Satellite Communication Market Research, 2033

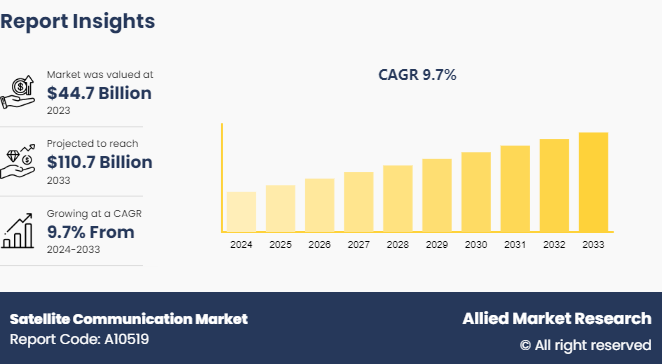

The global satellite communication market size was valued at $44.7 billion in 2023, and is projected to reach $110.7 billion by 2033, growing at a CAGR of 9.7% from 2024 to 2033. Artificial or man-made satellites orbit the Earth or other celestial objects for analyzing and predicting solar system and universe. Satellites are also utilized for communication applications such as television signals, phone calls, positioning technology, military, and others. Satellite communication is achieved through transmission of radio waves from satellite and capturing & processing of information from antennas and transponders installed at various locations on Earth. The space organizations are increasing satellite launches globally to overcome the maximum distance signal transmission constraint associated with the conventional signal communication system. The satellites relay digital and analog signals for transmitting voice, video, and data across several locations globally.

Increase in Internet of Things (IoT) and autonomous systems and rise in demand for military and defense satellite communication solutions are expected to drive the global satellite market growth during the forecast period. However, cybersecurity threats to satellite communication and interference in satellite data transmission are anticipated to hamper the growth of the market during the forecast period. Industries such as agriculture and oil exploration are creating satellite communication market opportunity for service providers.

Moreover, technological advancements in satellite missions and deployment of 5G network through satellites are anticipated to offer lucrative opportunities for the market in the future. Satellite communications technology offers a high data rate and low latency network. It provides ubiquitous coverage for remote rural area coverage, emergency or disaster communication, and aeronautical & maritime communications. It can also be utilized for application in areas without standard terrestrial network coverage. New technologies in satellite design and launch are influencing the satellite communication market forecast.

Key Takeaways

The satellite communication industry study covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major automotive switches industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and assist stakeholders in making educated decisions to achieve their most ambitious growth objectives.

Recent Key Strategies and Developments

In September 2023, The UK competition watchdog approved the $7.3 billion merger between Viasat, Inc. and Inmarsat Global Limited. This approval marks a significant step forward for Viasat's acquisition of the British satellite mobile communications company Inmarsat.

In October 2022, Inmarsat Government recured a 10-year contract valued at $980 million to deliver broadband satellite and terrestrial communications services to the U.S. Navy. This contract, awarded by the Defense Information Systems Agency (DISA) , marks the second iteration of the U.S. Navy Commercial Broadband Satellite Program Satellite Services Contract, known as CSSC II.

Key Market Dynamics

Increase in Internet of Things (IoT) and autonomous systems and rise in demand for military and defense satellite communication solutions are expected to drive the global satellite communication market growth during the forecast period. However, cybersecurity threats to satellite communication and interference in satellite data transmission are anticipated to hamper the growth of the market during the forecast period. Moreover, technological advancements in satellite missions and deployment of 5G network through satellites are expected to offer lucrative opportunities for the market in the future.

Robust IoT, Artificial Intelligence (AI) , and autonomous technologies are being increasingly implemented throughout several industries namely automobile, defense, and healthcare. These technical tools are employed to increase the efficiency and effectiveness of the new installation or existing infrastructure. The rapid expansion of the Internet of Things (IoT) is a major driver for the market. IoT involves connecting everyday objects to the internet, allowing them to send and receive data. This connectivity requires a reliable and widespread communication network. Satellites provide an ideal solution because they can cover vast areas, including remote and rural regions where traditional terrestrial networks are not available.

As more devices and sensors become part of the IoT ecosystem, the demand for satellite communication grows. Industries such as agriculture, logistics, and environmental monitoring rely heavily on IoT devices for data collection and management, driving the need for robust satellite communication systems to support these applications. Moreover, satellite communication market is expected to increase significantly due to rising demand for global connectivity.

The rise of autonomous systems, such as self-driving cars, drones, and robotic machinery, is significantly boosting the market. These systems depend on constant, reliable communication to operate safely and efficiently. Satellites play a crucial role in providing the necessary communication links, especially in areas where ground-based infrastructure is limited or non-existent.

For example, autonomous vehicles require real-time data for navigation, obstacle detection, and decision-making processes. Satellite communication ensures that these vehicles remain connected to control centers and data sources regardless of their location. As the use of autonomous systems expands across various sectors, including transportation, defense, and industrial automation, the demand for satellite communication solutions continues to grow, driving the market forward.

Market Segmentation

The satellite communication market is segmented into application, component, end-use industry, and region. By application, the market is segregated into voice communication, broadcasting, and data communication. By component, it is divided into equipment and services. By end-use industry, the market is classified into maritime, aerospace & defense, industrial, government, transportation & logistics, and media. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, Latin America, and Middle East and Africa.

Regional/Country Market Outlook

The European satellite communication market is analyzed across Germany, France, Spain, the UK, and rest of Europe. The European Space Agency (ESA) heavily invests in the development of the satellite communication industry. Europe also consists of SES Global, the world’s second-largest commercial satellite communications operator. The rise in investment by governments across Europe and the R&D by commercial operators drives the expansion of the satellite communications market in Europe during the forecast period.

Germany is adopting satellite communication for providing improvement in existing communication networks. Satellite communications also offer critical applications such as secure transmissions of information and extended connectivity for public and governmental organizations. French companies are increasing the installation of satellite communication equipment to provide network connectivity solutions in remote areas for commercial and defense applications. The proliferation of satellite communication systems used by French defense agencies further fuels the growth of the market.

The UK Ministry of Defense (MoD) owns a family of military communication satellites Skynet. The satellites provide tactical and strategic satellite communication service for the British intelligence agencies and British Armed Forces, among other UK government departments and agencies. The UK is investing in the R&D of new satellite communication technologies to enhance the capabilities of UK defense agencies.

In Europe, there is a strong focus on expanding broadband services, particularly in rural and remote areas where traditional terrestrial infrastructure is insufficient. Satellite communication offers a reliable solution to bridge the digital divide. Initiatives such as the European Union’s Connectivity Toolbox and the Digital Decade targets aim to provide high-speed internet to all citizens, driving the demand for satellite communication services.

The growing adoption of Internet of Things (IoT) and Machine-to-Machine (M2M) communication is another significant trend in Europe. Industries such as agriculture, logistics, and energy increasingly rely on IoT devices to improve efficiency and data management. Satellite communication is essential for connecting these devices in areas where terrestrial networks are unavailable or unreliable, thereby boosting the demand for satellite services.

Technological innovations are propelling the European satellite communication market forward. European companies and research institutions are investing in the development of advanced satellite technologies, including high-throughput satellites (HTS) , low Earth orbit (LEO) constellations, and next-generation ground segment technologies. These advancements enhance the capacity, speed, and reliability of satellite communication, making it more attractive for various applications.

The defense and security sector in Europe is a major driver of the market. European countries are enhancing their military capabilities and investing in secure, resilient communication networks. Satellites provide critical communication links for defense operations, intelligence gathering, and emergency response. The increasing focus on national security and defense modernization is driving the demand for advanced satellite communication systems.

- In October 2023, Airbus and U.S.-based defense contractor Northrop Grumman announced the signing of a Memorandum of Understanding (MoU) to establish a strategic partnership for the UK's upcoming wideband SKYNET military satellite communications program. This collaboration between the prominent European and American defense and space companies is expected to integrate advanced technology and combine their expertise, knowledge, and capabilities to meet the military satellite communication needs of the British Ministry of Defence.

- In November 2023, Germany announced that it will supply Ukraine with an additional four IRIS-T SLM medium-range air defense systems as part of a military aid package exceeding $1.4 billion (€1.3 billion) , according to a statement by the German Defence Ministry. These systems will be delivered starting in 2025. The aid package also includes drones, drone-defense systems, demining vehicles, satellite communications equipment, electronic warfare tools, directional anti-tank mines, and artillery shells to address the urgent needs of the Ukrainian armed forces.

Competitive Landscape

The key players operating in the global market include Al Yah Satellite Communication Company PJSC (Yahsat) , Cobham Ltd, EchoStar Corporation, General Dynamics Corporation, Gilat Satellite Networks Ltd., Inmarsat Global Limited, L3Harris Technologies, Inc., SES S.A., SKY Perfect JSAT Holdings Inc., Telesat Canada, and Viasat, Inc. Companies are investing heavily to increase their satellite communication market share in emerging regions.

Industry Trends:

In May 2024, Pakistan launched a multi-mission communication satellite, PAKSAT MM1, to enhance internet connectivity with assistance from its close ally China. This marks Islamabad's second satellite launch within a month. The satellite was launched from the Xichang Satellite Launch Center in China's southwestern province of Sichuan.

Key Sources Referred

Federal Communications Commission (FCC)

European Space Agency (ESA)

The International Telecommunication Union (ITU)

Satellite Industry Association (SIA)

Global VSAT Forum (GVF)

European Satellite Operators Association (ESOA)

Key Benefits For Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the satellite communication market analysis from 2024 to 2033 to identify the prevailing satellite communication market opportunities.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the satellite communication market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global satellite communication market trends, key players, market segments, application areas, and market growth strategies.

Satellite Communication Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 110.7 Billion |

| Growth Rate | CAGR of 9.7% |

| Forecast period | 2024 - 2033 |

| Report Pages | 320 |

| By Application |

|

| By Component |

|

| By End-Use Industry |

|

| By Region |

|

| Key Market Players | SES S.A. , Telesat Canada , General Dynamics Corporation , SKY Perfect JSAT Holdings Inc. , Company PJSC, Cobham Ltd , Gilat Satellite , L3Harris Technologies, Inc. , Viasat, Inc. , EchoStar Corporation , Networks Ltd. , Inmarsat Global Limited , Al Yah Satellite Communication |

The key players operating in the global satellite communication market include Al Yah Satellite Communication Company PJSC (Yahsat), Cobham Ltd, EchoStar Corporation, General Dynamics Corporation, Gilat Satellite Networks Ltd., Inmarsat Global Limited, L3Harris Technologies, Inc., SES S.A., SKY Perfect JSAT Holdings Inc., Telesat Canada, and Viasat, Inc.

Increase in Internet of Things (IoT) and autonomous systems and rise in demand for military and defense satellite communication solutions are expected to drive the global satellite market growth during the forecast period.

The global satellite communication market to grow at a CAGR of 9.7% from 2024 to 2033.

The largest regional market for Satellite Communication is Europe

The global satellite communication market was valued at $44.7 billion in 2023, and is projected to reach $110.7 billion by 2033, growing at a CAGR of 9.7% from 2024 to 2033.

Loading Table Of Content...