company

- Honeywell International Inc.

- Infineon Technologies AG

- Murata Manufacturing Co., Ltd.

- NXP Semiconductors N.V.

- Robert Bosch GmbH

- Saab AB

- Siemens AG

- Texas Instruments Inc.

Collision Avoidance Sensor Market Report Highlights

| Aspects | Details |

| By TECHNOLOGY |

|

| By FUNCTION TYPE |

|

| By APPLICATION |

|

| By INDUSTRY VERTICAL |

|

| By Region |

|

| Key Market Players | .NXP Semiconductors N.V., SAAB AB, DENSO Corporation, Infineon Technologies AG, General Electric Company, Murata Manufacturing Co., Ltd., Siemens AG, Robert Bosch GmbH, Texas Instruments Inc., Honeywell International Inc. |

Analyst Review

A collision avoidance sensor is a part of electronic safety equipment which senses an impact through vibrations. These sensors are very common in self-guided vehicles in warehouses & factories. It is generally assembled on the rear, top, and front of the vehicle. When any object is detected, the sensor initiates a visual or sound alarm, or may trigger the vehicle’s brakes.

The growth of the global collision avoidance sensor market is anticipated to be driven by factors such as surge in sales of sports utility vehicles (SUVs), high-end luxury vehicles, and utility vehicles. In addition, rising improvements in the fields of the camera, boosts the overall market growth. However, cyclic nature of automotive sales and production acts as a major restraint of the global collision avoidance sensor industry. On the contrary, rise in the automotive safety norms, and installing advanced driver assistance system in passenger cars is expected to create lucrative opportunities for the collision avoidance sensor industry.

The key players of the market focus on introducing technologically advanced products to remain competitive in the market. Product launches, partnership, collaboration, acquisition, expansion, and product development are expected to be the prominent strategies adopted by the market players. Europe accounted for a major share of the market in 2020, owing to the presence of major players in the region; however, Asia-Pacific is expected to witness growth at the highest CAGR, owing to rise in adoption of collision avoidance sensor in a variety of fields.

Loading Table Of Content...