Commercial Water Heater Market Research, 2032

The global commercial water heater market was valued at $6.3 billion in 2022 and is projected to reach $9.9 billion by 2032, growing at a CAGR of 4.6% from 2023 to 2032.

Key Report Highlighters:

- The commercial water heater market has been analyzed in terms of value ($ million) covering more than 15 countries.

- For growth prediction, we have looked into historical trends, present and future activities of key business players.

- The report covers detailed profiling of the major 10 market players.

Commercial water heater is equipment that is used for the purpose of heating large volumes of water. It is capable of heating water at a faster pace and exhibits a fast recovery time. The water heater is equipped with a temperature valve, pressure relief valve, drain valve, thermostats, tank, and anode rod. A variety of commercial water heaters are available in the market catering to different requirements. These heaters are available based on storage capacity, power capacity, and type of fuel.

Working Mechanism

The water heater consists of a dip tube through which cold water is passed. Through a heating source such as a gas burner, or electric rod depending on the heater type, water is heated. This water is transported through a pipe to a tank for storage. The hot water can be taken from the storage tank through outlets.

Developing economies, especially in Asia-Pacific, serve as potential markets for commercial water heaters. This is attributed to the fact that the countries such as China, India, Japan, Malaysia, Singapore, and Australia are developing their public as well as commercial infrastructure. In addition, governments of these countries are encouraging energy transition, which involves the installation of solar commercial water heaters.

The commercial sector, especially in the building & construction industry, is experiencing increased investment owing to an increase in demand for official and residential premises due to the increase in population. The boost in the real estate sector augments the demand for commercial water heaters. Moreover, public and commercial infrastructure is being developed at a remarkably high speed; thus, the requirement for commercial water heaters in such buildings has increased considerably, which acts as a major driving force of the global commercial water heater industry. The market growth is further fueled by the rise in demand for hot water in restaurants, hotels, hospitals, and other hospitality sectors.

Moreover, continuous efforts toward increasing the efficiency of present technologies of water heaters contribute toward the growth of the market. However, high maintenance costs associated with the product restrain the growth of the commercial water heater market. On the contrary, advancements in commercial water heaters to enhance energy efficiency and reduce losses are expected to offer lucrative opportunities for the expansion of the global commercial water heater industry.

In many developing nations, especially in Asia-Pacific, governments are heavily investing in the development of the commercial sector. The commercial sector plays a pivotal role in the development of a nation as it boosts domestic as well as foreign investments, thereby creating job opportunities. Moreover, the expansion of the hospitality sector which offers luxury services boosts the demand for commercial water heaters.

Hybrid water heaters are those that work on heat pumps, meaning they use surrounding hot air to heat water. These hybrid heaters are rapidly being adopted owing to their enhanced efficiency and cost savings, which notably contribute toward the growth of the global market. In addition, they are widely used in setups where heat is produced during any operational process. Such applications of heat pumps in the commercial sector drive industry growth.

Commercial water heaters are large equipment, especially those that come with storage tanks. These water heaters incur a higher cost of installation. Moreover, they need to be cleaned and maintained frequently to prevent damage and ensure efficient working conditions. These water heaters are prone to damage from salt or matter deposits from water, rusting, and breakage. Thus, regular maintenance is required for the same, which adds to the high cost. All these factors collectively restrain the commercial water heater market growth.

Technological disadvantages lead to loss of energy and efficiency. Moreover, they have a slower flow rate, are at risk of a short circuit or blown fuse, and have short operating life. However, by developing existing technology, the new technologies that are capable of reducing energy and efficiency losses are expected to offer potential opportunities for commercial water heater industry growth.

The global commercial water heater market size is studied by type, storage capacity, rated capacity, and region.

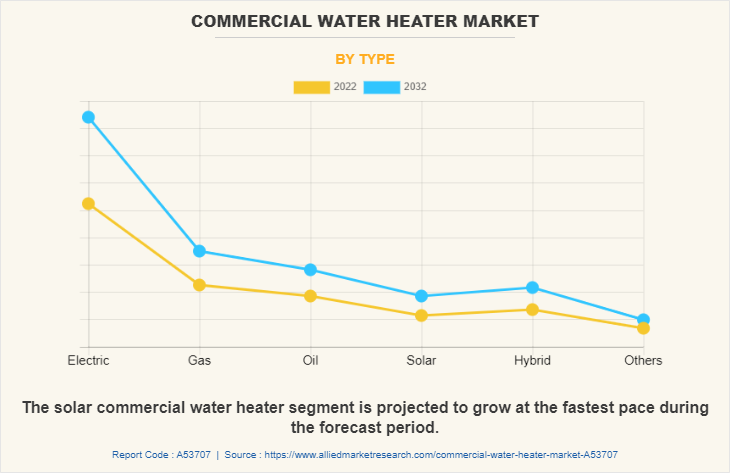

On the basis of type, the market is segregated into electric, gas, oil, solar, hybrid, and others. Electric water heaters are easy to install, as they require no ventilation.The electric segment dominated the commercial cater heater market share in 2022. Electric water heaters do not operate on fuel, which makes them highly efficient systems. However, they can take time to warm up the water. They are continually working to keep the water hot, which means the equipment is constantly consuming energy. Gas water heaters are easier to repair than any other water heater and have lower operating costs. A gas water heater offers more accurate temperatures and is able to heat the water at a faster pace, facilitating a continuous supply of hot water. However, it can be bulky and take up more space than any other water heater.

Oil-fired water heaters work similarly to electric- and gas-powered water heaters. An oil-fired system uses both oil and electricity to heat the water. Oil-fired water heaters are also known for their energy efficiency. They can operate using oil and electricity or dual fuel sources such as propane plus oil. Although an oil-fired water heater uses its own energy source to heat water, the healing time is much faster. This makes the oil-fired water heater a popular choice for buildings with a high demand for hot water. However, these heaters are bulky in comparison to other heaters. This means that they are not as portable as electric heaters since they are built of metal.

Solar water heater uses sunlight to heat water. It operates on the principle of thermosiphon. It serves as the most effective way to generate hot water and save operating costs. Moreover, it is environmentally friendly, and hence is being promoted by governments across the world. Hybrid water heaters have a storage tank similar to a traditional standard tank water heater. Instead of creating heat, the hybrid water heater moves heat from the surrounding air into a converter that uses it to heat the water using a heat pump.

Other commercial water heaters include solid-fueled and bio-fuel water heaters. The biomass water heating system consists of an inner shell and outer cladding with rock wool insulation in between. The inner shell stores the water for heating and the outer shell protects the insulation from atmospheric damage. The cold-water input from an elevated tank is fed into the system and hot water output from the system is connected to utility points. The system works on the thermosyphon principle.

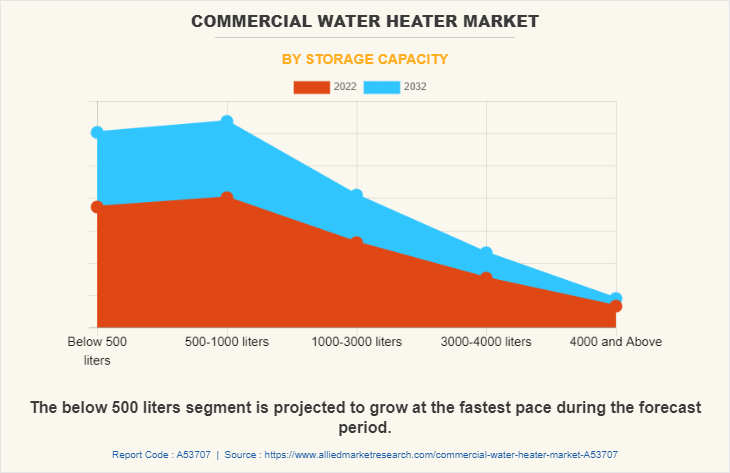

Depending on the storage capacity, it is fragmented into below 500 liters, 500–1,000 liters, 1,000–3,000 liters, 3,000–4,000 liters, and above 4,000 liters. Commercial water heaters with the capacity of heating and storing up to 500 liters of water fall in this category. These water heaters are majorly used in small commercial places such as small offices, beauty salons, small restaurants, and small or individual health clinics. Water heaters with a capacity of 500–1,000 liters are studied in this segment. These water heaters are widely used in hotels, restaurants, hospitals, and small office buildings.

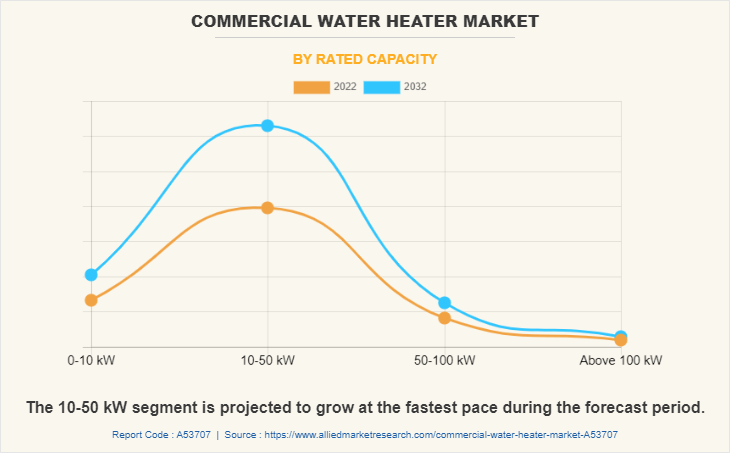

By rated capacity, it is categorized into 0–10 kW, 10–50 kW, 50–100 kW, and above 100 kW. A commercial water heater with a rated capacity of 0–10 kW is considered in this segment. They are usually used in smaller commercial buildings, beauty salons, and cafes. A commercial water heater with a rated capacity of 10–50 kW is used in moderate commercial buildings where continuous hot water supply is required but in low quantities. A commercial water heater with a rated capacity of 50–100 kW is used in commercial buildings where continuous hot water supply is required in large quantities. Hotels, restaurants, offices, commercial laundries, and resorts are a few examples of where these water heaters are used.

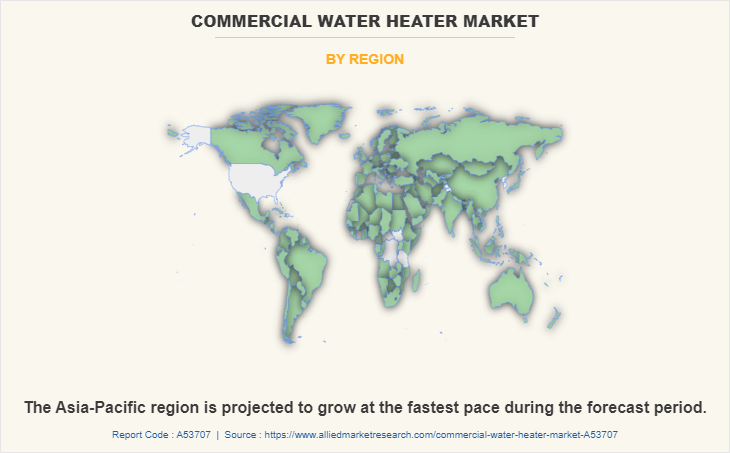

Region-wise, the commercial water heater market analysis is done across North America, Europe, Asia-Pacific, and LAMEA (Latin America, the Middle East, and Africa). North America garnered the largest commercial water heater market share in 2022. This was attributed to the high consumption of hot water during winter for heating purposes. In addition, the strong presence of major players such as A.O. Smith, Bradford White Corporation, and Carrier Global Corporation notably contributes toward the growth of the market. Moreover, large corporations and governments are collaborating to develop present water heating technologies and make them more sustainable and environmentally friendly, which is expected to drive market growth in North America.

The Europe region’s growth was dominated by Germany owing to rapid electrification activities in the country. The region is strongly promoting the use of solar and hybrid commercial water heaters with the aim to curb net carbon emissions and push the energy transition from a fossil-based economy to a clean energy economy. This is expected to boost the market growth for commercial water heaters.

Asia-Pacific region is expected to grow at a higher CAGR during the commercial water heater market forecast. China is the dominant country in the Asia-Pacific region in terms of market share, followed by India. South Korea garners the lowest share of the market. China is the largest consumer as well as producer of commercial water heaters, which acts as the key driver of the market. Moreover, the demand for hot water is at its peak during the winter season, which notably contributes to the market growth. In addition, the high demand for commercial water heaters from various commercial sectors such as hospitality and healthcare is expected to augment the market growth

The major players operating in the commercial water heater industry are A.O. Smith Corporation, Danfoss A/S, Mitsubishi Electric Corporation, STIEBEL ELTRON GmbH and Co. KG, NIBE Industrier AB, Carrier Global Corporation, Robert Bosch GmbH, Rheem Manufacturing Company, Bajaj Electricals Ltd., and Bradford White Corporation. Other players in the industry include Racold, Venus, Nortiz Corporation, Daikin Industries, Valliant, and American Water Heaters.

A.O. Smith Corporation is a manufacturing company. It is mainly engaged in the production and sale of a wide range of water purifiers and treatment systems. It has a comprehensive portfolio of products, which are mainly classified into residential and commercial water heaters, water treatment products, boilers, electric water heaters, solar water heating systems, swimming pool and spa heaters, and various parts and accessories.

Rheem Manufacturing Company is primarily engaged in innovative water heaters, tankless water heaters, air conditioners, furnaces, pool heaters, and HVAC systems for residential and commercial applications. It has a presence in more than 80 countries with more than 40 brands of air and water products. Similarly, Bradford White Corporation is a manufacturer of residential, commercial, and industrial products for water heating, space heating, combination heating, and storage applications.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the commercial water heater market analysis from 2022 to 2032 to identify the prevailing commercial water heater market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the commercial water heater market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global commercial water heater market trends, key players, market segments, application areas, and market growth strategies.

Commercial Water Heater Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 9.9 billion |

| Growth Rate | CAGR of 4.6% |

| Forecast period | 2022 - 2032 |

| Report Pages | 350 |

| By Type |

|

| By Storage Capacity |

|

| By Rated Capacity |

|

| By Region |

|

| Key Market Players | STIEBEL ELTRON GmbH and Co. KG, Carrier Global Corporation, Robert Bosch GmbH, Danfoss A/S, Rheem Manufacturing Company, NIBE Industrier AB, A.O. Smith Corporation, Bajaj Electricals Ltd, Mitsubishi Electric Corporation, Bradford White Corporation |

Analyst Review

According to the insights from the CXOs, the growing commercial infrastructure is aiding the development of the commercial water heater market. The commercial heater market is highly fragmented in nature, as many players are operating in the industry that offers a variety of commercial water heaters. Electric and gas-fired water heaters witness the highest demand in the market due to several advantages such as ease of installation, high efficiency, ease of maintenance, and lower emissions.

The CXOs further added that increased investment in enhancing the efficiency of present heater technologies is expected to drive the growth of the commercial water heater industry. However, the high maintenance cost associated with the product acts as a key deterrent factor in the market. Conversely, since these water heaters operate depending on renewable sources of electricity (solar), they are being increasingly adopted for ongoing and planned commercial projects. Moreover, governments encouraging sustainable energy transition is also expected to boost the demand for commercial water heaters as many countries offer subsidies on solar commercial water heaters owing to their low carbon emissions.

Electric water heaters are the leading type of Commercial Water Heater Market.

booming commercial sector and real estate sectors in Asia-Pacific region and technological advancements are the upcoming trends of Commercial Water Heater Market in the world.

The estimated industry size of Commercial Water Heater is $9.9 billion.

North America is the largest regional market for Commercial Water Heater.

A.O. Smith Corporation, Danfoss A/S, Mitsubishi Electric Corporation, STIEBEL ELTRON GmbH and Co. KG, NIBE Industrier AB, Carrier Global Corporation, Robert Bosch GmbH, Rheem Manufacturing Company, Bajaj Electricals Ltd., and Bradford White Corporation are the top companies to hold the market share in Commercial Water Heater.

Loading Table Of Content...

Loading Research Methodology...