Container Tracking Market Insights, 2032

The global container tracking market size was esteemed at USD 10,075.00 million in 2022 and is anticipated to reach USD 21,627.26 million by 2032, witnessing a CAGR of 8.2% from 2023 to 2032.

![]()

Report Key Highlighters:

- The container tracking market study covers 12 countries. The research includes regional and segment analysis of each country in terms of value ($billion) for the projected period 2023-2032.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

- Over 3,700 product literature, annual reports, industry statements, and other comparable materials from major industry participants were reviewed to gain a better understanding of the market.

- The container tracking market share is slightly fragmented, into several players including CMA CGM, COSCO, GoComet, Hanjin Logistics Corporation, Hapag-Lloyd AG, INTTRA, Maersk, Orient Overseas Container Line Limited, Project44, and SeaRates. These companies have adopted strategies such as product launches, product development, and others to improve their market positioning.

Container tracking is defined as a process of monitoring and tracing the movement of shipping containers during their journey from the point of origin to the final destination. It typically provides real-time or near-real-time information about the location, status, and condition of the containers. This information is critical for numerous stakeholders involved in the shipping and logistics industry, including shippers, freight forwarders, carriers, and consignees. It further uses automatic identification systems (AIS), container tracking devices (CTDs), and smart containers that facilitate shippers and logistics companies to ensure efficient and transparent supply chain operations. Further, contained tracking solutions benefit users in several ways: risk management, enhanced security, cost reduction, time-saving, and maximizing return on investment.

The container tracking market trends include the increasing efforts to streamline and simplify cross-border trade processes. With these developments, the demand for container tracking technologies has substantially grown to help reduce delays at border crossings and improve overall trade efficiency. Moreover, favorable government support and initiatives for improving the trade infrastructure and logistics efficiency are driving market players to develop container-tracking solutions with advanced technical capabilities. In response to this, market vendors initiated the integration of GPS and RFID technologies to provide real-time visibility into container locations and conditions. These factors are contributing to the growth of the market across the globe.

Additionally, the digital transformation of transportation and logistics is an important factor influencing the market for container tracking. Temperature-sensitive cargo can be monitored and controlled in real-time by incorporating smart technologies like IoT (Internet of Things) and telematics. This not only saves the integrity of what is being transported, but it also increases overall operating efficiency, thus contributing to the widespread adoption of high-end tracking devices in the logistics industry.

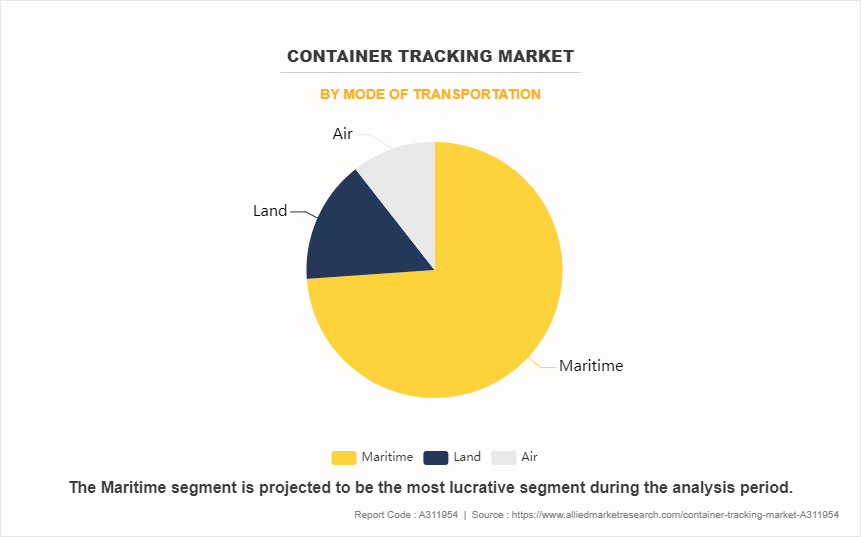

The global container tracking market analysis is segmented into offering, technology type, mode, end-user, and region. Depending on the offering, the market is segregated into hardware, software, and services. By technology type, it is categorized into RFID, GPS, cellular, and satellite.

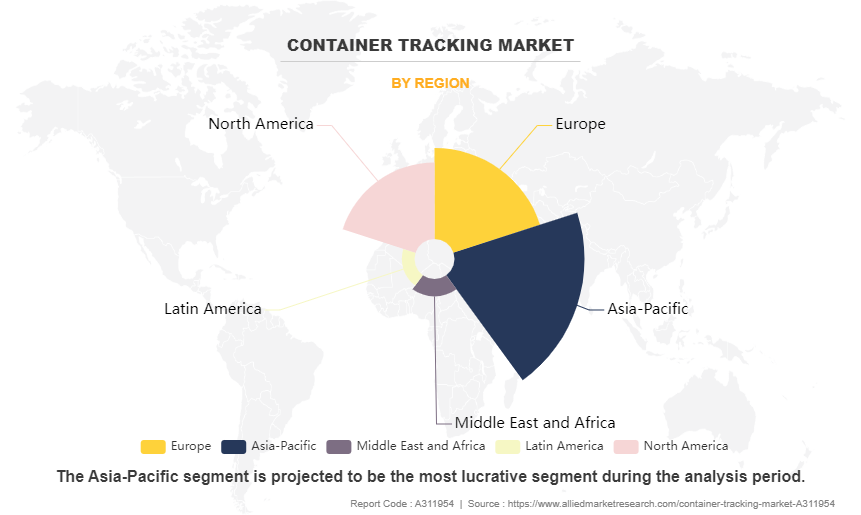

Based on mode, it is divided into maritime, land, and air. As an end-user, it is fragmented into food & beverage, consumer goods, vehicle transport, healthcare, industrial products, and others. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Due to an expansion in Asia-Pacific's shipping and logistics industries brought about by the robust growth in e-commerce operations, along with industry upgrading through supply chains going global, this region takes a dominating lead in the global container tracking market. In recent years, consumer inclination toward online shopping has grown considerably, causing increased demand for efficient and reliable logistics solutions, such as container tracking, for managing the movement of goods and meeting the expectations of fast and traceable deliveries. Moreover, the strict implementation of regulations related to cargo security and transparency has driven the adoption of advanced container tracking in the Asia Pacific region. This emphasis on maintaining cargo security integrity has prompted government and industry stakeholders to invest in advanced container-tacking technologies to secure the global supply chain.

For instance, in the U.S., the Transportation Security Administration (TSA) is an effective agency in adapting its approach to meet the demands of the changing air cargo security landscape and direct statutory & international requirements, such as the mandate in the Implementing Recommendations of the 9/11 Commission Act of 2007 to require 100 percent screening of air cargo transported on a passenger aircraft and deviations to ICAO cargo screening standards effective on June 30, 2021, which require the same security standards for passenger and all-cargo operations.

While China dominates the market, other countries in the region, such as India and Southeast Asian nations, also present substantial growth opportunities. China has a huge base of shippers and logistics service providers and favorable compliance with international shipping regulations, which is a key factor for driving the adoption of the container tracking market. Further, the economic boom and rising international trade in India and Southeast Asian countries help the entire region expand its market. In addition, the ongoing developments and improvements in port infrastructure in countries like India, Singapore, Malaysia, and Vietnam are crucial for efficient container handling, which is further paving the adoption of container tracking technology.

For instance, in October 2023, the Port of Singapore introduced long-term infrastructure development plans, such as the Tuas Mega Port project, which is likely to improve the port’s capabilities, solidifying its position as a global maritime giant. This project also undertakes the implementation of emerging technologies, including blockchain, artificial intelligence, and autonomous vessels, enabling the port to maintain its competitive edge in the digital era. Moreover, Singapore is often dedicated to improving connectivity and strengthening partnerships through initiatives like the Belt and Road Initiative (BRI) and the ASEAN Single Window. Such strategic initiatives will unlock new growth opportunities for international trade, driving the adoption of the container tracking industry.

Recent Developments in the Container Tracking Industry

- In February 2022, CMA CGM launched the SMART reefer container, a connected container for refrigerated goods. This connected container helps to track the position and status of refrigerated goods and ensures the movement of goods in optimal conditions.

- In March 2022, Project44 introduced Port Intel, the industry’s first port intelligence solution with real-time data on congestion and container flow at all global ports. The platform delivers shippers, logistics service providers (LSPs), freight forwarders (FFW), and other stakeholders with what they require to manage and reduce the impacts of ocean turmoil and chaotic supply chains.

Increase in the Volume of International Trade and Globalization

The growing volume of international trade and the process of globalization have significantly impacted various aspects of the global economy. According to the United Nations Conference on Trade and Development (UNCTAD), the growth of international trade remained robust during 2022, both for goods and services. As of mid-2022, the volume of global trade in goods was about 33% higher than its level of 2019. These trends have been accompanied by advancements in technology, such as the development of container tracking solutions, which play a pivotal role in facilitating and managing the movement of goods across borders. This solution further enables companies to optimize their supply chain operations. By tracking the accurate location of goods in transit, businesses can streamline the logistics process, reduce lead times, and make data-driven decisions to improve overall efficiency. These advanced features of container tracking solutions help to propel its demand across diverse industry verticals, such as food & beverage, transportation, and more.

Moreover, container tracking fosters the seamless integration of global trade networks. It allows for the coordination of activities among numerous stakeholders, including shipping companies, logistics providers, customs authorities, and retailers, contributing to the interconnected nature of global trade. In addition, these solutions assist in meeting regulatory requirements and compliance standards. It helps ensure that shipments adhere to trade laws, customs regulations, and other international shipping requirements, avoiding delays and potential penalties. Hence, these aforementioned benefits may fuel the widespread adoption of the container tracking market, especially among businesses seeking to navigate the complexities of global supply chains.

Rising Cargo Theft and Security Concerns

The rise in cargo theft and security concerns has become a significant driver for the adoption of container tracking solutions in the logistics and supply chain industry. These incidents of cargo thefts have primarily been driven by the growing local competition, bigger international market opportunities due to globalization, and better availability of logistics solutions. According to the CargoNet report, there were around 582 theft cases reported in the supply chain across the U.S. and Canada in the second quarter of 2023, indicating a growth of 57% compared to the second quarter of 2022. In fact, ongoing shipment misdirection attacks have further reported a rise in incidences of cargo thefts. As a result, shipment and logistics companies started to deploy container tracking solutions, which help mitigate the risks associated with cargo security by providing real-time monitoring, visibility, and security features.

Furthermore, container tracking solution helps in complying with customs and regulatory requirements related to cargo security. As a result, numerous governments and regulatory bodies have evolved to encourage or mandate the use of tracking systems to improve security and ensure compliance with international trade standards. For instance, as per the Cargo Theft Report 2021, the French government has modified legislation to regulate the issue of fraud conducted via freight exchanges and digital marketplaces through which companies can connect with transporters. Simultaneously, the U.S. has notified the Federal Trade Commission to track down companies that had not yet functioned to resolve issues about cybersecurity risks, more specifically the Log4j vulnerability. This is likely to impact the container tracking market demand worldwide.

Growing Focus on Supply Chain Optimization

Digital evolution is remarked as a significant step in bringing the digital supply chain, and at the center of any supply chain lies the shipping container. No matter how the supply chain becomes advanced, its efficiency depends partly on the effective movement and management of containers. In this context, container tracking finds a suitable application in the efficient management of shipments during transit. This enables companies to make optimized and responsive decisions, along with the prospect of taking proactive approaches to identifying improvement opportunities. Further, the implementation of container tracking solutions in the supply chain ensures end-to-end visibility, to manage containers at every point from pick-up to the destination.

In addition, businesses are increasingly emphasizing optimizing their supply chains to enhance efficiency and reduce costs. Container tracking provides real-time visibility into the movement of goods, enabling companies to streamline logistics operations, improve route planning, and minimize delays. These factors are projected to promote the container tracking market growth.

Key Benefits For Stakeholders

- This container tracking market report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the market analysis from 2022 to 2032 to identify the prevailing market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the market segmentation assists in determining the prevailing opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes an analysis of the regional as well as global market trends, key players, market segments, application areas, and market growth strategies.

Container Tracking Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 21.6 billion |

| Growth Rate | CAGR of 8.2% |

| Forecast period | 2022 - 2032 |

| Report Pages | 265 |

| By Offering |

|

| By Technology Type |

|

| By Mode of Transportation |

|

| By End-User |

|

| By Region |

|

| Key Market Players | GoComet, INTTRA, SeaRates, Maersk, Hapag-Lloyd AG, Orient Overseas Container Line Limited, Project44, COSCO, Hanjin Logistics Corporation, CMA CGM |

Analyst Review

According to CXO's perspectives of the leading companies, the global container tracking market is expected to grow at a promising rate during the forecast period. Numerous industry verticals have perceived changes in business processes, operations, and automation. This is primarily driven by the rapid integration of digital platforms in logistics operations, increased global trade, and the rise in consumer shift from hardware to software-based solutions. These factors eventually create a significant deployment of container tracking solutions in a range of industry verticals for improving supply chain efficiency and monitoring the status of containers during transit.

Furthermore, the ongoing trend of smart tracking and traceability in cargo handling operations facilitates suppliers to track the location, condition, and status of shipments at each stage of the supply chain, thus ensuring product safety and avoiding revenue loss. As a result, container tracking solutions find an increased application with increased acceptance across industry verticals due to digitalization initiatives.

Moreover, the government's initiatives to strengthen the coastal shipping and supply chain infrastructure are also expected to contribute to the industry's growth. For instance, in India, The Ministry of Ports, Shipping and Waterways has undertaken numerous initiatives in the last few years to facilitate coastal shipping, such as reducing port tariffs for coastal cargo, incentivizing the construction of coastal berths, provisioning green-channel clearance of coastal cargo, and prioritizing berthing of coastal vessel. This will enable a conducive environment for the container tracking market to thrive all over the world.

Among the analyzed regions, Asia-Pacific is expected to account for the highest revenue in the global market throughout the forecast period, followed by North America, Europe, and LAMEA. On the other hand, Asia-Pacific is also expected to witness the highest growth rate owing to the region's economic growth, and international trade plays a pivotal role, due to the increased need for efficient logistics and supply chain solutions. As businesses focus on improving supply chain efficiency and meeting evolving consumer demands, the demand for container tracking solutions in the Asia-Pacific market is expected to continue its upward trajectory to support trade and commerce.

The key factor that drives the growth of the market are the increasing cargo theft and security concerns, the growth of international trade and globalization, and the focus on improving fleet optimization and efficiency. However, the high initial cost of the container tracking solutions, along with the integration challenges and compatibility issues are the factors likely to hinder the market growth.

By technology type, the GPS segment is projected to show significant growth in the market during the forecast period.

Among the analyzed regions, Asia-Pacific is expected to account for the highest revenue in the global market throughout the forecast period, followed by North America, Europe, and LAMEA.

The global container tracking market size was esteemed at $10,075.00 million in 2022 and is anticipated to reach $21,627.26 million by 2032, witnessing a CAGR of 8.2% from 2023 to 2032.

• The container tracking market share is slightly fragmented, into several players including CMA CGM, COSCO, GoComet, Hanjin Logistics Corporation, Hapag-Lloyd AG, INTTRA, Maersk, Orient Overseas Container Line Limited, Project44, and SeaRates.

Loading Table Of Content...

Loading Research Methodology...