Commercial Livestock Supplies Market Research, 2034

The global commercial livestock supplies market was valued at $447.2 billion in 2024, and is projected to reach $671.2 billion by 2034, growing at a CAGR of 4.1% from 2025 to 2034. Commercial livestock supplies consist of products and equipment essential for supporting the nutrition, health, housing, and overall management of farm animals raised for food, fiber, or labor. Feed ingredients include roughages, concentrates, compound feeds, vitamins, minerals, and veterinary supplements. Equipment covers automated feeders, water systems, housing structures, and health monitoring devices. Large-scale farming operations rely on commercial livestock supplies to improve animal productivity, ensure welfare, maintain biosecurity, and comply with regulatory requirements and market expectations.

Market Dynamics

Growth in awareness regarding animal nutrition and welfare has directly contributed to the expansion of the commercial livestock supplies industry. Livestock producers are increasingly purchasing scientifically formulated feed, veterinary supplements, and health management products to improve animal performance and meet strict production standards. The focus on targeted nutrition has driven the demand for precision feeding technologies, nutrient-specific additives, and automated delivery systems, encouraging commercial livestock suppliers to scale up their offerings. Improved nutritional practices increase animal yield and product quality, which in turn help meet growing consumer demands for higher-quality animal products, thus driving growth of advanced livestock inputs and support solutions.

Moreover, stricter welfare expectations have influenced purchasing behavior in commercial livestock operations. Producers are investing in equipment that minimizes animal stress and complies with global welfare standards, including temperature-regulated housing, injury-reducing flooring, and humane handling systems. Demand for such welfare-focused infrastructure has increased the market share of companies producing housing, monitoring, and care equipment tailored to welfare-compliant operations. Furthermore, retailers and food processors enforcing animal welfare protocols across supply chains have driven the transition toward welfare-compliant livestock practices, which in turn has made commercial livestock supplies essential for regulatory compliance and market access.

However, environmental concerns related to livestock farming have restrained commercial livestock supplies market by increasing regulatory burdens and discouraging investment in intensive farming systems. Rising attention to greenhouse gas emissions, nutrient runoff, and land use associated with large-scale animal farming has led to stricter operational limits. Livestock producers in several regions face new rules on herd sizes, manure disposal, and emissions thresholds, which in turn has led to a decline in investment in high-input commercial farming models. Reduced scalability discourages purchases of compound feed, veterinary additives, and productivity-enhancing equipment commonly used in intensive operations.

In addition, public concern regarding environmental degradation has shifted consumer preferences toward low-impact animal products, prompting food retailers and processors to enforce stricter environmental standards across sourcing practices. Livestock producers responding to sustainability demands are reallocating resources toward emission mitigation and environmental monitoring technologies rather than purchasing commercial feed systems or veterinary formulations. In markets where carbon pricing, land-use restrictions, or environmental audits are mandatory, profit margins are further constrained, limiting capacity to adopt premium commercial livestock supplies. Thus, growing environmental pressure is anticipated to influence livestock investment strategies, leading to slower the commercial livestock supplies market growth.

Furthermore, growth of online distribution channels for livestock products has created numerous opportunities in the market by expanding access, improving procurement efficiency, and reducing dependency on traditional supply chains. Digital platforms enable direct delivery of feed, veterinary supplies, and livestock equipment to producers in remote and underserved regions. Online ordering systems with real-time inventory updates, transparent pricing, and integrated logistics support have increased purchasing convenience for small and mid-sized livestock farms. Wider product visibility through e-commerce has increased demand for certified feed products, disease control solutions, and customized farm tools, thereby driving commercial livestock supplies market.

Simultaneously, manufacturers and distributors of commercial livestock supplies are adopting digital sales models, including mobile ordering apps, digital catalogs, and subscription-based deliveries. Platforms that provide product education, dosage information, and remote consultation services help producers make informed purchasing decisions. Online channels support targeted marketing and flexible delivery scheduling, thus improving service quality for livestock operators. Increased internet connectivity and mobile adoption in rural areas have boosted digital transformation in livestock input procurement. Expansion of e-commerce for agricultural inputs is creating sustained opportunities for companies supplying feed, veterinary products, biosecurity solutions, and durable livestock equipment to digitally connected livestock producers across emerging and developed markets.

Segmental Overview

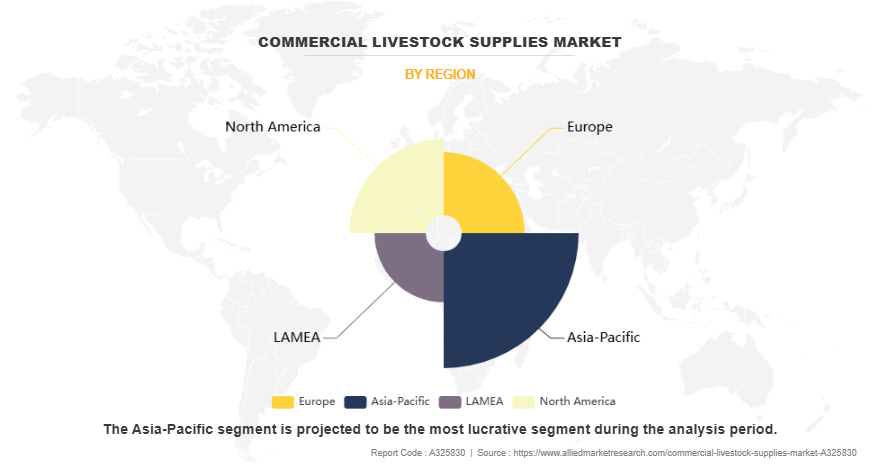

The commercial livestock supplies market is segmented into type, livestock, and region. By type, the market is divided into roughages, concentrates, compound feeds, and feed supplements. By livestock, the market is categorized into cattle, goats/sheep, poultry, swine, aquatic animals, and others. Region-wise, it is analyzed across North America (U.S., Canada, and Mexico), Europe (UK, Germany, France, Italy, Spain, Russia, and rest of Europe), Asia-Pacific (China, Japan, India, South Korea, Australia, and rest of Asia-Pacific), and LAMEA (Brazil, Argentina, Saudi Arabia, UAE, South Africa, and rest of LAMEA).

By Type

By type, the compound feeds segment dominated the global commercial livestock supplies market share in 2024 and is anticipated to maintain its dominance during the forecast period. High nutritional content, standardized formulations, and ease of storage and distribution contribute to sustained demand for this segment across poultry, swine, and cattle sectors. Compound feeds improve feed conversion ratios and promote efficient animal growth, aligning with commercial livestock producers’ emphasis on productivity and profitability, thus driving market growth. Expansion of large-scale farming operations, especially in Asia-Pacific and LAMEA, is expected to drive bulk purchases of compound feeds. Manufacturers increasingly offer region-specific formulations to meet dietary needs based on species and local regulations. In addition, rising concerns regarding animal health and product safety have strengthened the preference for controlled, quality-assured compound feed solutions, which is driving commercial livestock supplies market expansion.

By Livestock

By livestock, the poultry segment dominated the global commercial livestock supplies market size in 2024 and is anticipated to maintain its dominance during the forecast period. Large-scale broiler and layer integration across major production countries has significantly driven demand for commercial livestock supplies for poultry. Integrated farms are using precision compound feeds, temperature-regulated housing, and automated drinker systems to maintain uniform growth and reduce mortality. Hatcheries have adopted chick grading tools, high-efficiency incubators, and probiotic-based feed additives to support flock health and meet genetic potential. Broiler farms are procuring automated feeders, real-time performance monitoring systems, and high-density ventilated housing to maintain fast growth rates and efficient feed conversion ratios, which has led to increased demand for commercial livestock supplies in this segment.

Moreover, layer production units have increased procurement of enriched cages, calcium-optimized feeds, and artificial lighting systems to regulate egg production cycles. Poultry supply companies are witnessing demand for vaccination kits, foot sanitizing units, and disinfectant foggers owing to strict biosecurity protocols. Antibiotic-free poultry programs have further driven the adoption of herbal growth promoters, acidifiers, and clean feed lines. Moreover, rise in on-farm processing and contract farming arrangements has created strong demand for slaughtering tools, defeathering machines, and cold storage units. Market-driven traceability requirements and food safety standards have led producers to adopt input traceability systems, breed-specific health supplements, and farm-level digital integration tools across large and mid-sized poultry operations.

By Region

Region-wise, Asia-Pacific is anticipated to dominate with the largest share during the commercial livestock supplies market forecast period. Rapid population growth, rising meat consumption, and expanding commercial livestock supplies market production in countries such as China, India, and Vietnam contribute to strong demand for commercial livestock supplies. Government support for modernizing animal husbandry practices and improving food safety standards have further boosted market development. In addition, increased adoption of compound feeds, veterinary supplies, and automated equipment in large-scale farms has led to regional market growth. Also, feed manufacturers and supply chain players are expanding operations and forming partnerships to meet localized needs of farmers and meat producers. Urbanization and income growth have shifted dietary patterns toward higher animal protein intake, thus supporting sustained demand for livestock products. Thus, the strong agricultural base, supportive infrastructure development, and rise in investments in livestock technologies are expected to drive the commercial livestock supplies market demand in the coming years.

Competitive Analysis

The key players operating in the global commercial livestock supplies industry include Alltech Inc., Archer Daniels Midland Company, BASF, Cargill Incorporated, CHS Inc., DSM-Firmenich AG, Evonik Industries AG, Kemin Industries, Inc., Nutreco, and Purina Animal Nutrition LLC. Several well-known and upcoming brands are vying for dominance in the expanding commercial livestock supplies market in the region. Smaller niche firms are more well-known for catering to consumer demands and preferences in the global market. Large conglomerates, however, control most of the market and often buy innovative start-ups to broaden their product lines.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the commercial livestock supplies market analysis from 2024 to 2034 to identify the prevailing commercial livestock supplies market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the commercial livestock supplies market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global commercial livestock supplies market trends, key players, market segments, application areas, and market growth strategies.

Commercial Livestock Supplies Market Report Highlights

| Aspects | Details |

| Market Size By 2034 | USD 671.2 billion |

| Growth Rate | CAGR of 4.1% |

| Forecast period | 2024 - 2034 |

| Report Pages | 292 |

| By Type |

|

| By Livestock |

|

| By Region |

|

| Key Market Players | Archer Daniels Midland Company, Cargill Incorporated, BASF, Purina Animal Nutrition LLC., CHS Inc., Alltech Inc., Evonik Industries AG, Kemin Industries, Inc., Nutreco, DSM-Firmenich AG |

Analyst Review

This section consists of the opinion of the top CXOs in the commercial livestock supplies market. Senior executives highlighted a shift toward data-integrated management across large-scale livestock farms. Digitized feed blends, sensor-driven health monitoring, and RFID-enabled livestock tracking were identified as essential tools for optimizing production cycles. Leaders reported that livestock supply firms moved toward tailoring formulations and equipment to species-specific health profiles, growth rates, and environmental adaptation needs. Product lines were recalibrated to support standardized gains and welfare compliance in vertically integrated meat and dairy operations.

Many CXOs reflected on the growing requirement for bundled offerings that combine diagnostics, automated dosing, and disease prevention inputs. Strategic emphasis was placed on vaccine-oriented health management in intensive poultry and swine operations. Supply chain traceability, driven by retail procurement policies, encouraged manufacturers to provide audit-compliant formulations and livestock-handling equipment. Several leaders focused on the role of rural distributor tie-ups and contract farm integration in improving market reach. Furthermore, new sales channels increased product penetration in underserved zones, thus supporting both volume growth and cost-efficiency. Margin improvements were achieved by combining tailored inputs with service-backed delivery. CXOs concluded that future growth highly rely on scalable, traceable, and precision-driven livestock supply models aligned with evolving compliance and productivity benchmarks.

The commercial livestock supplies market was valued at $447.2 billion in 2024.

Upcoming trends in the global commercial livestock supplies market include precision livestock farming, smart feeding systems, automated health monitoring, climate-resilient infrastructure, and sustainable inputs supporting high-yield and welfare-compliant production systems.

Poultry has leading application in the Commercial Livestock Supplies Market.

Region-wise, Asia-Pacific is anticipated to dominate the market with the largest share during the global commercial livestock supplies market forecast period.

The key players operating in the global commercial livestock supplies industry include Alltech Inc., Archer Daniels Midland Company, BASF, Cargill Incorporated, CHS Inc., DSM-Firmenich AG, Evonik Industries AG, Kemin Industries, Inc., Nutreco, and Purina Animal Nutrition LLC.

Loading Table Of Content...

Loading Research Methodology...