Commercial Banking Market Research, 2031

The global commercial banking market size was valued at $2540.3 billion in 2021, and is projected to reach $7404.4 billion by 2031, growing at a CAGR of 11.5% from 2022 to 2031.

A commercial bank is a kind of financial institution that carries out all the operations related to deposit and withdrawal of money for the general public and providing loans for investment. These banks are profit-making institutions and do business only to make a profit. The two primary characteristics of a commercial bank are lending and borrowing. The bank receives the deposits and gives money to various projects to earn interest (profit). The rate of interest that a bank offers to depositors is known as the borrowing rate, while the rate at which a bank lends money is known as the lending rate.

Commercial banks facilitate business transactions by making the use of cheques, bank drafts, and online transfers possible. Moreover, commercial banks make business transactions possible by providing digital payments offerings. In addition, commercial banks offer consumers and small-to mid-sized businesses with basic banking services. Furthermore, it increases global trade among various countries. Therefore, these are some of the factors propelling the market growth.

However, the amount of collateral security required by commercial banks before offering loans is usually high, which the borrowers may not be able to provide. If people do not have the necessary collateral security with which to borrow money from the banks, the commercial banks are reluctant to make loans available. This therefore tends to hamper the market growth. In addition, risk of robberies and frauds is one of the major factors limiting the growth of commercial banking market. On the contrary, commercial banks play a major role in the growth of the economy through the creation of credit, which leads to an increase in production, employment, and consumer spending, thereby boosting the country economy. Therefore, this is a major factor expected to provide lucrative growth opportunities in the coming years.

Segment Review

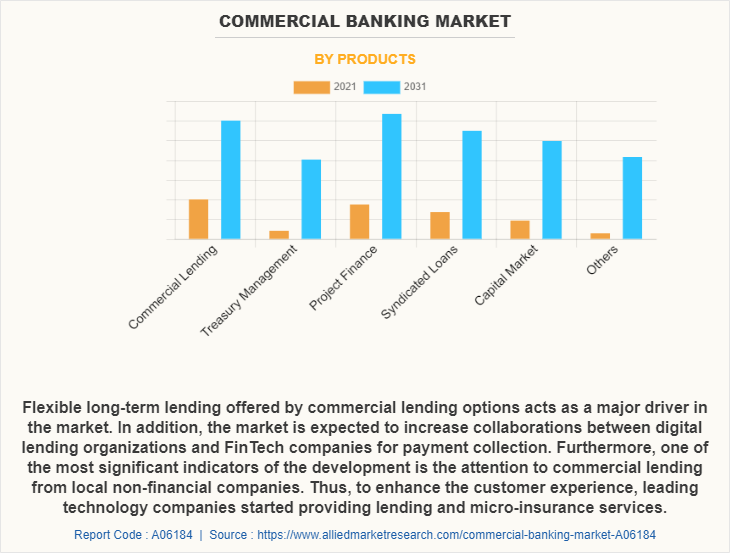

The commercial banking market is segmented on the basis of product, application, and region. By product, it is segmented into commercial lending, treasury management, project finance, syndicated loans, capital market and others. On the basis of application, it is segmented into healthcare, construction, transportation & logistics, media & entertainment, and others. By region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Based on product, the commercial lending segment attained the highest growth in 2021. This is attributed to the flexible long-term lending offered by commercial lending options, which acts as a major driver in the market. In addition, the market is expected to increase collaborations between digital lending organizations and FinTech companies for payment collection. Furthermore, one of the most significant indicators of the development is the attention to commercial lending from local non-financial companies.

By region, North America attained the highest growth in 2021. This is attributed to the fact that commercial banks in North America have profited significantly from recent economic upswings during the past several years. On the volume side, deposits and balances grew by approximately 5% CAGR as companies translated higher profits into cash holdings. Moreover, across loans and deposits, net-interest margins widened significantly, with 10 to 20% increases common across banks. As a result, growth has been broad-based, with most North American commercial banks recording strong results in recent years.

The report focuses on growth prospects, restraints, and trends of the commercial banking market analysis. The study provides Porter’s five forces analysis to understand the impact of various factors, such as bargaining power of suppliers; competitive intensity of competitors; threat of new entrants; threat of substitutes; and bargaining power of buyers, on the commercial banking industry.

The report profiles of key players operating in the commercial banking market analysis, such as Bank of America Corporation, Bank of China (BOC), Barclays Bank PLC, BNP Paribas, China Construction Bank, Citigroup Inc., HSBC Group, J.P. Morgan Chase & Co., U.S. Bank, and Wells Fargo. These players have adopted various strategies to increase their market penetration and strengthen their position in the commercial banking industry.

Top Impacting Factors

Commercial Banks Increases Global Trade

Commercial banks facilitate international trade and travel by making foreign exchange transactions easier. They help in making overseas payments for their customers. Furthermore, they assist in international trade by issuing letters of credit to importers and providing travelers’ checks to overseas travelers. With globalization, the modern economy is a borderless economy. There is always a need to settle international indebtedness. Commercial international bank aid in the remittance of cash; exchanging one currency for another; aid in export & import by transferring documents & payments; and lend money to governments, institutions, and other world organizations. The reach of the commercial banks is unlimited and it helps in making the world a global village. Therefore, this is one of the major factors for the commercial banking market growth.

Risk of Robbery and Fraud

Piling up cash in publicly known places like commercial banks can attract robbers. There have been numerous cases of robbers breaking into banks and emptying the vaults. Increase in internet banking in recent times has as well led to increase in cybercrime. Commercial bank online customers are now exposed to criminal attacks in through stolen ATM cards, passwords, and hacking of accounts. There have been robberies where robbers have stolen millions of dollars through the internet, without physically entering the bank premises. With the rise of internet banking, fraudsters now devise more innovative ways to scam and rob people off their money. Commercial banks are investing heavily on their internet and database infrastructure to secure their cyber acts. This adds to the operating costs of the banks which the customers have to bear. Therefore, this is a major factor hampering the growth of the commercial banking market.

Commercial Banks are Important for the Economy Growth

Commercial banks are an important part of the economy. They not only offer consumers a crucial service, but they support the influx of capital and increase market liquidity. They ensure liquidity by taking the funds that their customers deposit in their accounts and lending them out to others. Commercial banks play a role in the creation of credit, which leads to an increase in production, employment, and consumer spending, thereby boosting the economy. Furthermore, commercial banks are crucial to the fractional reserve banking system. As a result, banks are permitted to offer new loans up to 90% of the deposits they already hold, which should expand the economy by freeing up cash for lending. As a result, this is a significant component that is expected to present profitable chances for the expansion of the commercial banking business in the ensuing years.

Report Coverage & Deliverables

Type Insights:

The commercial banking market encompasses a broad spectrum of commercial banking services, including business loans, credit lines, cash management, and trade financing. These services cater to a wide range of businesses, from small enterprises to large corporations, addressing their diverse financial needs and supporting their growth and operations.

Technological Trends

The commercial banking sector is undergoing a significant transformation driven by several key technological trends. The most prominent trends in commercial banking is the rapid digital transformation driven by advancements in fintech. Banks are increasingly integrating with fintech companies to enhance their service offerings and streamline operations. This includes adopting technologies such as blockchain for secure transactions, AI-driven analytics for personalized financial advice, and cloud computing for scalable operations. The rise of neobanks and digital-only banks, which operate without traditional physical branches, is also a testament to this trend, offering customers convenience and lower costs through their digital platforms. Also, The use of big data and advanced analytics is becoming crucial for commercial banks as they strive to gain deeper insights into customer behavior and preferences. By analyzing data from various sources, banks can offer more tailored financial products and services, improve customer relationship management, and enhance decision-making processes. Predictive analytics helps in anticipating commercial banking market trends and customer needs, enabling banks to proactively address issues and opportunities for commercial banking growth.

Application Insights:

The commercial banking market share is influenced by various applications such as corporate lending, investment banking, and treasury services. Corporate lending holds a substantial share due to its importance in financing business operations and expansion. Investment banking and treasury services also contribute to the market share by offering specialized financial solutions to large businesses and institutional clients.

Regional Insights:

The commercial banking value varies across regions, with North America and Europe leading due to their mature financial markets and established banking infrastructure. In contrast, the Asia-Pacific region is experiencing rapid growth in commercial banking value, driven by economic development, increasing industrialization, and rising demand for business financial services.

Key Companies & Market Share Insights:

Major players in the commercial banking market include JPMorgan Chase, HSBC, and Citibank, which hold significant market shares due to their extensive range of services and global reach. Additionally, regional banks and emerging fintech companies are capturing market share through specialized services and innovative digital solutions, shaping the competitive dynamics of the commercial banking industry.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the commercial banking market share from 2021 to 2031 to identify the prevailing market opportunities.

- The market research is offered along with information related to key drivers, restraints, and commercial banking market opportunity.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the commercial banking market forecast assists in determining the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global commercial banking market outlook.

- The report includes the analysis of the regional as well as global commercial banking market trends, key players, market segments, application areas, and market growth strategies.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global auto insurance market trends, key players, market segments, application areas, and market growth strategies.

Commercial Banking Market Report Highlights

| Aspects | Details |

| By Products |

|

| By Application |

|

| By Region |

|

| Key Market Players | Agriculture Bank of China, Wells Fargo, China Construction Bank, BNP Paribas, HSBC Holdings PLC, Industrial and Commercial Bank of China, Citigroup Inc., Bank of America, Bank of China, J.P. Morgan Chase |

Analyst Review

The growth of digital economy and supportive regulators have propelled rise of commercial banks across the globe. While initially slow to react, incumbents are now ramping up their efforts to penetrate rise in demand for commercial banking across the globe. Furthermore, loans are expected to grow, as economies open borders, boost infrastructure spending, and increase product offering capacity.

Moreover, as economies open up for trade and tourism following two years of the COVID-19 pandemic, banks are anticipated to experience higher loan growth and improved profitability. In addition, commercial banks are integrating the use of technology to enhance their services. For instance, Intellect Global Transaction Banking (iGTB), a transaction banking platform from Intellect Design Arena Limited, announced on April 2022, that it will integrate Microsoft Cloud for Financial Services to accelerate cloud adoption and digital transformation initiatives of commercial banks. The collaboration is expected to see iGTB adopt Microsoft as its preferred cloud platform to remove traditional barriers of banking technology adoption, thereby help banks go-to-market four times faster with liquidity, cash management, payments, trade finance, and supply chain finance cloud offerings to their clients. This collaboration is set to drive sustained banking digitalization, help banks transform their banking business models, modernize their cloud technology stacks, and consume “Banking-As-A-Service.”

Some of the key players profiled in the report include Bank of America Corporation, Bank of China (BOC), Barclays Bank PLC, BNP Paribas, China Construction Bank, Citigroup Inc., HSBC Group, J.P. Morgan Chase & Co., U.S. Bank, and Wells Fargo. These players have adopted various strategies to increase their market penetration and strengthen their position in the industry.

Commercial banks facilitate business transactions by making the use of cheques, bank drafts, and online transfers possible. Moreover, commercial banks make business transactions possible by providing digital payments offerings.

Based on product, the commercial lending segment attained the highest growth in 2021. This is attributed to the flexible long-term lending offered by commercial lending options, which acts as a major driver in the market. In addition, the market is expected to increase collaborations between digital lending organizations and FinTech companies for payment collection. Furthermore, one of the most significant indicators of the development is the attention to commercial lending from local non-financial companies.

By region, North America attained the highest growth in 2021. This is attributed to the fact that commercial banks in North America have profited significantly from recent economic upswings during the past several years. On the volume side, deposits and balances grew by approximately 5% CAGR as companies translated higher profits into cash holdings. Moreover, across loans and deposits, net-interest margins widened significantly, with 10 to 20% increases common across banks. As a result, growth has been broad-based, with most North American commercial banks recording strong results in recent years.

The commercial banking market size was valued at $2,540.33 billion in 2021, and is projected to reach $7,404.43 billion by 2031, growing at a CAGR of 11.5% from 2022 to 2031.

Bank of America Corporation, Citigroup Inc., HSBC Group, J.P. Morgan Chase & Co., and Wells Fargo. are the top companies holding major share in the commercial banking market.

Loading Table Of Content...