Content Disarm and Reconstruction Market Insights:

The global content disarm and reconstruction market was valued at USD 274.8 million in 2022, and is projected to reach USD 1.4 billion by 2032, growing at a CAGR of 18.3% from 2023 to 2032.

Rise in incidents of cyber-attacks and data breaches and increase in government compliance and regulatory standards on cyber security are driving the growth of the market. In addition, surge in adoption of cloud-based security solution and services is fueling the growth of the content disarm and reconstruction market. However, high implementation cost of content disarm and reconstruction solution and Dearth of skilled cyber security professional and strategic planning limits the content disarm and reconstruction market growth. Conversely, rise in investments in in big data security solutions and surge in digital transformation initiatives across different industries are anticipated to provide numerous opportunities for the expansion of the market during the forecast period.

Content disarm and reconstruction is a security strategy that involves shedding potentially dangerous elements from incoming files and reconstructing it with uncontaminated content. This technique can be used to mitigate the risk of malware attacks on enterprise networks and ensure that all files are safe for use. Additionally, several industries such as healthcare, finance, retail and others have regulations around data privacy and security. Content disarm and reconstruction can help organizations to meet such compliance requirements by providing an additional layer of protection against file-based attacks.

The global content disarm and reconstruction market is segmented into component, application area, deployment mode, organization size, vertical and region. Depending on the component, the market is divided into solution and services. Based on application area, it is categorized into email, web, File Transfer Protocol (FTP) and removable devices. By deployment mode, it is divided into on-premises and cloud. Based on organization size, it is bifurcated into telecom large enterprises and small & medium enterprises. By vertical BFSI, IT & telecom, energy & utilities, manufacturing, healthcare and others. Region-wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

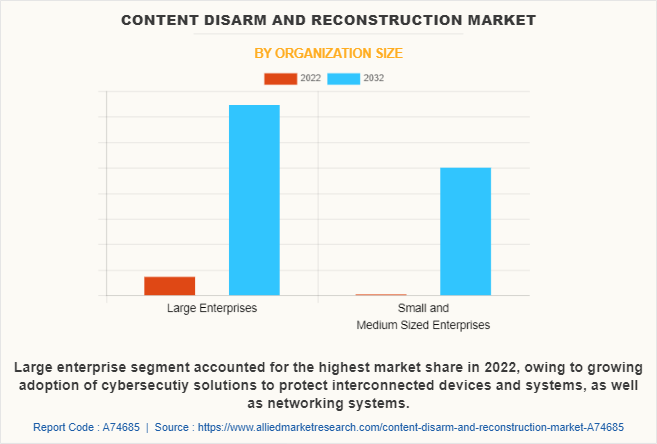

Depending on the organization, the large enterprises segment dominated the content disarm and reconstruction market share in 2022 and is expected to continue this trend during the forecast period, as large enterprises typically have more extensive and complex IT infrastructures and more significant amounts of sensitive data to protect, which further expected to expand the growth of the large enterprises segment. However, the small & medium enterprises segment is expected to witness significant growth in the upcoming years, owing to the increasing prevalence of cyber threats and the adoption of remote work policies, small and medium-sized businesses are also expected to adopt content disarm and reconstruction solutions.

Region-wise, the content disarm and reconstruction market size was dominated by North America in 2022 and is expected to retain its position during the forecast period, owing to the presence of major players in the cybersecurity industry in North America, such as Symantec, Palo Alto Networks, and Cisco Systems, are some of the driving factors in the region. However, Asia-Pacific is expected to witness significant growth during the forecast period, as the region is like home to many emerging economies and developing countries, which are rapidly adopting digital technologies and facing increasing cyber threats. This has resulted in a growing demand for content disarm and reconstruction solutions in the region. Thus, these factors are expected to witness considerable growth during the forecast period.

The global content disarm and reconstruction industry is dominated by key players such as Broadcom Inc., Check Point Software Technologies Ltd., Deep Secure, Fortinet, Inc., Gatefy, Glasswall Solutions Limited, OPSWAT, Inc., Resec Technologies, Votiro and YazamTech. These players have adopted various strategies to increase their market penetration and strengthen their position in the content disarm and reconstruction industry.

Top Impacting Factors:

Rise in Incidents of Cyber-attacks and Data Breaches

The rising incidents of cyber-attacks and data breaches in large and small enterprises is the major factor driving the growth of the content disarm and reconstruction market. In the present scenario, organizations become more reliant on technology for routine operations, resulting to become more vulnerable to cyber-attacks. This is particularly factual for organizations that store and process large amounts of sensitive data, such as financial institutions, healthcare providers, and government agencies. According to the cloud security firm Bitglass, cyber-attacks against U.S. healthcare entities rose by over 55% in 2020 compared with the previous year 2019. Thus, such rising amounts of cyber-attacks and data breaches further propel the demand for content disarm & reconstruction solutions in the industries such as healthcare, finance, and more.

Additionally, the increasing sophistication of cybercriminals in the attacks, using advanced techniques such as social engineering, phishing, and malware to gain access to systems and steal data has made it more difficult for organizations to detect and prevent the attacks. Traditional antivirus and other security solutions are often unable to detect and prevent such types of threats, which in turn, create a lucrative opportunity for disarm & reconstruction solutions. It offers a way to prevent the attacks by focusing on the file itself, rather than just its contents, such factors are further expected to contribute towards the content disarm and reconstruction market growth.

Surge in Adoption of Cloud-based Security Solutions and Services

Rising trend of cloud-based solutions in security to improve optimization is directly influencing the growth of the global content disarm and reconstruction market. Cloud-based security solutions and services, including content disarm & reconstruction, offer several benefits, such as scalability, flexibility, and cost-effectiveness, helping organizations to manage security operations in a more streamlined and centralized way. As a consequence, security operations are gaining significant adoption to increase the use of IT and control systems among security operators, particularly IoT and other digital technologies. These numerous features associated with cloud-based security solutions are anticipated to contribute to the increased content disarm & reconstruction market across the globe.

Furthermore, the integration of cloud solutions allows early detection of threats and fight against cyber threats, because it detects and removes malware hidden in seemingly innocuous files, such as PDFs, Microsoft Office documents, and image files. The content disarm & reconstruction removes malicious code from these files and prevents attacks such as ransomware, phishing, and other forms of malware. In addition, the integration of cloud systems in security operations has reduced the rate of errors, as well as operating costs. Hence, these multiple benefits offered by cloud-based solutions and services used in content disarm & reconstruction will boost the demand for the content disarm and reconstruction market.

Digital Capabilities:

Content disarm and reconstruction is increasingly relevant in advanced digital technologies where advanced interference control techniques such as email security gateways, web filtering solutions and cloud-based security solutions will benefit from protecting against cyber threats and ensure the safe use of files within digital environments. In addition, web filtering solutions in content disarm and reconstruction technology is widely used to scan files downloaded from the internet and remove any potentially harmful content. This approach can help prevent drive-by downloads and other types of web-based attacks. Web filtering solutions uses various techniques to scan web traffic and block potentially harmful content, including malware and phishing scams. It blocks access to malicious websites and preventing the download of harmful files, further such solutions can help prevent web-based attacks and protect against cyber threats, which in turn expected to contribute in driving demand of such technologies in content disarm and reconstruction market.

Furthermore, cloud-based security solutions and services, including content disarm & reconstruction, offers several benefits, such as scalability, flexibility, and cost-effectiveness, help organizations to manage security operations in a more streamlined and centralized way. As a consequence, security operations are gaining significant adoption to increase the use of IT and control systems among security operators, particularly IoT and other digital technologies. For instance, in December 2022, Vi Business inveiled a new cyber security portfolio for enterprises namelt, Vi Secure. Vi Secure is a comprehensive cyber security portfolio with a range of reliable solutions that offer protection against multiple threats arising from network, cloud and endpoints. Such innovations associated with the cloud-based security solutions are anticipated to contribute to the increased content disarm and reconstruction market across the globe.

End-User Adoption:

The growing cloudification and digitalization in security operations is accelerating end-user adoption. Content disarm and reconstruction technology is increasingly adopted in a variety of industries where protecting against cyber threats and ensuring the safe use of files is critical. In the healthcare industry, content disarms and reconstruction technology can be used to protect against threats and ensure the safe use of electronic health records (EHRs). This technology sanitizes the files uploaded to EHRs and other digital platforms, healthcare organizations can minimize the risk of data breaches and protect patient privacy. Such trends further contribute to the increasing adoption of content disarm and reconstruction technology in the healthcare sector, which is expected to enhance the content disarm and reconstruction market growth.

Furthermore, the industry is transforming and introducing digital technologies such as AI, cloud technology, and others. With the introduction of cloud-based security solutions in content disarm and reconstruction, this overall solution is benefiting the finance sector in various ways. The major benefit of this solution is to protect financial data against phishing scams and other types of cyber attacks that target financial institutions. By scanning email attachments and web traffic for potential threats, financial organizations can prevent data breaches and protect sensitive financial information.

In addition, several public and private businesses are innovating different security solutions to protect the data. For instance, in March 2022, Glasswall launched the Glasswall Desktop Freedom, a premium version of its desktop Content Disarm and Reconstruction (CDR) application. It protects organizations across both sectors from the risks of file-based threats such as malware and ransomware. Thus, such development is expected to propel the driving demand for content disarm and reconstruction solutions in various industries.

Government Initiatives:

Various companies and government bodies are inforcing different initiatives to strengthen R&D in the various industries such as healthcare, finance and others with evolving productive alliances that lead to indigenous design, development, manufacturing, and deployment of cost-effective security products and solutions. For instance, in February 2023, the Technology Modernization Fund (TMF) raised over $650 million in funding, aiming to build and improve cyber security and digital services at the Social Security Administration. These funds have supported projects reaching from providing a single secure login experience for government websites to digitizing temporary worker visa programs and modernizing systems that support crop inspection and certification.

Similarly, in September 2022, the Insurance Regulatory and Development Authority of India (IRDAI) launched an updated cybersecurity framework, focused on the insurer’s main security concerns. It is targeted to encourage insurance firms to develop and maintain a robust risk assessment plan and improve mitigation methods for internal and external threats. These innovations and investment strategies will augment the adoption of security solutions and create new avenues for wider adoption and monetization of cloud-based security products & solutions.

Key Benefits for Stakeholders:

- The study provides an in-depth analysis of the global content disarm and reconstruction market forecast along with current & future trends to explain the imminent investment pockets.

- Information about key drivers, restraints, & opportunities and their impact analysis on content disarm and reconstruction market trends is provided in the report.

- Porter’s five forces analysis illustrates the potency of the buyers and suppliers operating in the industry.

- The quantitative content disarm and reconstruction market analysis from 2023 to 2032 is provided to determine the market potential.

Content Disarm And Reconstruction Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 1.4 billion |

| Growth Rate | CAGR of 18.3% |

| Forecast period | 2022 - 2032 |

| Report Pages | 339 |

| By Component |

|

| By Deployment Mode |

|

| By Organization Size |

|

| By Application |

|

| By End User |

|

| By Region |

|

| Key Market Players | Glasswall Solutions Limited, Gatefy, OPSWAT, Inc., Votiro, Resec Technologies, Deep Secure, Broadcom Inc., YazamTech, Check Point Software Technologies Ltd., Fortinet, Inc. |

Analyst Review

Content disarm and reconstruction is a technique that involves breaking down files into the component parts, scanning each part for malware, and then rebuilding the file with only safe content. This process helps prevent the spread of malicious code and ensures that files can be safely used within an organization. Moreover, content disarm and reconstruction can help organizations save money by minimizing the need for costly incident response measures and reducing the risk of data breaches. Additionally, the ability to automate file inspection and reconstruction can help reduce the time and resources needed to maintain a secure network.

Key providers in the content disarm and reconstruction market are Broadcom Inc., Check Point Software Technologies Ltd., and Deep Secure. With the growth in demand for security services, various companies have established partnerships to increase their solutions offerings in security operations. For instance, in February 2022, Redington partnered with Check Point Software Technologies, to provide uncompromised security to the Small and Medium Sized Business (SMB) businesses in India. Such partnership strategy further expected to drives the market growth.

In addition, with the surge in demand for content disarm and reconstruction, various companies have expanded their current product portfolio to continue with the rising demand in the market. For instance, in March 2021, Gatefy launched the new version of its website namely Gatefy website. The website aims to provide and spread more information about digital security and has accelerated digital transformation across industries. Thus, such innovations is anticipated to drive the market demand.

For instance, in August 2020 2022, Menlo Security partners with ReSec, to the integrate the ReSec and Sasa Software, which allows companies to add the ability to sanitize and reconstruct files to neutralize any potential threats while maintaining full usability of the file and supporting hundreds of file types. This strategic partnership are expected to drive market growth.

The content disarm and reconstruction market is estimated to grow at a CAGR of 18.3% from 2023 to 2032.

The content disarm and reconstruction market is projected to reach $ 880.16 million by 2032.

Rise in incidents of cyber-attacks and data breaches and increase in government compliance and regulatory standards on cyber security are driving the growth of the market. In addition, surge in adoption of cloud-based security solution and services is fueling the growth of the content disarm and reconstruction market. However, high implementation cost of content disarm and reconstruction solution and Dearth of skilled cyber security professional and strategic planning limits the growth of this market. Conversely, rise in investments in in big data security solutions and surge in digital transformation initiatives across different industries are anticipated to provide numerous opportunities for the expansion of the market during the forecast period.

The key players profiled in the report include Broadcom Inc., Check Point Software Technologies Ltd., Deep Secure, Fortinet, Inc., Gatefy, Glasswall Solutions Limited, OPSWAT, Inc., Resec Technologies, Votiro and YazamTech.

The key growth strategies of content disarm and reconstruction market players include product portfolio expansion, mergers & acquisitions, agreements, geographical expansion, and collaborations.

Loading Table Of Content...

Loading Research Methodology...