Global LiDAR Market Research, 2031

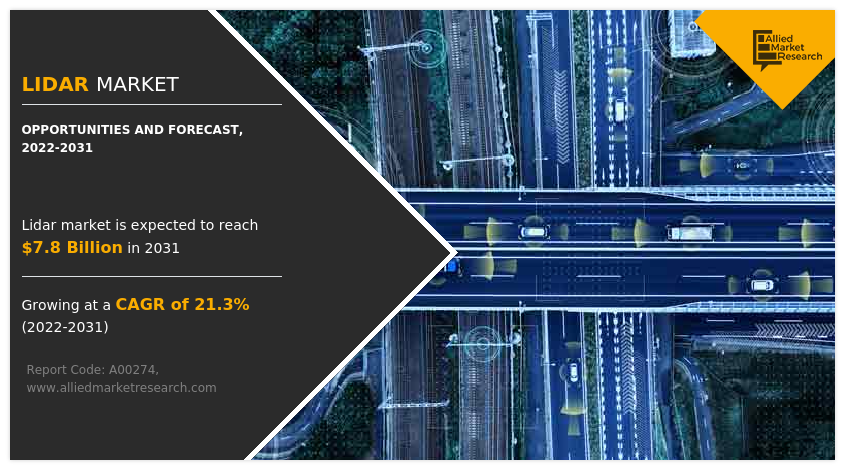

The Global LiDAR Market was valued at $1.1 billion in 2021 and is projected to reach $7.8 billion by 2031, growing at a CAGR of 21.3% from 2022 to 2031. The light detection and ranging (LiDAR) system is a remote sensing device that examines, detects, and maps objects using light rays. The LiDAR device is equipped with a sender that emits light rays and a receiver that captures reflected light rays for mapping. This system has gained popularity over traditional surveying methods due to its ability to provide highly accurate data and 3D images in less time. The major factors driving the growth of the global LiDAR market are improved automated processing capability of LiDAR scanners and systems in terms of image resolution and prompt data processing capability over other technologies.

In addition, the growth of the LiDAR market is driven by an increase in demand for 3D imaging technology in a variety of application areas and a surge in the use of aerial LiDAR systems to explore and detect places and historic details. However, a lack of awareness about the benefits of LiDAR systems acts as a key deterrent factor in the market. Moreover, the integration of expensive components in these systems, such as laser scanners, navigation systems, and high-resolution 3D cameras, incurs additional costs, which limit their adoption, thereby hampering the market growth.

On the contrary, the surge in the adoption of LiDAR systems across various industries and the rise in demand for 3D imaging are expected to offer remunerative opportunities for the expansion of the global market in the near future. Furthermore, automated processing in LiDAR systems paired with the superior performance of LiDAR systems as compared to other technologies is anticipated to open new avenues for the growth of the LiDAR industry during the forecast period. In addition, an increase in LiDAR applications in new industries is projected to provide lucrative opportunities for market growth.

Key Takeaways

- The global market study covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

- More than 1,500 product literature, industry releases, annual reports, and other such documents of major market industry participants, along with authentic industry journals, trade associations' releases, and government websites, have been reviewed to generate high-value industry insights.

- The study integrated high-quality data, professional opinion, analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions to achieve their most ambitious growth objectives.

Segment Overview

The lidar market is segmented into Type, Component, Application, End User, and Region.

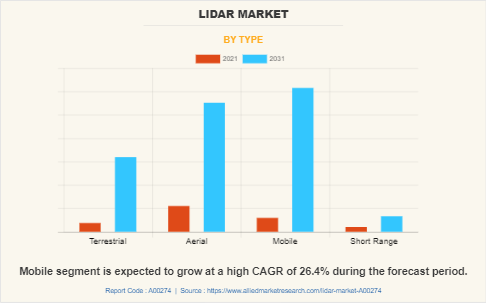

Based on type, the LiDAR market share is categorized into static or terrestrial, aerial, mobile, and short-range LiDAR systems. In 2021, the aerial segment dominated the market in terms of revenue and is expected to follow the same trend during the forecast period. However, the mobile segment is expected to exhibit the fastest growth during the forecast period.

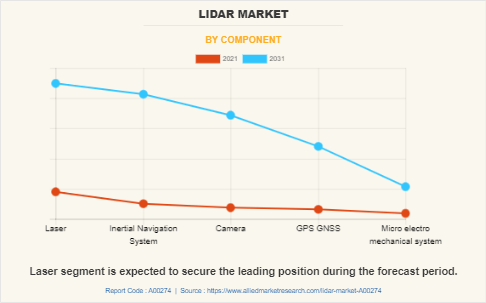

By component, the LiDAR market forecast is fragmented into laser scanners, inertial navigation systems, cameras, GPS receivers, and micro-electro-mechanical systems. The laser segment accounted for a major share of the LiDAR market outlook in 2021.

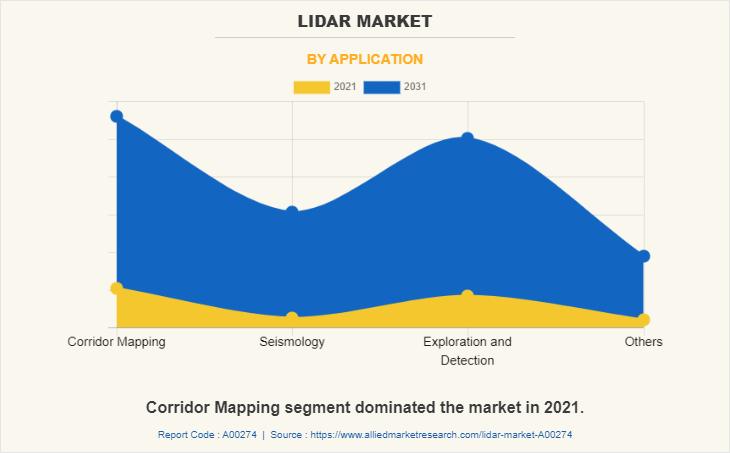

Depending on the application, it is segregated into corridor mapping, seismology, exploration & detection, and others. The exploration & detection segment dominated the market in 2021 in terms of revenue and is expected to dominate the market during the forecast period.

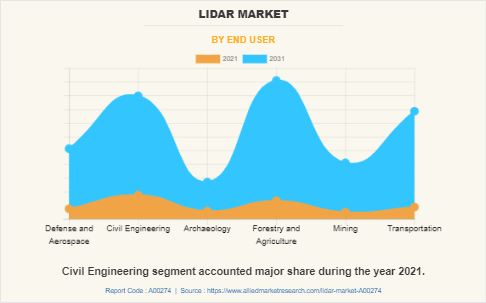

As per the end-user sector, the LiDAR market size is classified into defense & aerospace, civil engineering, archaeology, forestry & agriculture, mining industry, and transportation. The civil engineering segment dominated the market in 2021 and is expected to follow the same trends during the forecast period.

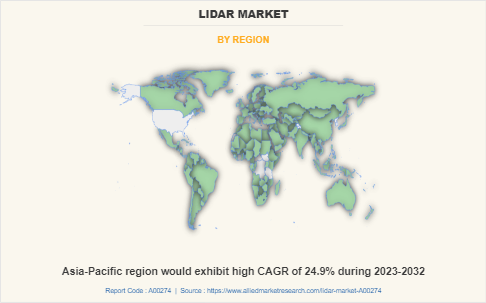

Region-wise, the LiDAR market trends are analyzed across North America (the U.S., Canada, and Mexico), Europe (UK, Germany, France, and rest of Europe), Asia-Pacific (China, Japan, India, and rest of Asia-Pacific), and LAMEA (Latin America, Middle East, and Africa). North America, specifically the U.S., remains a significant participant in the LiDAR market. This is attributed to the fact that major organizations and government institutions in North America are significantly putting resources into action to develop enhanced LiDAR-based electronics solutions.

Competitive Analysis

Competitive analysis and profiles of the major global LiDAR market players that have been provided in the report include Leica Geosystems AG, RIEGL Laser Measurement Systems GmbH, Mira Solutions, Inc., FARO, Firmatek, LEOSPHERE (Vaisala), Velodyne Lidar, Inc., Aerometrex, Yellowscan, and SICK AG.

Key Market Dynamics

The LiDAR market is expected to witness notable growth during the forecast period, owing to the rising adoption of autonomous vehicles. Furthermore, the increased use of 3D mapping across various industries, including architecture, agriculture, and defense, drives the growth of the market. Moreover, increasing investments in UAVs (drones) are expected to propel the growth of the LiDAR market during the forecast period.

However, the high cost of LiDAR systems is one of the prime factors that restrain market growth. On the contrary, the integration of AI and machine learning is expected to provide lucrative opportunities for the growth of the LiDAR market during the forecast period.

Country Analysis

Country-wise, the U.S. acquired a prime share in the LiDAR market in the North American region in 2021 and is expected to grow at a high CAGR of 21.0% during the forecast period. The U.S. held a dominant position in the LiDAR market, owing to the presence of prime players in this region putting resources into action to develop next-generation advanced LiDAR scanners.

In Europe, Germany dominated the LiDAR market in terms of revenue in 2021 and is expected to follow the same trend during the forecast period. Furthermore, the UK is expected to emerge as the fastest-growing country in Europe's LiDAR with a CAGR of 20.6%, owing to significant development in the Internet of Things and consumer electronics solutions.

In Asia-Pacific, China holds a dominant market share in the Asia-Pacific region and is expected to follow the same trend during the forecast period, owing to a significant rise in investment by prime players in next-generation Medical HIFU, Therapeutic Ultrasound, and Hydrophones solutions, which is expected to drive the market in China during the forecast period. However, South Korea is expected to emerge as a dominant country in the LiDAR market in the Asia-Pacific region.

In LAMEA, Latin America held a significant market share in 2021 owing to the presence of prime vendors in this region. Moreover, the Middle East is expected to emerge as the fastest-growing region of the LAMEA region, with a high CAGR of 17.4% from 2022 to 2031.

Top Impacting Factors

Significant factors that impact the growth of the global LiDAR industry include the automated processing in LiDAR systems, paired with the enhanced performance of LiDAR systems compared to other technologies. Moreover, the rise in demand for 3D imaging coupled with the surge in adoption of LiDAR across various industries is expected to drive market opportunity. However, the lack of awareness about LiDAR across emerging economies is acting as a prime barrier to early adoption, which hampers the growth of the market. On the contrary, the expansion of LiDAR applications in new industries and markets is expected to offer potential growth opportunities for the LiDAR market during the forecast period.

Historical Data & Information

The LiDAR market is highly competitive, owing to the strong presence of existing vendors. Vendors of LiDAR machines with extensive technical and financial resources are expected to gain a competitive advantage over their competitors because they can cater to market demands. The competitive environment in this market is expected to increase as technological innovations, product extensions, and different strategies adopted by key vendors increase.

Key Developments/ Strategies

Leica Geosystems AG, RIEGL Laser Measurement Systems GmbH, SICK AG, FARO, and Velodyne Lidar, Inc. are the top 5 companies holding a prime share in the LiDAR market. Top market players have adopted various strategies, such as product launches, agreements, partnerships, acquisitions, product upgrades, product development, and more to expand their foothold in the LiDAR market.

- In Nov 2021, Leica Geosystems announced a partnership with Airbus to integrate two Leica Chiroptera 4X bathymetric LiDAR sensors for maritime surveillance into the C295 MSA, Airbus’ Maritime Surveillance Aircraft. It enables the detection of underwater objects in near real-time.

- In Apr 2020, RIEGL launched RIEGL VMX-RAIL mobile LiDAR. The RIEGL VMX-RAIL mobile LiDAR Mapping System is designed with a triple scanner configuration for integration on a railcar for track mapping and clearance surveying.

- In Dec 2022, FARO Technologies, Inc. announced the acquisition of SiteScape, an innovator in LiDAR 3D scanning software solutions for the AEC and O&M markets. SiteScape enables LiDAR-equipped mobile devices to easily capture indoor spaces digitally, providing a readily available entry point to scanning physical spaces for a broad range of applications.

- In Sept 2022, FARO Technologies, Inc. announced the acquisition of UK-based GeoSLAM, a leading provider of mobile scanning solutions with proprietary high-productivity simultaneous localization and mapping (SLAM) software to create 3D models for use in Digital Twin applications.

- In Jan 2023, PR Enhancement- Vaisala announced enhancements to WindCube Lidar, including new design features, measurement capabilities, and service and support for optimal Wind Resource Assessment in extreme weather conditions across a diverse array of climates.

- In Nov 2022, Velodyne Lidar, Inc. announced a multi-year agreement to provide its lidar sensors to GreenValley International for handheld, mobile, and unmanned aerial vehicle (UAV) 3D mapping solutions, including in GPS-denied environments.

- In Oct 2022, Velodyne Lidar, Inc. announced a multi-year agreement to provide its lidar sensors to Yamaha Motor for Eve Autonomy, a joint venture between Yamaha Motor and Tier IV, Inc. Eve Autonomy’s autonomous goods transport service, Eve Auto, provides logistical support for factories to improve efficiency and safety.

- In Aug 2022, YellowScan partnered with FIXAR, a European unmanned aerial vehicle developer. FIXAR provides a range of solutions which including its flagship model, the FIXAR 007, a UAV dedicated to outdoor VLOS and BVLOS missions, which is upgraded with a YellowScan LiDAR system.

Report Coverage & Deliverables

This report delivers in-depth insights into the LiDAR market, type, component, application, end-user, and region, and key strategies employed by major players. It offers detailed market forecasts and emerging trends.

Type Insights

Terrestrial LiDAR is primarily used for ground-based applications such as urban planning, infrastructure monitoring, and topographical mapping, providing highly detailed measurements. Aerial LiDAR, mounted on aircraft or drones, covers vast areas like forests and coastlines, offering quick, large-scale surveying capabilities. Mobile LiDAR, installed on vehicles, is ideal for real-time data capture in dynamic environments like roads and urban areas, aiding in infrastructure and transportation management. Moreover, short-range LiDAR is employed for high-precision tasks at close distances, commonly in indoor mapping, robotics, and industrial automation, where detailed scanning and object detection are essential.

Component Insights

The laser is central to the system, emitting light pulses to measure distances and generate spatial data. An inertial navigation system (INS) ensures accuracy in mobile and aerial LiDAR applications by determining the system’s position and orientation. Cameras complement the LiDAR system by providing visual context, enhancing object recognition, and improving the accuracy of spatial mapping. GPS GNSS technology is vital for positioning and georeferencing, ensuring the LiDAR data is accurately tied to real-world coordinates. Micro-electromechanical systems (MEMS) are used to miniaturize components, making LiDAR more efficient, cost-effective, and adaptable for mass-market use.

Application Insights

LiDAR technology has various applications across industries. Corridor mapping provides detailed elevation and spatial data crucial for infrastructure projects like roads, railways, and pipelines. In seismology, it plays a vital role in monitoring ground displacement and fault lines, offering valuable data for earthquake predictions and hazard assessments. For exploration and detection, LiDAR is essential in activities such as resource exploration and archaeological digs, offering detailed surface and subsurface data without environmental disruption. Other applications include urban planning, environmental conservation, and coastal erosion monitoring, where LiDAR's precise topographical capabilities are highly valued.

End User Insight

LiDAR serves a diverse range of industries. In civil engineering, it is widely used for terrain mapping, infrastructure development, and construction monitoring, providing accurate measurements that enhance project safety and efficiency. Archaeology benefits from LiDAR’s ability to uncover hidden structures and historical sites without invasive exploration, particularly in densely vegetated or remote areas. Forestry and agriculture use LiDAR to monitor vegetation, analyze crop health, and aid in land management and environmental conservation. In mining, LiDAR helps with resource exploration, volumetric analysis, and site monitoring, improving safety and operational efficiency. The transportation sector utilizes LiDAR for autonomous vehicle navigation, traffic management, and road infrastructure maintenance. Furthermore, the defense and aerospace sectors employ LiDAR for terrain mapping, surveillance, and target detection, offering real-time situational awareness and enhancing mission planning accuracy.

Regional Insights

The North America region dominates the LiDAR market due to several key factors, including widespread adoption of advanced technologies such as autonomous vehicles and drones, significant investments in infrastructure development, and strong demand for LiDAR in industries like transportation, defense, and agriculture. Additionally, the presence of leading market players, along with substantial government initiatives aimed at smart city projects and environmental monitoring, further accelerates growth. Research and development efforts in autonomous driving and robust regulatory support for geospatial mapping applications also contribute to North America's leadership in the LiDAR market.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the lidar market from 2021 to 2031 to identify the prevailing lidar market opportunities.

- Market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- An in-depth analysis of the lidar market segmentation assists in determining the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes an analysis of the regional as well as global lidar market trends, key players, market segments, application areas, and market growth strategies.

LiDAR Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 7.8 billion |

| Growth Rate | CAGR of 21.3% |

| Forecast period | 2021 - 2031 |

| Report Pages | 288 |

| By Type |

|

| By Component |

|

| By Application |

|

| By End User |

|

| By Region |

|

| Key Market Players | Velodyne Lidar, Inc., yellowscan, Aerometrex, LEOSPHERE(Vaisala), Mira Solutions, Inc, Firmatek, RIEGL Laser Measurement Systems GmbH, Leica Geosystems AG, SICK AG, FARO |

Analyst Review

LiDAR technology is gaining high traction in the market due to its ability to provide highly accurate mapping and object detection of the environment. This has led to its widespread use in various industries such as autonomous vehicles, construction, mining & quarrying, and entertainment & gaming. The market for LiDAR is expected to continue to grow in the coming years, driven by increasing demand for accurate and detailed mapping and object detection. However, the high cost and complexity of LiDAR technology limit its adoption in certain industries.

The CXOs further added that the global LiDAR market is highly competitive, owing to the strong presence of existing vendors. LiDAR vendors, who have access to extensive technical and financial resources, are anticipated to gain a competitive edge over their rivals, as they have the capacity to cater to the market requirements. The competitive environment in this market is expected to further intensify with technological innovations, product extensions, and different strategies adopted by key vendors.

The prime economies such as the U.S., China, Germany, and Japan are developing and deploying next-generation LiDAR-based advanced mapping and remote sensing solution, which is anticipated to provide lucrative opportunities for market growth. Among the analyzed geographical regions, the adoption of LiDAR has been witnessed to be highest in Asia-Pacific. On the other hand, North America is expected to grow at a faster pace, as the U.S. and Mexico are heavily investing in these technologies

North America is the largest regional market of LiDAR.

The corridor mapping segment dominated the market in 2021 in terms of revenue and is expected to dominate the market during the forecast period.

The LIDAR Market valued for $1,142.05 million in 2021 and is estimated to reach $7,768.50 million by 2031, exhibiting a CAGR of 21.3% from 2022 to 2031.

Significant factors that impact the growth of the global LiDAR industry include, the automated processing in LiDAR systems paired with the enhanced performance of LiDAR systems compared to other technologies script. Moreover, rise in demand for 3D imaging coupled with the surge in adoption of LiDAR across various industries are expected to drive market opportunity.

Leica Geosystems AG, RIEGL Laser Measurement Systems GmbH, SICK AG, FARO, and Velodyne Lidar, Inc. are the top 5 companies holding a prime share in the LiDAR market.

Loading Table Of Content...

Loading Research Methodology...